READ MORE: Global Entertainment & Media Outlook 2022–2026 (PwC)

The US remains the largest single OTT market, generating $29 billion across transactional and SVOD last year — with double-digit growth in 2021 alone. Throughout the pandemic, many consumers who previously eschewed paid video entirely were finally convinced to take the plunge, and there’s new data to prove it.

PwC‘s new “Global Entertainment & Media Outlook 2022-2026” explores these recent growth metrics in detail, and pinpoints how connected TV is shaping up to be an AVOD battleground.

On OTT Growth

In absolute terms, the US added $6.4 billion of OTT video revenue in 2020, and $4.8 billion in 2021, driven by a combination of new subscribers and subscription package price increases.

Over the next five years, PwC expects the market will increase at an average 6.8% compound annual growth rate (CAGR).

“While this represents a significant cooling compared to the recent past, in absolute terms the US will still be adding more revenue than any other single market.”

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

In total, by the end of 2026, OTT video revenue in the US is expected to reach $40.4 billion, an increase of $11.3 billion from 2021.

SVOD will increase its share of the total OTT video market over the next five years and is expected to represent 83%, or $33.6 billion, by the end of 2026.

However, now that traditional entertainment companies have SVOD platforms of their own, they are beginning to pull back content as they look to grow their OTT subscriber bases. As more and more SVOD services are launched, PwC finds “a contrasting state of negotiating power that any single SVOD holds,” as the consumer is able to choose from a far larger portfolio of services and platforms.

This loosening of SVOD’s grip on the streaming model is featured in a number of data points in the report. Let’s look at those:

FAST Channels Solidify

FAST channels are increasingly gaining attention from the gatekeepers in online advertising. Google has agreed a broad-ranging partnership with Pluto TV that will see the FAST channel distributed to Google TV devices. PwC thinks it likely that Google will also be using Pluto TV and other platforms to begin distributing its own content at some point in 2022.

While Pluto TV is perhaps the largest household name, it is joined by a range of other services which are increasingly widely distributed. Rakuten TV is now available across 12 countries in Europe. Tubi, Peacock, Roku and Crackle all feature some sort of FAST provision which is alongside paid in some instances, creating a hybrid service that can often be used to upsell more premium content to users once they are within the content ecosystem.

Streaming experts gathered for a round table discussion hosted by The Wrap said they expect the looming recession will push consumers into FAST, “long stereotyped as a haven for a financially struggling Gen Z audience.” As premium services pivot to include ad-supported tiers to offset subscriber churn and slower-than-predicted growth, FAST services like Pluto, Tubi and Amazon’s Freevee are well-positioned to begin including premium content into the mix. Watch the entire conversation in the video below:

CTV, the AVOD Battleground

Connected TV (CTV) is a varied term, which applies not just to the TV set itself but to any device that connects to it, turning it into a device capable of streaming content OTT. Examples include Roku and Amazon’s stick-based devices. But the term also extends to games consoles and smart TVs like Sky Glass and OS-based solutions like Google TV.

“CTV is a driving force behind the changing nature of OTT thanks to AVOD and ad-insertion and more specifically the hardware companies in control of hardware manufacture,” says PwC.

Rather than ads sold at the point of broadcast, ads can be served in a variety of dynamic ways. This could mean all the way up to being completely dynamic across unrelated channels and aggregated through the platform rather than the broadcaster.

“While this does not directly affect SVOD and TVOD players, there are several reasons why this will affect them as services are carried across the range of CTV options available to consumers. Hardware manufactures are ceasing to be content agnostic.

“In the past, a set was primarily designed to provide the best image (for the cost), with other UX components like sound and user interface (UI) coming second. Because CTV represents an increasingly important battleground and revenue-generation stream, the UI is significant. Carriage and prominence within a platform will be affected by the relationship of that player to the hardware manufacturer, not just the popularity of the app with the general viewership.”

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- The Ever-Changing Scenery of the CTV Landscape

- TV is Not Dead. It’s Just Becoming Something Else.

- Converged TV Requires a Converged Ad Response

- Connected TV and the Consumer

- Connected TV Opens Up a Million Ad Possibilities

Pay-TV Continued to Decline

The US saw a revenue decline of 7.4% across 2021, seeing a loss of over US $6.6 billion, decreasing from $89.4 billion in 2020. By comparison, the global decline in traditional TV revenue was just 1.5%, with regions like Asia Pacific and EMEA showing slight growth.

Cable, which represents 63% of the US market, previously used to best retain its customer base by bundling telco services with pay-TV; however, this has changed in recent years and now Internet access is being bundled along with SVOD and OTT services, as well as access to linear OTT such as Comcast Xfinity and Spectrum.

The analysts at PwC note that this has contributed to the fast growth in SVOD and OTT services but has slowed growth in pay-TV. Even so, pay-TV has slowly been growing its market share (in terms of subscriptions), with an increase from 56% in 2017 to 63% in 2021.

A Map of Worldwide SVOD Penetration Rates

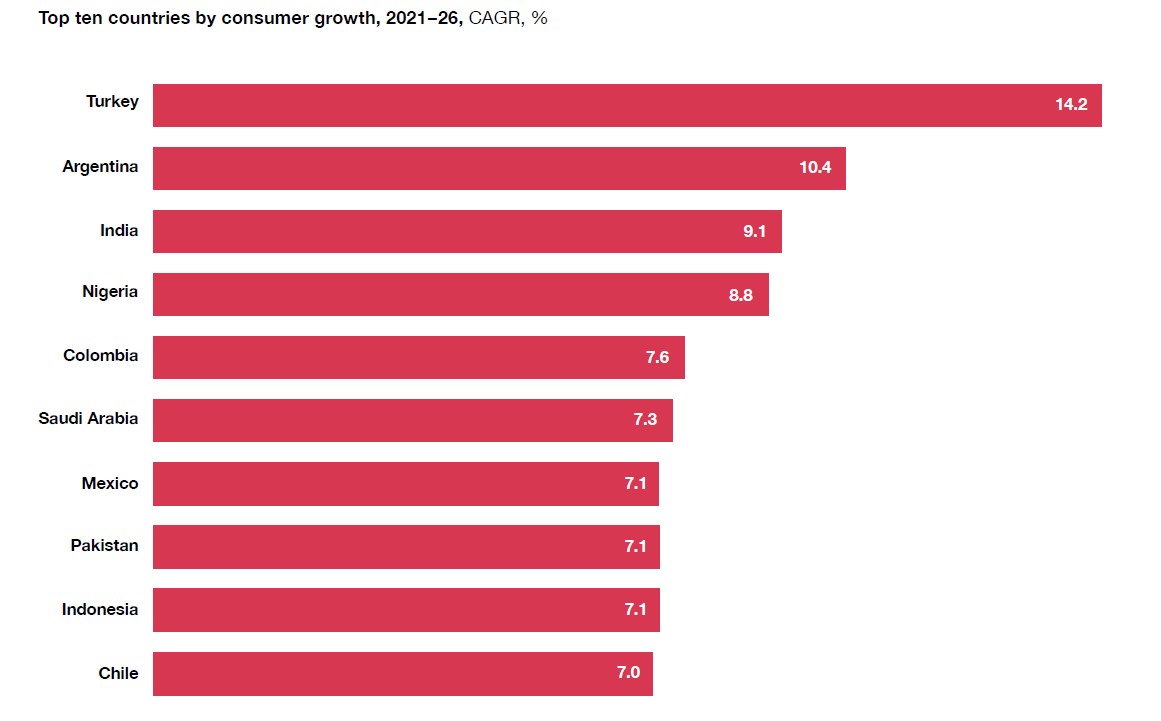

Facing a rising number of competitors, Netflix has found it difficult to grab more share in the streaming marketplace and recorded its first decline in its subscriber base since the first quarter of 2022. However, worldwide growth of SVOD services rose roughly 20% in 2022, according to market research & analysis consultancy Statistia.

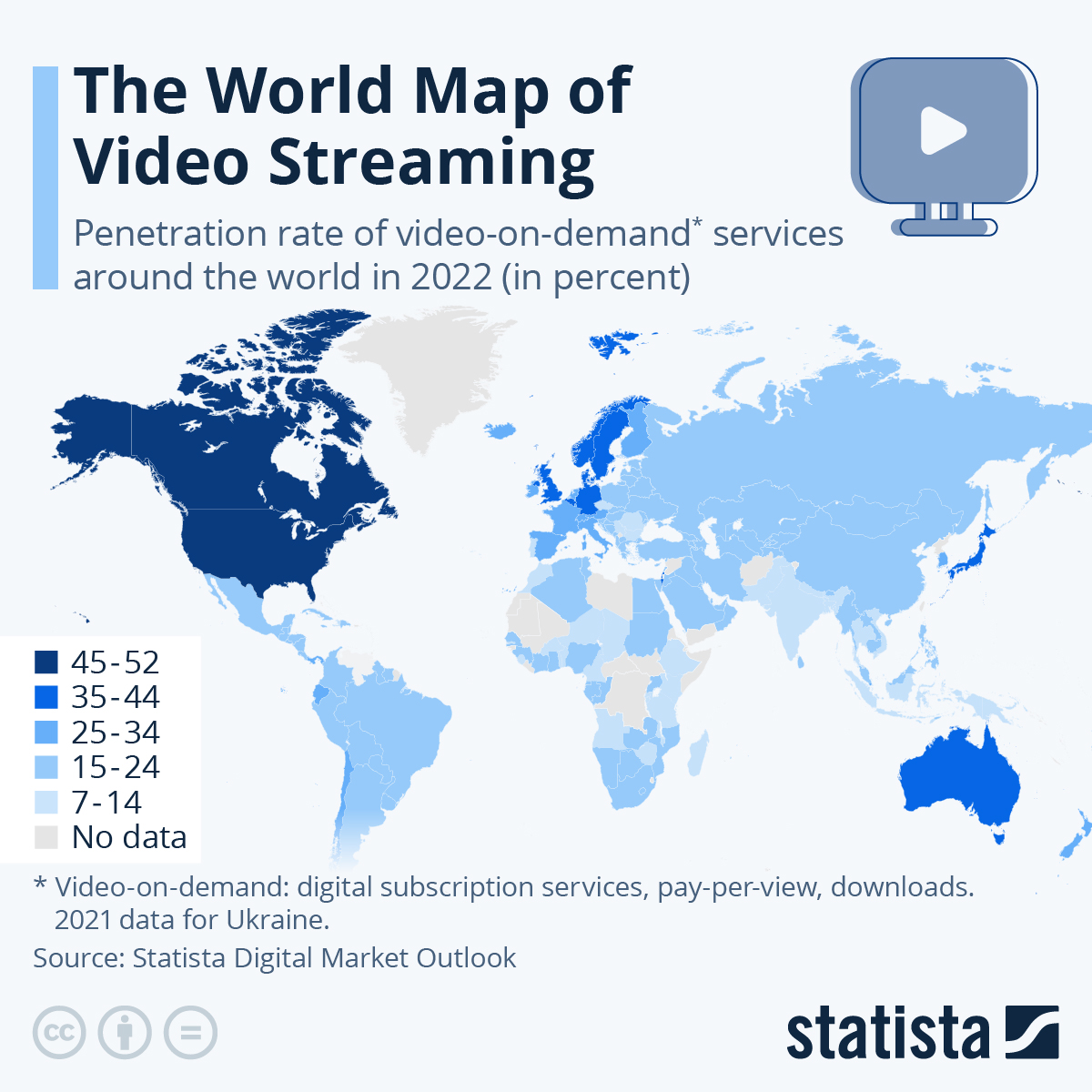

As Statista senor data analyst Katharina Buchholz explains, the map below shows “the most promising markets for chasing video-on-demand users are now South Asia, Latin America and Africa, where Disney+ has arrived in several countries (including South Africa) in 2022. While the market is expanding more slowly in North America, where video-on-demand has reached approximately 50% of the population, there is still some more room to grow in Europe, where this figure varies from 14% in Bulgaria to 42% in the United Kingdom.”

READ MORE: The World Map of Video Streaming (Statista)

Pay TV Finally Gains a Foothold in OTT Distribution

Cable companies are at the center of consumer video, says PwC. Cable allows customers to sign up to OTT services through a single package and allows integration of these services through pay-TV STBs and platforms.

“This is important because it allows cable to weather the storm of cable-cutting and cord-trimming as users move to using more stand-alone TV providers. Retaining these now lower-paying subs means that as the re-bundling of third-party services occurs, cable TV will be able to recoup these losses.”

To be specific, this proposition states that while SVOD has unbundled pay-TV and caused a huge degree of chaos in the industry, to a major extent this model only works where there are one or two major SVOD services to choose from.

“When there are more, competition between each of these services takes its toll on the performance of all of them. In order to grow revenue across all of these competing companies, it is necessary for a neutral aggregator to play the role of the consumer gatekeeper.”

Replicating this kind of model in the SVOD space is expected to be increasingly prominent over the next five years. A light form of pay-TV is expected to be bundled with a data subscription, while premium sports and movies will remain as a core pillar of pay-TV.

TV and Home Entertainment Outlook

Over the next five years, pay-TV is expected to continue to decline in the US, both in terms of subscriptions and, at a slightly slower rate, in terms of revenue.

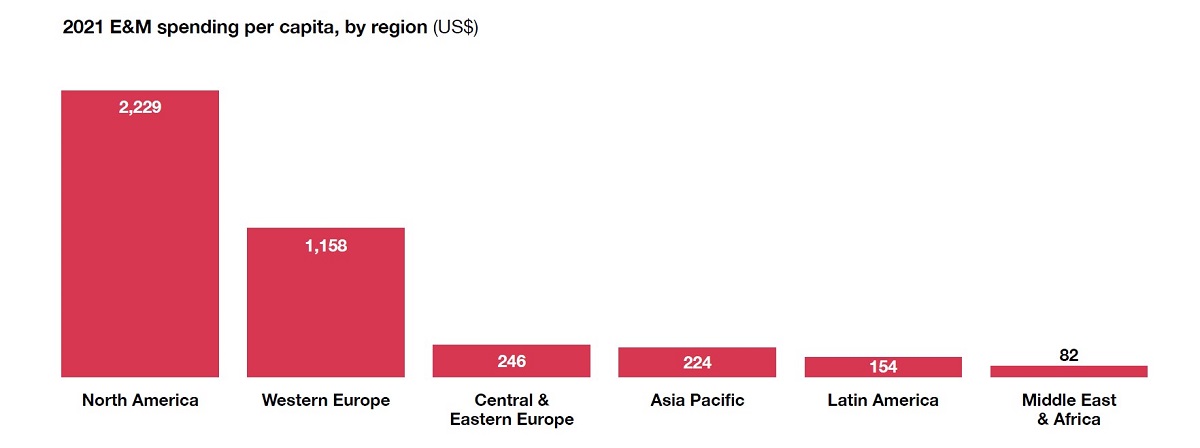

By 2026 North America as a whole, with the US making up 90% of its revenue, will have seen a significant decline in global market share, decreasing from 44% in 2017 to just 33% in 2026.

The US will be worth $65.6 billion in 2026, slightly smaller than the EMEA market, which is expected to bring in $72.4 billion.

Satellite is expected to continue to be the worst affected platform experiencing the fastest decline due to extensive cord-cutting and an industry shift towards OTT services. Over the next five years, satellite will churn around one-third of its total base (at a -8.0% CAGR), or around 6.7 million subscribers, falling from almost 20 million in 2021 to 13 million in 2026.

Cable is expected to lose 4.5 million subscribers over the next five years, with losses slowly decreasing and expecting to stabilize, from -3.9% year-on-year in 2021 to just -0.8% in 2026, shrinking at a -2.1% CAGR.

“By this point, cable distribution is expected to be nearly synonymous with broadband double-play, meaning that for many of these households there will be little difference between a cable and an effective IPTV home. Indeed, the underlying technologies driving cable and IPTV television continue to move closer together.”

VOD usage in particular means that an increasing amount of viewing by cable subscribers is of content delivered through IP — in essence the end product that consumers use is rapidly becoming “an indistinguishable proposition.”

Performance of these two platforms is therefore driven more by the proposition than the technology behind the platform.

Internet Ad Revenues Accelerate

The US Internet ad market enjoyed an acceleration in growth in 2021, expanding year-on-year by 35.4% after the uncertainties in 2020. The market will continue to increase at an 8% CAGR between 2021 and 2026 to reach a value of US $278 billion, still the largest market globally.

Contributing to the rapid expansion in US Internet ad revenue is the shift towards ad-funded online video (such as the ad-supported options from Discovery+, Paramount+ and HBO Max), and E-commerce with market leader Amazon capitalizing significantly alongside other prominent retailers that launched their own retail media services.

Internet advertising is expected to evolve over the next 10 years into a broader category of Web 3.0 and “metaverse advertising” which will encompass online 3D advertising (three dimensional ads expected to run soon on Facebook and Instagram platforms), VR ads and perhaps other IOT advertising channels and spaces, along with new ad formats such as branded NFTs.

“The business cases for these technologies remain unclear and uncertainty about adoption makes category forecasting challenging,” PwC finds.

Meanwhile, regulatory attention continues to be a thorny subject in the US for the market’s top-10 leading tech players — which together combine to take 78.6% of US digital Internet advertising revenue, according to an April report by the IAB.

The regulatory environment is set to become more stringent from 2022. PwC says: “This will be a critical aspect of protecting the open Internet, which is being threatened by increasing shifts towards privacy protection, some of which could potentially strengthen the hand of big tech and its first-party data-rich walled gardens while heavily impacting the open programmatic market.”

Streamers Shift to Hybrid Models

The bounce in video consumption during the pandemic continued in 2021, when the online video market also shifted greater attention to ad-supported monetization strategies. As a result, total online video advertising revenue grew by 50.9% during 2021 to reach $39.5 billion. PwC expects rapid expansion to continue, forecasting that in five years from now online video ad revenue will reach $66.6 billion. By that point, it will represent 44.2% of total Internet display advertising revenue in the US and 25.2% of the country’s total Internet advertising market value, up from 40.5% and 22.0% in 2021, respectively.

Much of this will remain dominated by mobile-first social platforms — like YouTube, Facebook, Instagram and, increasingly, TikTok — but opportunities for premium ad-funded platforms are growing rapidly in the US as more viewers shift from linear TV to Internet-delivered alternatives.

“In the medium term, shifts towards hybrid monetization methods, connected TV and FAST channels will cement video’s role as the main driver of revenue between 2021 and 2026.”

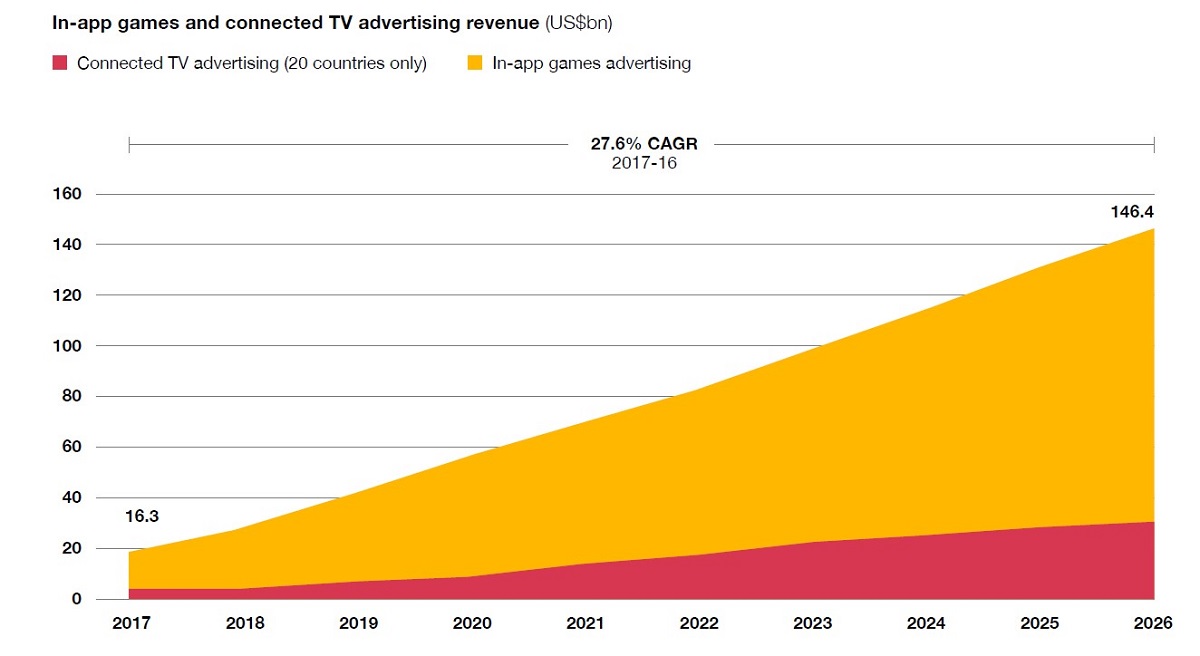

As uptake of ad-supported subscriptions and FAST channels increase, and advertiser appetite for premium, brand-safe, addressable messaging on connected TVs grows. The connected TV advertising segment will enjoy substantial growth over the forecast period when it expands from $8.1 billion in 2021 to $17.5 billion in 2026, representing an increase at a 16.8% CAGR.

Additionally, while online TV advertising is occasionally seen to be competing with other forms of online advertising, the reality is most experts consider that online TV advertising is in fact additive in this space. The net result is that the impact of online TV advertising over the next five years will be net positive both for TV advertising and for the advertising industry as a whole.

In total, broadcast networks will increase their share of total terrestrial advertising revenue from 48% in 2021 to 50.9% in 2026.

Award-Winning Producer Evan Shapiro to Keynote 2022 NAB Show New York Opening

By NAB Amplify

Award-winning film producer and industry thought leader Evan Shapiro will keynote the 2022 NAB Show New York opening event on Wednesday, October 19 at 10:30 a.m. at the Javits Center.

In his keynote address, “Bringing Media Into the Current Century, Now,” Shapiro’s notoriously interactive presentation will engage NAB Show New York attendees in examining the shifts occurring in today’s media landscape.

Shapiro’s address will take place in the Content Theater located on the show floor following welcome remarks by National Association of Broadcasters (NAB) President and CEO Curtis LeGeyt.

Evan Shapiro is an Emmy and Peabody Award-winning producer of film, TV and podcasts. He is a professor of Media Studies at New York University and Fordham University schools of business and co-hosts a podcast called Cancel Culture. Many in media know him as the official, unofficial cartographer of the media universe. Using his specific point of view, Shapiro has mapped the tech and entertainment ecosystem, and through his essays, helps chart media’s future. Shapiro uses these insights to power his change agency, ESHAP, which offers partners and consumers media insight as a service.

“With an impressive resume of award-winning projects, unique insight into the competition for audience’s attention and influential thinking about the future of the business, Evan Shapiro is a sought-after voice for preparing media professionals for the challenges and opportunities of tomorrow,” said Chris Brown, NAB executive vice president and managing director, Global Connections and Events. “We are excited to have Evan share his perspective with our community as we kick off the return to an in-person NAB Show New York.”

Shapiro will also participate in an exclusive interview on NAB Amplify as a preview to his NAB Show New York keynote address.