Watching a movie on Netflix is a passive one-way lean back experience watching high quality video which we all love, right? Wrong. Millennials want interactive social connection and if SVODs don’t offer it… well they’ve been warned.

That’s the key takeaway from Deloitte’s latest annual Digital Media Trends survey, that also finds that if streaming providers are seeking a long-lasting marriage with subscribers, it now looks more like a dynamic game of speed dating.

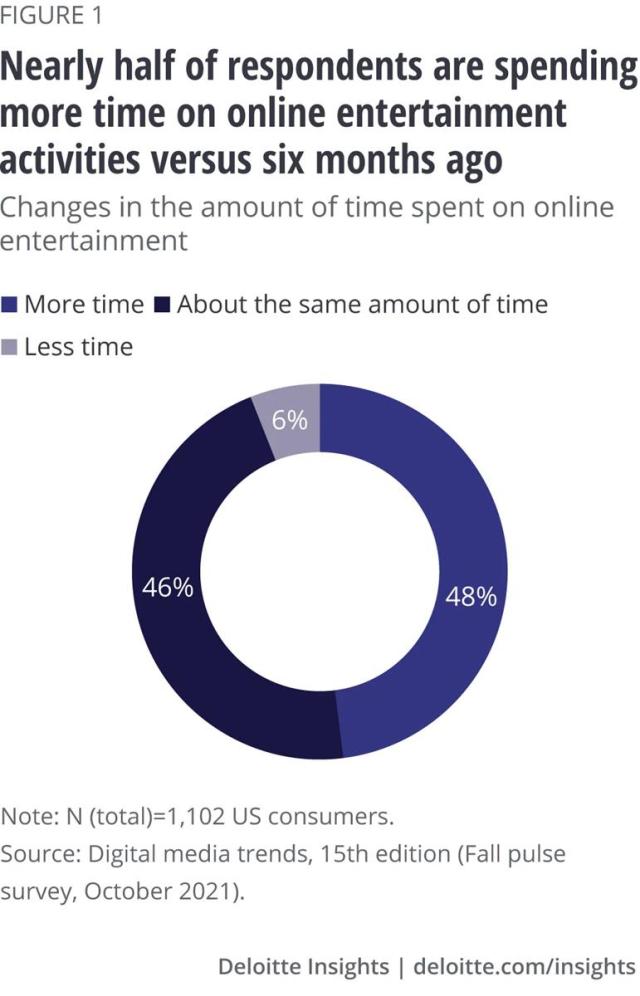

The report that cements the understanding that pandemic has accelerated online entertainment, with an estimated 21% boost in consumer spending on subscriptions in the first half of 2021. But people — especially younger generations — are managing costs by adopting ad-supported options, looking for discounts and bundles, and moving on and off services to meet their content needs. For streaming video providers, keeping these subscribers is harder than ever.

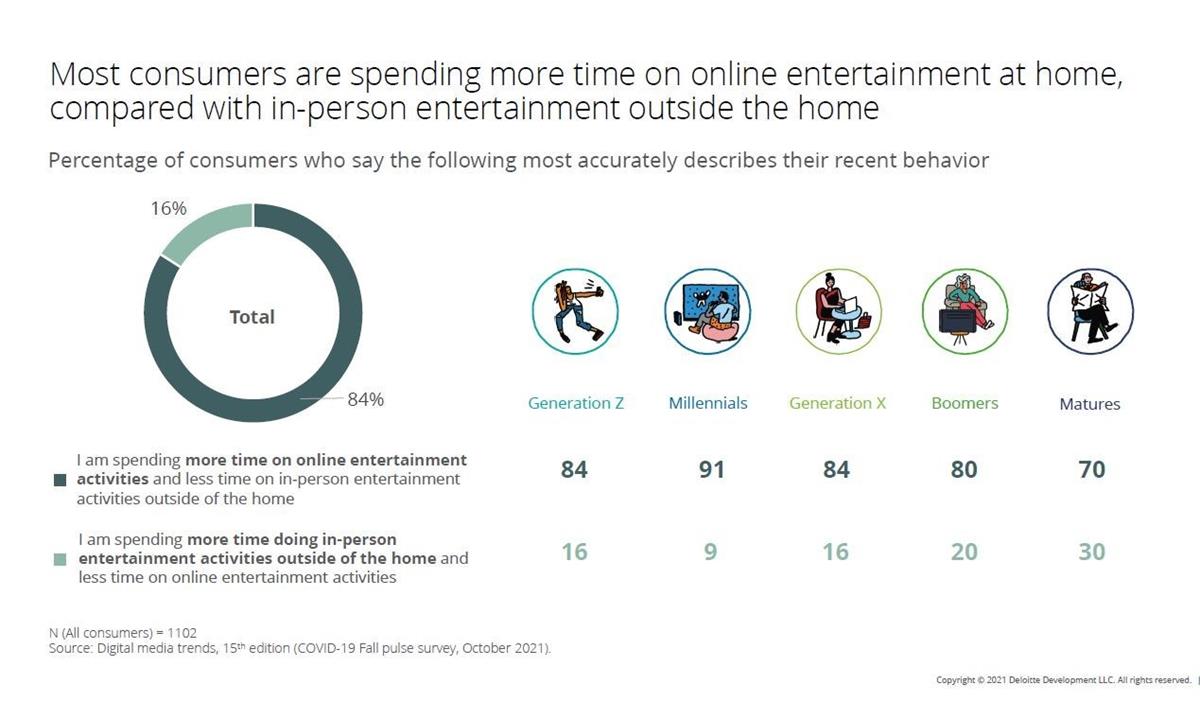

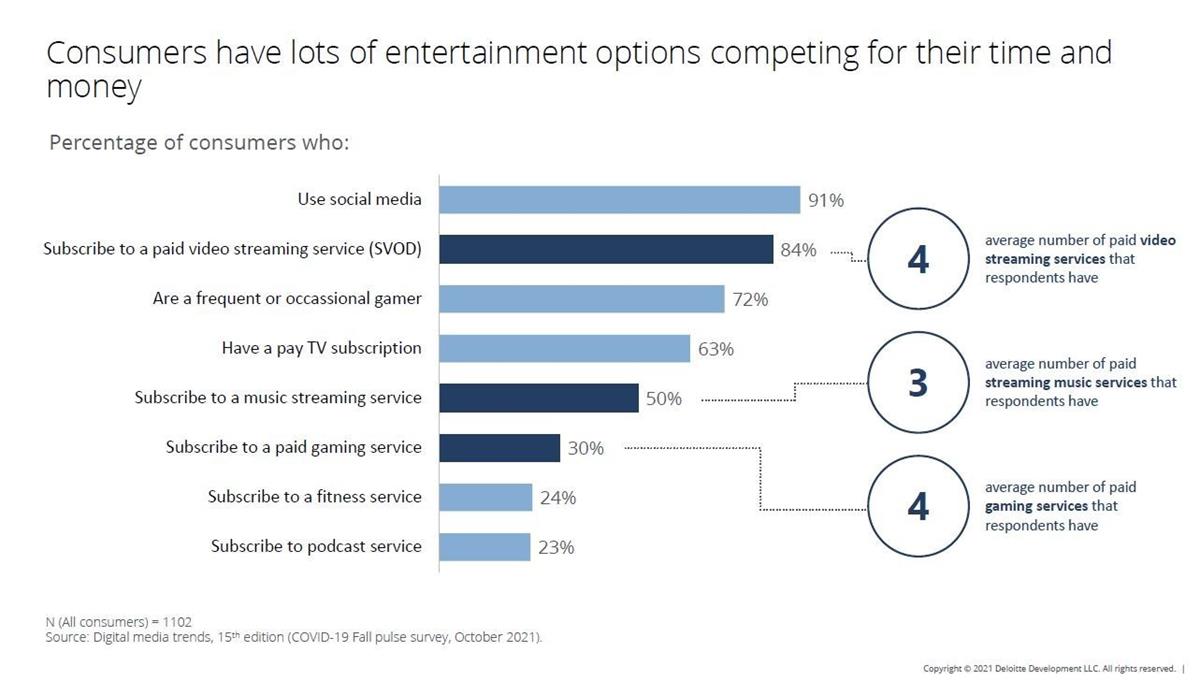

At the same time, consumers’ attention is being frayed by the continued aggregation and innovation of content on social media — mostly a mobile experience, and entirely free — and by the increasingly social experiences available in video games, which are also often free-to-play.

Combating Churn

The survey revealed that 84% of respondents now pay for a SVOD service, and the average household has four subscriptions — figures that have remained largely unchanged over the past year.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

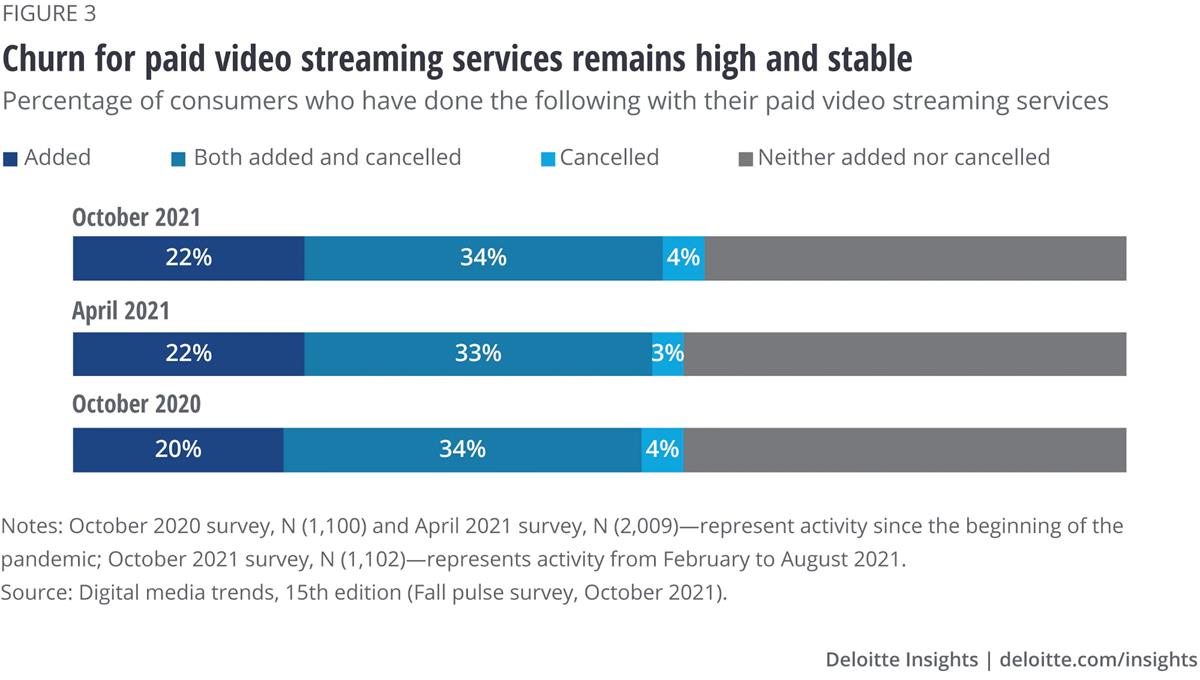

People still prioritize new original content, a broad content library, and a low enough cost to subscribe. But they are getting better at developing strategies to optimize costs and content. For providers seeking to retain them, the overall churn rate — the number of people who have cancelled, or both added and cancelled, a paid SVOD service — has remained stable at about 38%, although it varies from service to service.

The top reason people cancelled a paid SVOD service was due to high cost, suggesting there will be more growth ahead for ad-subsidized and free ad-supported subscription tiers.

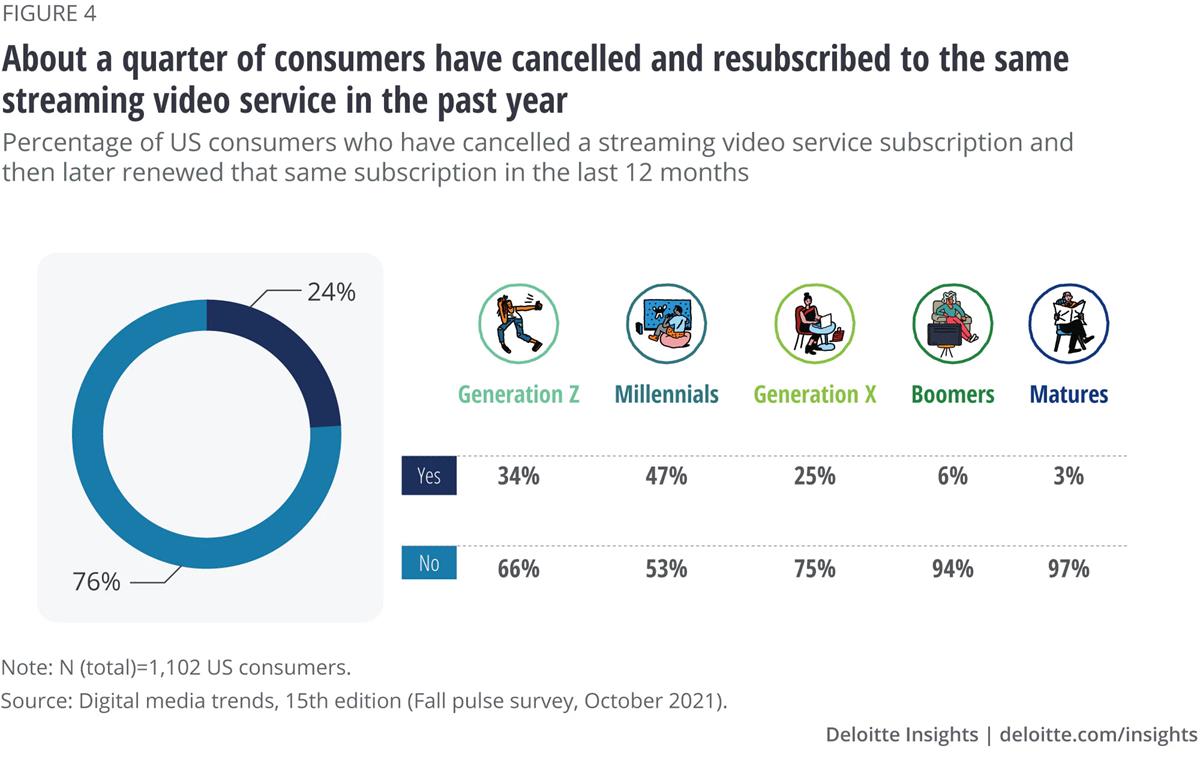

The second most common reason was that they finished the show they signed up to watch. Consumers, finds Deloitte, are enjoying the benefits of easy cancellation, choosing to turn the tap off rather than leaving it running when they don’t need it. This “churn & return” behavior is most common among younger generations: Almost half of Millennials and 34% of Gen Z respondents cancelled and then resubscribed to the same service later.

However, providers looking to reduce churn by adding friction to unsubscribing should know that the second-largest frustration people have with SVOD services is when they make it harder to cancel.

Get Cuter with Social

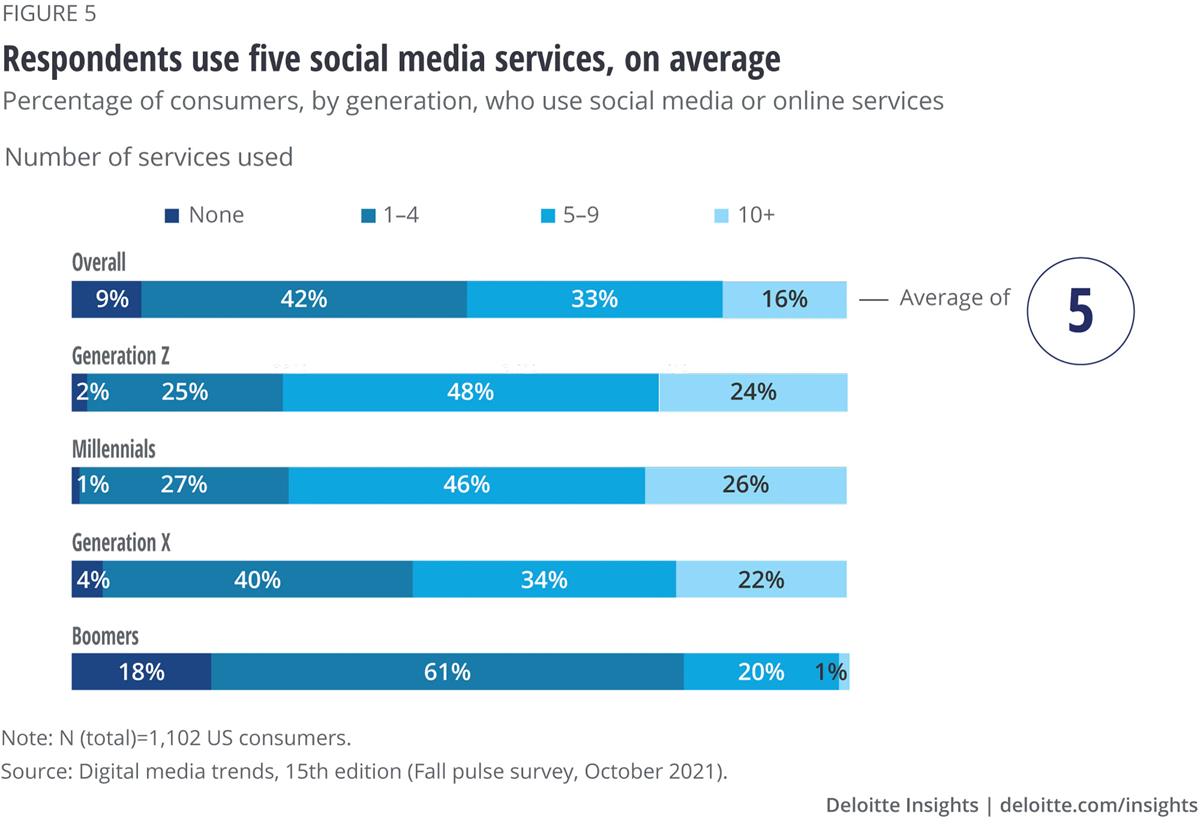

The use of social media and online services is widespread among US consumers and is a daily activity for many. About 90% of respondents cited using at least one social media service, and the average person uses five different services. This number increases to seven for Gen Zs and millennials, with about a quarter of each using 10 or more different services.

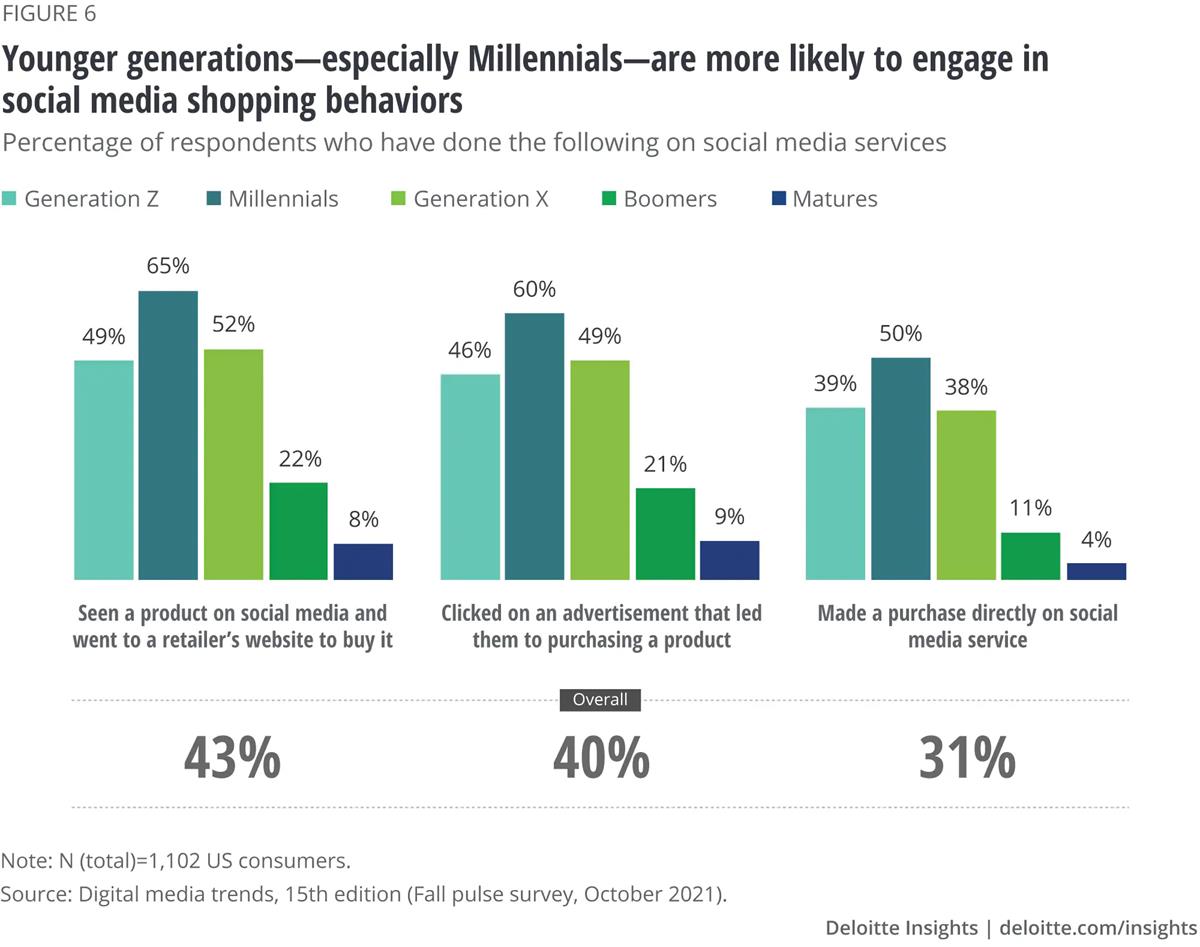

We’re not only watching more videos on social, especially short videos made by average users and influencers. M&E options are migrating onto them, and social commerce is booming.

“It’s clear people still want to enjoy socializing with friends and family, even if that means the experience is online and the interaction is from within their home,” says Deloitte’s Jana Arbanas, leader of telecom, media & entertainment. “Streaming video in its current form doesn’t satisfy this social desire, so to meet this need, consumers are spending increasingly more time on other forms of online entertainment. Given this, streaming companies need to evolve their offerings into connected social experiences in order to keep subscribers interested and engaged… whether through partnerships, acquisitions, or simply establishing a really effective social media department.”

Virtual Worlds, Real Interactions

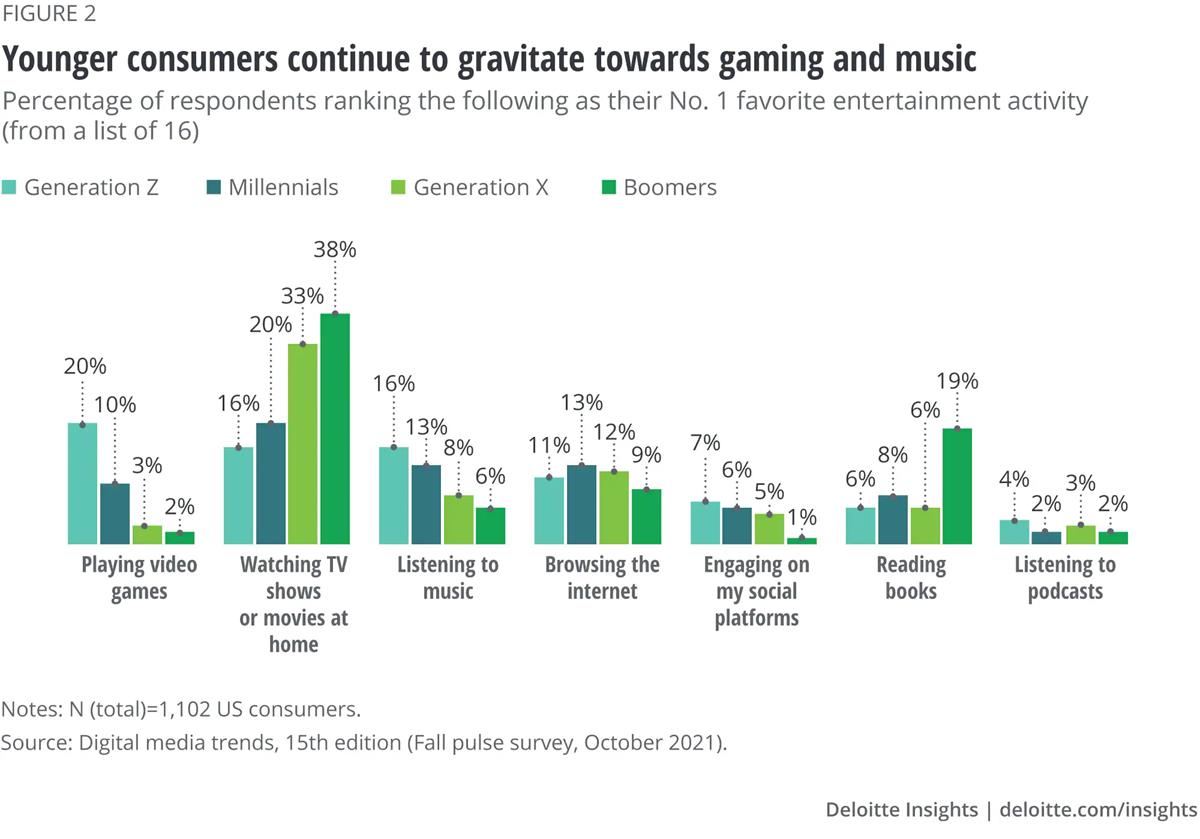

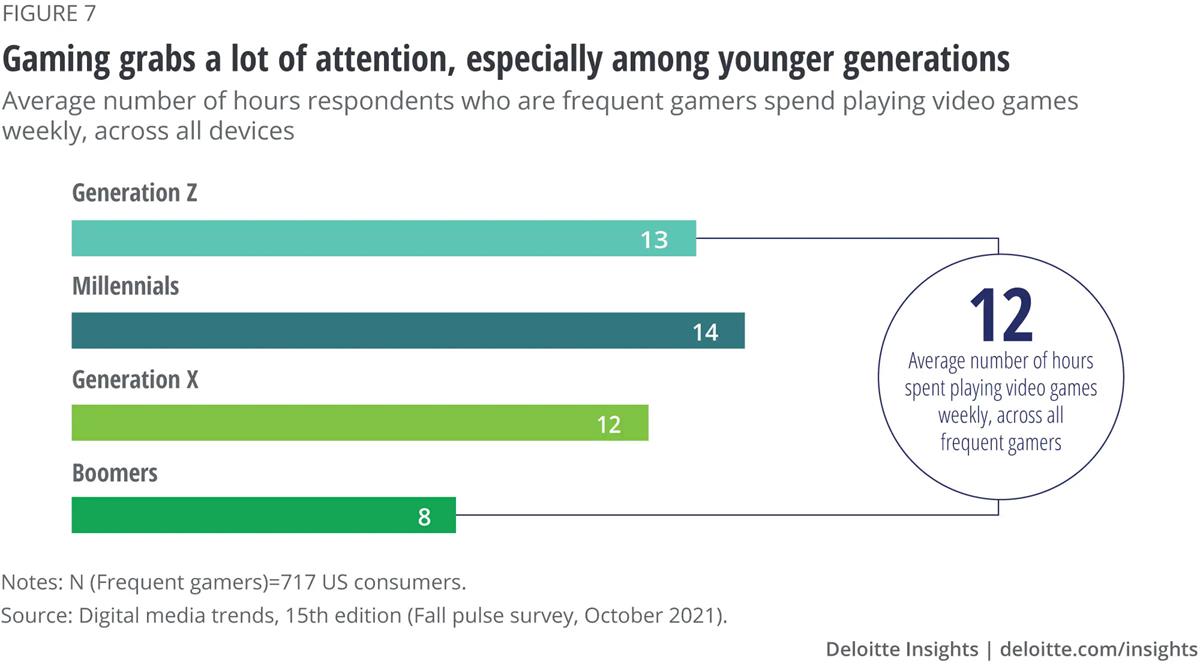

Gaming and game-related content, such as live streams and video, continue to compete for entertainment time. And, for many gamers, these activities have become social too. The survey reports 65% of respondents as frequent gamers, playing at least once a week. Gen Zs and Millennials play closer to 13 or 14 hours weekly.

Game companies have “inadvertently” become immersive, interactive social media services. When Deloitte asked gamers about important factors related to their gaming experience, more than half said ‘having positive interactions with other players’ and ‘being able to personalize my game character or avatar’ were important, followed not far behind by ‘chatting or socializing with other players and meeting up with friends online to play together.’

“Younger generations have grown up connecting through digital networks, engaging with digital and interactive entertainment, and relating to the world through a social lens. Gaming is meeting these expectations with unique, immersive experiences that can put players in the starring role. For streaming video providers, understanding social gaming and creating strong relationships with gamers may be critical to future growth.”

Deloitte’s Prescription

In the near term, SVOD players should address churn and retention among diverse segments in different markets, and shift from measuring subscribers to understanding how to unlock the lifetime value within their customer bases.

In the future, says the consultant, they should better address how customers are paying attention to and how they are choosing to engage and be entertained.

“Streaming video will likely continue to be a dominant force, especially as leading services are now pursuing global markets. However, any social elements are deferred to the “second screen” — mobile — which, for many, is really the first screen. Interactivity on SVOD is an early experiment.

“It may or may not make sense for SVOD to offer social and interactivity directly in their services, but they will likely face greater competition in courting younger generations and keeping them as lifelong subscribers if they don’t integrate a social element in some way.”