TL;DR

- The first big shift for CTV was the rapid adoption of streaming content.

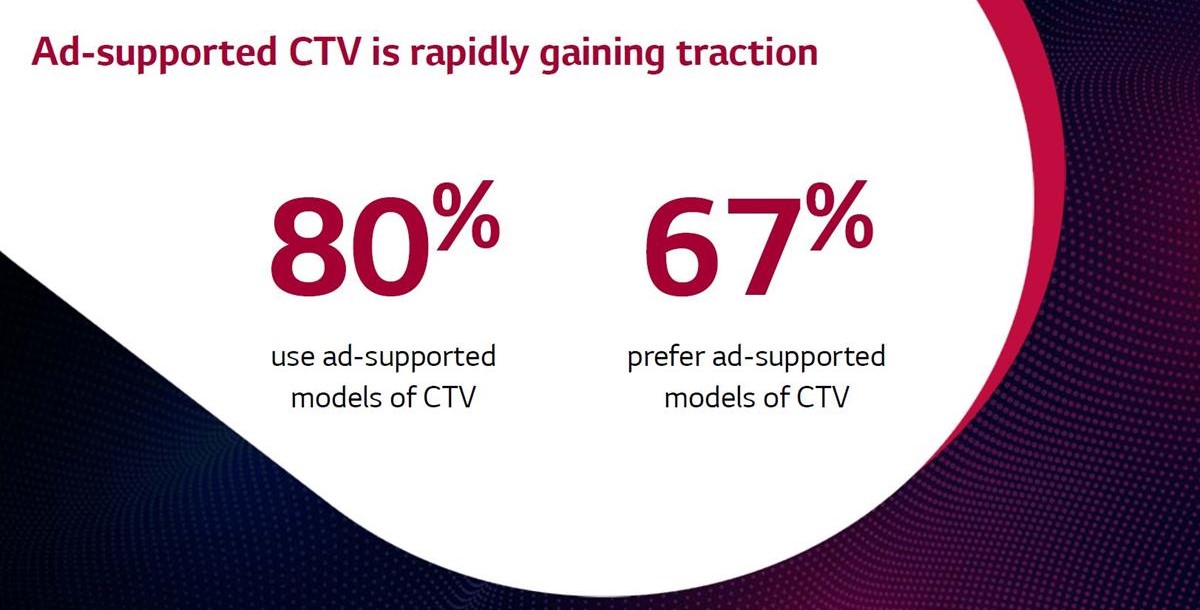

- In our current, second shift, consumers increasingly preferring free content that is supported by ads.

- Research finds that audiences will continue to remove subscription CTV services and bolster their viewing by adding free (FAST or Ad-Supported) channels

READ MORE: CTV: The Big Shift (LG Ad Solutions)

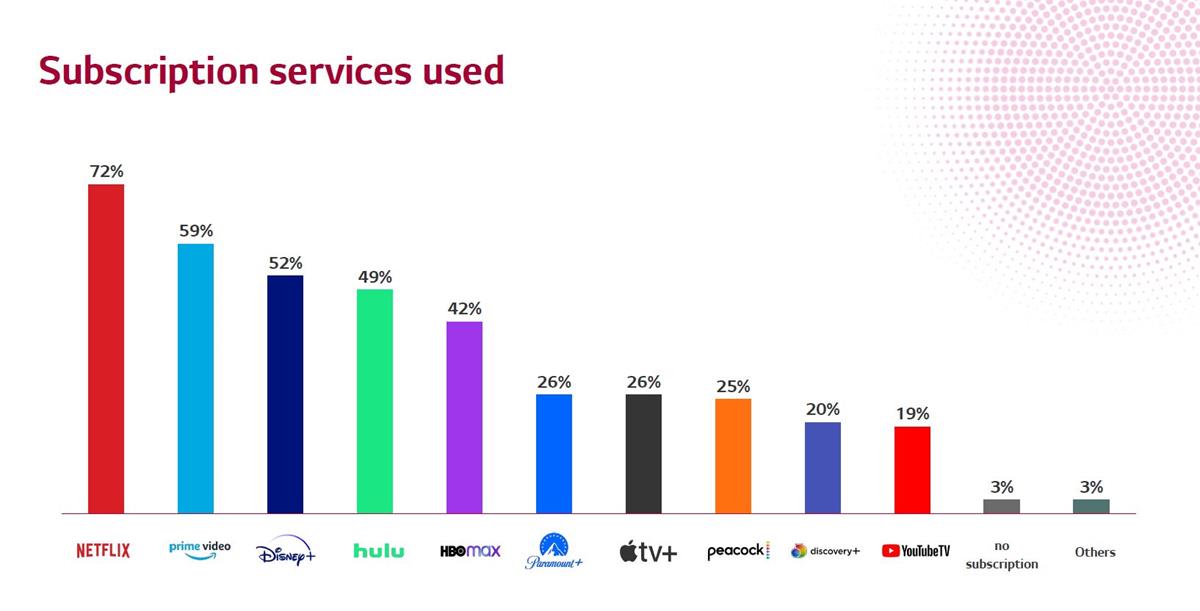

A massive 93% of US internet users are reachable by Connected TV (CTV) as households continue to shed subscription services and linear TV for ad-supported TV and FAST channels finds TV maker LG in a new report from the advertising division.

CTV adoption continues to skyrocket since the early days of the pandemic which drove rapid adoption through 2020. Progressing through 2023, consumer behaviors will continue to shift as CTV preferences have changed.

The new LG Ads Solutions survey, “CTV: The Big Shift,” investigates CTV usage and preferences amongst US internet users.

Firstly, CTV owns the living room with reach near saturation. Only 7% of US internet users do not have access to CTV while 80% of CTV households say the living room is their main TV.

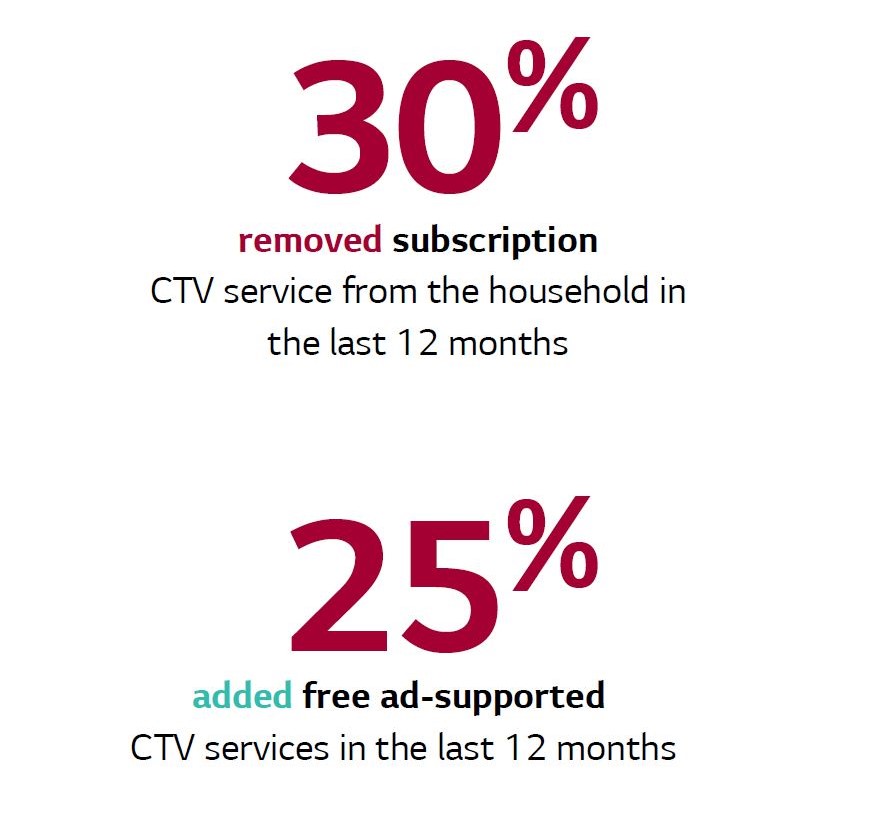

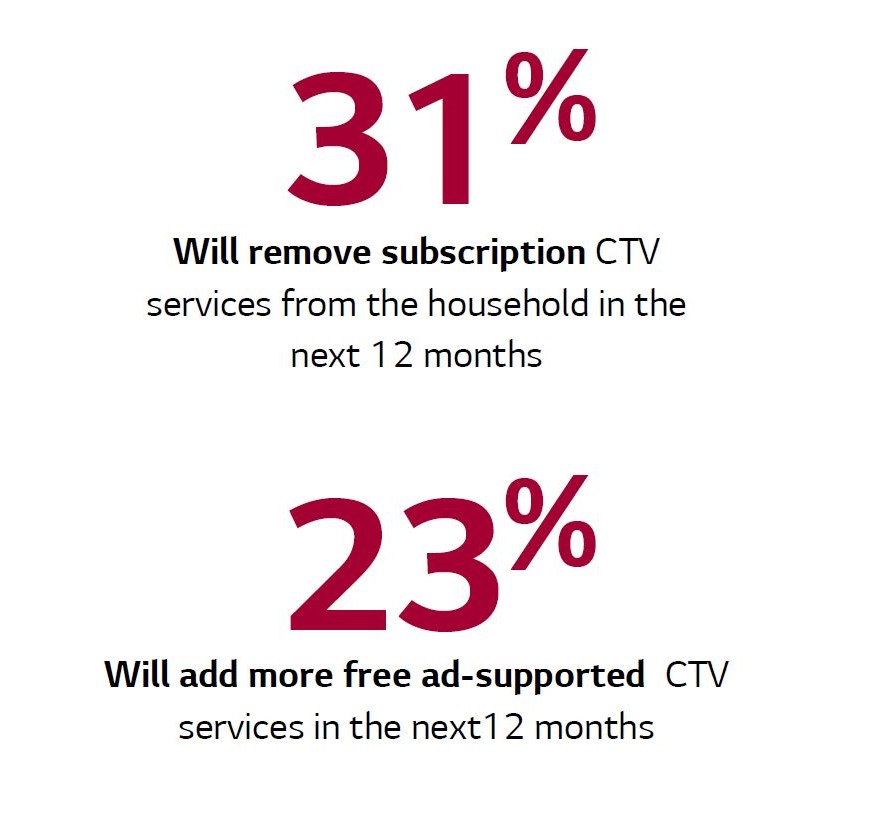

Yet consumer CTV preferences are shifting: 30% of households have removed an SVOD from their CTV in the last year and a quarter have added a free ad-supported services in that time.

“There have been two recent ‘big shifts’ in television viewing habits. The first big shift was rapid adoption of streaming content on connected televisions; this first shift was underpinned by subscription-based video content. The second big shift is underway right now. Consumers are drifting away from some of their CTV subscriptions and increasingly preferring free content that is supported by ads.”

Tony Marlow, Global Chief Marketing Officer, LG Ads

This trend will likely continue with 31% stating that they will remove subscription CTV services by this time 2023 and another 23% will bolster their viewing by adding a free (FAST or Ad-Supported) channel.

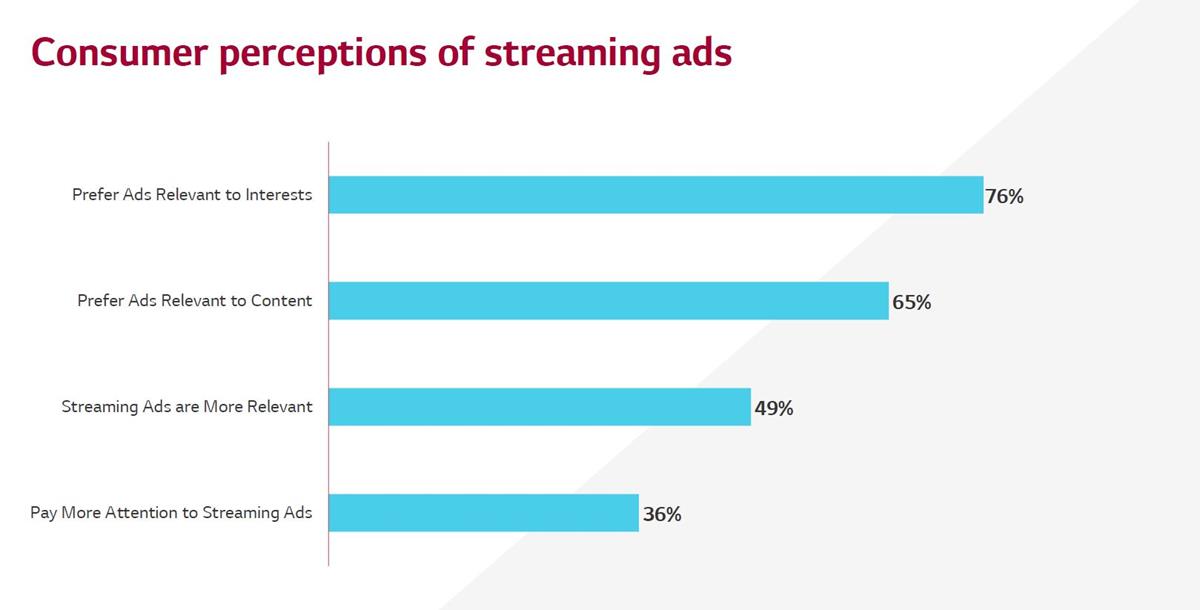

According to LG, viewers overwhelmingly support the idea of ad-subsided subscriptions. Seventy-six percent will trade off less expensive subscriptions for ad inclusion.

In other findings, over one-third say they discover CTV content from the TV’s home screen and 21% are watching less linear TV than 12 months ago. This prompts LG to conclude that CTV is cannibalizing linear TV at a steady rate.

Of note for advertisers is that viewers seem to enjoy multi-tasking in front of the big screen, so it’s important for advertisers to take a multi-screen approach to the ad campaign.

“There have been two recent ‘big shifts’ in television viewing habits,” Tony Marlow, global chief marketing officer for LG Ads, says. “The first big shift was rapid adoption of streaming content on connected televisions, fueled in-part by stay-at-home guidance at the onset of the pandemic. This first shift was underpinned by subscription-based video content. The second big shift is underway right now.

“Consumers are drifting away from some of their CTV subscriptions and increasingly preferring free content that is supported by ads,” he continues. “This presents an opportunity to provide better CTV experiences for viewers and opportunities for marketers to connect with their audiences on the biggest screen in the home.”

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- Connected TV Takes Over the World

- Connected TV Is the New TV, and That’s Where We Are

- FAST TV and SVOD Are “Channeling” the Cable Business Model

- More Consumers Are Headed Into the FAST Lane

- SVOD vs. AVOD Today, All Connected TV Tomorrow

- Ways Pay TV Operators Can Win the SVOD Game