READ MORE: Global Media Outlook Report 2022 (YouGov)

While Covid-19 fueled a surge in media consumption over the last year, and in the coming 12 months, new data suggests a “leveling out” in overall consumption.

YouGov’s Global Media Outlook Report 2022 identifies a high proportion of global consumers who are planning to stick with their media choices in 2022/3.

The study combines data from multiple products, including YouGov Custom Research, in 17 international markets with specific focus on the US and the UK.

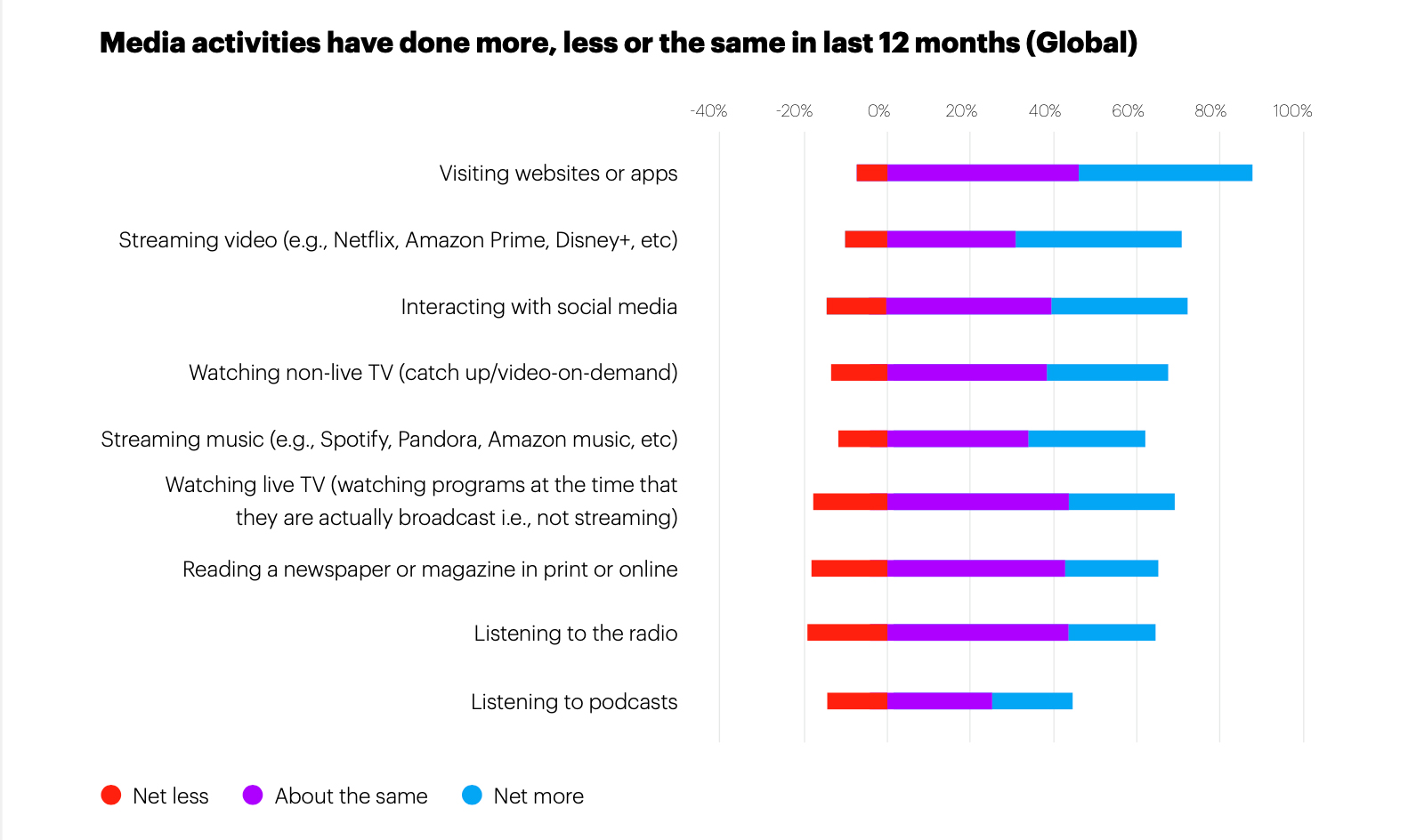

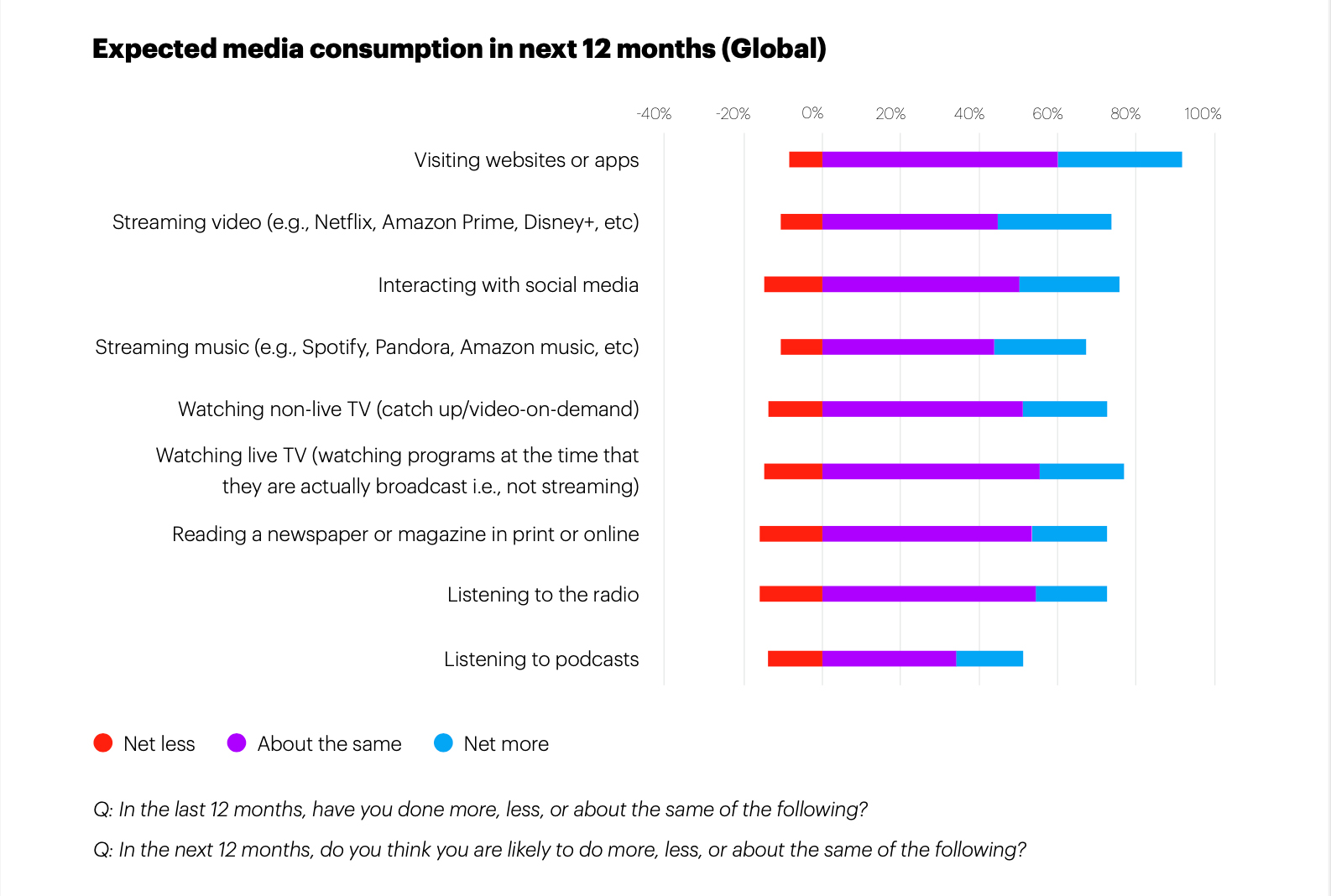

Its reports also shows that main drivers of media consumption growth in the next 12 months are all digital. For instance, more than a third of those who either maintained or increased their video streaming activity in the last year are likely to increase their use of video streaming services in the next 12 months. Streaming music followed, with 32% who streamed more or the same amount of music in the last year likely to increase their streaming activity in the next 12 months.

Social media is the third main driver of media consumption growth in the research. Its appeal and usage is likely to remain robust in 2022, with those categorized as Gen Z the most likely to increase their interaction in the next 12 months. In the US, social media is the top source of news for Gen Z (45%) ahead of traditional TV (34%).

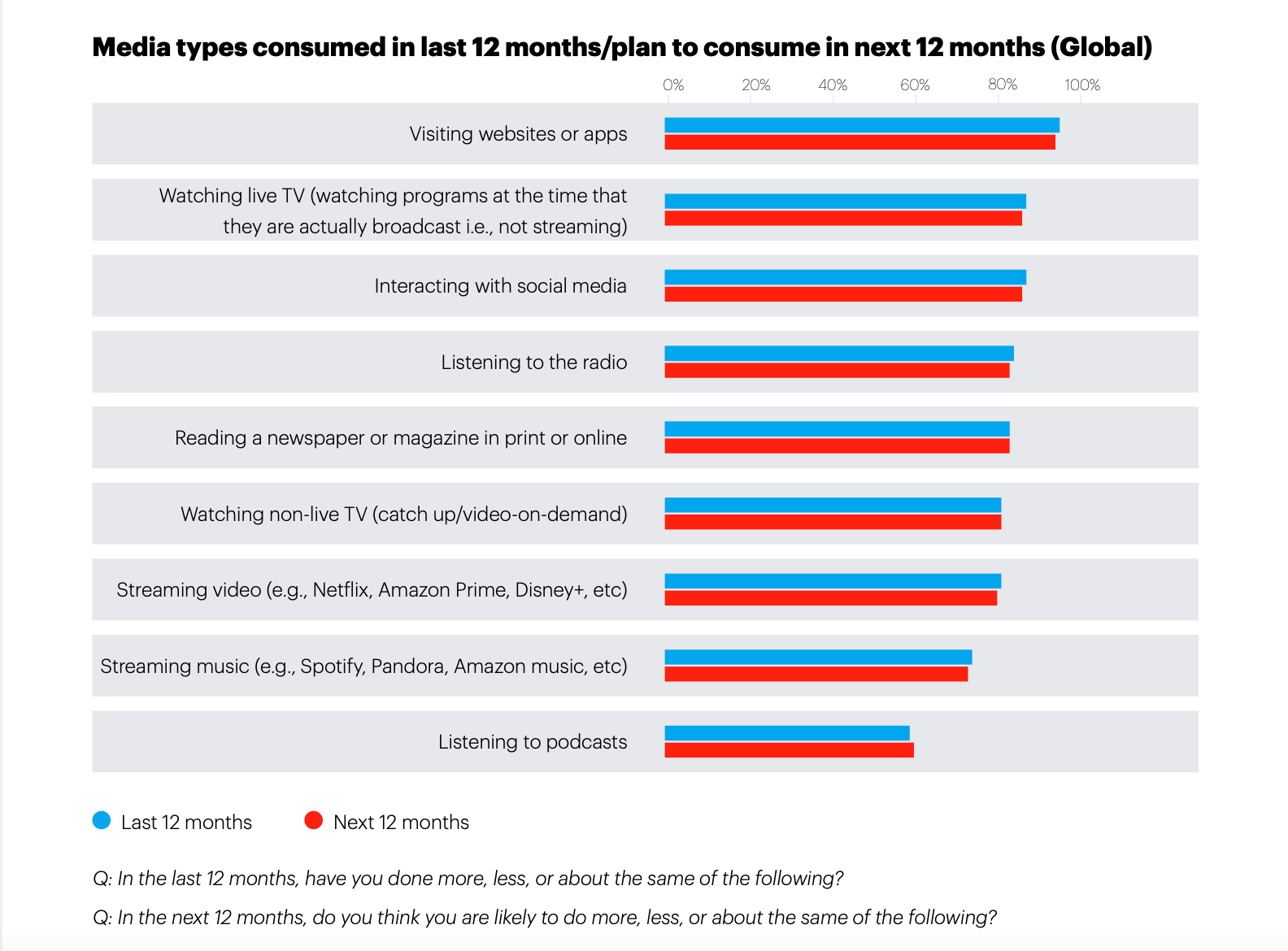

Using YouGov’s “stickiness” measure as a gauge of future intent, its data suggests that a high proportion of global consumers are unlikely to change their media behavior dramatically in the next 12 months. More than eight in 10 adults globally registered a strong stickiness score with each media type they had previously consumed in the last 12 months.

For instance, a large majority of global consumers who claimed to have maintained or increased their use of video streaming services (71%) or watching live TV (69%) and non-live TV (68%), show a strong propensity to stick with their level of viewing in the next 12 months (86%, 88% and 89%, respectively).

Per the report, a higher proportion of global consumers plan to consume more streaming services than any other type of media in the next year. This is again more pronounced among Gen Z.

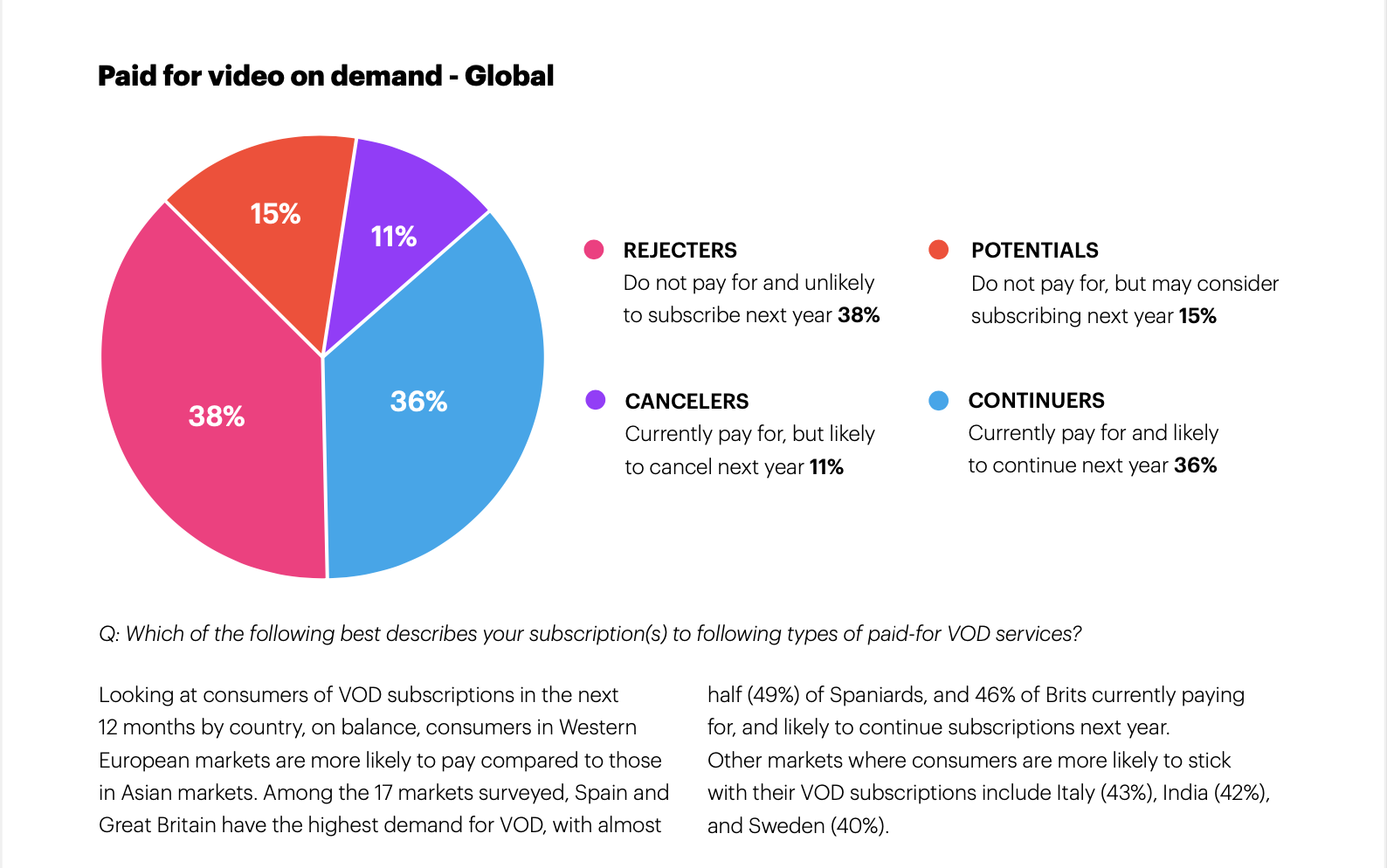

Moreover, global consumers exhibit a stronger stickiness to SVODs than other paid-for content services, with 36% intending to renew in the coming year, and a further 15% (who do not currently pay for VOD), considering a subscription.

“As the popularity of streaming video services persists in the coming year, – and consumers are spoilt for choice — intensifying competition among service providers is likely to trigger further investments in content, as well as subscription price adaptations to retain and grow audiences.”

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

Podcasts Booming

While radio has been the media sector hardest hit by the pandemic, spending more time at home has benefited other audio services such as music streaming and podcasts, especially attracting the digital-savvy younger generations. More than four in five listened to the radio globally, whereas three-quarters streamed music.

Globally, almost a fifth (17%) of consumers do not currently pay for but may consider subscribing to music streaming services next year — presenting a considerable growth opportunity for leading service providers such as Spotify and Apple Music, YouGov concludes. Thirty percent of consumers intend to listen to more podcasts in the coming year. Indeed, podcasts are the only media type registering a higher projected annual consumption in the year ahead.

“Podcasts present a strong opportunity for brands and advertisers to engage with a highly receptive and engaged set of listeners, particularly younger generations. Whilst annual podcast consumption has not quite reached the penetration levels of other media counterparts, some three in five global consumers claimed to have listened to podcasts in the last year or intend to do so in the next 12 months.”