READ MORE: 2022 State of Streaming (Comscore)

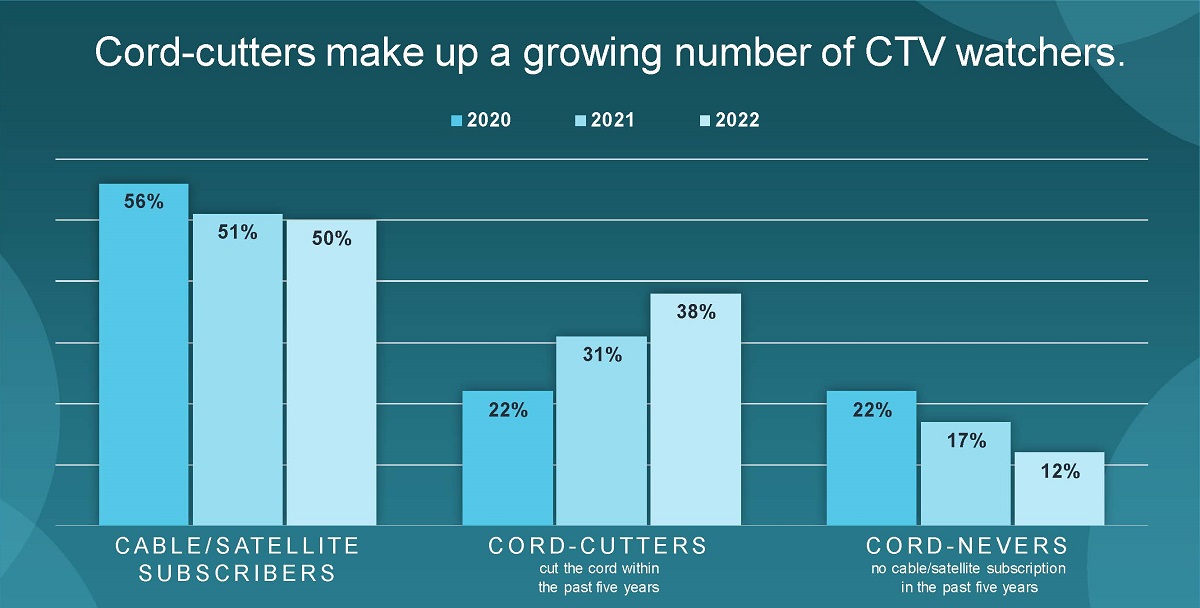

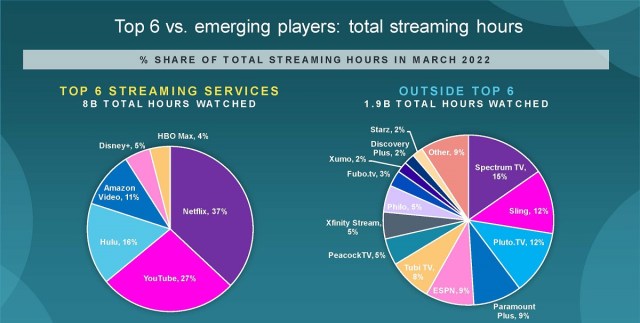

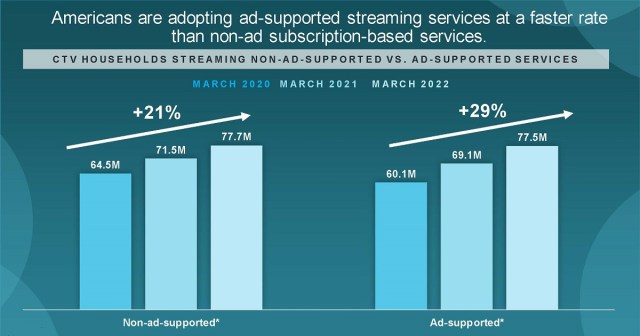

Ad-supported streaming services are seeing adoption at a faster rate than subscription-based ones, according to newly published research from Comscore.

In a new report, “2022 State of Streaming,” the global media measurement and analytics company charts a 29% increase in US households streaming AVODs in 2022 compared to 2020, versus a 21% increase during the same period for SVODs.

“While both ad-supported and subscription-based streaming services are growing in the US, we’re seeing that consumers are being more mindful of their budgets and leaning towards ad-supported services,” said James Muldrow, VP of product management at Comscore. “This makes sense as inflation continues to hit consumer’s wallets. The time is ripe for traditionally subscription-based streaming services like Netflix to consider launching an ad-supported tier to enhance their growth trajectory.”

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

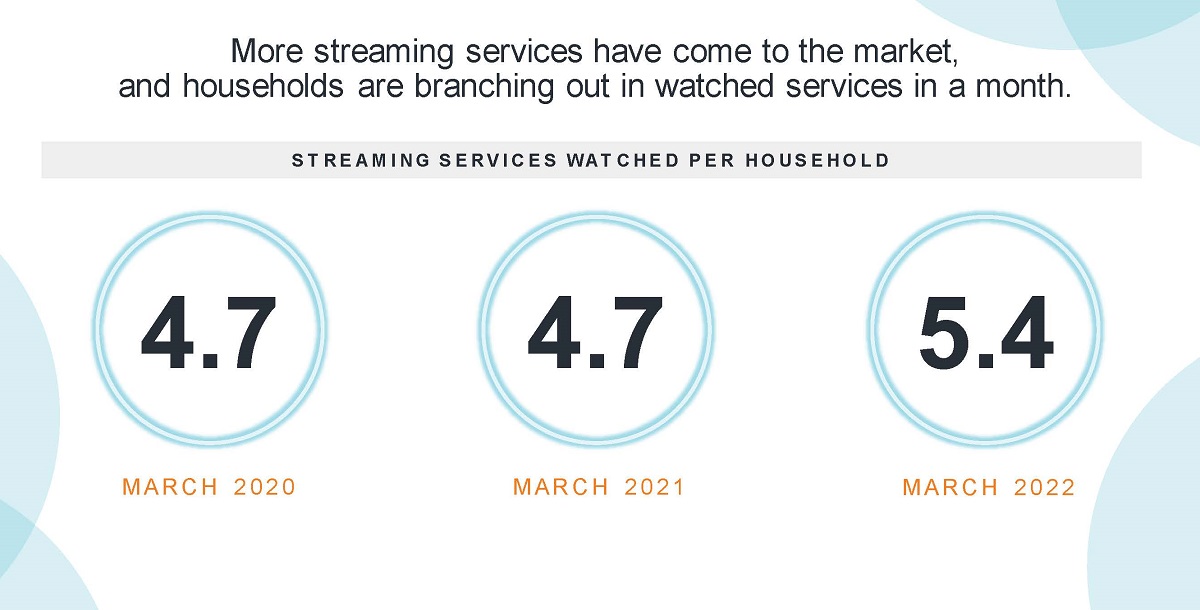

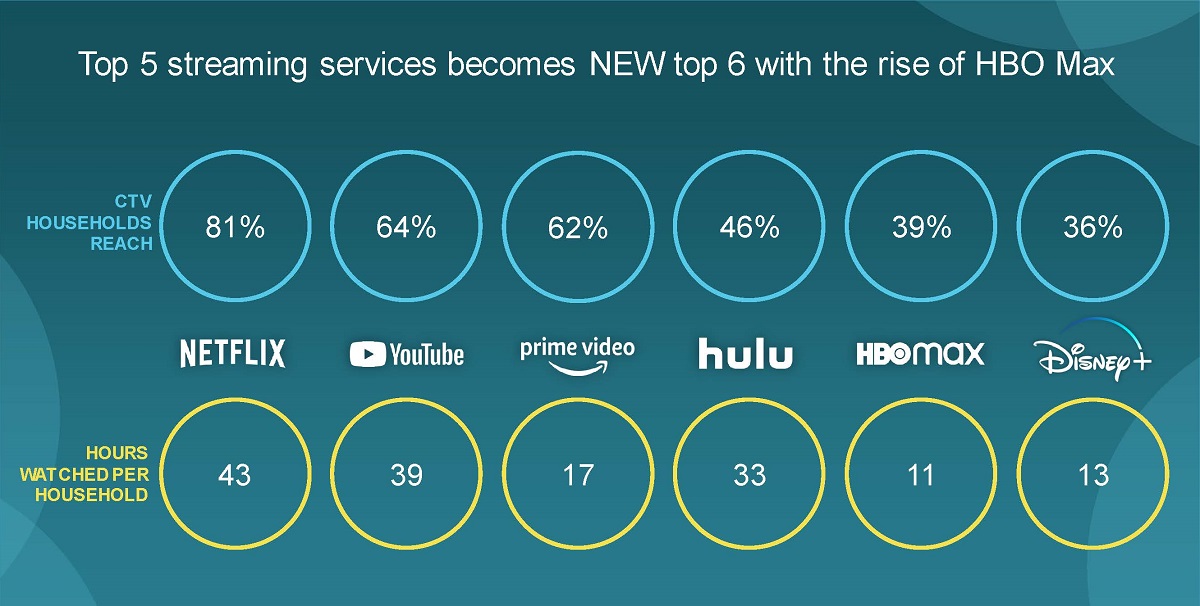

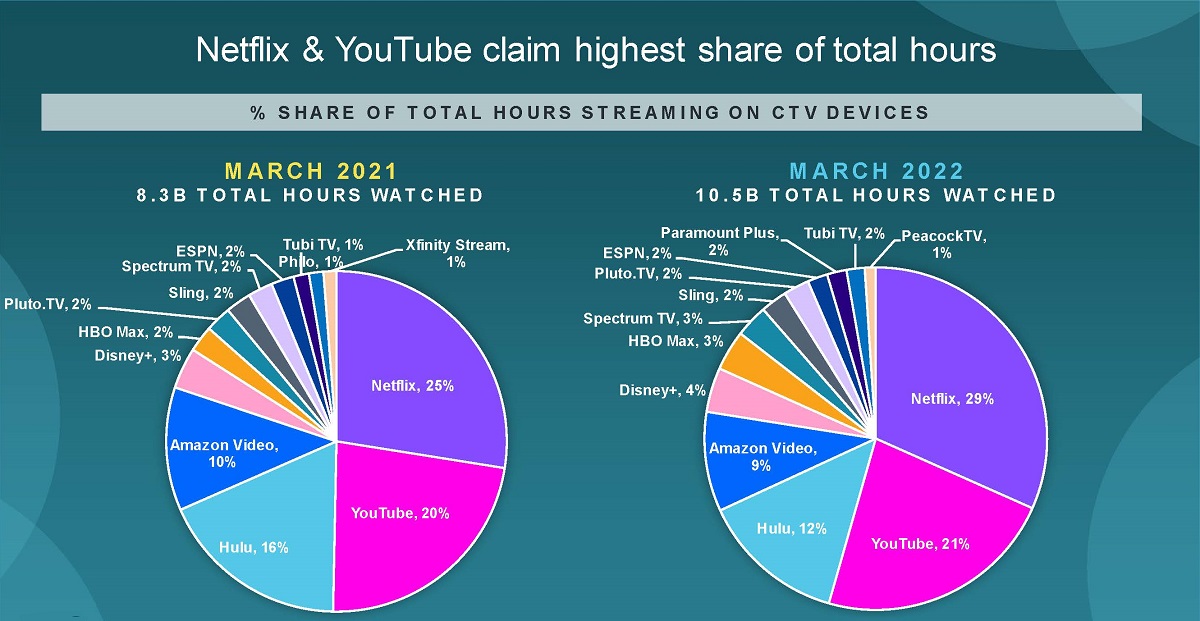

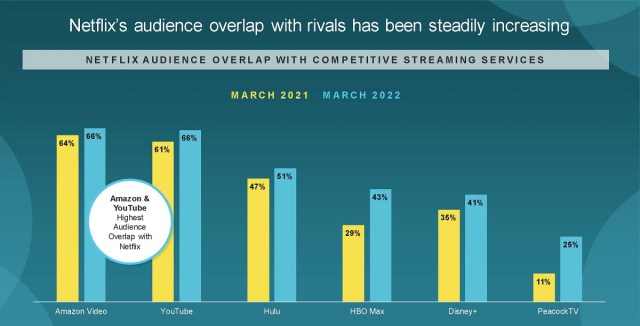

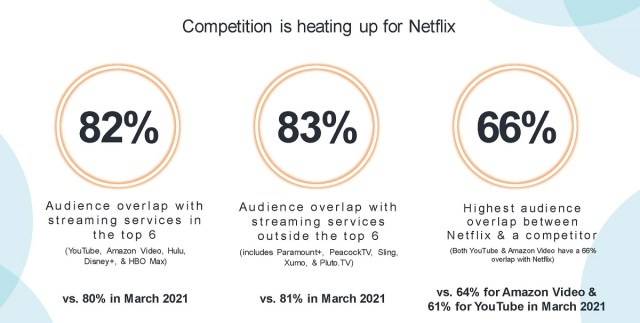

Comscore’s analysis also found that American households watched 5.4 streaming services per month as of March 2022, compared to 4.7 in March 2021, as “The Big Five” streaming services became “The Big Six” with the rise of HBO Max. In terms of audience overlap, Netflix has an 82% overlap with the other top six streaming services, especially Amazon (66%) and YouTube (66%).

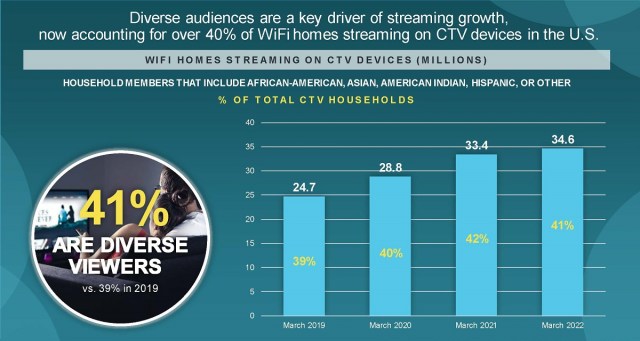

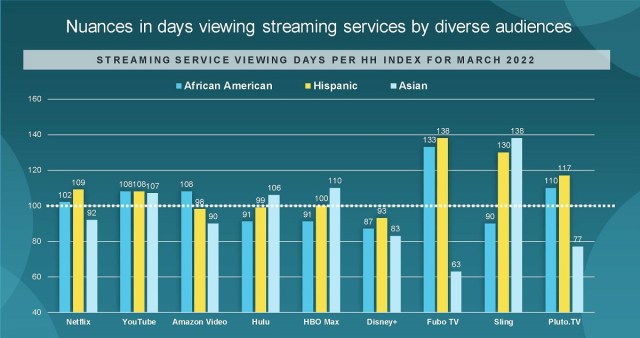

Diverse audiences (African American, Asian, American Indian and Hispanic populations) are a key driver of streaming growth, the research suggests. In terms of the streaming platforms viewing days per household, African Americans over-index for Amazon, FuboTV, YouTube and Pluto.TV, while Asians over-index for HBO Max, Hulu, YouTube and Sling. Accounting for the largest segment of diverse homes that stream, the Hispanic audience over-indexes for Netflix, YouTube, FuboTV and Sling.

WATCH THIS: TheGrill: Focus on AVOD presented by FilmRise

As inflation rises toward a possible recession and consumers continue to tighten their belts, ad-supported video-on-demand — including FAST channels — are quickly becoming the norm.

WrapPRO recently convened a panel of industry experts to discuss consumer habits amid the rise of AVOD as part of its symposium, “TheGrill: Focus on Streaming presented by FilmRise.”

Moderator Brandon Katz was joined by Daniel Christman, SVP of cross platform group at Screen Engine/ASI; Tejas Shah, SVP of commercial strategy and analytics at FilmRise; Katina Papas Wachter, head of ad revenue strategy at Roku; and Alysha Dino, senior director of publisher development at Publica.

The rise of AVOD could create favorable conditions for both producers of advertising and delivery platforms, Christman commented, kicking off the discussion. “There just isn’t an overwhelming urge among consumers to add more paid subscriptions to their monthly budgets, especially as we head into all this recession talk,” he says. “And we know the demand for content is as great now as ever. So this sets up as an extremely favorable story for those involved in ads content creation, and delivery.”

Watch the full conversation in the video below:

READ MORE: ‘The Great Shift to AVOD’: Why Viewers Are Flocking to Ad-Supported Streaming (WrapPro)

Other findings:

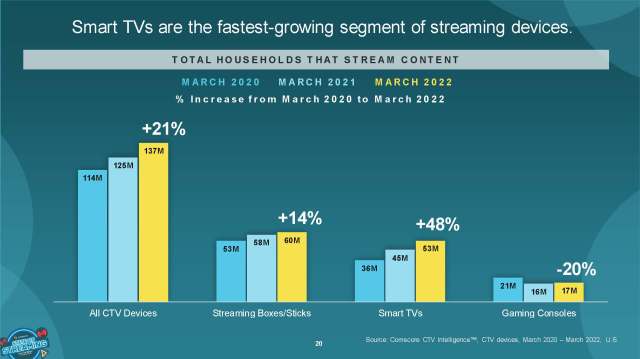

Smart TVs are the fastest-growing segment of streaming devices with 48% growth year-on-year.

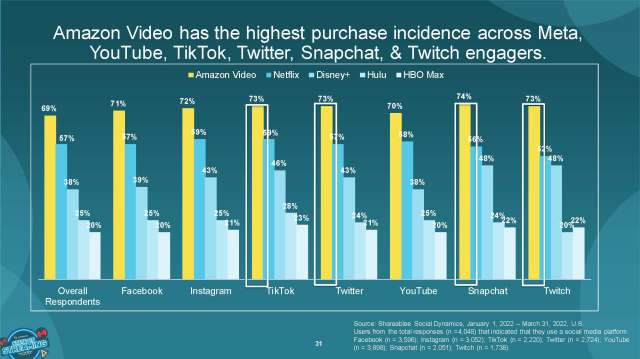

Amazon Prime Video has the highest resonance with the younger TikTok, Twitter, Snapchat and Twitch audiences.

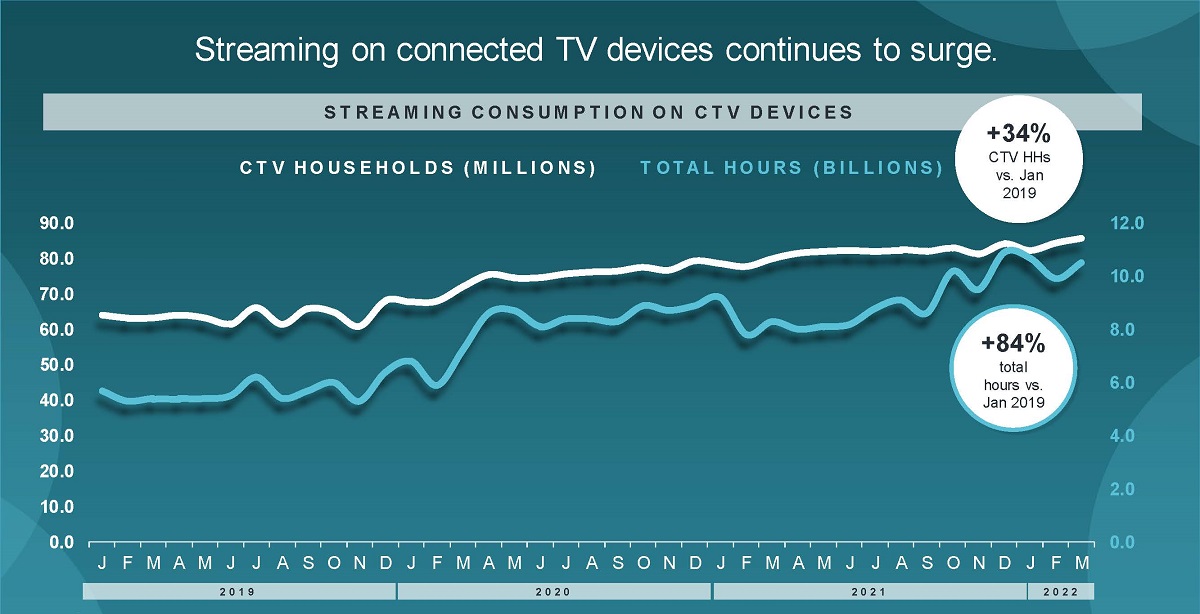

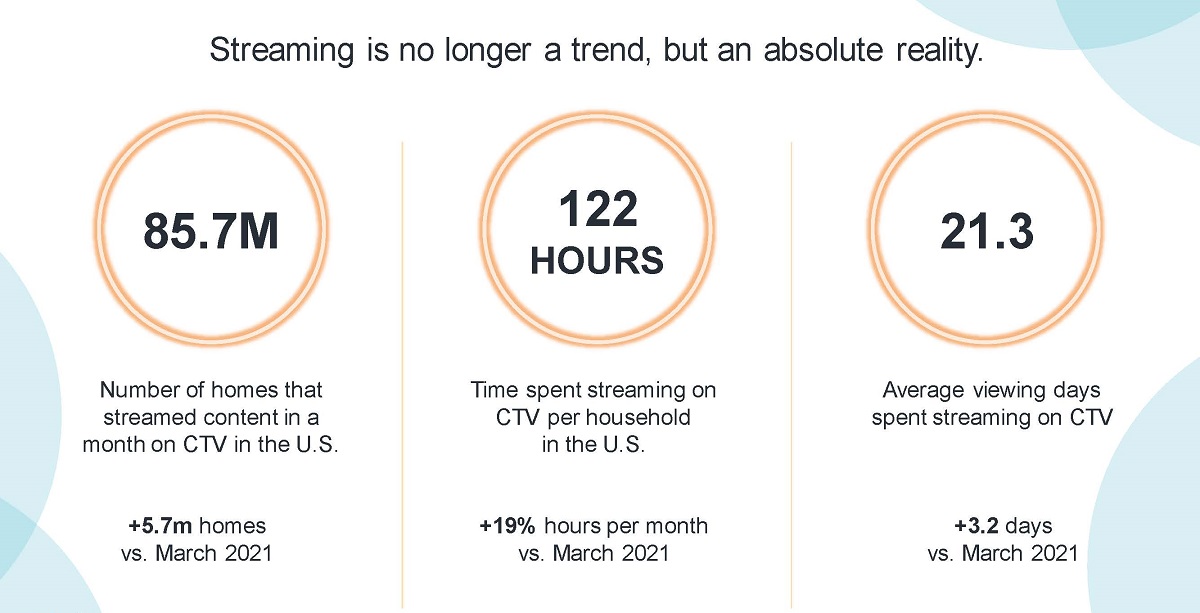

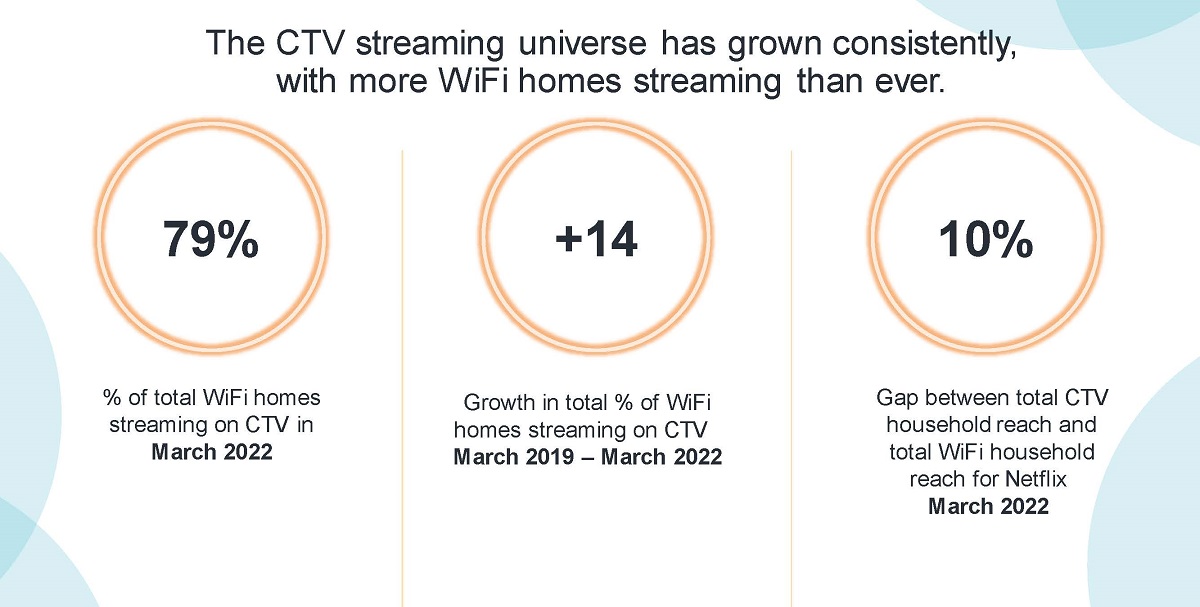

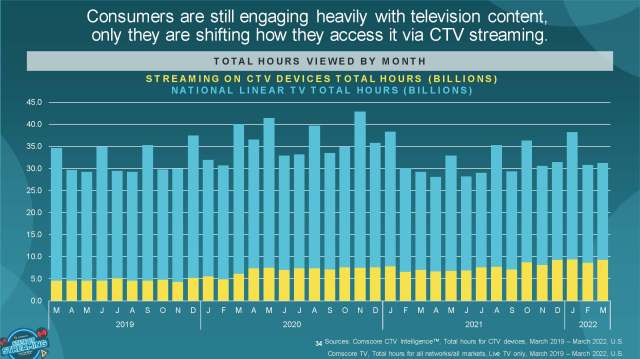

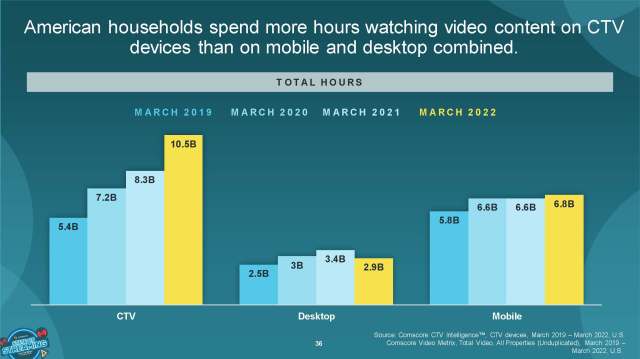

Seventy-nine percent of Wi-Fi enabled homes are watching streaming content on Connected TV devices and each such household is spending about 122 hours per month doing so, a 19% growth from March 2021. Netflix captures the most hours per month watched at 43, followed closely by YouTube at 39 hours, and Hulu at 33 hours.

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- The Ever-Changing Scenery of the CTV Landscape

- TV is Not Dead. It’s Just Becoming Something Else.

- Converged TV Requires a Converged Ad Response

- Connected TV and the Consumer

- Connected TV Opens Up a Million Ad Possibilities