TL;DR

- Ampere Analysis founder Guy Bisson says the global TV and streaming industry is shifting away from Hollywood toward a global rise in demand for non-English content.

- The shift, says Bisson, is part of a wider and more fundamental story about changes in the content business over the past 18-24 months in which the studios refocused on streaming.

- This change in direction is the result of a general slowdown in growth opportunities and cost pressures, he says, that were partly driven by investors who increasingly turned against the studio direct model.

- Bisson was featured at the 2024 NAB Show session “Catch a Global Star: Unveiling the Rise of Non-English Entertainment.”

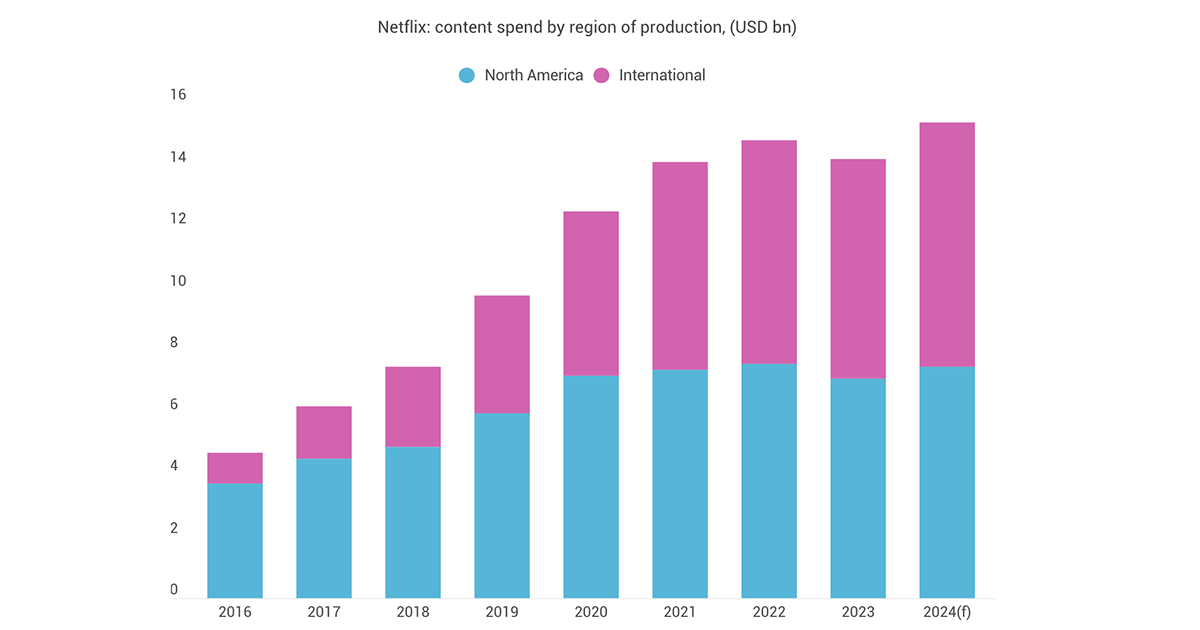

The major streamers now produce more than half of their content internationally, an inflection point from traditional US-centric production to a more diversified and growing global approach.

In a presentation at the 2024 NAB Show, Guy Bisson, executive director and co-founder of Ampere Analysis, illustrated how the global TV and streaming industry is shifting away from Hollywood toward a global rise in demand for non-English content.

Changes in the Content Business

The shift, says Bisson, needs to be seen in context as part of a wider and more fundamental story about changes in the content business over the past 18-24 months in which the studios refocused on streaming.

That change in direction is the result of a general slowdown in growth opportunities and cost pressures that were partly driven by investors who increasingly turned against the studio direct model.

In addition, wealthy western markets were saturated for streamers. Simply put, there were no new customers to find. One way of finding new customers is to look at demographic expansion. Streamers have traditionally skewed to a younger audience but there is still headroom among an old audience.

The bigger opportunity lies in international expansion which is why streamers have trained their focus on markets with room to grow.

“Clearly the best way to target them is to provide content that will engage the audience in those regions and you do that by making content that appeals. That has been the big driver for the internationalization of content.”

The fact that it is expensive to produce content in the US as well as other countries like the UK is another driver.

“These three interrelated factors have all led to the internationalization of content. What it means is that the US is no longer the be all and end all of production, an issue highlighted during the 2023 strikes,” says Bisson.

“The changes in the business models that the streamers had planted created the environment in which those strikes took place.”

The Global Growth Opportunity

The Ampere boss is very clear that the US market remains “orders of magnitude bigger than anyone else in value terms,” but equally that the growth opportunity lies elsewhere.

There is still growth to be had in Western Europe markets, he says, including the UK, also Italy, France, Germany and Spain. Eastern Europe is showing growth too.

In Asia, South Korea has led the way with K-dramas like Squid Game; Japan is not far behind, being particularly strong in feature films (like Oscar winner Drive My Car).

In terms of where we’re going next, Bisson points to sub-Saharan Africa (in countries like Nigeria) and the Middle East.

He draws a parallel between trends now and that of multichannel growth when digital TV was introduced into the cable market.

“Over time thematic channels that were entirely programmed with US content evolved to become more and more local in terms of content, and continuity and presenters. We are seeing the same thing.”

Click here to view a larger version of the graphic.

Streamers are funding content that has to work locally and for global distribution. Local content means local language, local actors and locations but with a production value and certain aspect of story and narrative that is global in appeal.

“Drama is generally used as a spearhead just as it was in the early days of streaming but beginning before the pandemic streamers have moved heavily into unscripted to the point today where over half of first run of original commissions — across the board from Netflix, Amazon, Disney, Warner Bros. Discovery, Apple and more — are now unscripted.”

Check the Numbers

Full year comparison of the number of scripted shows produced in the US for 2023 against the average of the previous two years shows a 38% decline. Netflix and Amazon now generate more than half of their content outside the US, underscoring a decreasing reliance on American production ecosystems. This global pivot is not merely a shift in geography but may signal a broadening of narrative scopes and audience engagement strategies.

“The majority of content on their platforms are scripted today but the majority of first run commissions going forward are unscripted with formatted content favored because of its adaptability to international markets.”

Ampere forecasts global investment change to grow upwards by 30% across 2023-2028. Central and South America will see increased investment, along with Asia and MENA & SSA, whereas a leveling off and slight decline is expected in Europe and the US.

Markets like India have proven hard for international streamers to crack despite its attractive scale, in part because of the relative low value per customer but premium advertising tiers may help grow subscriptions.

“Ads serve a dual function in both the US and international markets which is churn protection, giving customers who would otherwise leave an opportunity to downgrade and stay onboard,” says Bisson. “Ads also bring in a new market opportunity around people who might not have subscribed at all due to cost pressure.”

Why subscribe to The Angle?

Exclusive Insights: Get editorial roundups of the cutting-edge content that matters most.

Behind-the-Scenes Access: Peek behind the curtain with in-depth Q&As featuring industry experts and thought leaders.

Unparalleled Access: NAB Amplify is your digital hub for technology, trends, and insights unavailable anywhere else.

Join a community of professionals who are as passionate about the future of film, television, and digital storytelling as you are. Subscribe to The Angle today!