READ MORE: 2022 TV Advertising: Fact vs Fiction (Hub Research)

Ad-free TV was once the heart of SVOD platform’s value proposition. But by the end of 2022, all streaming platforms will offer some flavor of ad-supported content. What’s encouraging for everyone from Netflix to Roku is that audiences seem more than willing to embrace ads provided the ad load and relevance provides a better experience to that of cable TV.

When it comes to consumers’ perceptions about ads, more important than the mere presence or absence of ads is the overall value they feel they get from the viewing experience, Hub Research finds in its latest report, “TV Advertising: Fact vs Fiction.”

That’s an intricate calculation that takes into account things like ad load, length of ad breaks, ad relevance, the overall service subscription fee, etc. “When ads are delivered effectively, viewers can actually be more satisfied with the overall viewing experience — and feel more loyal to the service — than viewers of ad-free content,” says Hub.

Ad-supported lower price SVOD tiers are growing alongside Free Ad-Supported TV (FAST), although the latter is growing more quickly than any other category. And for viewers squeezed by inflation, the appeal of free TV will only grow. FAST platforms are now investing in original shows, access to local stations, and other content that give viewers a reason to watch in addition to “it’s free.”

Streaming experts gathered for a round table discussion hosted by The Wrap said they expect the looming recession will push consumers into FAST, “long stereotyped as a haven for a financially struggling Gen Z audience.” As premium services pivot to include ad-supported tiers to offset subscriber churn and slower-than-predicted growth, FAST services like Pluto, Tubi and Amazon’s Freevee are well-positioned to begin including premium content into the mix. Watch the entire conversation in the video below:

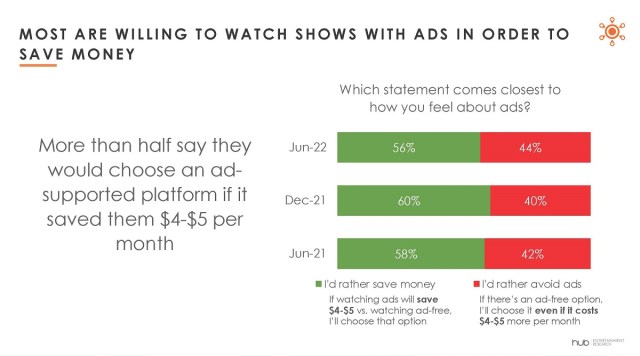

The assumption that today’s viewers won’t tolerate ads appears misplaced. Per Hub’s survey of 3,000 streaming TV consumers in the US, more than half said they would choose an ad-supported platform if it saved them $4-$5 per month.

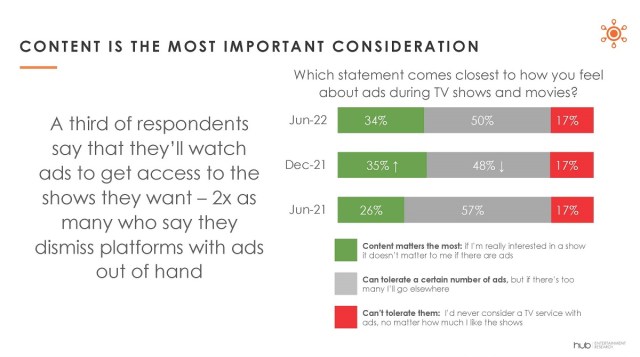

Content remains the most important consideration. A third of respondents said that they’ll watch ads to get access to the shows they want — two times as many who say they dismiss platforms with ads out of hand.

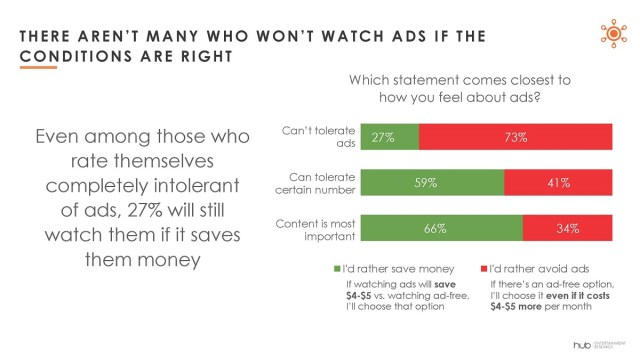

Even among those who rate themselves completely intolerant of ads, 27% will still watch them if it saves them money.

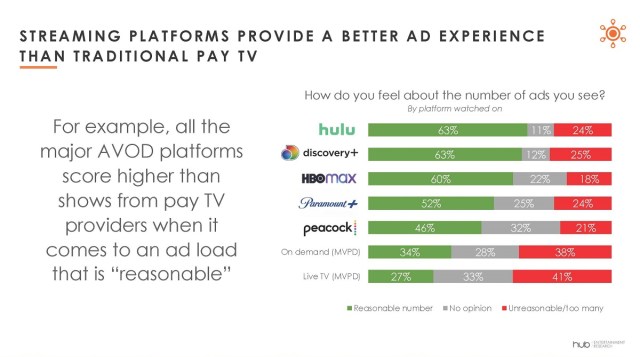

Streaming platforms currently provide a better ad experience than traditional pay-TV. According to Hub’s survey, all the major AVOD platforms score higher than shows from pay TV providers when it comes to an ad load that is “reasonable.”

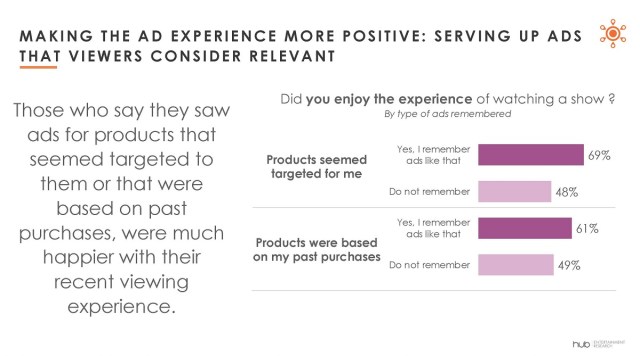

Logically, serving up ads that viewers consider relevant will make the ad experience more positive all round.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

Those who say they saw ads for products that seemed targeted to them or that were based on past purchases, were much happier with their recent viewing experience.

“Our research demonstrated that — contrary to conventional wisdom — a relatively small percentage of consumers say they can’t tolerate any commercials in TV content. But many in even that supposedly ‘ad-intolerant’ group say they’d sign up for a TV service with ads in order to save money.”

WATCH THIS: TheGrill: Focus on AVOD presented by FilmRise

As inflation rises toward a possible recession and consumers continue to tighten their belts, ad-supported video-on-demand — including FAST channels — are quickly becoming the norm.

WrapPRO recently convened a panel of industry experts to discuss consumer habits amid the rise of AVOD as part of its symposium, “TheGrill: Focus on Streaming presented by FilmRise.”

Moderator Brandon Katz was joined by Daniel Christman, SVP of cross platform group at Screen Engine/ASI; Tejas Shah, SVP of commercial strategy and analytics at FilmRise; Katina Papas Wachter, head of ad revenue strategy at Roku; and Alysha Dino, senior director of publisher development at Publica.

The rise of AVOD could create favorable conditions for both producers of advertising and delivery platforms, Christman commented, kicking off the discussion. “There just isn’t an overwhelming urge among consumers to add more paid subscriptions to their monthly budgets, especially as we head into all this recession talk,” he says. “And we know the demand for content is as great now as ever. So this sets up as an extremely favorable story for those involved in ads content creation, and delivery.”

Watch the full conversation in the video below: