READ MORE: The latest entertainment trends (GWI)

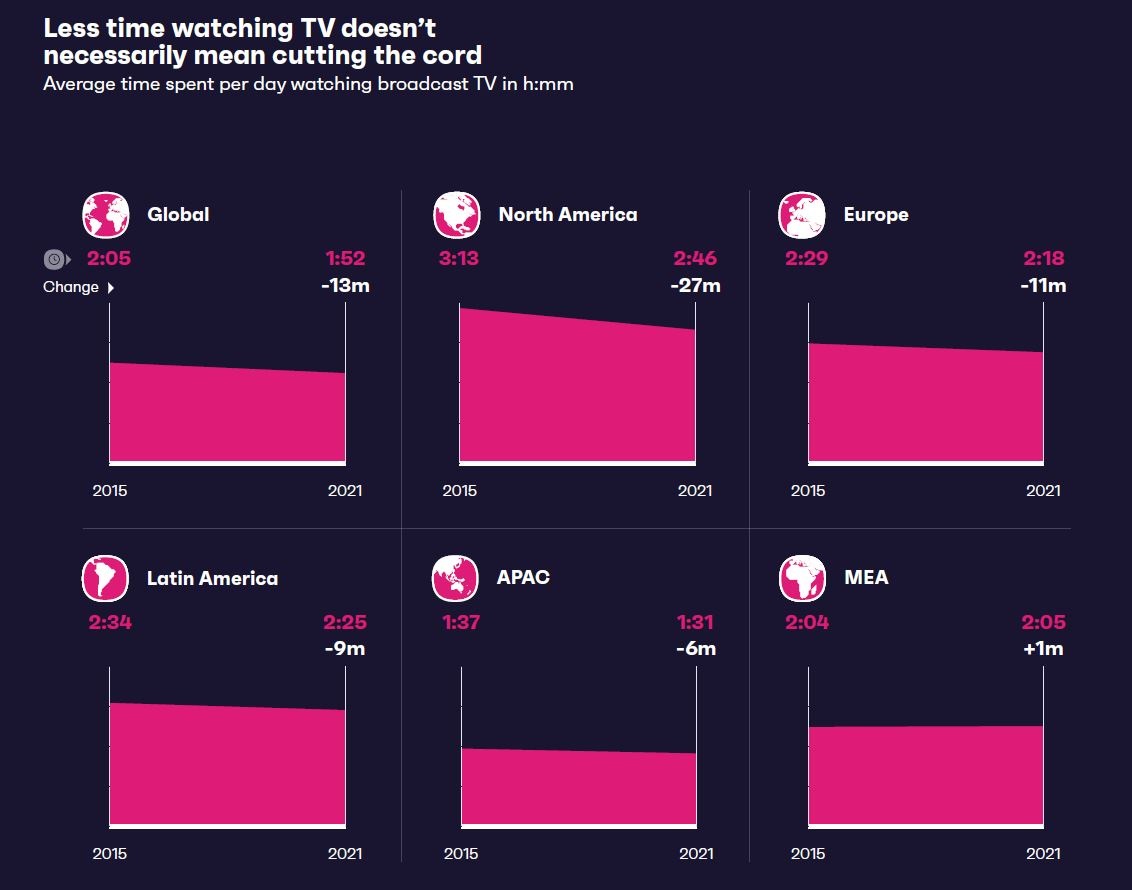

Although movie streaming was a clear winner of the pandemic, it’s now struggling to sustain its growth, according to a new report from GWI. Despite digital disruption, live TV isn’t going anywhere, and cord-cutting doesn’t necessarily mean ditching linear TV for streaming.

“The latest entertainment trends,” a report compiled from surveys of 700,000 people aged 16 to 64 across 47 markets, also confirms TikTok as go-to place for short-form content and the fastest-growing social app across all age groups.

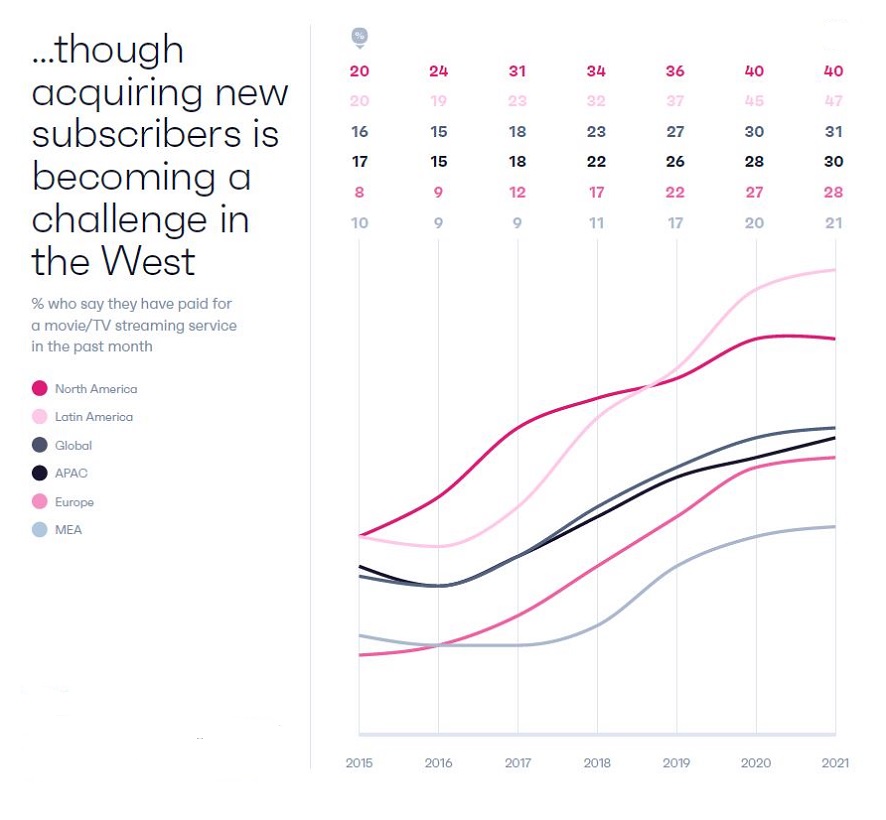

The report suggests we may have reached “peak subscription” for video services in the West at least, with the number saying they’ve paid for a movie or TV streamer starting to plateau.

“As the battle for eyeballs intensifies, subscription fatigue follows,” warns GWI.

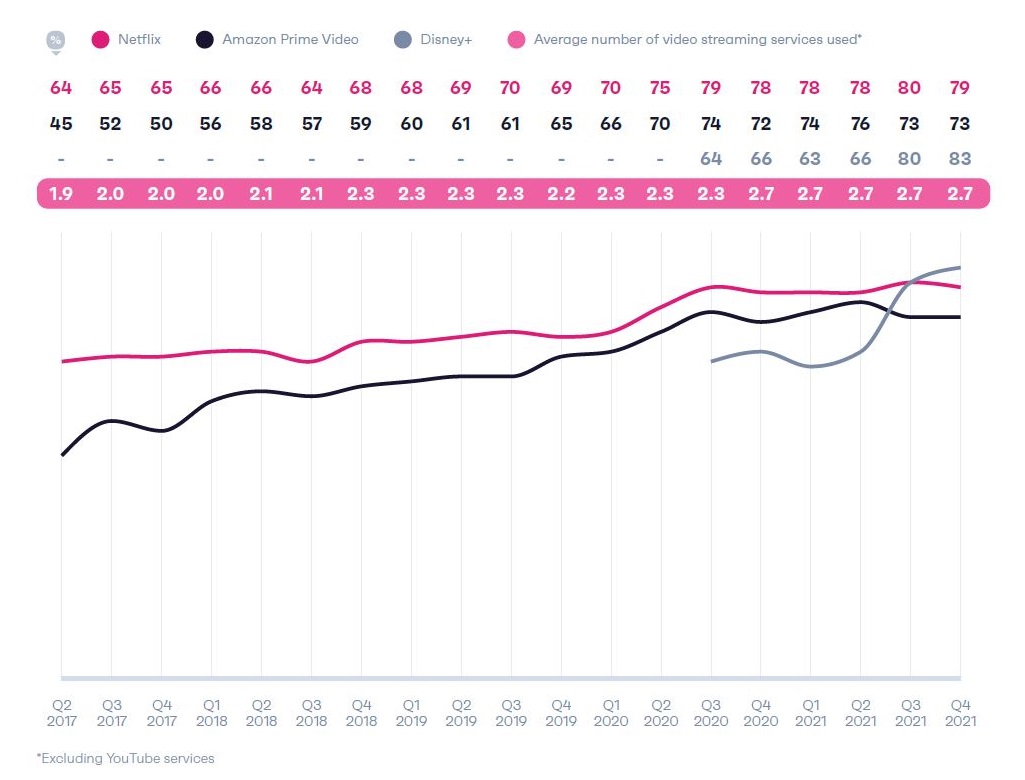

The average number of streaming services consumers use has been steadily increasing since Q2 2017, until last year when it remained static at 2.7 services. In North America this figure goes as far as 3.8, while places like the Middle East and South Africa “are ripe with opportunity given internet users here are still only watching on an average of 1.8 services each month.”

Netflix is still leading the charts, with the platform having the most loyal user base and attracting the majority of those already paying for other platforms. For example, 75% of Amazon Prime subscribers outside China pay for Netflix, while only 40% of Netflix subscribers pay for Amazon. However, Disney+ is catching up fast. In fact, in Q4 2021 the platform managed to convert 83% of its users into paying subscribers, higher than both Netflix and Amazon Prime.

At the same time, more and more consumers are flocking to video-based social media apps like TikTok and Instagram to consume and create content.

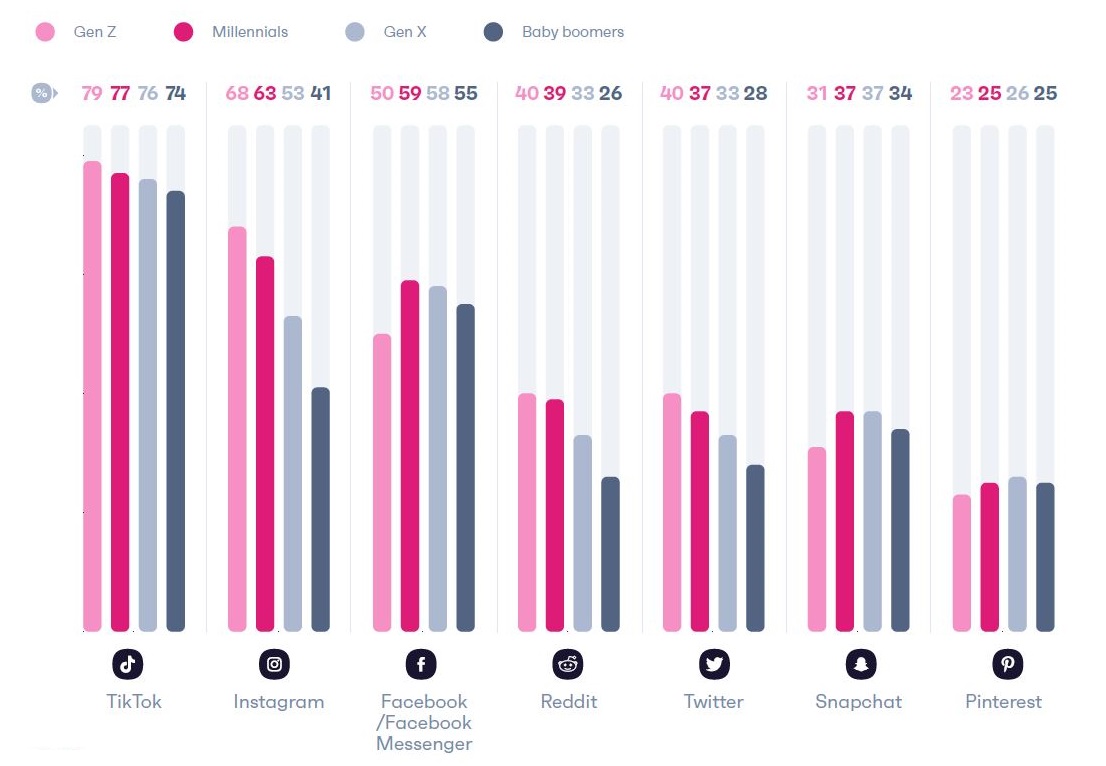

Per the report, close to 80% of Gen Z TikTok users outside of China use the platform to find funny/ entertaining content, only dropping to 74% among baby boomers. It’s also the fastest-growing platform across all generations.

Short-form might be the preferred video content overall, but there’s strong demand for long-form too, particularly among Gen Z. YouTube leads the way when it comes to longer content, with 82% of Gen Z engaging with the platform in the past month. TikTok is hot on its heels, though, as it expands maximum video length to 10 minutes.

The Evolution of Traditional and Online TV

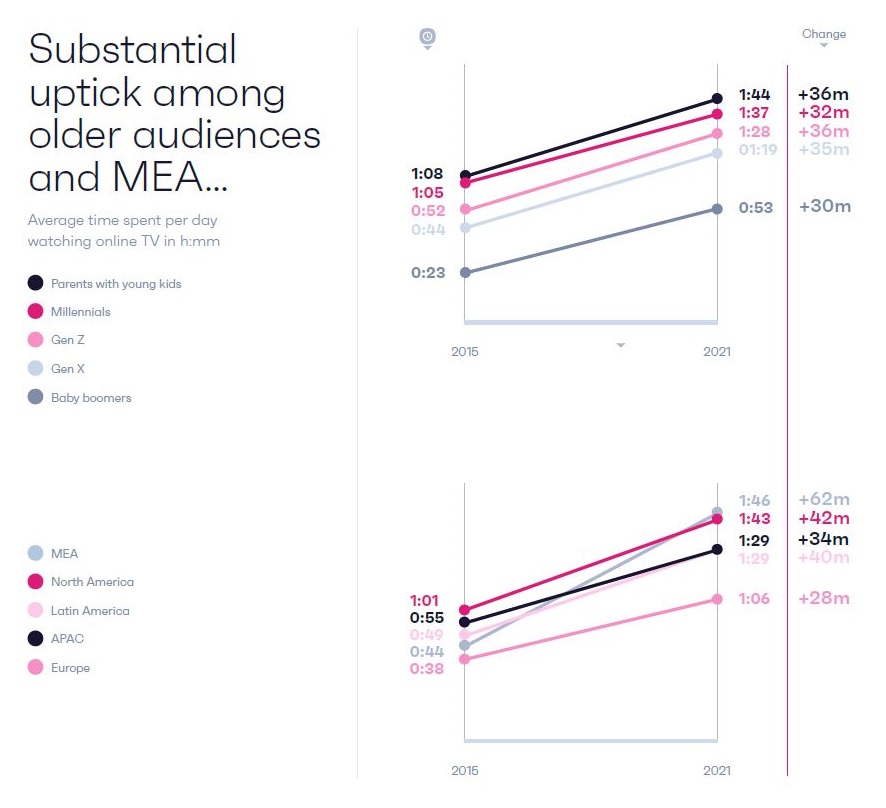

The pandemic accelerated online TV watching with consumers globally spending 1 hour and 26 minutes streaming movies on an average day in 2020, per GWI’s report. Since then, this growth has slowed and broadcast TV remains firmly ahead of online TV.

Globally, people are still spending an average of 25 minutes more watching traditional TV, with this gap being as large as one hour and three minutes in North America and one hour and 12 minutes in Europe. But the researcher warns that advertisers and marketers should be aware that online TV is progressively eating up a larger portion of the overall viewing time.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

The gap between online and broadcast TV viewing is expected to “fully close” in the near future, largely being driven by younger generations. 2021 is the first year Gen Z was spending slightly more time watching online than linear TV (1h 28m vs 1h 27m).

APAC, with its younger internet population, will likely be the first region to close the gap. But it’s also the only region that saw streaming TV reverting back to its pre-pandemic levels (one hour and 29 minutes).

GWI data confirms a global decline in linear TV viewing since 2015, but at the same time the cord-cutting trend is stabilizing. In North America, there appears to be a link between cutting the cord and reducing linear TV watching. GWI finds that even though six million subscribers were lost between 2019 and 2021, this loss is set to decrease from now on.

Meanwhile, in Europe, time spent on broadcast TV is down 11 minutes while paying for TV channels is actually up 17% in the same timeframe. MEA is also one to watch; engagement with traditional TV here has been more or less stable, while there’s been a 23% increase in consumers paying for satellite TV.

Africa alone is projected to add 18 million paid TV subscribers by 2027, “meaning cord-cutting is unlikely to be a thing on the continent for a while, despite the rise of online TV.”

The majority of consumers globally continue to watch linear TV on a regular basis, with 88% saying they watch live TV each month.

A Map of Worldwide SVOD Penetration Rates

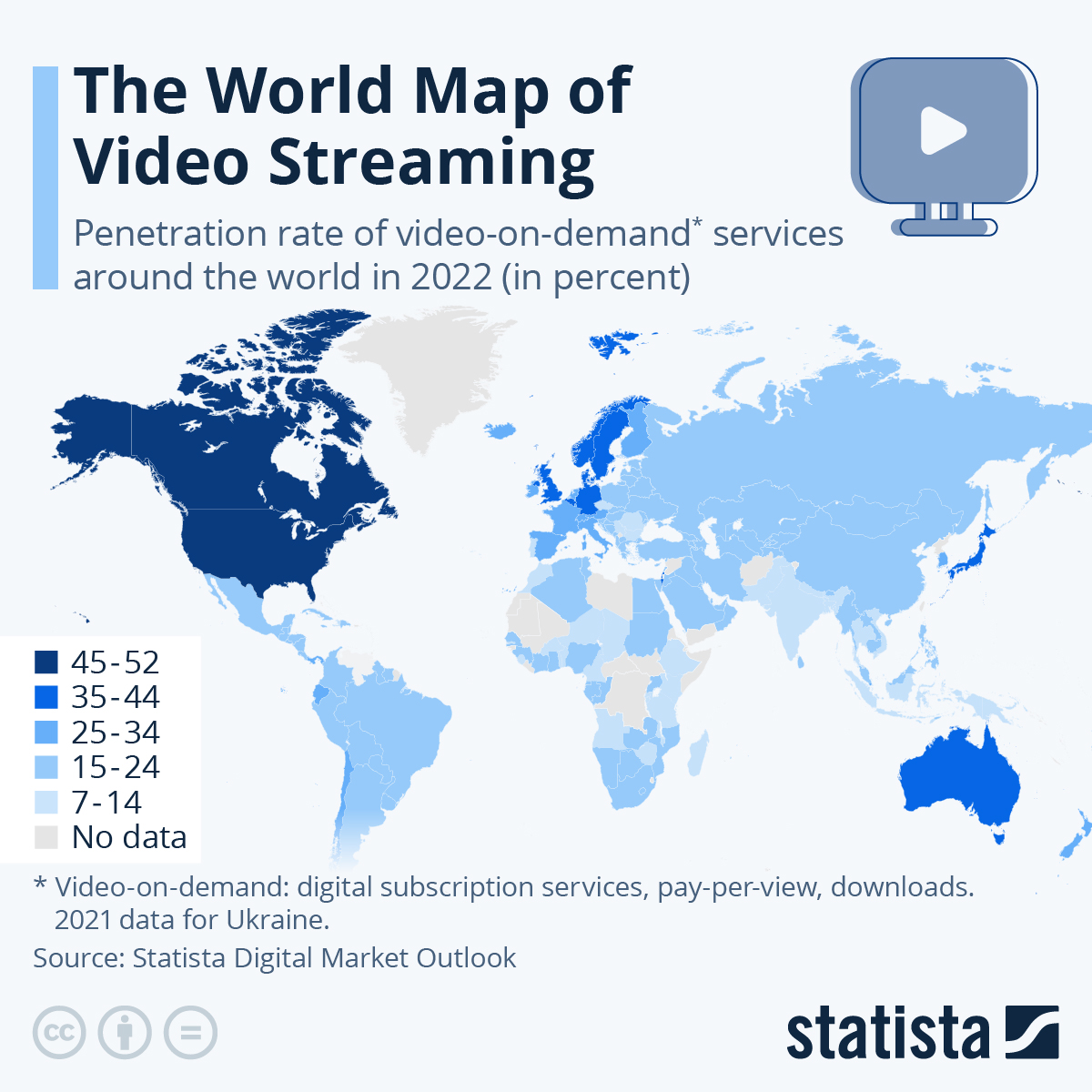

Facing a rising number of competitors, Netflix has found it difficult to grab more share in the streaming marketplace and recorded its first decline in its subscriber base since the first quarter of 2022. However, worldwide growth of SVOD services rose roughly 20% in 2022, according to market research & analysis consultancy Statistia.

As Statista senor data analyst Katharina Buchholz explains, the map below shows “the most promising markets for chasing video-on-demand users are now South Asia, Latin America and Africa, where Disney+ has arrived in several countries (including South Africa) in 2022. While the market is expanding more slowly in North America, where video-on-demand has reached approximately 50% of the population, there is still some more room to grow in Europe, where this figure varies from 14% in Bulgaria to 42% in the United Kingdom.”

READ MORE: The World Map of Video Streaming (Statista)

The Battle for Gamers’ Attention

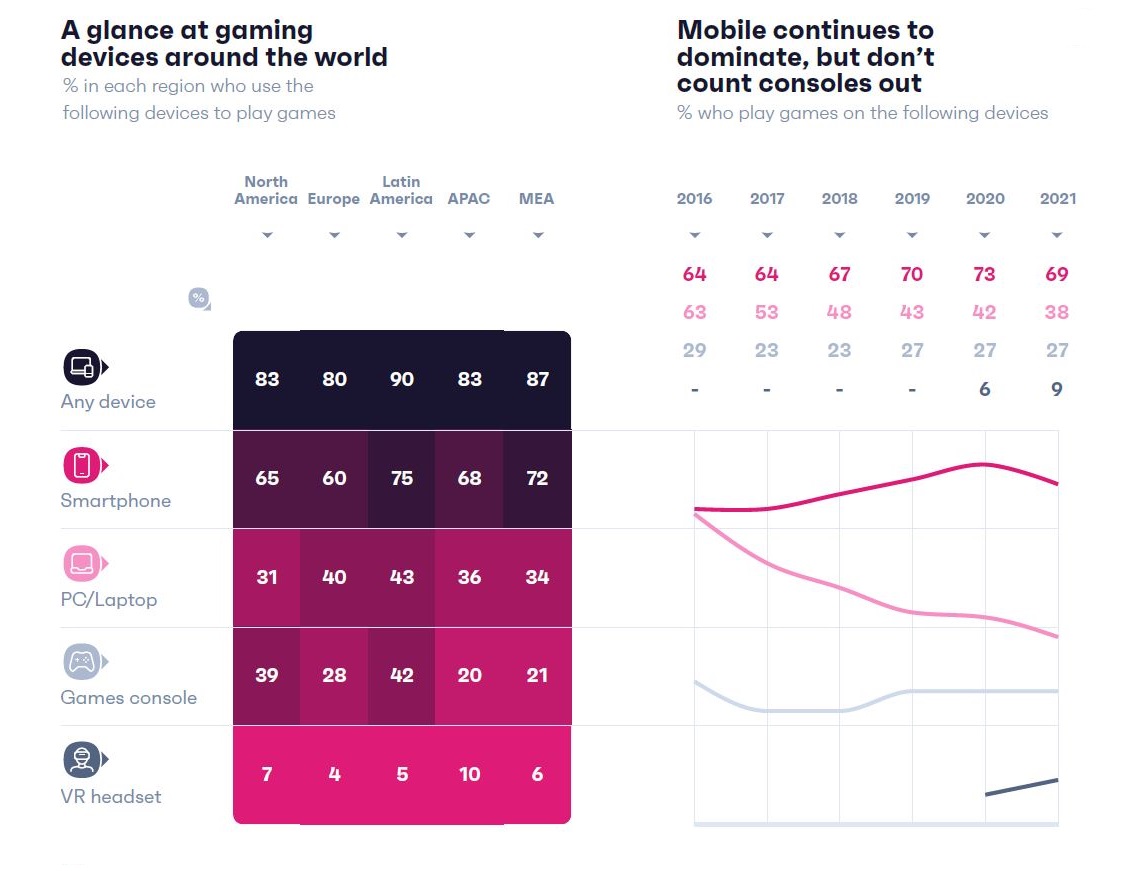

In Q2 2020, when the pandemic first hit, 87% of consumers said they play games on any device — this has steadily declined and now stands at 83%. It’s still a huge portion of consumers who play games though, and it’s been making “serious gains” among older consumers too. Per the report, pre-pandemic in Q4 2019, 56% of baby boomers said they play games via any device, climbing to 65% today.

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- The Ever-Changing Scenery of the CTV Landscape

- TV is Not Dead. It’s Just Becoming Something Else.

- Converged TV Requires a Converged Ad Response

- Connected TV and the Consumer

- Connected TV Opens Up a Million Ad Possibilities

The portion of women who play games has also increased (+5%), with almost as many women playing games as men — 85% vs. 81% — respectively “underpinning just how diverse the gaming audience is.”

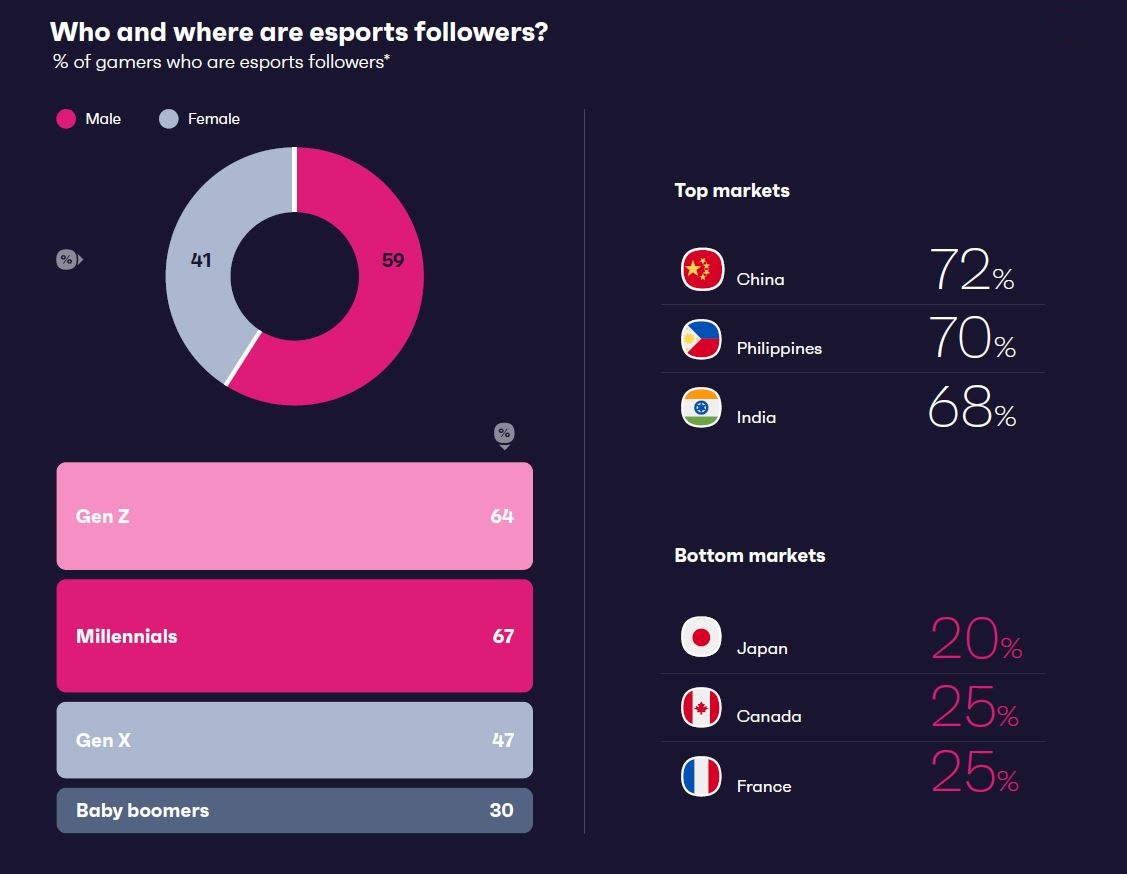

Similarly, just over 40% of female gamers are now esports followers, which isn’t miles behind their male counterparts at 59%. Yet, on the competitive front, female esports players are left behind when it comes to earnings, as the industry struggles with stamping out sexism and creating an even-playing field that’s supportive and welcoming to all.

In North America and Latin America, mobile devices continue to pull in the most gamers, growing by 20% and 11% respectively since Q4 2019. Netflix clearly recognizes the potential of mobile gaming judging by its acquisition of Finnish firm company Next Games.

“With one eye firmly set on building out its gaming strategy, it’ll be one to watch as platforms find ways to stand out in an ever-cluttered space. It’s also another sign that gaming and other forms of entertainment are becoming increasingly blurred,” GWI says.

But Netflix should beware of TikTok: Gaming is one of the app’s top performing categories in 2021, “so it’s little wonder why it’s edging further into this space.”

Obligatory Metaverse Question

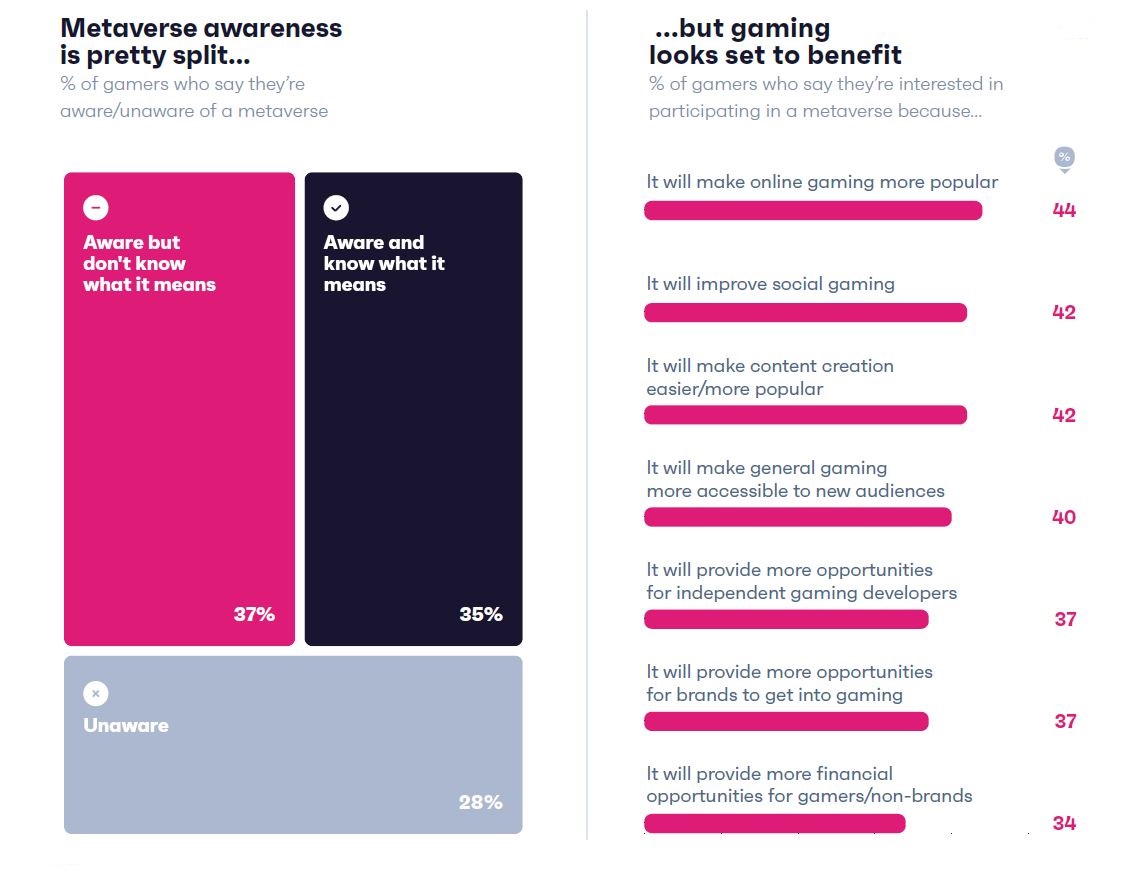

Consumer awareness of the metaverse was pretty split according to this research. More than half of consumers said they’re interested in participating in the metaverse, with considerable interest among those who didn’t know what it was — showing the anticipation people have regardless of awareness.

NAVIGATING THE METAVERSE:

The metaverse may be a wild frontier, but here at NAB Amplify we’ve got you covered! Hand-selected from our archives, here are some of the essential insights you’ll need to expand your knowledge base and confidently explore the new horizons ahead:

- What Is the Metaverse and Why Should You Care?

- Avatar to Web3: An A-Z Compendium of the Metaverse

- The Metaverse is Coming To Get You. Is That a Bad Thing?

- Don’t Expect the Metaverse to Happen Overnight

- A Framework for the Metaverse from Hardware to Hollywood and Everything in Between

Gaming looks set to benefit from the metaverse, with many believing it’ll make online gaming more popular, make content creation easier, and improve the social aspect of gaming. This is something where services like Discord, TikTok, and Twitch come into play — spaces where users already value the sense of community and creativity they provide.

“The current conversation around the metaverse often raises more questions than answers,” says GWI, “but there’s one thing that’s pretty clear: it’s got a lot to live up to.”