OTT video has surpassed traditional pay TV, becoming the dominant way US broadband households watch video.

According to new research from Parks Associates, the overall adoption of subscription OTT services continues to increase, with more than 80% of US broadband households having at least one OTT service subscription.

Two main factors are driving growth. The launch of multiple new services from flagship companies such as Disney, NBCUniversal, Apple, and WarnerMedia has increased the number of offerings available and divested and diversified the amount of content available through online services.

“Consumers who own and use smart TVs watch more hours of video per week than owners of any other devices, but streaming media player owners watch more content from SVOD and AVOD video services. The role of streaming video across multiple platforms is more important than ever before in the entertainment mix for consumers.”

— Paul Erickson, Parks Associates

“Additionally, consumers’ default expectations today are that high-quality video content from flagship companies is automatically going to be available on an OTT basis — streaming has replaced traditional pay TV as the medium for premium content in the consumer psyche.”

Fifty-six percent of US broadband households now own a smart TV, per the report. More than half of those households are now using the smart TV as the device they access most frequently to watch streaming video. The increase in connected TV devices and viewership in turn has driven growth in the average number of hours per week of video consumed.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

Weekly video consumption is now at 37.5 average hours per week, up an extra three hours per week since early 2020.

“Consumers who own and use smart TVs watch more hours of video per week than owners of any other devices, but streaming media player owners watch more content from SVOD and AVOD video services,” comments Parks Associates director of research Paul Erickson. “The role of streaming video across multiple platforms is more important than ever before in the entertainment mix for consumers.”

According to data from Bitmovin, which co-wrote the report, the global market for video streaming surpassed $100 billion in 2020 and is expected to grow past $250 billion by 2025 as viewer consumption habits increasingly change to favor streaming.

As a result of this significant shift, Bitmovin saw a 174% growth in the number of broadcasters opting for OTT in 2020.

Industry analyst Brett Sappington, who leads the video and entertainment research practice at global insights firm Interpret, chats about the evolution of streaming and its impact on the pay-TV model on the Light Reading podcast with senior editor Jeff Baumgartner.

“Before you would ever get to a subscriber floor, I think [the pay-TV industry] fundamentally has to change… to make the economics work,” Sappington comments. “We’re really looking at a pretty significant shift in how pay-TV works in the next few years just to make the economics work out.”

Listen to the full conversation in the audio player below:

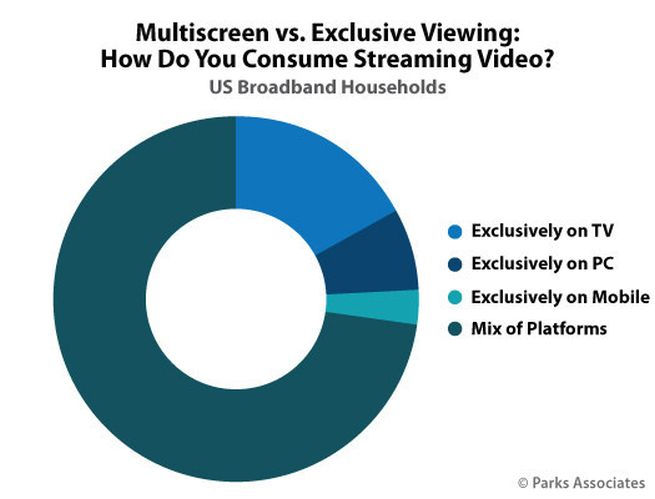

Seventy-two percent of broadband households are engaging in multiplatform streaming video viewing, and 40% are viewing on all platforms available to them. “Consumer adoption of multiple streaming video services may slow, but their comfort with streaming content will persist — the connected home is now permanently a multiplatform environment,” said Erickson.

“Consumers’ default expectations today are that high-quality video content from flagship companies is automatically going to be available on an OTT basis — streaming has replaced traditional pay TV as the medium for premium content in the consumer psyche.”

— Paul Erickson, Parks Associates

The report suggests that the increasing diversity of devices on which streaming video is consumed presents a rising challenge. The number and type of devices requiring support is one challenge; ensuring that the service is delivered in the highest quality with must-have features 4K and HDR are table stakes.

That’s where Bitmovin comes in. A section of the report is devoted to the ways the company’s compression technology can help alleviate both issues.

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- The Ever-Changing Scenery of the CTV Landscape

- TV is Not Dead. It’s Just Becoming Something Else.

- Converged TV Requires a Converged Ad Response

- Connected TV and the Consumer

- Connected TV Opens Up a Million Ad Possibilities

“In today’s market, return on investment is a constant challenge, churn is ever present, and maximizing subscriber acquisition and retention are crucial. Platform support limitations can collectively contribute to making the path to ROI longer, more difficult, and harder to predict.”

While nearly half of US broadband households subscribe to four or more OTT services, as of Q1 2021, there were still 18% of US broadband households not subscribed to any at all.