As viewing OTT or via Connected TV (CTV) continues to grow, it’s natural that the advertising universe will expand alongside it.

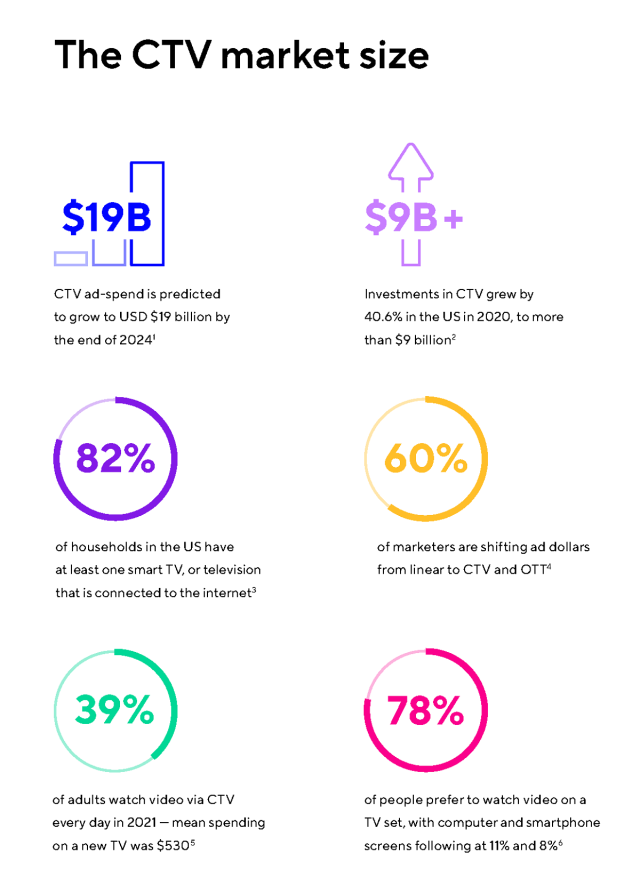

CTV ad-spend is predicted to grow to $19 billion by the end of 2021 as advertisers begin to use CTV as a means to reach their users, either alongside an existing linear TV strategy, or as a standalone channel.

A report from mobile analytics platform Adjust gives advice for advertisers looking to go this route.

“Ad formats for CTV provide marketers with a unique opportunity to combine the interactiveness of digital formats (tracking video completion rates and linking real-time ad exposure to conversions) with the visuals native to traditional TV advertising,” it says in its Connected TV: the ultimate how-to guide. “With direct CTV ad buying, marketers have opportunities to incorporate UI and in-video banners, and even show ads on pause screens or menus.”

Advertisers can also show relevant ads across multiple devices that are connected to the same network, which can give retargeting campaigns a boost.

As it currently stands, the majority of CTV inventory is not sold by mobile marketing networks. As it continues to grow and as verticals like gaming become more prominent, this is likely to change. Google is very well positioned to capitalize on the fact that they own CTV inventory and are one of the larger CTV networks — you can advertise on the YouTube network via Google’s Advertising network. Apple and Amazon are also well placed, owning their own streaming devices and services.

What Is CTV and Other Jargon?

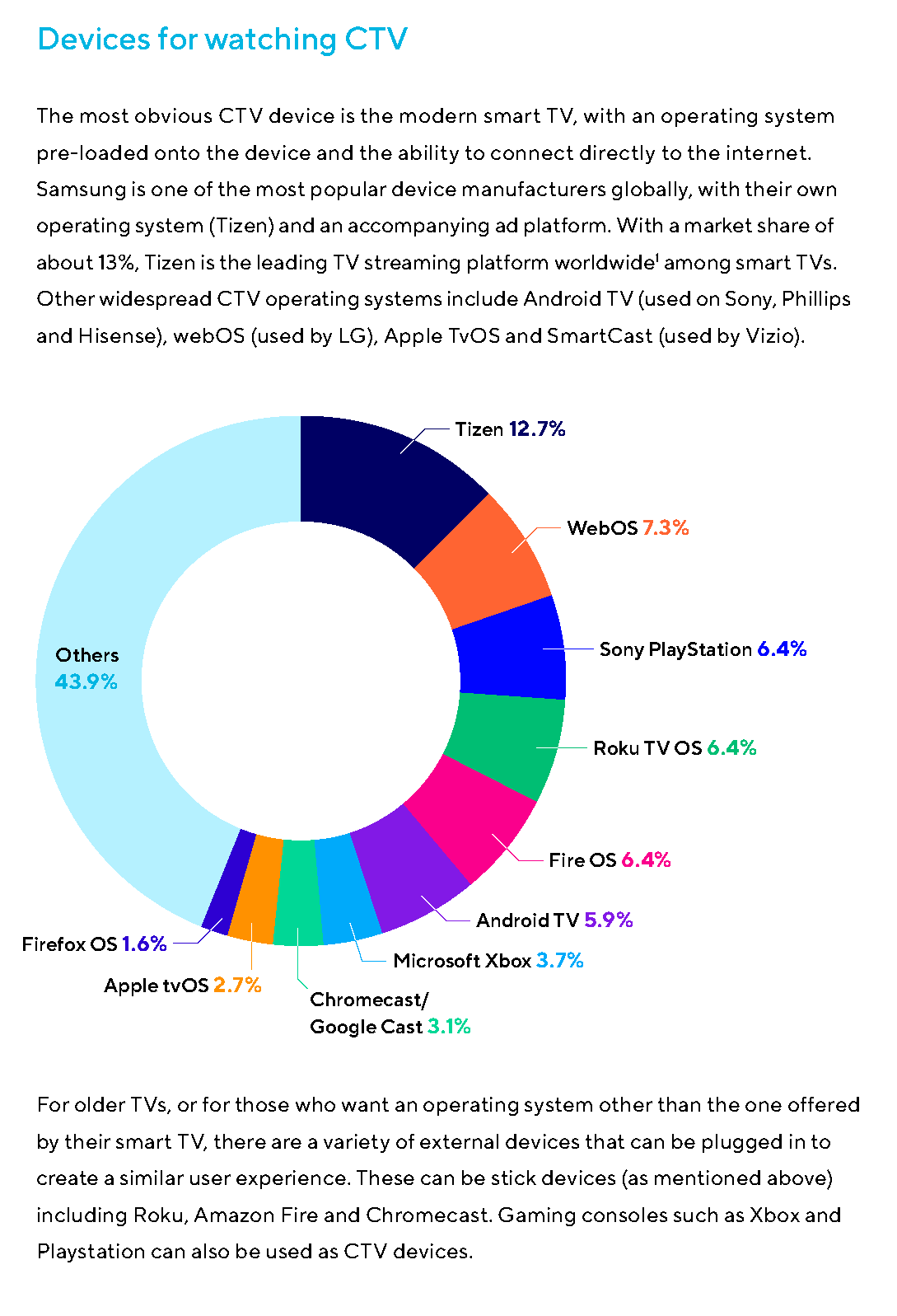

Connected TV refers to content viewing devices connected to the internet and the viewing experience usually happens in the living room. The most obvious CTV device is the modern smart TV, however, many apps come from other verticals too, particularly gaming, which is the second largest category on Amazon Fire TV and Apple TV. To put this into perspective, on Roku OS alone there are more than 23,000 apps. Many of the apps offer the ability to show ads (ad inventory). Advertisers can access this programmatically via their DSP or by working directly with ad networks.

Aha – acronyms and jargon. The DSP is Demand Side Platform: the interface that enables the buying of programmatic OTT and display ads. The Supply Side Platform (SSP) is the publisher’s side of the programmatic equation. Each publisher works with at least one SSP that lists their inventory as available on exchanges.

Programmatic Ad Buying

Buying programmatically, the Adjust report helpfully explains, gives you the greatest level of flexibility in terms of timing, targeting and optimization. It’s possible to rapidly iterate tests in ways that aren’t possible through other buying methods. This is a powerful approach, which is why an increasing amount of CTV advertising is being bought this way.

The downside? Without specific agreements in place, there are limitations on the formats and placements you can buy. Buying CTV programmatically requires having an agreement in place with a DSP that allows you to run CTV campaigns. There are many options here, with some of the most popular including The Trade Desk, Google’s DV360, OneView (formerly DataXu), and MediaMath.

Working with Platforms

The second approach to CTV buying is to work directly with a platform. If you’re working directly with Roku, for example, the agreement would include inventory within the Roku UI as well as in-stream video that you could also buy programmatically. In this case, however, almost all of this particular inventory is bought to promote apps that function on the Roku OS.

Adjust says this tactic may offer you premium inventory or better access than you would have received programmatically. The downside of this method is that you’re effectively limited to the inventory available within that platform. So if buying directly from Roku, you will only reach Roku viewers. And in order to reach viewers of Samsung smart TVs, you would need a deal with Samsung Ads.

Working With Publishers

Another method to buying CTV advertising, which will feel more familiar to those coming from the linear side, is working directly with publishers. This involves contacting your desired app or publisher, requesting a proposal and negotiating a deal.

“While some publishers may offer access to third-party segments to add a layer of targeting, others may also have first-party data on their users that would not be accessible programmatically,” the how-to guide outlines.

Potential downsides of the publisher-direct deal method listed by Adjust include a very limited or nonexistent ability to optimize during the course of the campaign. As the campaign is managed by the publisher, they both serve the impressions and send you the impressions report. Another difficulty with publisher-direct-deals is the legwork involved. In order to reach the same scale as a programmatic campaign, deals will need to be negotiated with multiple publishers. This can require additional resources — for both the negotiation of these deals and their eventual activation.

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- The Ever-Changing Scenery of the CTV Landscape

- TV is Not Dead. It’s Just Becoming Something Else.

- Converged TV Requires a Converged Ad Response

- Connected TV and the Consumer

- How Social Media and TV Advertising Boost Content Discovery

And as difficult as attribution already is with CTV, it becomes even more so with multiple direct deals running in parallel. Publishers often accept only specific third-party trackers so at the end of the campaign you may end up with a basic report showing the number of impressions served — without the in-depth insights you were perhaps looking for.

Feels Like a TV Ad

“The ad format you’ll encounter most commonly is the one that feels like the familiar TV ad — an in-stream, pre-roll ad of 15-30 seconds in length, appearing before or in the middle of a piece of streamed content. When buying programmatically, this will likely be your only option.”

This format allows you to make your brand very appealing visually and provides you with the opportunity to explain what you are advertising at considerable length. When buying directly the options open up more. You will probably be able to access in-UI and in-video banners, sponsor a free movie or even place an ad on a pause screen, to name but a few examples. Many of these formats are new, so they will stand out to the user.

What all ad formats on CTV have in common is that because of their digital nature, they provide you with the opportunity to create strong call-to-actions. A powerful example is provided by Burger King with their QR Whopper giveaway, consisting of three TV commercials with a QR code on the TV screen.

In short, CTV ad formats have the potential to combine the best of two worlds: the visual and messaging potential of TV and the interactive potential of digital advertising.