Streaming hours on connected TV exploded during the pandemic, accelerating an already existing trend and creating new opportunities for advertisers. Now, platforms like Roku, Amazon Fire TV and Vizio, are focusing on bulking up their content offerings as well as updating their interfaces to keep customers coming back.

Almost half (46%) of US TV viewers reported using AVOD at least monthly, and 28% use a FAST service with ad-supported linear channels in addition to their on-demand offerings, according to Horowitz Research.

READ MORE: Free Ad-Supported TV Gains Suggest Linear Programming Might Not Be Dead After All (Horowitz Research)

As reported at Adweek, Amazon Fire TV reported 50 million monthly active users in Dec. 2020, a 25% increase from January of that year, while Roku had 55.1 million active accounts as of the second quarter of 2021, 28% year-over-year growth. In the second quarter, Vizio SmartCast accounts jumped 43% year over year to hit 14 million, and streaming hours climbed 22% to reach 3.5 billion. Overall, CTV is expected to see nearly $6 billion in 2022 upfront dollars, up from $4.5 billion in 2021, eMarketer predicts.

AVOD Services Launch Originals

Must-see content is one approach these companies are using to keep and grow their users. Roku for example launched Roku Originals in May built out of programming from the now-defunct Quibi. So far, it’s paying off: in the first 60 days following their premiere on the Roku Channel, the top five most-watched TV programs on the AVOD were all Roku Originals. In June, Roku was the sixth most-streamed channel by household reach, according to Nielsen figures.

Roku isn’t the only company looking at originals as a draw. Tubi, Fox’s ad-supported streaming service, has a 140-hour slate of originals bowing this autumn. Content ranges from feature-length documentaries from Fox Alternative Entertainment, animated titles from Fox’s Bento Box studio and “premium independent-minded” titles across Black Cinema, romance and western genres.

“Everyone thinks linear is going to die but viewers like linear. Especially those aged 18-34 years old. They like linear but don’t want to pay for it.”

— Arun Maljaars, Insight TV

Then there’s Amazon’s AVOD IMDb TV which has originals include unscripted series Luke Bryan: My Dirt Road Diary, true-crime docu-series Bug Out from The Cinemart; scripted spy thriller Alex Rider, an untitled Bosch spinoff and comedy series Sprung.

According to Roku’s VP of content partnerships, Tedd Cittadine, the company thinks of free programming as the second stop for consumers after getting them acquainted with Roku as a platform.

“That’s really the kind of the life cycle of how we’re looking to get users first introduced to Roku, then to get them engaged and then to offer them this very compelling, free content advertising supported experience through The Roku Channel,” he told Adweek.

Building a Better UI

Allied with exclusive content, AVOD platforms are also busy upgrading the user experience. Amazon Fire TV has a new interface that includes a new main menu that contains a single destination to access experiences like Find, Live TV and Library.

CONNECTING WITH CONNECTED TV:

Currently one of the fastest-growing channels in advertising, Connected TV apps such as Roku, Amazon Fire Stick and Apple TV offer a highly effective way for brands to reach their target audience. Learn the basics and stay on top of the biggest trends in CTV with fresh insights hand-picked from the NAB Amplify archives:

- The Ever-Changing Scenery of the CTV Landscape

- TV is Not Dead. It’s Just Becoming Something Else.

- Converged TV Requires a Converged Ad Response

- Connected TV and the Consumer

- Connected TV Opens Up a Million Ad Possibilities

Other benefits of the new UI come in the form of targeted advertising. Adweek explains that this has provided Amazon Fire TV “with an additional suite of display advertising services, such as a feature rotator and a screensaver, a full screen-sized ad placement, as well as sponsored tiles and sponsored content rows.”

Similarly, Vizio has unveiled an updated experience for its free streaming video service WatchFree+ including a new programming guide. It is putting the emphasize on data to improve its customer experience.

A Data-First Experience

“When we first think about our role in terms of growing audiences, growing streaming hours, growing programming, all of that to us really comes back to being a data-driven organization,” Adam Bergman, VP of national ad sales, told Adweek. “Your experience on a Vizio television is distinct because the programs you watch, the content you engage with, that now informs the way we deliver you content, the way we deliver programming and the way we deliver advertising.”

READ MORE: Here’s How Connected TV Platforms Are Expanding Their User Bases (Adweek)

A Map of Worldwide SVOD Penetration Rates

Facing a rising number of competitors, Netflix has found it difficult to grab more share in the streaming marketplace and recorded its first decline in its subscriber base since the first quarter of 2022. However, worldwide growth of SVOD services rose roughly 20% in 2022, according to market research & analysis consultancy Statistia.

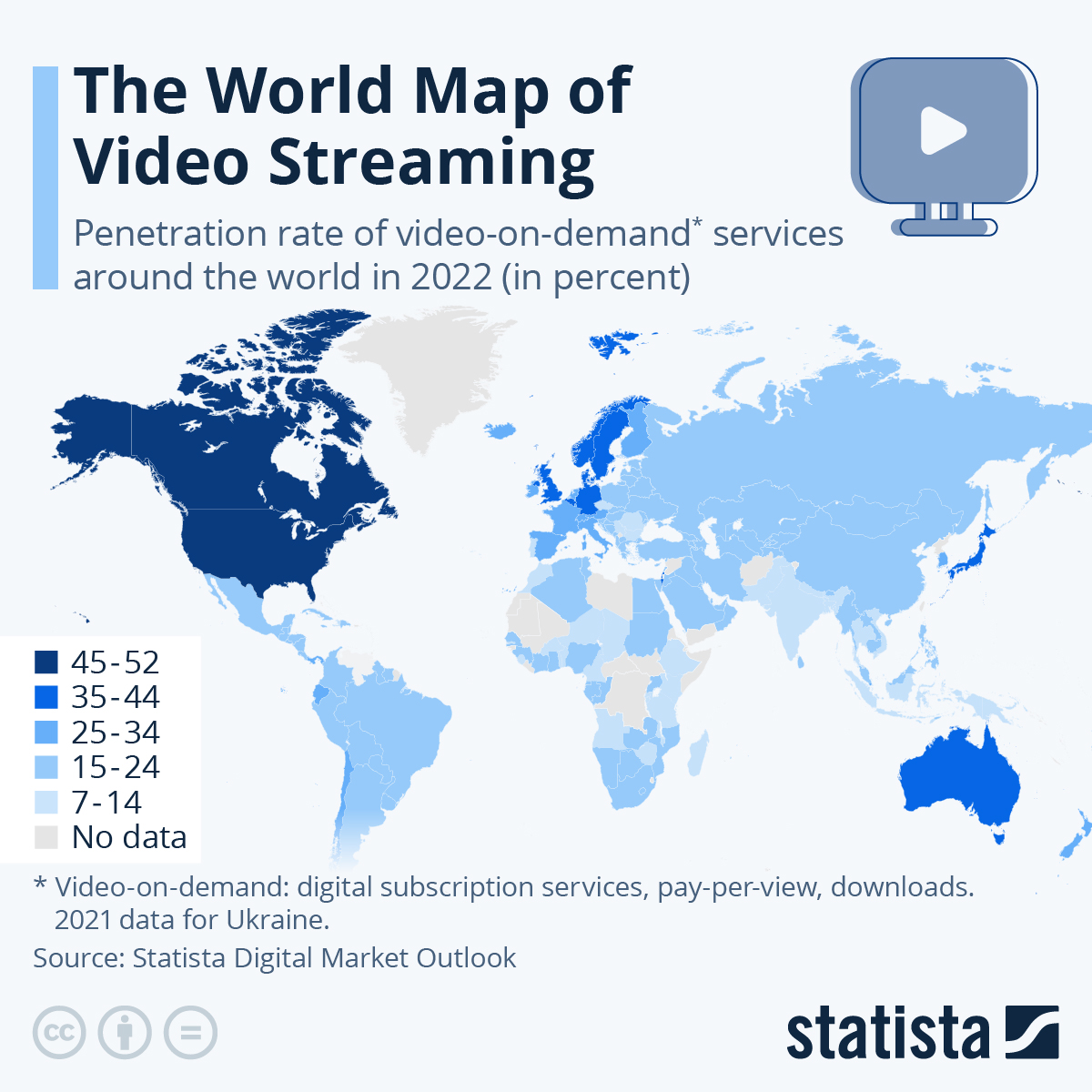

As Statista senor data analyst Katharina Buchholz explains, the map below shows “the most promising markets for chasing video-on-demand users are now South Asia, Latin America and Africa, where Disney+ has arrived in several countries (including South Africa) in 2022. While the market is expanding more slowly in North America, where video-on-demand has reached approximately 50% of the population, there is still some more room to grow in Europe, where this figure varies from 14% in Bulgaria to 42% in the United Kingdom.”

READ MORE: The World Map of Video Streaming (Statista)

Among initiatives in this area is a Vizio customer curated channel offering on WatchFree+, alongside a new featured category with seasonal programming, themed collections and pop-up channels like the culinary and travel channel Fork & Flight.

It has also launched a “data-informed programming arm” — Vizio Features. This blends Vizio’s first-party viewership data distribution and targeting capabilities with content partners.

Target SVOD

You might think that an AVoDs primary target is linear TV for both advertising and audience but Dan Fahy, SVP, Head of Emerging Business, ViacomCBS Networks UK says, in the UK market at least, it is SVoDs which are the battleground for ViacomCBS-owned AVOD Pluto TV.

“We actually see our biggest opportunity in SVOD-first homes,” he told Broadcast Now. “[That’s because] homes where viewing is primarily SVOD-first are less likely to access traditional linear TV, so Pluto’s app-based linear offer plays into this space. Secondly, research shows that SVOD-first homes will periodically desire a more ‘passive’, immersive TV experience and Pluto’s ease of use and simplicity is a valued complement to these households.”

READ MORE: Analysis: Growing up fast: the rise of AvoD (Broadcast Now)

There is also an indication that such platforms are attracting a younger demographic. Currently, the large international AVODs are fueled by older catalogues and archive content attracting older demos but this is changing rapidly as they seek to buy or commission content that attracts younger audiences.

“Everyone thinks linear is going to die but viewers like linear,” says Arun Maljaars, VP Content & Channels, Insight TV. “Especially those aged 18-34 years old. They like linear but don’t want to pay for it.”

WATCH THIS: TheGrill: Focus on AVOD presented by FilmRise

As inflation rises toward a possible recession and consumers continue to tighten their belts, ad-supported video-on-demand — including FAST channels — are quickly becoming the norm.

WrapPRO recently convened a panel of industry experts to discuss consumer habits amid the rise of AVOD as part of its symposium, “TheGrill: Focus on Streaming presented by FilmRise.”

Moderator Brandon Katz was joined by Daniel Christman, SVP of cross platform group at Screen Engine/ASI; Tejas Shah, SVP of commercial strategy and analytics at FilmRise; Katina Papas Wachter, head of ad revenue strategy at Roku; and Alysha Dino, senior director of publisher development at Publica.

The rise of AVOD could create favorable conditions for both producers of advertising and delivery platforms, Christman commented, kicking off the discussion. “There just isn’t an overwhelming urge among consumers to add more paid subscriptions to their monthly budgets, especially as we head into all this recession talk,” he says. “And we know the demand for content is as great now as ever. So this sets up as an extremely favorable story for those involved in ads content creation, and delivery.”

Watch the full conversation in the video below:

READ MORE: ‘The Great Shift to AVOD’: Why Viewers Are Flocking to Ad-Supported Streaming (WrapPro)

There’s no contradiction here. Maljaars believes younger people appreciate FAST as opposed to linear TV because it is delivered in a screen-agnostic, watch-anywhere, and highly personalized viewing experience of the streaming environment.

In a press release, Tubi makes a point of claiming that its average audience age of 37, “20 years younger than that of linear TV.”