READ MORE: SVOD & AVOD Forecast 2022-2027 (Rethink TV)

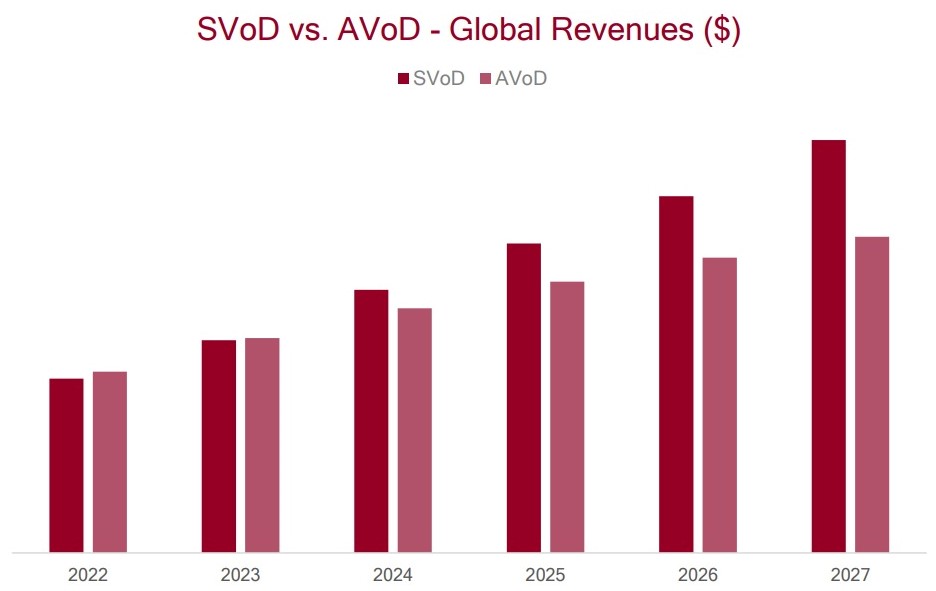

There will be $1.8 billion subscriptions to SVOD worldwide by 2027, making the market worth $171 billion, according to a new report from Rethink TV. The video research team also forecasts that the AVOD market will be worth $91 billion in ad revenue by 2027 based on 8.6 million monthly active users.

Contrary to recent popular reporting, Netflix will not fade, but will retain its top spot, with Disney second and HBO Max in third. But only because Netflix will have successfully launched an ad-supported tier. If ranking is just taking into account subscriber tiers, Disney+ comes out on top by 2027 in Rethink’s analysis, with Netflix second and HBO Max in third.

A key point from the survey is that we’re seeing the beginning of AVODs collective expansion into subscription models. Through the five-year period (2022-27), Rethink believes there will be no crossover between the two camps but does pose the question whether AVOD platforms will attempt to challenge the traditional SVOD realm in the future.

Netflix’s recent confirmation that they would be exploring an advertising strategy is “news that has sent the market into a frenzy. Depending on the route that Netflix takes, the lines between SVOD and AVOD could be completely obliterated,” Rethink suggests.

ARPU from subs is expected to be relatively flat through 2027 due to increasing competition between SVODs.

“A speculative factor might be the move away from rolling annual subscriptions,” notes Rethink. “Once consumers reach a pain point, with regard to the size of their monthly streaming bills, they will begin to cancel services.”

SVODs are likely to offer discounts to tempt these viewers back, which will suppress ARPU. If viewers cannot be counted on for an entire year’s subscription, SVODs might have to consider increasing their prices. The change would arise on the basis that subscribers are not going to be active for an entire year and will instead be transient, staying for only a few months of the year.

When it comes to AVODs, Rethink predicts that most services are set to see an increase in both Monthly Active User (MAU) hours watched and revenues.

YouTube makes up for 40% of AVOD MAUs, with this proportion only set to grow further. “We expect that YouTube will become ever more dominant in the lives of web users outside of China, and an increasingly recognized as a source of legitimately ‘premium’ video,” says Rethink. “This will only serve to fuel the viability of its premium tier — more YouTube users will mean more people that are willing to cough up the cash for an ad free experience, especially as Google pushes monetization of its video outpost to the limit.”

The survey also examined the impact on pay TV and broadband operators with the rise in SVOD and AVOD services. Unsurprisingly, they do not foresee pay TV increasing in value among consumers. Instead, Rethink suggest that the fears that pay TV providers have about becoming dumb pipes will intensify.

Another future avenue to explore is the comparative penetration of sports-focused streaming services (DAZN, fuboTV, etc.) — a market that Rethink believes “is going to be severely disrupted by sports leagues moving into direct-to-consumer services.”

WATCH THIS: TheGrill: Focus on AVOD presented by FilmRise

As inflation rises toward a possible recession and consumers continue to tighten their belts, ad-supported video-on-demand — including FAST channels — are quickly becoming the norm.

WrapPRO recently convened a panel of industry experts to discuss consumer habits amid the rise of AVOD as part of its symposium, “TheGrill: Focus on Streaming presented by FilmRise.”

Moderator Brandon Katz was joined by Daniel Christman, SVP of cross platform group at Screen Engine/ASI; Tejas Shah, SVP of commercial strategy and analytics at FilmRise; Katina Papas Wachter, head of ad revenue strategy at Roku; and Alysha Dino, senior director of publisher development at Publica.

The rise of AVOD could create favorable conditions for both producers of advertising and delivery platforms, Christman commented, kicking off the discussion. “There just isn’t an overwhelming urge among consumers to add more paid subscriptions to their monthly budgets, especially as we head into all this recession talk,” he says. “And we know the demand for content is as great now as ever. So this sets up as an extremely favorable story for those involved in ads content creation, and delivery.”

Watch the full conversation in the video below: