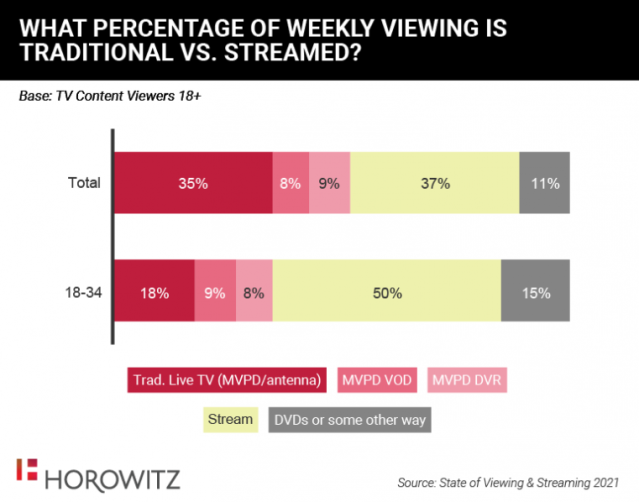

Streaming may be poised to eclipse traditional platforms as the main way to watch TV but that doesn’t mean we’re all going on-demand. The linear schedule is proving remarkably resilient, a new study shows.

The reason is the rising popularity of advertiser-supported streaming services, particularly those that play out programming and offer a lean-back experience.

READ MORE: Why Streamers Are Pressing “FAST” Forward (NAB Amplify)

The growth of so called FAST channels — Free Ad Supported TV — which can be found (alongside VoD inventory) on platforms like Pluto TV, Samsung TV, Tubi, Roku and IMDb TV, signal an important turning point for media companies struggling to adjust their business models to the streaming environment.

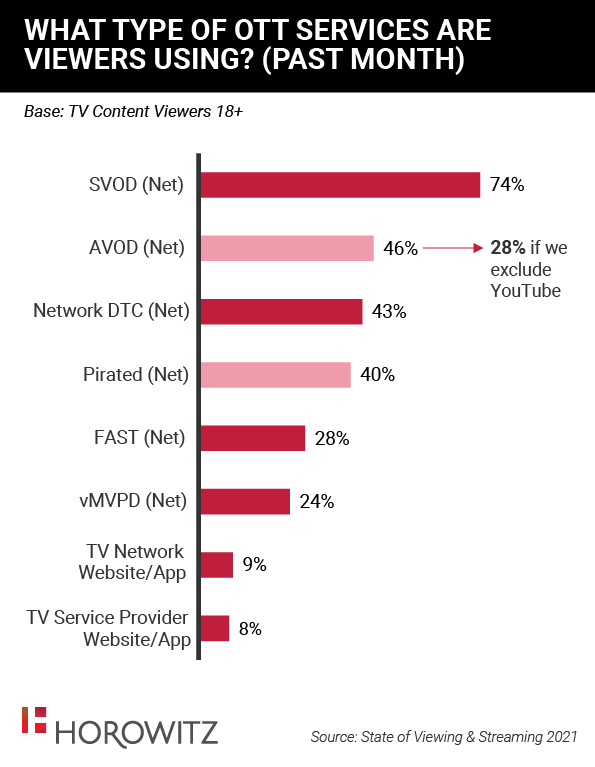

The State of Viewing and Streaming 2021 report from Horowitz Research found consumers were using a wide range of ad-supported services with linear content. are among the services consumers report using most often. Almost half (46%) of TV content viewers in the U.S reported using an ad-supported streaming service (AVOD) at least monthly, and a full 28% use a FAST service with ad-supported linear channels in addition to their on-demand offerings.

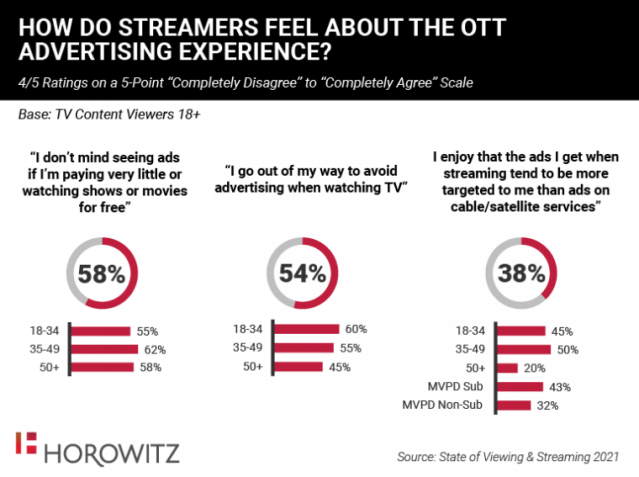

The Horowitz study suggests that consumers are very open to advertising in the streaming space — perhaps even more so than they were in the traditional, linear space.

READ MORE: Free Ad-Supported TV Gains Suggest Linear Programming Might Not Be Dead After All (Horowitz Research)

While about half of streamers go out of their way to avoid advertising when watching TV, there is more tolerance when watching content that is available for free (or at low cost). Six in ten (58%) streamers feel that ads are a fair “price” for being able to watch TV content for free (i.e., saying they don’t mind seeing ads if they are paying very little or watching for free). Moreover, almost 4 in 10 consumers are starting to notice — and appreciate — the more customized, personalized advertising experience they are getting through streaming.

“Consumers’ love for entertainment content — and their desire to get as much of that content as they can for as little as they can — hasn’t changed. The fundamentals of the industry haven’t changed,” remarked Adriana Waterston, SVP of Insights and Strategy for Horowitz. “When delivered in the screen-agnostic, watch-anywhere, and highly personalized viewing experience of the streaming environment, we are seeing some consumers not just tolerating, but welcoming advertising, particularly when it is customized to their interests.”

While younger audiences overwhelmingly prefer streamed content (just 18% of their time is spent with traditional linear content, according to the report) there is evidence this is changing. FAST channel operators are beginning to target the 18-34 year old audience, not least by beginning to commission their own original content rather than rely on archives from the back catalogue.

Tubi, Fox’s ad-supported streaming service, which claims an average audience age of 37, “20 years younger than that of linear TV,” has a 140-hour slate of originals bowing this autumn. Content ranges from feature-length documentaries from Fox Alternative Entertainment, animated titles from Fox’s Bento Box studio and “premium independent-minded” titles across Black Cinema, romance and western genres.

READ MORE: Tubi Unveils Audience Report, The Stream, Outlining Key Insights Shaping Streaming and TV Ad Strategies (Tubi)

Amazon’s IMDb TV is also booking originals including unscripted series Luke Bryan: My Dirt Road Diary, true-crime docuseries Bug Out from The Cinemart, scripted spy thriller Alex Rider, an untitled Bosch spinoff, and comedy series Sprung.

“We’re at the stage where most households have multiple paid streaming service and multiple ad supported streaming services that all these distinctions between AVOD, SVOD, linear, BVOD and FAST are irrelevant,” says Guy Bisson, co-founder and director at Ampere Analysis. “As far as the consumer is concerned it’s all television. So, at that point we just need to call it TV. It is just migrating from one means of delivering Free to Air TV to another. The migration is a tech shift not a business or economic shift.”