READ MORE: The Next Season of the Streaming Wars (TV Rev)

The ability for streamers to stem churn is the new frontier in the battle for consumer wallets, according to a new survey from Samsung.

Understanding and identifying the churn risk — and the retention opportunity — is likely to define the next wave of success for TV app marketers, the report finds.

“TV app marketers have to work a lot harder than traditional broadcast companies to achieve consumer loyalty, and build brand awareness,” says Justin Evans, Global Head of Analytics & Insights, Samsung Ads. “It is critical to focus equally on retention and new customer acquisition to succeed in this competitive streaming landscape.”

The report, available via TV Rev, combines behavioral insights drawn from Samsung Smart TVs with an attitudinal survey of 1,000 owners of Samsung Smart TVs in the US, to shed light on motivations.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

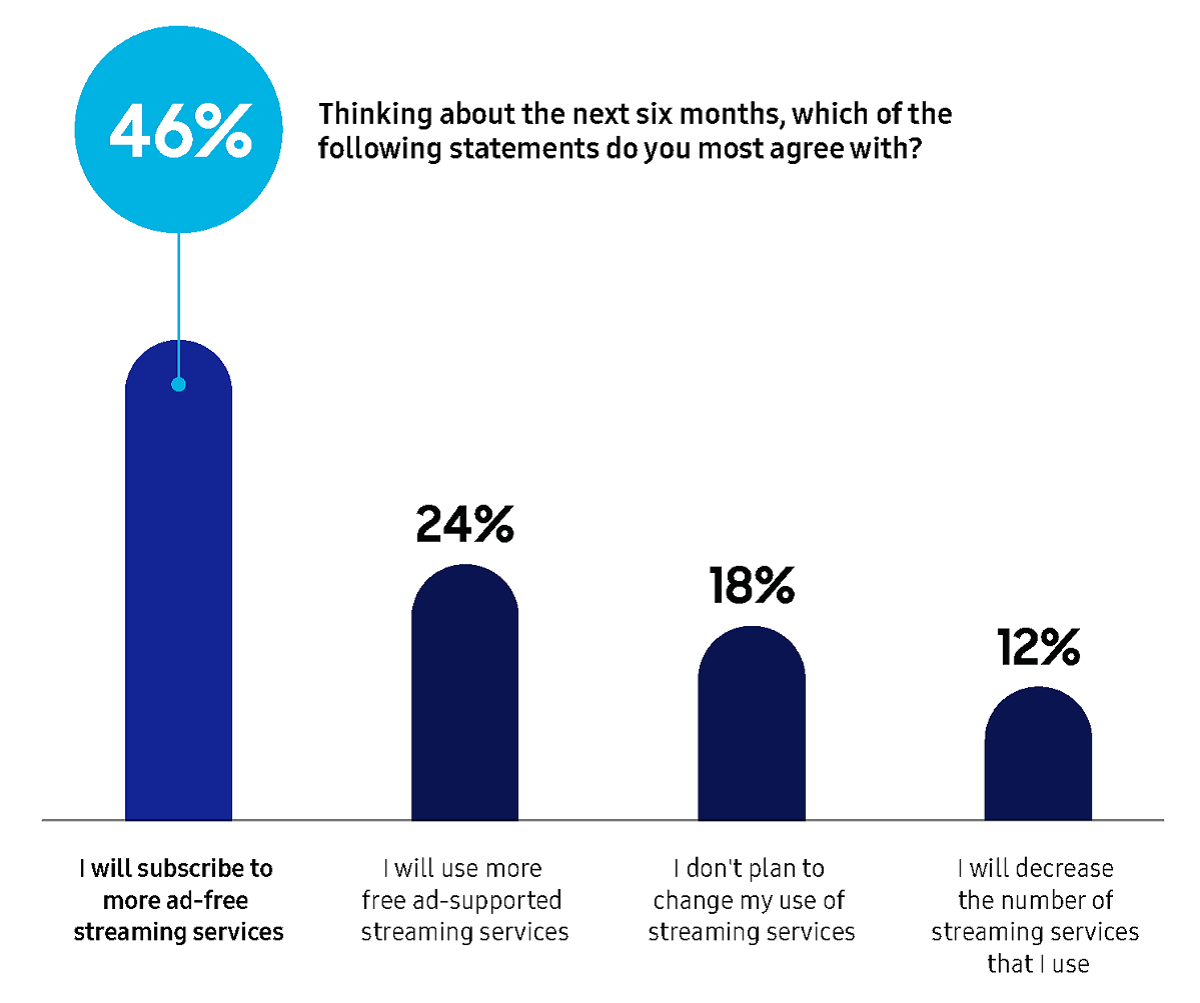

While the future for TV apps looks robust — some 88% of respondents intend to use streaming apps more or at the same level, and only 12% intend to cut back — the real fight is to retain subscribers who habitually swap out services.

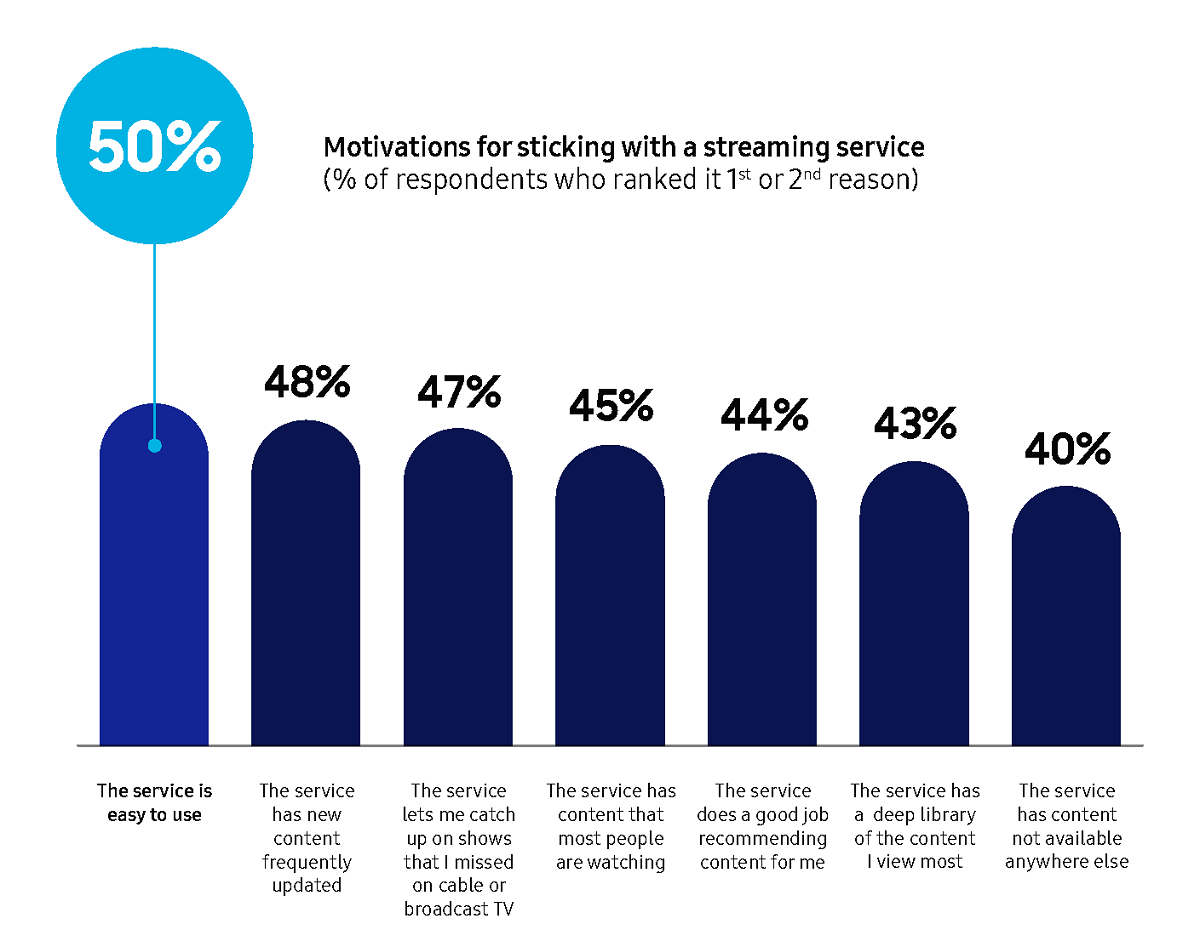

Churn remains high, at 50% on average, per the survey, and at any given moment, approximately one third (32%) of a streaming app’s audience is new. With so much content at consumers’ fingertips, if they can’t find it, and fast, they aren’t going to watch it.

“One thing is for certain,” advises TV Rev. “Don’t use the same marketing playbook you’re familiar with for linear TV. The goal posts are not the same.”

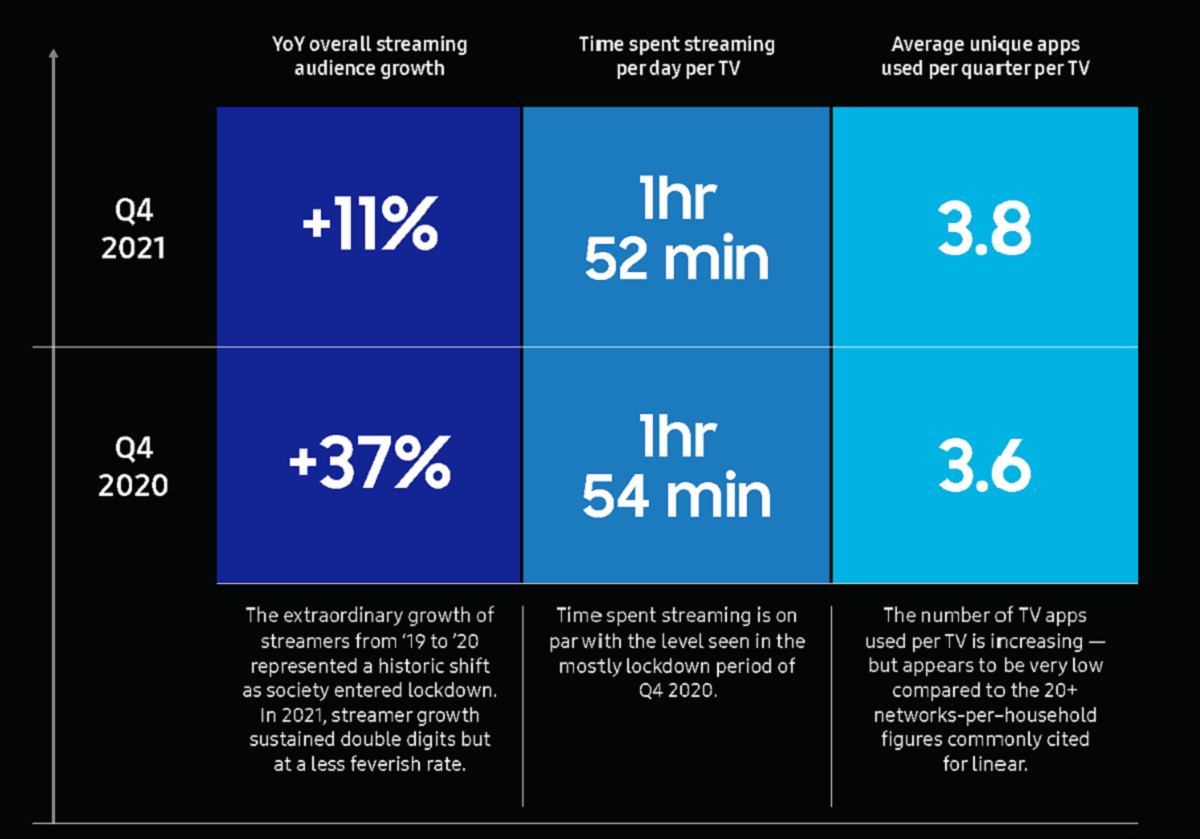

For example, while there are thousands of apps available on smart TVs in 2022, audiences use an average of 3.8 apps per quarter for streaming. This is fractional when compared to channel surfing on TV where the average household watches between 10-30 networks per quarter which means that brand awareness and content discovery have never been more important for app marketers.

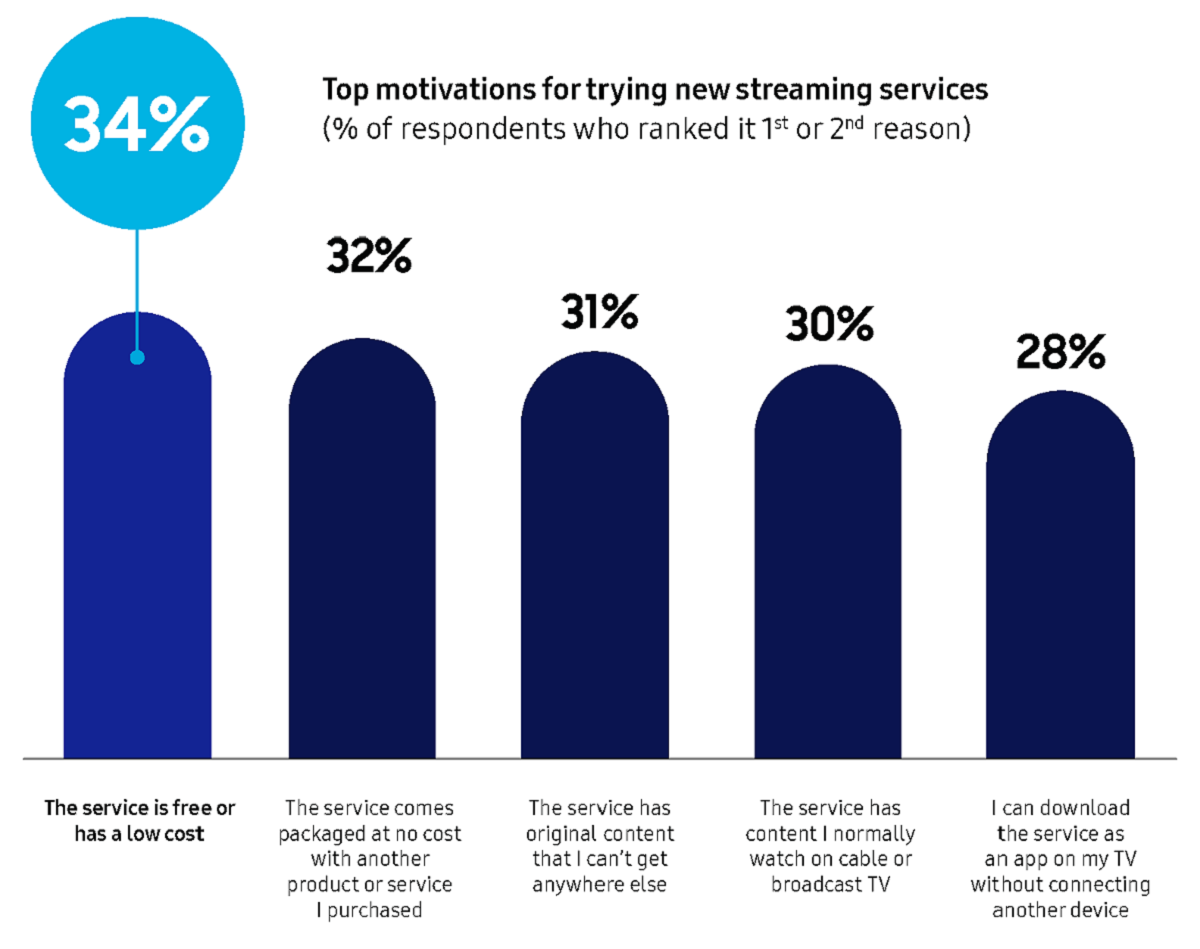

When Samsung asked consumers their top motivations for trying new streaming services, cost was a significant factor. A third indicated that they chose to try a service because it was free or low-cost. Another third indicated that they’d try a streaming service packaged at no cost with another service purchased. A third valued the chance to watch exclusive, original content.

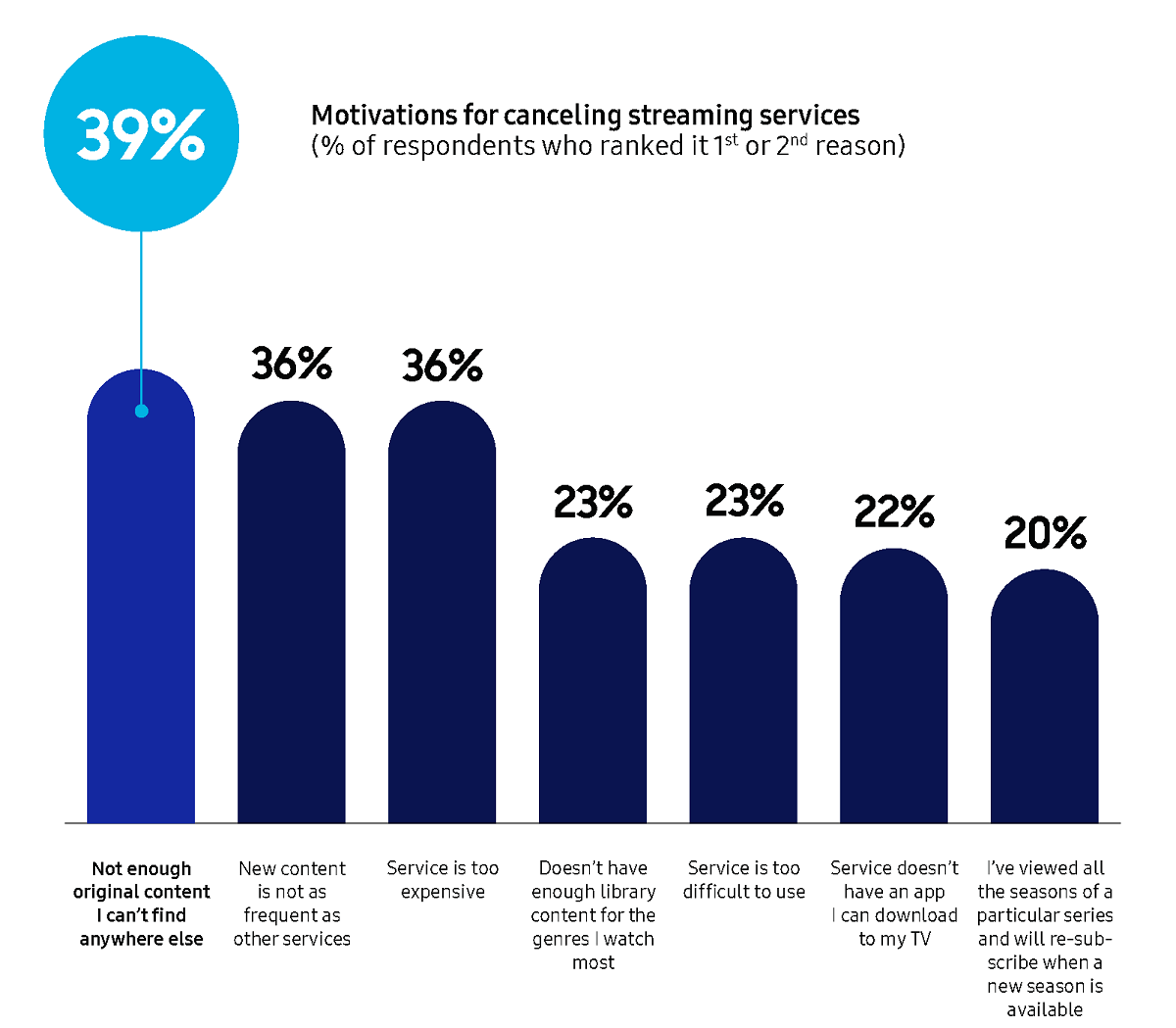

When asked what causes them to leave an app, it came down to content and money. Nearly 40% of consumers leave an app because there isn’t enough original and exclusive content, while 36% cite cost as a reason to leave.

So, what are the lessons here for marketers? Nearly a third of the average TV app’s audience is new to the app–a high rate of users discovering and sampling. Still, the momentum for discovery is slowing somewhat, indicating a need for data-driven strategies for audience acquisition.

“Understand who your churned users were before they lapsed,” advises the Samsung report. “For example, did they simply sample the app and never make it past authentication? Or did they lapse despite using your app multiple times?”

Additional analysis might examine the difference between “light” versus “heavy” app users: “Once you know what makes someone binge vs. ‘drop in,’ your programs will strengthen.”

It follows that marketing campaigns need to be tweaked for different sets of users. Retention, says Samsung, is just as important as acquisition and strategies should be tailored to each audience.