Watch the IABM’s “State of the Industry Breakfast Briefing” from the 2023 NAB Show.

TL;DR

- NAB hosted IABM executives to discuss the findings of its latest industry benchmark report at the 2023 NAB Show.

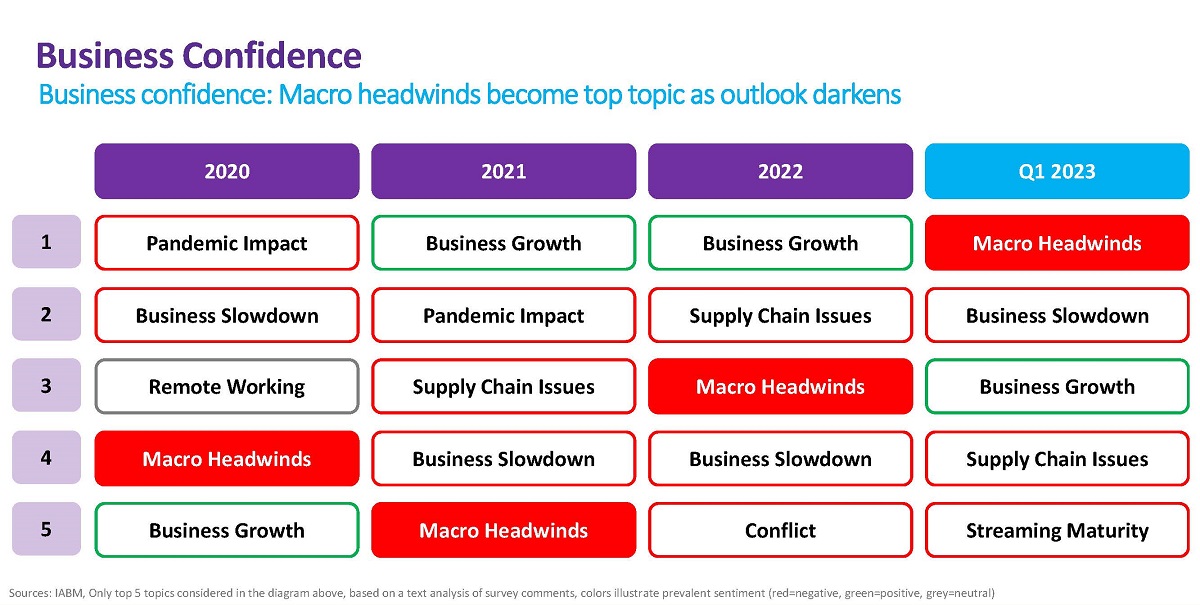

- Business confidence in MediaTech is slightly down from its peak in 2022 though it is still quite positive, the IABM reports.

- Scarcity of resources, and particularly of talent, remains a growth barrier for MediaTech businesses, and is influencing investment.

Economic headwinds have negatively affected business confidence and M&E business models, the IABM reports. Its latest research into the media tech industry says investment is being rationalized with the priority put on cost reductions. Watch the IABM’s State of the Industry Breakfast Briefing from the 2023 NAB Show in the video at the top of the page, and read the full IABM reports, “The State of MediaTech 2023” and “The State of the Industry Breakfast Briefing.”

“The mood is darkening in the industry compared to the last two years,” said Lorenzo Zanni, lead research analyst at IABM, in conversation with NAB Amplify. “It’s still better in a better position compared to the COVID period but macro headwinds are influencing the industry in a variety of ways.”

Watch “NAB Amplify with Lorenzo Zanni of IABM” at the 2023 NAB Show.

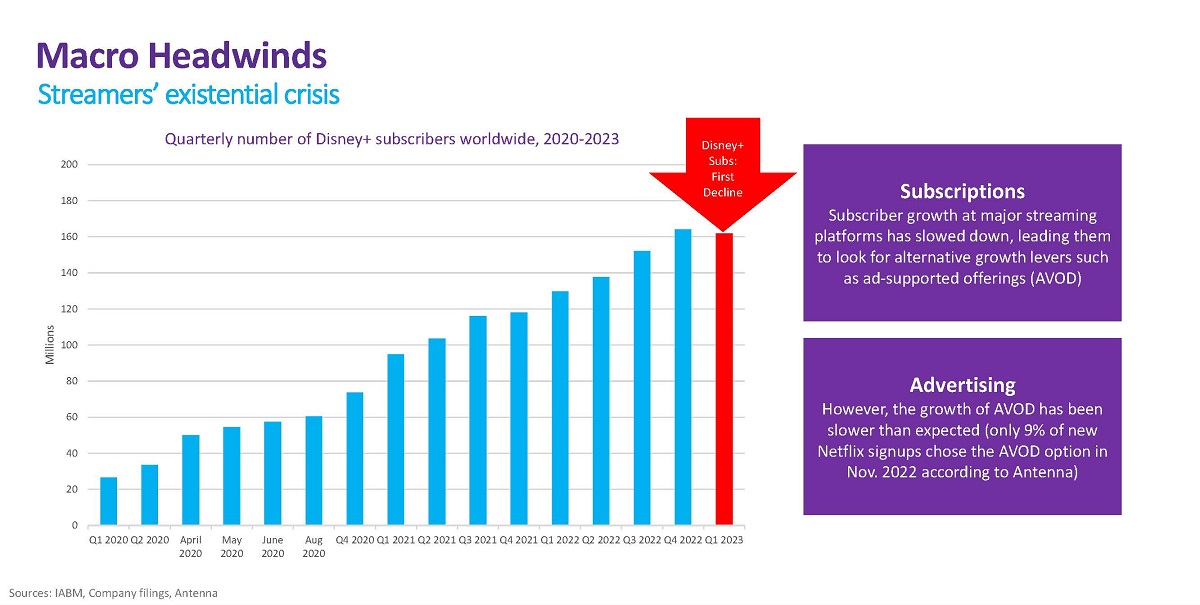

Macro headwinds such as inflation have already negatively influenced Media & Entertainment business models, including ad-funded, subscription-based and content models.

These challenges are evident in the number of companies making staff redundant. As of Q1 2023, 528 technology companies (about 50% of the 2022 number) had laid off about 95% of the total number of people laid off in 2022.

Although the overall media tech market for broadcast is valued by the IABM at $67 billion, major technology stocks have recently declined by 20% from a peak in December 2021 to Q1 2023.

As a result, the sector is focused on achieving greater efficiency. That translates into investment in media technology with organizations more likely to purchase AI/ML tech for automation ahead of technologies that might deliver a more immersive experience for viewers.

From an investment perspective, the IABM research finds a slowdown in cloud investment compared to 2020-2022. Zanni speculates, “This may have been driven by a re-evaluation of cloud spending by media businesses that heavily invested in it out of necessity in that period, which is consistent with anecdotal evidence we have gathered.

“Conversely, we have seen a rise in hardware and services investment by media businesses — these bounced back compared to 2020-2022. The uptick in services is consistent with a positive outlook for outsourcing, which may be driven by media businesses attempting to reduce costs and circumvent talent shortages.”

Another trend is scarcity, both in terms of supply chain components, which continues to disrupt the the industry and send prices higher (65% of media tech suppliers reported moderate to severe supply chain issues in Q1 2023 — significantly down from the 97% reported last year), and in talent. In fact, the labor shortage has gotten worse year-on-year, the IABM finds. Eighty-seven percent of respondents said that it is difficult or very difficult to recruit technical talent at the moment, with 69% saying that the situation has worsened in the last three years.

“Companies are telling us that they’re finding it very difficult to recruit talent at the moment,” said Zanni. “It is not up to single companies to solve that. It’s a complex issue and we will be publishing a report on that post-NAB, talking to some stakeholders to try to find some solutions about that.”

The IABM was keen to strike an optimistic note. That while macro headwinds undoubtedly represent a challenge for MediaTech businesses in 2023, they could also be an opportunity for some.