TL;DR

- The rise of international accessible streaming technology has created a true global village for TV content, with Korean content — and notably K-drama — leading the way.

- Netflix original Korean content regularly makes the streamer’s Top 10 series list across 90 countries in 2022, with “Extraordinary Attorney Woo” viewed for 657 million hours over 20 weeks.

- Could the romance-driven, female-centric nature of the K-drama format be a clue to its successful global export?

This was the year when K-pop took the streaming charts by storm. Globally, non-English language content is on a high, but South Korea content excels. In fact, Netflix says more than 60% (or (134 million) of all its subscribers watched “K-Content” this year, Erik Gruenwedel reports at Media Play News, including shows such as zombie teen drama All of Us Are Dead, which racked up 124.8 million viewing hours in just three days, sending it to fourth place in Netflix’s all-time Top 10 Most Popular Non-English TV shows ever.

READ MORE: Netflix Says Subscribers Love Korean Content (Media Play News)

Money Heist: Korea – Joint Economic Area was a Korean remake of the massive Spanish hit, rising to the top spot at Netflix in six countries days after release (Part 2 of the series is now streaming).

Other Netflix K-drama hits include Extraordinary Attorney Woo, 20th Century Girl, Narco-Saints and Little Women. Korean content made it into the Netflix Weekly Top 10 chart in more than 90 countries over the past year, the streamer said.

Netflix is not the only company looking to capitalize on the increased popularity of Korean content. Earlier this summer, David Satin at The Streamable reported that that Disney+ would release five major K-pop titles on its service, three of which would feature the K-pop super-group BTS, arguably the most popular band in the world currently.

READ MORE: Over 60% of Netflix Global Users Have Watched Korean Content in 2022 (The Streamable)

Meanwhile, exploding interest in South Korean pop culture is fueling the growth of niche streaming services that deliver Korean and pan-Asian movies, TV shows and music in multiple international markets. Cynthia Littleton and Sara Layne at Variety describe platforms such as Rakuten Viki, Cinedigm’s AsianCrush, and Korean broadcast network joint venture Kocowa as “a movement that will only accelerate South Korea’s maturation into a major player in media and entertainment.”

READ MORE: K Dramas Can’t Be Denied: Global Streaming Spurs Demand for Asian Content Platforms (Variety)

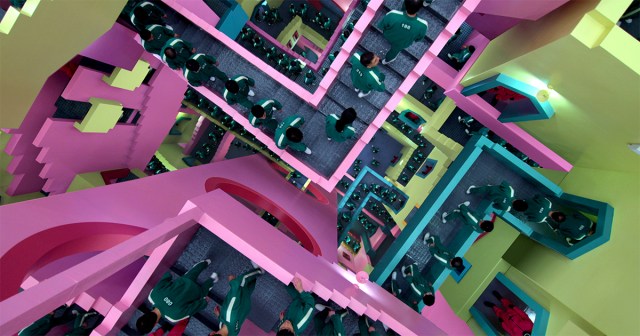

For evidence, look no further than the 14 groundbreaking Emmy nominations racked up by Netflix’s Squid Game. Hwang Dong-hyuk’s death by reality game satire remains the most-searched South Korean drama worldwide, research by cybersecurity firm VPN Overview revealed, despite being released in mid-September 2021.

READ MORE: ‘Squid Game’ Still Leading Online Searches for K-Drama a Year After Release – Global Bulletin (Variety)

“We’ve seen this growth in interest of Asian entertainment over the last 10 years and really picking up more recently,” Sam Wu, CEO of Rakuten Viki, told Variety. “Through word-of-mouth and social sharing and through new streaming destinations like Viki and other global and US-based services, introducing Asian content to the US audience really has driven this growing interest and popularity in the market.”

READ IT ON AMPLIFY: “Squid Game” and Calculating the “Value” of Global Content

READ IT ON AMPLIFY: The (Unavoidable) Universal Appeal of “Squid Game” Is By Design

But why? What are the ingredients of the Korean wave (or Hallyu, as it is sometimes known). Classic K-dramas come in all genres, shapes and sizes, but they often feature K-pop stars to broaden the appeal, particularly among younger viewers.

“Many series are quickly accompanied by original soundtrack record issues that often feature actors warbling a tune or two,” note Variety’s Littleton and Layne. “The soundtracks are produced to enhance the series and focus fan attention on key moments and plot points.”

David Chu, co-founder and president of DMR, which launched AsianCrush and was acquired in January by Cinedigm, points to the interconnected nature of Korean content. He also points to the rise of webtoon comics — short-form content that is distributed via YouTube and other online platforms — that have become an IP-generating engine for Korean movie and TV studios.

Korean director Park Chan-wook doesn’t make K-dramas, but his latest film, Decision to Leave, won him Best Director at Cannes and is South Korea’s entry into this year’s Oscars. Of Hallyu’s popularity he told Entertainment Weekly’s Jessica Wang. “I think it’s because Korean people are so emotionally expressive. There’s a wide dynamic range or spectrum of the emotions that they have. So, in their cultural products, they really want to experience all of these different emotions [and that resonates with viewers everywhere].

READ IT ON AMPLIFY: “Decision To Leave:” Park Chan-wook’s Love Story/Detective Story

READ MORE: Director Park Chan-wook on why Oldboy’s twist remains his favorite (Entertainment Weekly)

Angela Killoren, CEO of CJ ENM America (which has a production deal with Paramount Global), has an interesting take. Speaking at The Korea Program at Stanford earlier this year, she referred to K-drama and K-pop as “female gaze entertainment,” adding: “I think it’s the greatest example of providing something to the market that doesn’t exist.”

She broadly categorized Hollywood film, TV, and music as “very male gaze-driven.” She continued: “It’s often all about ‘How sexy are the girls,’ ‘How bad-boy am I?’ I often have talked to fans of K-pop and Korean dramas and [they say] the same thing: ‘I love [Hallyu] because it rekindles a sense of romance. It’s something that feels different than all the other entertainment that I have.’ ”

That leads Kayti Burt at Paste Magazine to ponder whether it is less weird that Korean entertainment serves this purpose around the world, or the fact that nobody else thought to make content for female audiences, “especially for younger female audiences?”

READ MORE: What Makes K-Dramas So Popular? (Paste Magazine)

Lest we think it’s just Western audiences falling for K-drama’s honesty and romance, video streaming services are growing in Southeast Asia, too, with Korean content most in demand.

The Southeast Asia Online Video Consumer Insights & Analytics report from research firm Media Partners Asia shows viewership across the region up by 6% on a quarter-on-quarter basis, as reported by Patrick Frater at Variety.

Analyzed by content origin, some 38% of premium video viewership is for Korean-made content, far ahead of the 22% recorded by US content and 13% for Chinese content. K-dramas are often remade in other Asian markets. And another big trend lately has been K-drama remakes of Western drama formats, such as Woori the Virgin, a spin on the Juana la Virgen telenovela format.

“The growth of Vidio and Prime Video have thus far expanded the Southeast Asia streaming universe. Breakout Korean hits such as Extraordinary Attorney Woo helped boost Netflix’s consumption leadership in Southeast Asia,” said MPA analyst Dhivya T.

READ MORE: Streaming Video Grows in Southeast Asia as New Platforms Spur Market Leaders – Study (Variety)

Clearly streamers are only going to double down on the content pipe. Revenge thriller The Glory, starring Song Hye-kyo, premieres December 30, and coming up in 2023 is Netflix romance series Doona!, starring former K-pop star Bae Suzy and Yang Se-jong, and series two of Squid Game. Could there be a more cast-iron hit?

READ MORE: Netflix Orders ‘Doona!’, From ‘Crash Landing On You’ Director Lee Jung-hyo; Reveals 60% Of Global Members Watched K-Content In 2022 (Deadline)

CHARTING THE GLOBAL MARKETPLACE:

Big content spends, tapping emerging markets, and automated versioning: these are just a few of the strategies OTT companies are turning to in the fight for dominance in the global marketplace. Stay on top of the business trends and learn about the challenges streamers face with these hand-curated articles from the NAB Amplify archives:

- “RRR:” Changing the Game for the Global Marketplace

- “1899:” Making a Mystery in Multiple Languages

- “Squid Game” and Calculating the “Value” of Global Content

- Global SVOD Market to Hit $171 Billion in Five Years

- Think Globally: SVOD Success Means More Content, Foreign Content and Automated Versioning