READ MORE: 2022 Monetizing Video (Hub Entertainment Research)

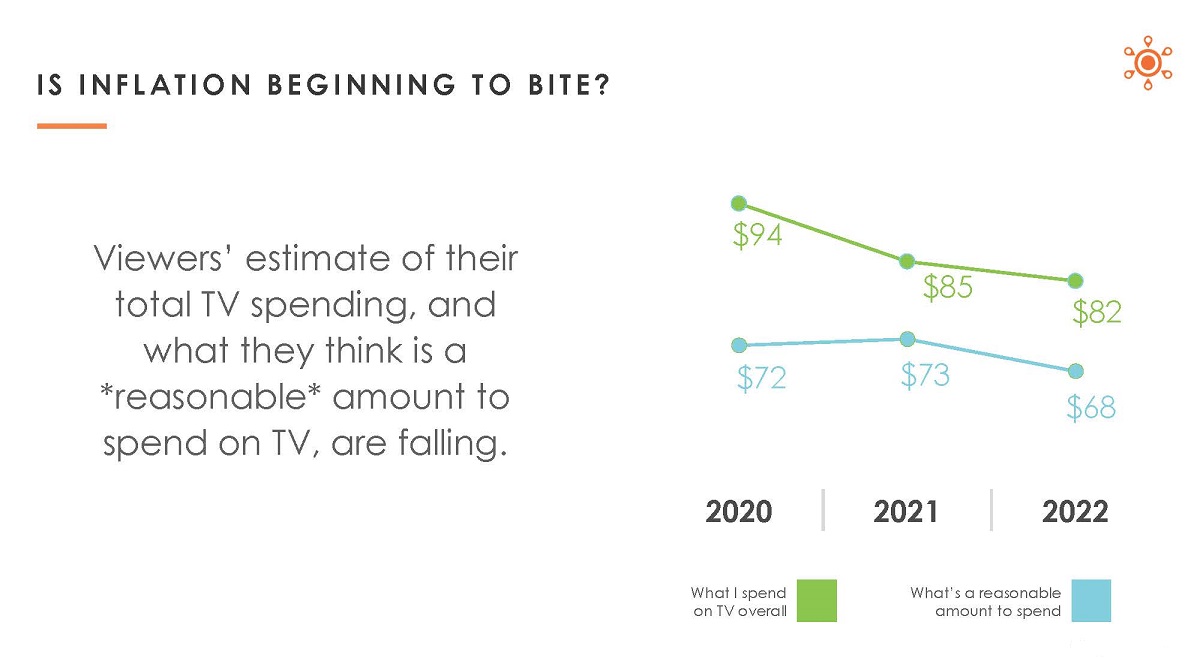

Inflation is hitting consumers. Viewers’ estimates of their total TV spending, and what they think is a reasonable amount to spend on TV, is falling, according to a new survey from Hub Entertainment Research. The fall is charted as $94 (total estimated spend per month) and ($72 “reasonable” spend per month) in 2020 to $82 and $68 today.

Hub’s “Monetizing Video” study traces how consumers navigate these changing pay-model alternatives.

Its research backs up the trending popularity of ad-supported streaming tiers noting that consumers are weighing up the value of a service before they sign up.

Satisfaction as a metric is more sensitive than just looking at subscriber counts, according to subscription retention service Cleeng. After all, many people stay with a service for a time, even if they are less than happy, before they cancel. Others cancel one subscription while acquiring another.

“Satisfaction with the value a service provides is a key measure because it reflects the relationship between quality of content and price,” Cleeng states in a blog post.

READ MORE: Value for money plays a key role as OTT evolves to tackle churn (Cleeng)

A year ago, for example, Netflix was among the leading SVODs in terms of customer satisfaction and the runaway leader as the indispensable streaming service.

Since then, consumers started comparing Netflix’s content with that of rivals (notably HBO Max), taking into account its recently increased price, and the perception of the service took a hit.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- How To Secure the Next Billion+ Subscribers

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning

- How Does OTT Gain Global Reach? Here’s Where to Start.

- Governments Draw Battlelines To Curb the US Domination of SVOD

- Streaming Content: I Do Not Think You Know What That Word Means

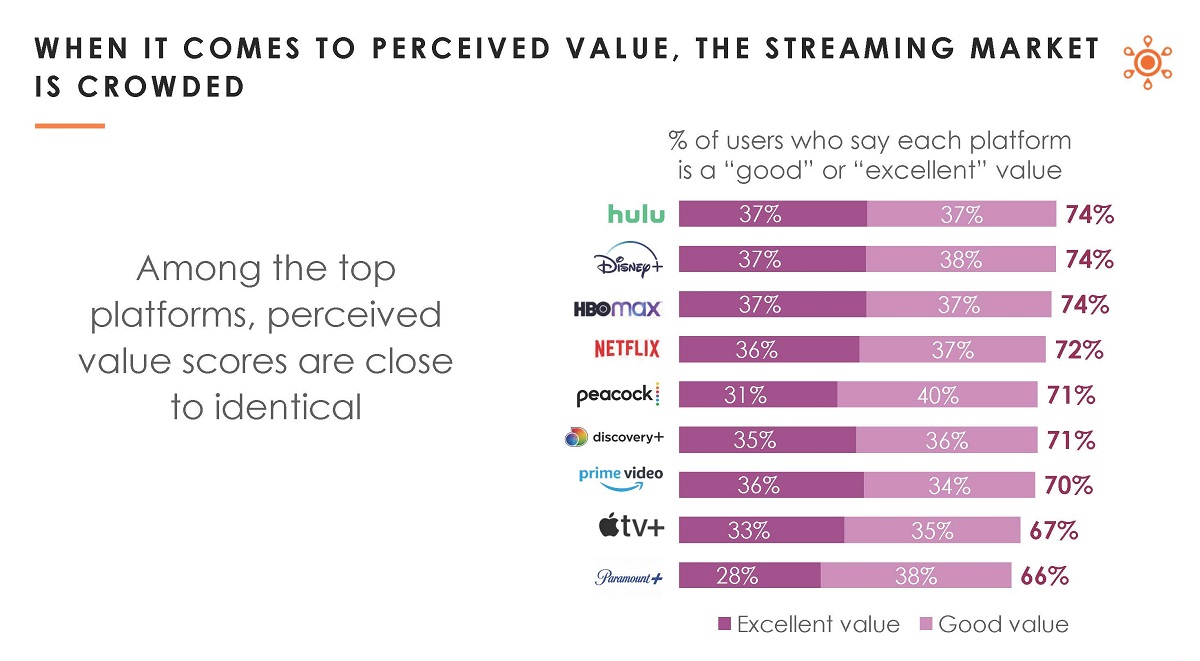

In the Hub report, among the top platforms, perceived value scores are close to identical with Hulu, Disney+ and HBO Max all achieving 74% ratings and Netflix not far behind with 72%.

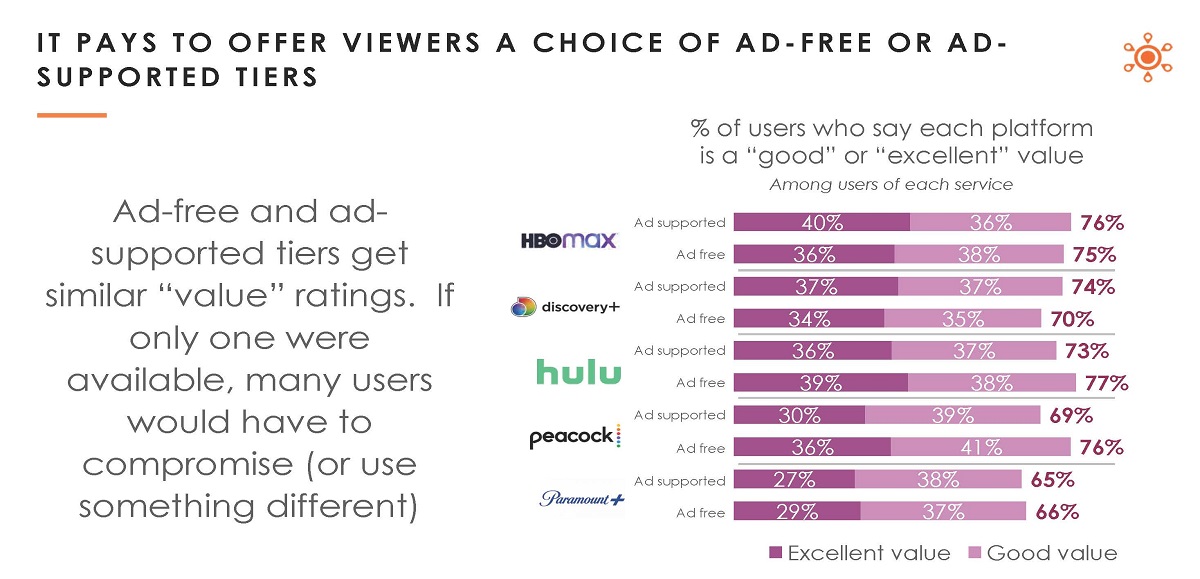

However, evidence suggests that it pays to offer viewers a choice of ad-free or ad-supported tiers. If only one were available, many users would have to compromise (or use something different). Here HBO Max, Discovery+ (both owned by the same conglomerate), Hulu and Peacock scored highly.

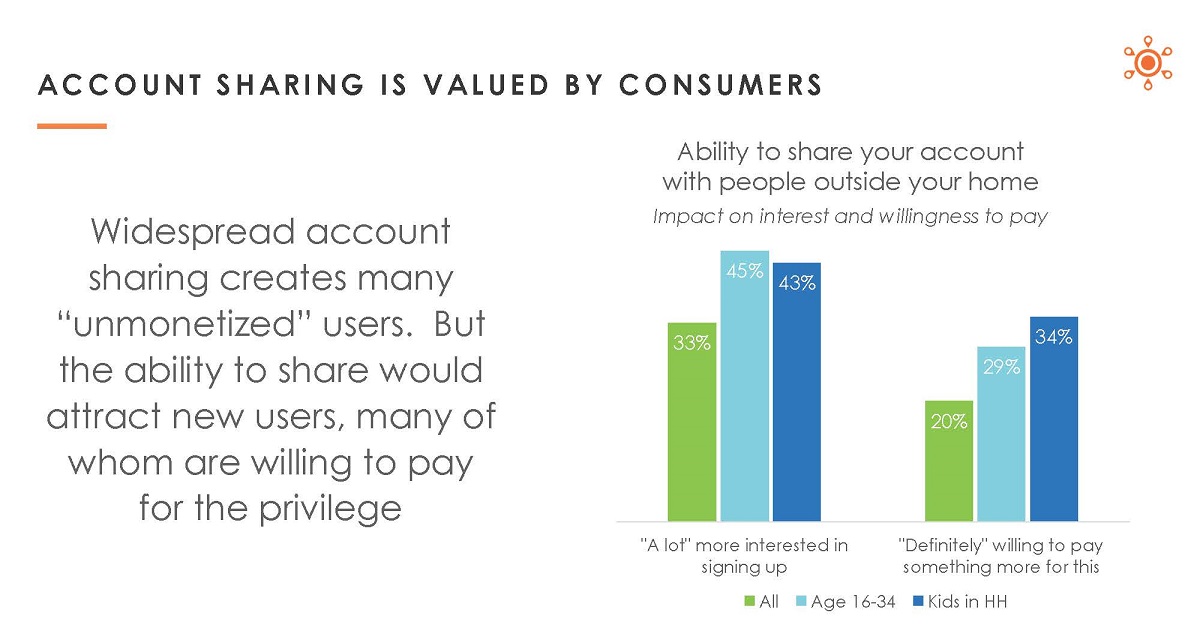

Although password sharing is under scrutiny since widespread account sharing creates many “unmonetized” users, the ability to share would actually attract new users. This survey found many of them willing to pay for the privilege. Thirty-four percent of kids, for example, say they were willing to pay more if account sharing were enabled.

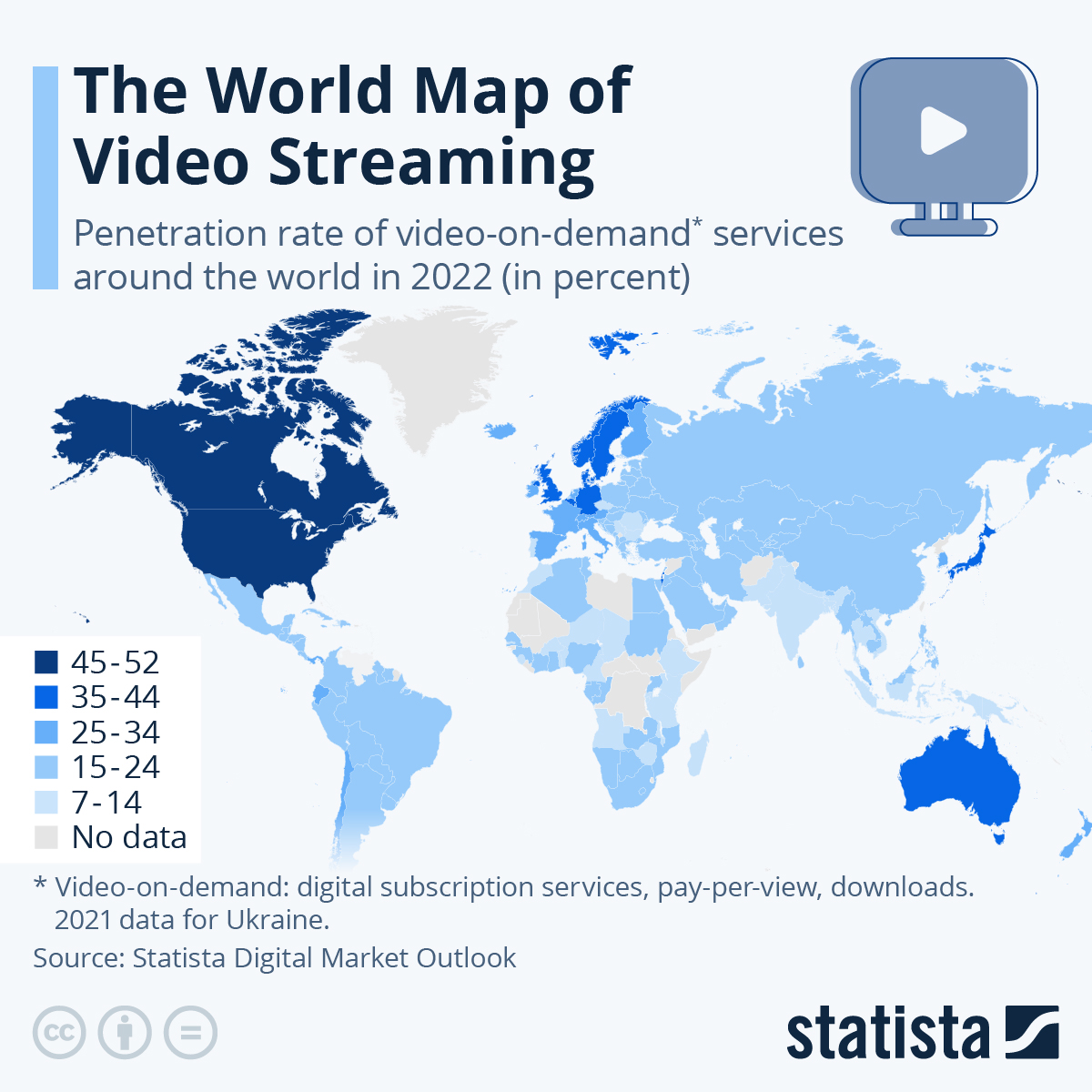

A Map of Worldwide SVOD Penetration Rates

Facing a rising number of competitors, Netflix has found it difficult to grab more share in the streaming marketplace and recorded its first decline in its subscriber base since the first quarter of 2022. However, worldwide growth of SVOD services rose roughly 20% in 2022, according to market research & analysis consultancy Statistia.

As Statista senor data analyst Katharina Buchholz explains, the map below shows “the most promising markets for chasing video-on-demand users are now South Asia, Latin America and Africa, where Disney+ has arrived in several countries (including South Africa) in 2022. While the market is expanding more slowly in North America, where video-on-demand has reached approximately 50% of the population, there is still some more room to grow in Europe, where this figure varies from 14% in Bulgaria to 42% in the United Kingdom.”

READ MORE: The World Map of Video Streaming (Statista)

Pay-TV Opportunity

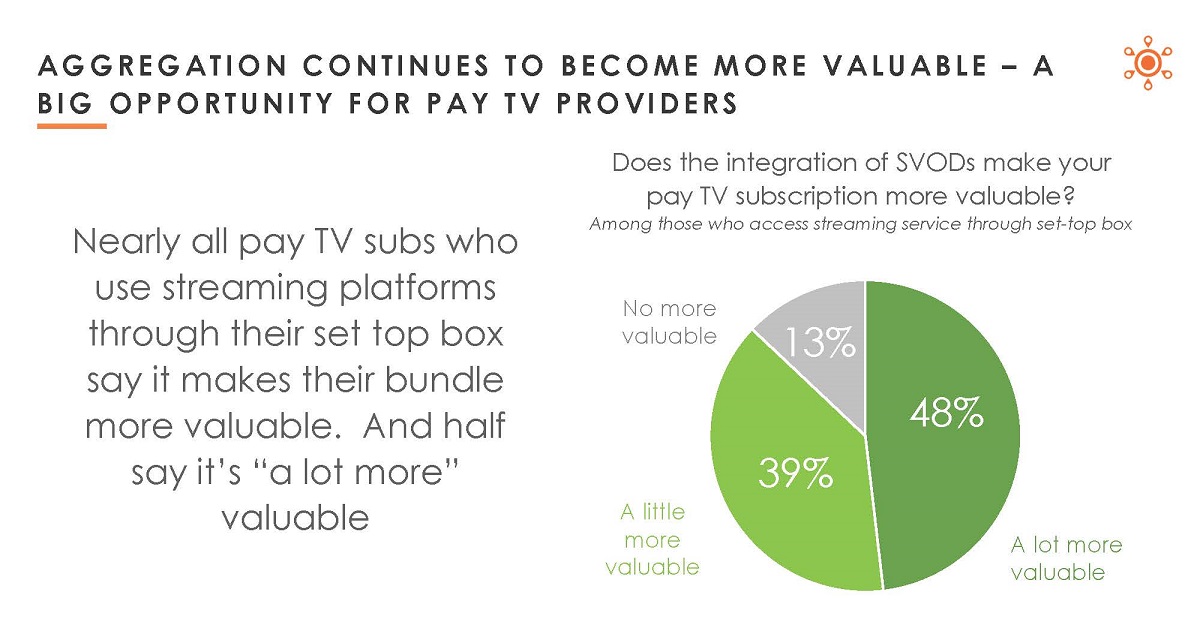

Aggregation continues to become more valuable a proposition to consumers and represents a big opportunity for pay-TV providers.

Nearly all pay-TV subs who access streaming platforms through their set top box say it makes their bundle more valuable. And half say it’s “a lot more” valuable

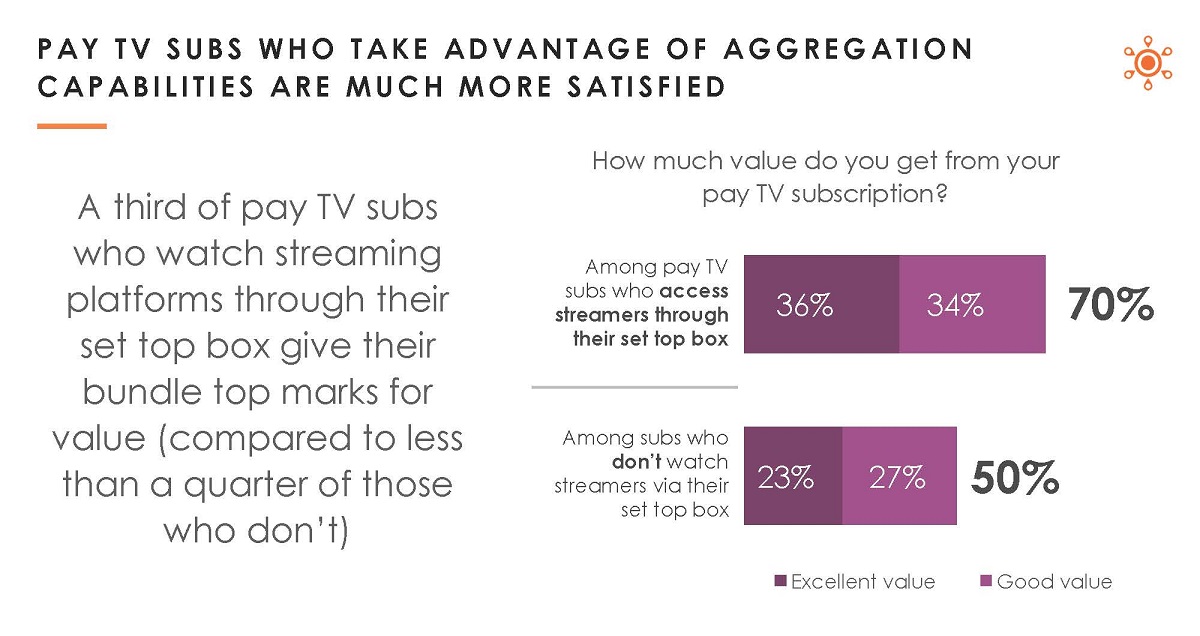

A third of pay-TV subs who watch streaming platforms through their set top box give their bundle top marks for value (compared to less than a quarter of those who don’t).

Streaming PVOD

COVID created an appetite among consumers for streaming new release movies at home. Many were prepared to pay a premium for this.

While the most aggressive windowing strategies have ended but the number of viewers willing to pay for same-day streaming is higher than last year, at every price point.

It’s worth noting that filmmakers like Christopher Nolan were so angered by Warner Bros.’ decision to day-date release its movie slate in 2020 that he has taken his next movie, Oppenheimer, to Universal.

Discussion

Responses (1)