TL;DR

- “Squid Game” and “Money Heist” are among drama series to have cracked open the market for foreign-language streaming originals — a trend that continues to attract audiences as shown by new data from Parrot Analytics.

- Dominating the top foreign-language streaming originals list, Netflix has been most successful when it comes to foreign-language content.

- While the demand share for foreign-language shows has been dropping on platforms like Amazon Prime and Hulu, it has been surging on Disney+ and Apple TV+.

READ MORE: Inside the Surging Demand for Foreign-Language Streaming Shows (The Wrap)

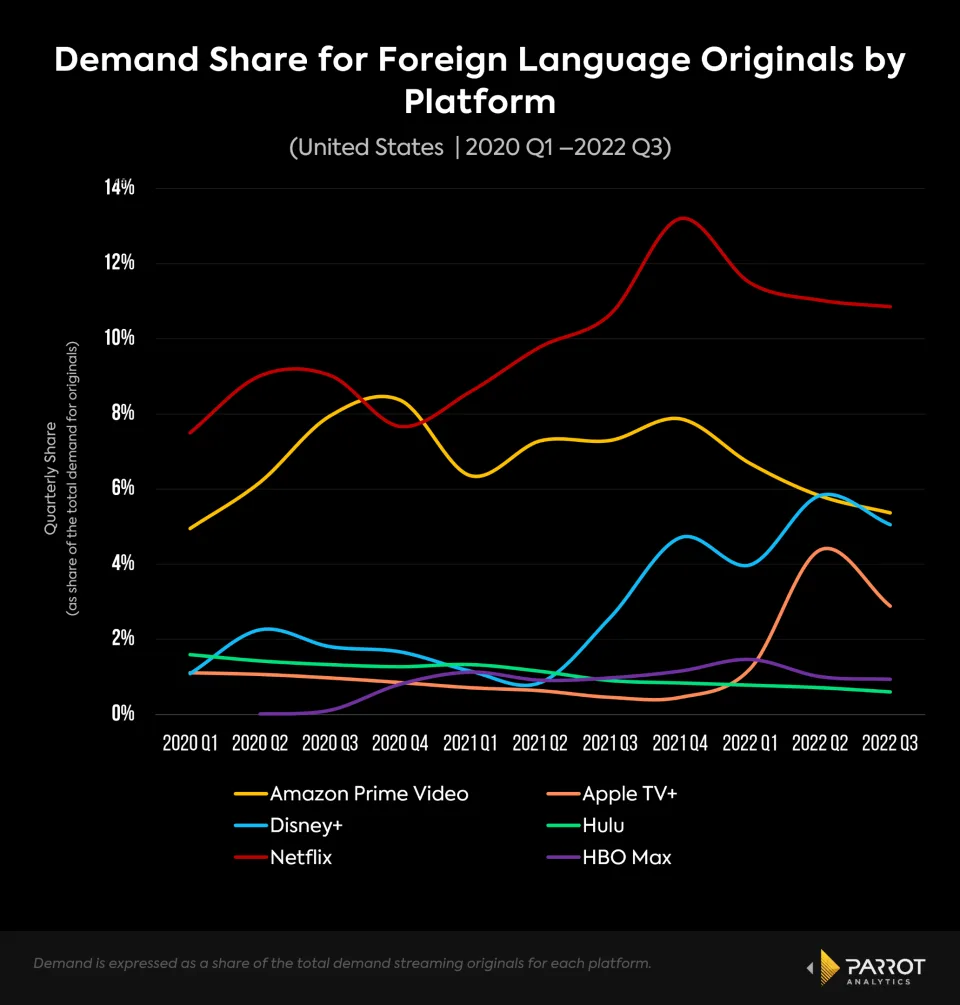

In the third quarter of 2022, shows in languages other than English were responsible for 8% of the demand for streaming originals in the US, according to data from Parrot Analytics as reported by Christofer Hamilton in The Wrap. That’s impressive growth, up from 6% in the first quarter of 2020.

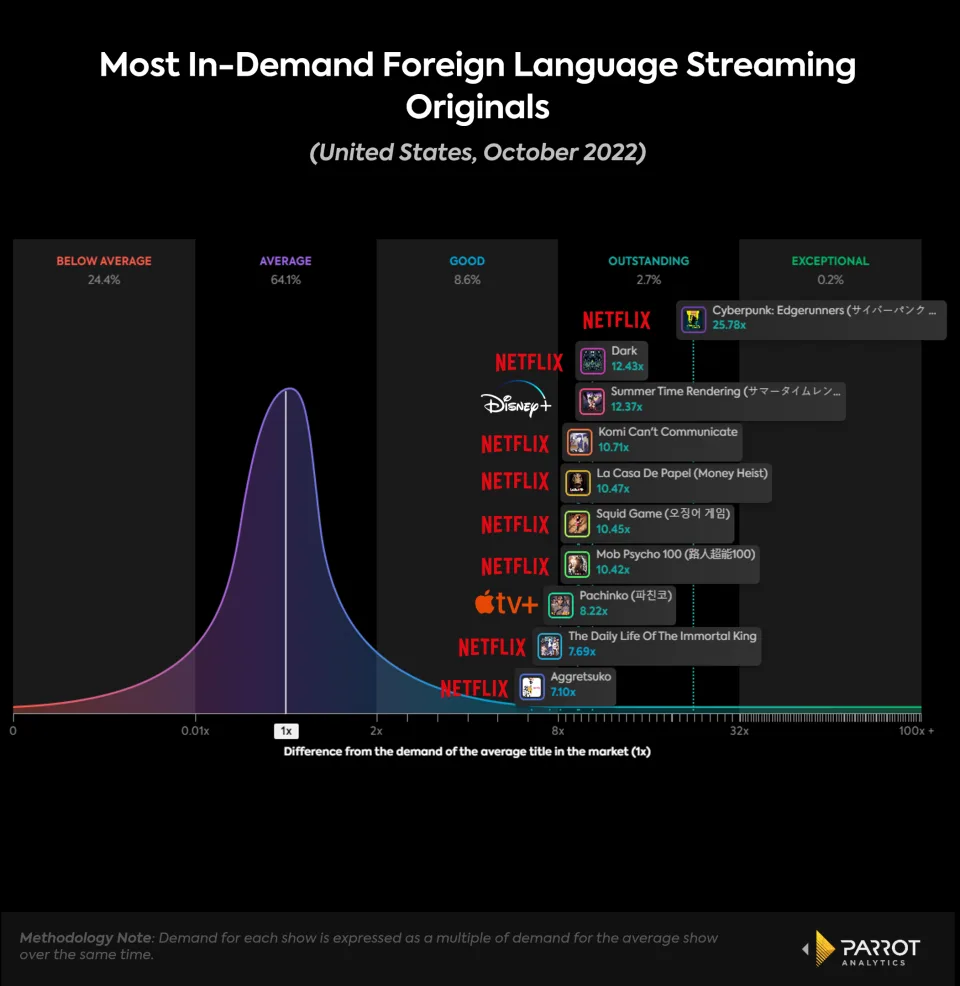

Netflix has been most successful when it comes to foreign-language content. It dominates the top foreign-language streaming originals list, with eight out of 10 shows including the top two slots, Japan’s Cyberpunk: Edgerunners and Germany’s Dark (still going strong since it 2020 release).

Spain’s Money Heist and South Korea’s Squid Game are ranked at fifth and sixth place, respectively. Parrot’s chart shows only two shows managing to break Netflix’s dominance in the top 10 foreign language shows: Disney+’s Japanese anime series Summer Time Rendering and Apple TV+’s Korean-language saga Pachinko.

“Those shows are also an example of the high demand for Korean and Japanese language shows,” says Parrott. “Seven out of the 10 shows in that ranking are in one of these languages.”

While the demand share for foreign-language shows has been dropping on platforms like Amazon Prime and Hulu, it has been surging on Disney+ and Apple TV+. Until Q2 of 2021, the demand share for foreign-language Disney+ originals was less than 2%. One year later, in the second quarter of 2022, that demand share peaked at 5.8%.

“That growth is the direct outcome of the release of successful shows like Summer Time Rendering and Star Wars: Visions, says Parrott. Both are also Japanese language animations. In the case of Apple TV+, the demand share is lower but the growth is still imprecise, from 0.5% in the last quarter of 2021 to 2.9% in Q3 of this year, thanks mostly to Pachinko.

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- “RRR:” Changing the Game for the Global Marketplace

- “1899:” Making a Mystery in Multiple Languages

- “Squid Game” and Calculating the “Value” of Global Content

- Global SVOD Market to Hit $171 Billion in Five Years

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning