Revenue models are crucial for the evolution of the media industry, but it is not clear what media monetization will look by the end of this decade.

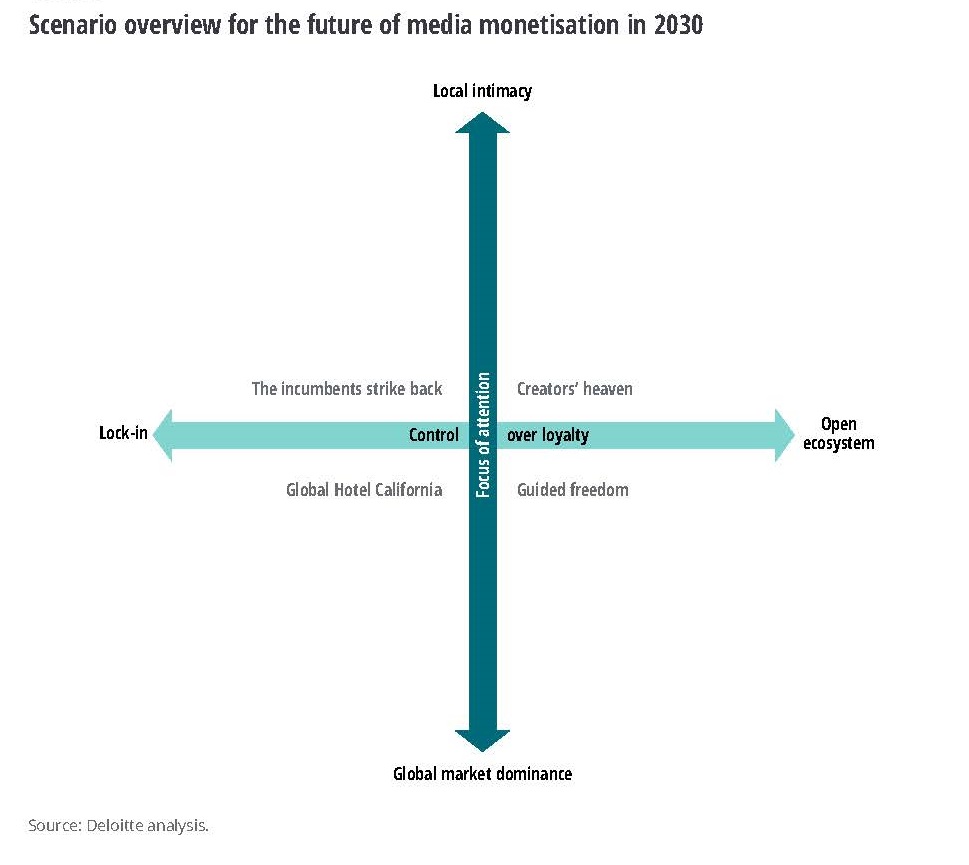

Industry consultants at Deloitte have taken a stab at it, coming up with four “extreme but valid” scenarios for the evolution of media revenue models up to the year 2030.

For a full understanding of their methodology, head to “Future of media monetization,” where Deloitte caveats its predictions by saying there are too many variables to make precise models.

However, in the face of all this uncertainty, it is worth acknowledging what we do know. Its analysis revealed that the following trends are “most likely universally valid” and provide context for the future of the media industry.

So, before we check out the four media monetization scenarios what Deloitte can reasonably say for sure by 2030 is:

1. Media will be almost exclusively digital and internet based. Consumers will cover their content needs digitally, and acceptance will cover all age segments — even seniors will primarily turn to web-based media.

2. Thanks to the omnipresence of adtech, the effectiveness of digital advertising will most probably be measured with the highest accuracy at the end of this decade. Nonetheless, even in 2030, a common, uniform performance indicator will still be essential for the entire media industry,

3. The willingness to pay for premium content will most likely be strong in 2030. A considerable number of consumers will have come to appreciate quality and curated media, for several reasons. One is becoming accustomed to a high level of quality in VOD and feeling it is necessary. Another is desiring quality news, as a response to the spread of fake news.

4. Micropayments will proliferate: for individual films, series, music tracks or news articles. Consumers will see such a payment model as easy and secure. Blockchain-based, pay-per-use models will complement conventional payment solutions, and they will enable new monetization options for media professionals, despite being initially complex and fragmented.

5. Screens will be everywhere — encompassing all sizes, from smartwatches to movie screens. Just like speakers, they will all be connected in the year 2030, so media can be streamed extensively. This applies to media consumption at home, as well as on the move.

Four Scenarios for Media and Revenue in 2030

So, onward then to the four scenarios painted by Deloitte. “It is not about predicting the future, per se, but depicting the risks and opportunities of specific strategic options,” the consultant says. “In other words, they are narratives set in alternative future environments that are affected by today’s decisions and trends.”

Scenario 1: Creators’ Heaven (Creators Win)

Here, the market is characterized by a fragmented and open ecosystem that includes a large number of local content providers who maintain a multitude of paid customer relationships.

“In this highly connected and hyper-digital world, the level of innovation and technological development is extremely high. Customers are used to micropayments and direct, blockchain-based payment methods. Content is cheap and easy to consume in small doses, and subscriptions are easy to cancel instantly. Individual, pay-as-you-go transactions and subscriptions are the dominant revenue models.”

This creator economy allows everyone to implement their own content and business models. As a result, the media landscape is fragmented and margins are low, due to atomistic competition.

The big legacy players — what Deloitte calls digital platform companies (DPCs) — cannot leverage their global blockbuster content, instead acting as one of many distributors of platform-as-a-service solutions for smaller media companies.

“In this scenario, local content producers and intellectual property owners are the winners, since they can use their direct access to media consumers in order to grow. They successfully implement e-commerce and in-app purchases as additional revenue models.”

Scenario 2: Guided Freedom (Aggregators and Local Content Owners Win)

In this scenario, numerous revenue models have prevailed in an open ecosystem, with large DPCs taking on the central aggregator role.

“DPCs provide their technology and set the rules of the game, which funnels the variety available in the open metaverse-ecosystem and allows DPCs to monetize their global content. Local content remains relevant but is supplied by partners. The DPCs’ search and recommendation functionalities provide orientation in the overwhelming content flood but, on the other hand, this shapes a global mainstream media culture in line with DPC preferences.”

Deloitte predicts that data, analytics and AI are omnipresent and freely available to all. As media has become almost entirely digital, smart technologies can predict consumption and pave the way for targeted advertising. Regulation is in place but is unable to break the supremacy of the DPCs.

The extensive availability of data allows for highly targeted advertisements. More than that, some content is offered for free in exchange for consumer data.

Subscription models survive as flat-fee access to premium DPC content, but the majority of payments are transaction based. Alongside these, a new generation of blockchain-based technologies and crowdfunding platforms enable small local producers to monetize their content directly.

CRUSHING IT IN THE CREATOR ECONOMY:

The cultural impact a creator has is already surpassing that of traditional media, but there’s still a stark imbalance of power between proprietary platforms and the creators who use them. Discover what it takes to stay ahead of the game with these fresh insights hand-picked from the NAB Amplify archives:

- The Developer’s Role in Building the Creator Economy Is More Important Than You Think

- How Social Platforms Are Attempting to Co-Opt the Creator Economy

- Now There’s a Creator Economy for Enterprise

- The Creator Economy Is in Crisis. Now Let’s Fix It. | Source: Li Jin

- Is the Creator Economy Really a Democratic Utopia Realized?

Local producers benefit from partnerships with the large platform providers but are making themselves increasingly independent through direct customer and payment relationships. In this way, the dominant role of DPCs tends to come under pressure.

Scenario 3: Global Hotel California (Slam Dunk for the Major Platforms)

This outcome has global DPCs command the bulk of media revenues through both subscription models and highly innovative forms of advertising.

“In a completely unregulated market environment, DPCs benefit at all levels: They can make best use of their financial power, monetize their global blockbusters, collect user data and leverage their analytics and AI capabilities. DPCs have created their own metaverses and act as central aggregators for all types of content, consequently ‘locking in’ media consumers. The level of technological innovation is high in this scenario, and DPCs set global standards. The outcome is an oligopolistic market structure with a high price level.”

Dominant DPCs rely on two main revenue models: First, there are constant revenue streams from subscriptions in this locked-in market landscape. Second, DPCs benefit from maximally customized and targeted forms of advertising. In addition, they cross-finance content through their e-commerce business.

Local content providers are pushed into a pure production role and depend on the DPCs for direct customer access. Small local aggregators and content producers have largely been eliminated.

Media consumers can access a wide variety of different content, but the offerings usually follow a global one-size-fits-all approach that completely ignores country-specific tastes and requirements. In the end, consumer sovereignty is weakened — “You can check out any time you like, but you can never leave,” as the song goes.

Scenario 4: The Incumbents Strike Back (Telcos and Newspapers Win)

In our last (perhaps least likely) scenario, media regulators strongly protect local content and have pushed back large global players. “Instead, traditional media channels, like newspapers, still play a prominent role. The dominant revenue model is subscription based. Advertising is less significant for future media revenues, not least because stakeholders are not incentivized to collect the data needed for targeted advertising. National media houses and telecommunication incumbents are the winners in this scenario: They are aggregators and super-aggregators, and act as content gateways for consumers.”

Deloitte says that due to intensive data regulation, the level of innovation and technological development is low in this outcome. “The market environment does not foster an intense start-up culture and lacks innovative media services, while M&A are also restricted. Regulatory requirements prevent DPCs from contributing their scale and data expertise. As a result, the entire media industry stagnates, and revenue potential cannot be exploited because media consumers face a limited and uninspiring media landscape that lacks international ingredients. Therefore, consumers’ willingness to pay is limited to the bare minimum of information, sports and entertainment.”

Deloitte concludes by saying that. companies that succeed will be alert, aware and planning for all possible outcomes ready to tweak those plans at a moment’s notice. Because as we look back at our pandemic-occupied past year, and ahead to media in 2030, the only thing certain is that nothing can be foretold with certainty.