READ MORE: Three issues eroding the streaming experience (Accenture)

Consumers may not be able to express it, but they want an aggregator. The industry knows this too. In a new survey, management consultant Accenture has determined that streamers who ignore the frustrations felt by consumer and instead focus blindly on subscriber acquisition do so at their own risk.

Based on a survey of 6,000 consumers across the world last October and November, industry consultancy Accenture has released a new report pointing to three big issues that are eroding the streaming experience.

Issue one: Navigating through OTT services is like entering different rabbit holes, each with its own entry and exit — a turnoff for consumers.

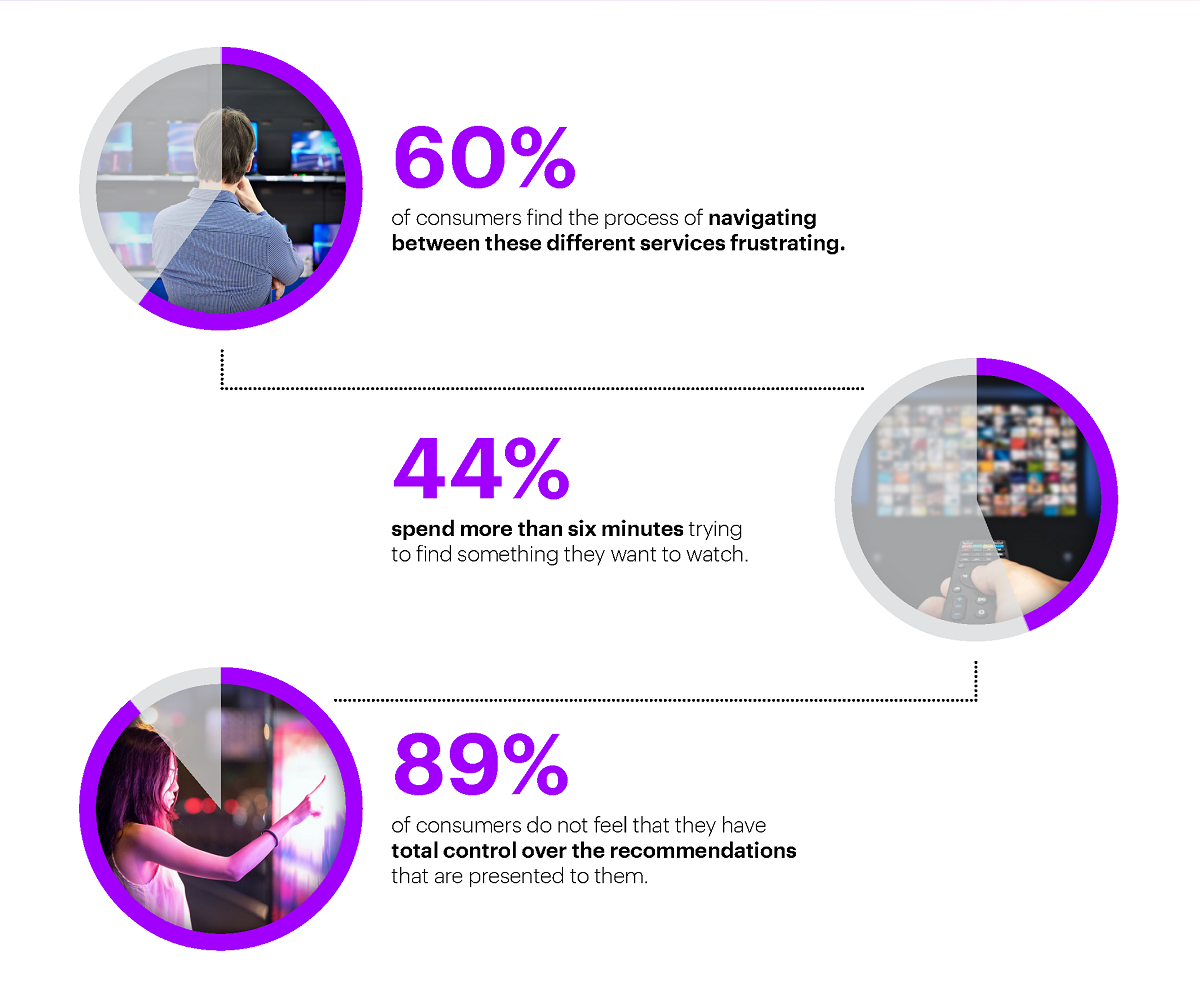

This is borne out by the survey, which found that 60% of consumers globally consider the process of navigating among these different services “a little” to “very” frustrating, and nearly half (44%) spend more than six minutes trying to find something they want to watch.

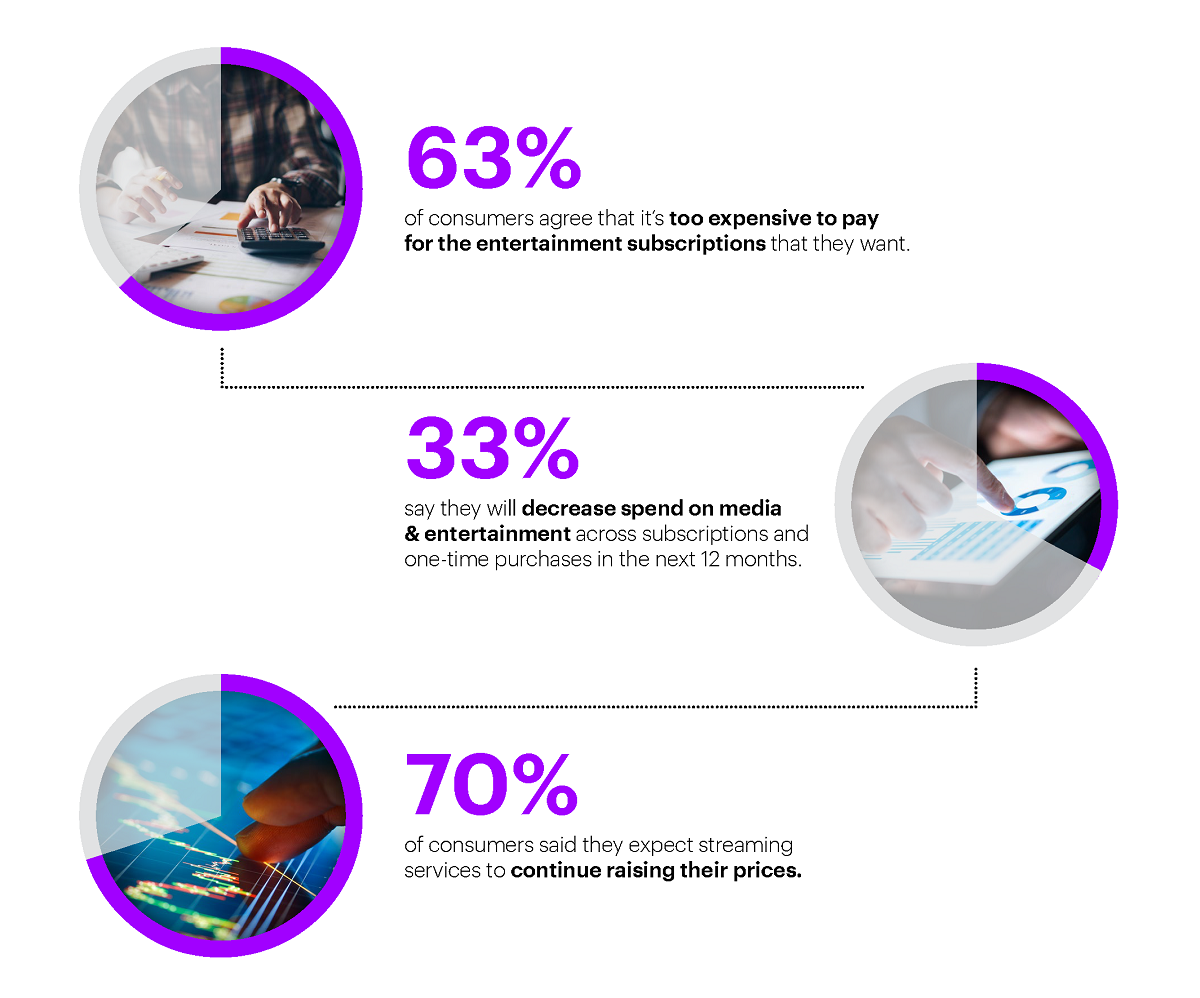

A second issue is encountering inefficient bundles. According to Accenture, 33% of consumers globally say they will “somewhat” or “greatly” decrease spend on media and entertainment across subscriptions and one-time purchases in the next 12 months.

A third issue is that incomplete or inaccurate recommendations and, hence, often irrelevant content, is the norm for most consumers. That’s because algorithms remained scattered across providers

“Furthermore, the reliance on the algorithm to pitch consumers shows doesn’t allow consumers to tune the model, except through actual show selection,” the report says.

“For streaming to continue to grow and fulfill its potential, we believe a big change to the ecosystem is needed: the addition of a smart aggregator, sitting across multiple platforms, that dramatically increases viewers’ control over the content they watch.”

— Accenture

Not surprisingly, a majority of global consumers said they’d like to be able to take their profile from one service to another to better personalize content (56%); and they’d be happy to let a VOD service know more about them to make recommendations more relevant to them (51%).

The analysts’ cast-iron prescription — an inevitability, in fact — is that the streaming landscape needs to consolidate under aggregators. This trend has been on the cards for a few years but it seems that, as streaming services continue to multiply, the need is greater than ever.

Accenture: “For streaming to continue to grow and fulfill its potential, we believe a big change to the ecosystem is needed: the addition of a smart aggregator, sitting across multiple platforms, that dramatically increases viewers’ control over the content they watch.”

For their part, most media executives agree: According to Accenture’s Technology Vision 2021 research, 77% of media executives said their organizations need to dramatically re-engineer the experiences that bring technology and people together in a way that puts people first.

Such an aggregator service would among other things act as a single platform that enables viewers to select exactly what they want to watch, such as categories of specific shows, regardless of who’s providing it.

It would also personalize the experience by providing seamless navigation and curation across streaming services, created in collaboration with and for every individual.

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- The Ever-Changing Scenery of the CTV Landscape

- TV is Not Dead. It’s Just Becoming Something Else.

- Converged TV Requires a Converged Ad Response

- Connected TV and the Consumer

- Connected TV Opens Up a Million Ad Possibilities

Any of the current streaming ecosystem players — major SVOD services, access devices and connected TVs, major internet onramps and consumer apps, and even traditional cable operators — could become an aggregator.

“Early versions are being assembled, although it’s too early to call the winners. Some might come from the top-tier SVODs that “google up” other apps or make partner apps available inside their service. Others might emerge from access devices that already do basic aggregation of apps on, for instance, a connected TV or a stick that plugs into a TV.”

The obvious question to ask is whether the end game for consumers is just another version of the cable/satellite pay TV bundle. Accenture thinks the new model will be different, if aggregators deliver on the promises of choice, personalization, and convenience.

“Initial incarnations will be bundles of SVOD and AVOD streaming services. But look out for the categories of offerings to expand to including music services, digital books and podcast apps, video games, virtual fitness, food delivery, commerce, and even productivity tools.

What’s more expect future evolutions to be the onramps for any form of digital consumer experience — such as the metaverse.

“Aggregators — if trusted — can be enablers and caretakers of digital identity, entitlements, security, currency, and more. Indeed, the battle to be the home of a consumer’s streaming experience may, in fact, be just the first skirmish in the broader battle to be the home of a consumer’s every experience.”

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

The analyst is in no doubt aggregation is coming.

“Becoming a successful aggregator or surviving as an individual streaming service requires different sets of actions. But what’s clear for all players: A blind focus on driving subscriber counts without taking steps to position the business for the aggregated future, regardless of which route you choose, presents near-certain peril.”