READ MORE: 2022 State of Crypto Report (a16z)

With investors getting jittery about cryptocurrency and reports of stocks tanking making headline news pages — not without a little schadenfreude — one of the biggest Web3 VCs wants to reassure you.

READ MORE: Could terra fall prove to be Lehman Brothers moment for cryptocurrencies? (The Guardian)

Current instability is merely a blip and part of the regular cycle of a maturing economic market, they would have you believe. Just stick with it and you’ll reap the rewards.

a16z, which is set up by Marc Andreessen and Ben Horowitz, has issued a State of Crypto report which lays out the positive macro trends we should be concentrating on, not the short term volatility.

The report runs to 50 pages, but we’ve condensed them into five key takeaways.

1. This is a “Price-Innovation Cycle” — Just Chill

There’s nothing to be alarmed about in the recent downturn in the market which has hit crypto like Terra and Bitcoin badly. Markets are seasonal; crypto is no exception.

Although crypto can be volatile and its cycles seem chaotic, there is an underlying logic at work, assures a16z. It points to a feedback loop “the price-innovation cycle,” which rules that consistent long-term gain is fueled by interest and innovation. It’s the kind of advice you might get from your mortgage advisor, that investing in stocks and shares will pay dividends in the long run. Or it may not.

But for those looking to duck out of the Web3 enterprise, a16z has this warning: Consider that any prospective founders who swore off tech and the internet in the aftermath of the early-2000s dot-com crash missed the best opportunities of the decade: cloud computing, social networks, online video streaming, smartphones, etc.

Now is the time to consider what the equivalent successes will be in Web3.

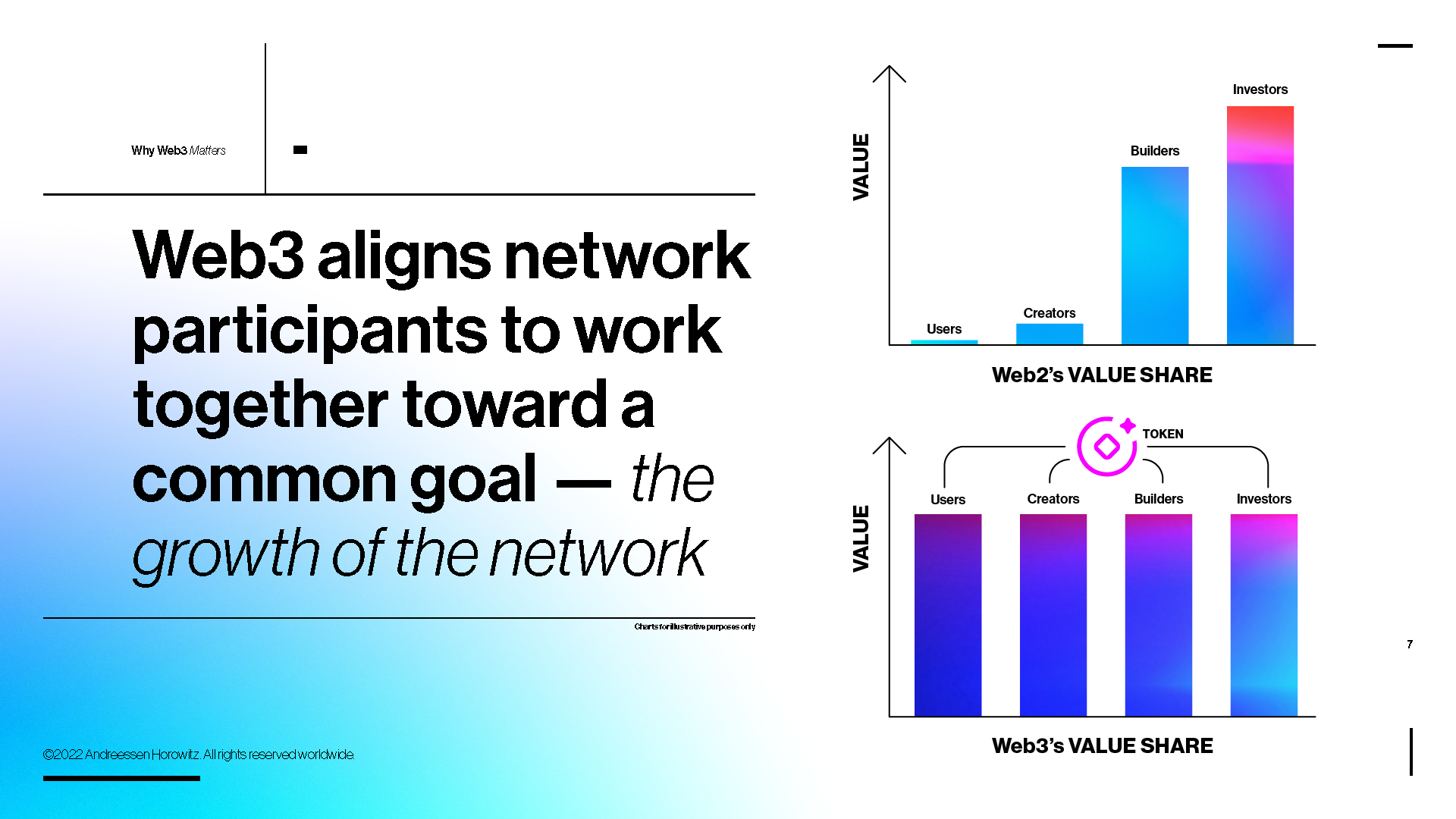

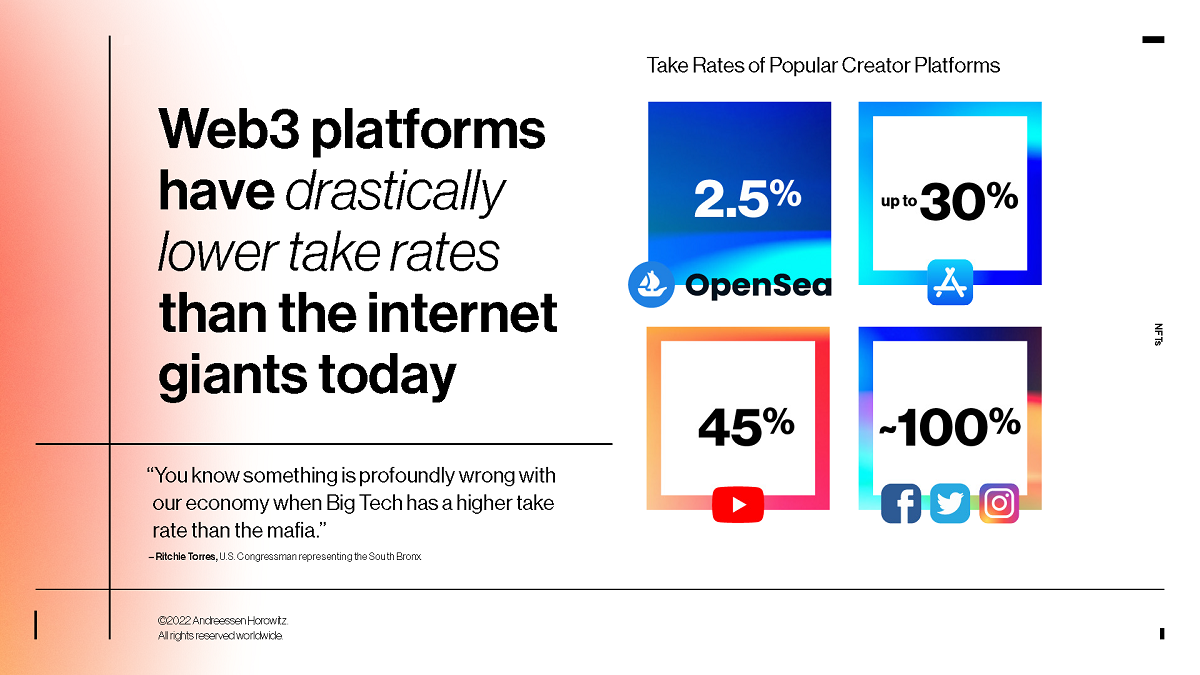

2. Web3 Pays More to Creators than Web2 — Like, MUCH More

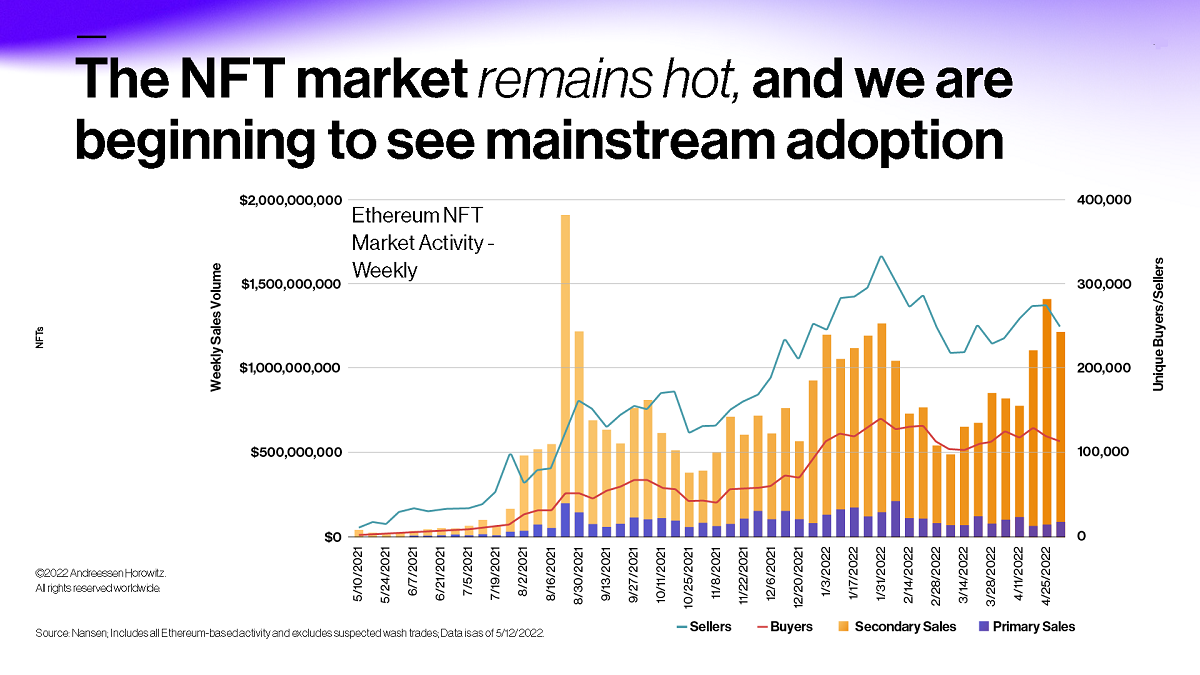

This is perhaps the biggest plus in the chart for a16z. It calls the take-rates (share of profit, or reward) of Web2 giants “extortionate,” but Web3 platforms offer fairer economic terms.

It compares Meta’s “nearly 100%” take-rates across Facebook and Instagram to the mere 2.5% of NFT marketplace OpenSea.

While in absolute terms, Spotify and YouTube paid out more to creators — $7 billion and $15 billion, respectively — the “per capita” disparity is striking. According to a16z’s analysis, Web3 paid out $174,000 per creator, while Meta paid out $0.10 per user, Spotify paid out $636 per artist, and YouTube paid out $2.47 per channel. This leads the company to conclude, with some justification, “Web3 is tiny but mighty.”

YOUR ROADMAP TO WEB3:

Does Web3 offer the promise of a truly decentralized internet, or is it just another way for Big Tech to maintain its stranglehold on our personal data? Hand-picked from the NAB Amplify archives, here are the expert insights you need to understand Web3’s potential and stay ahead of the curve on the information superhighway:

- The Web3 Dream vs. Digital (and Economic) Realities

- What Needs to Happen for Web3 to Go Mainstream

- Web3 and the Future of Work (Oh, Guess What? It’s Decentralized.)

- Web3, Free Will and Who Will Own the Future

- Taking Those First Steps Into Web3

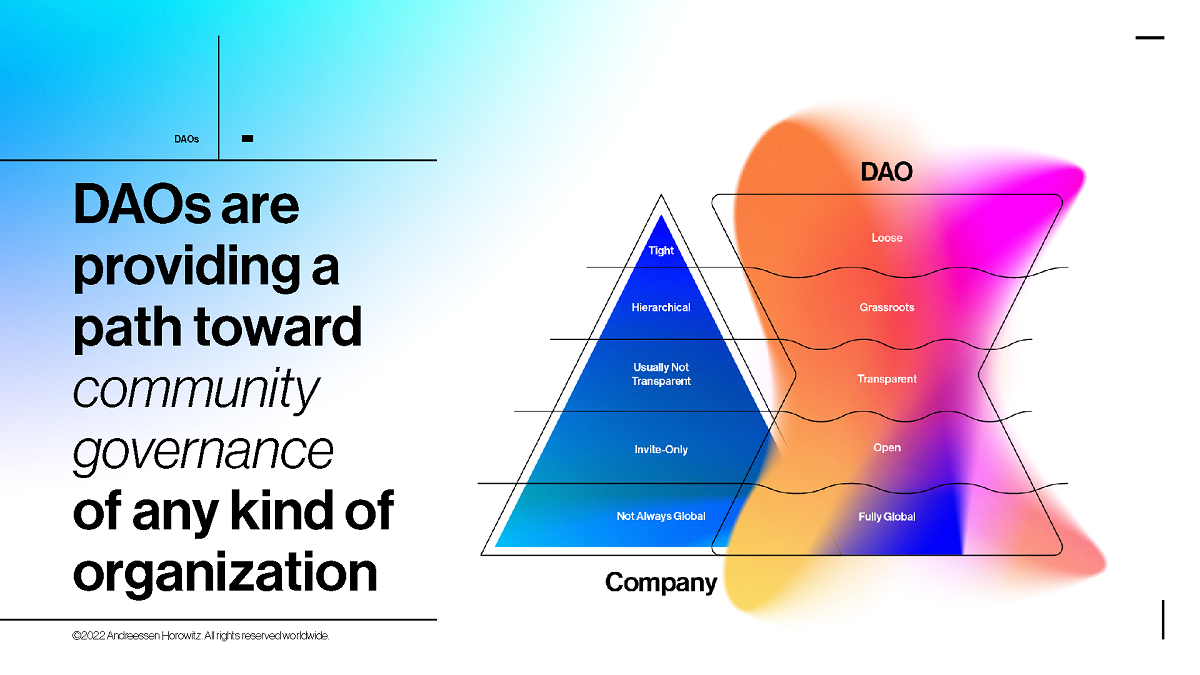

3. DAOs Are Making a Genuine Difference

DAOs, or decentralized autonomous organizations, are designed to be more democratic in that all stakeholders can coordinate and cooperate economically to achieve goals. a16z points to a number of these already making an impact.

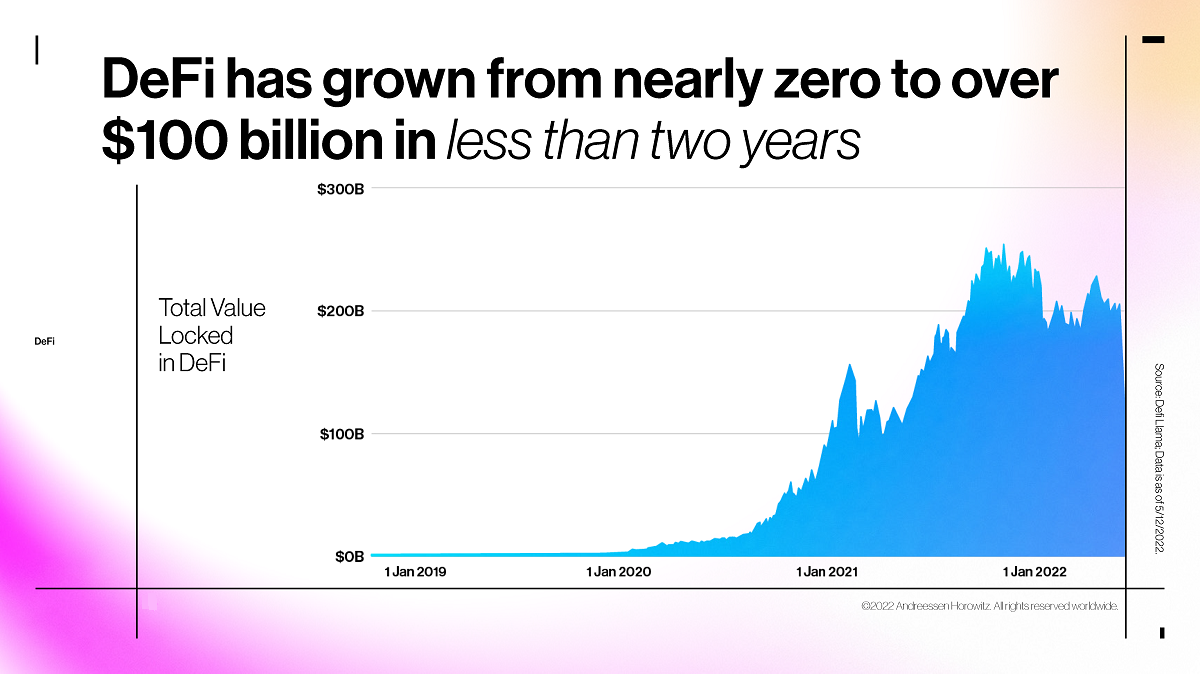

Perhaps the biggest is in the financial system, where demand for decentralized finance, or DeFi, and digital dollars has increased dramatically in the past few years, even after accounting for the recent downturn. Projects like Goldfinch are expanding access to capital that would otherwise be unavailable in emerging markets.

“Crypto is addressing broken marketplaces too. Crypto is far more than just a financial innovation — it’s a social, cultural, and technological one,” the company says.

Examples include Flowcarbon which is revamping carbon credits by making these increasingly important units of account transparent and traceable on blockchains. Helium, a grassroots wireless network, “is posing the first legitimate, decentralized challenge to entrenched telecom giants”; and Spruce is enabling people to control their own identities, rather than ceding that power to online intermediaries like Google and Meta.

4. Ethereum is the Clear Leader, But Faces Competition

Terra may have tanked, but a16z prefers to point to the runaway success of Ethereum and growth trends in several other blockchains.

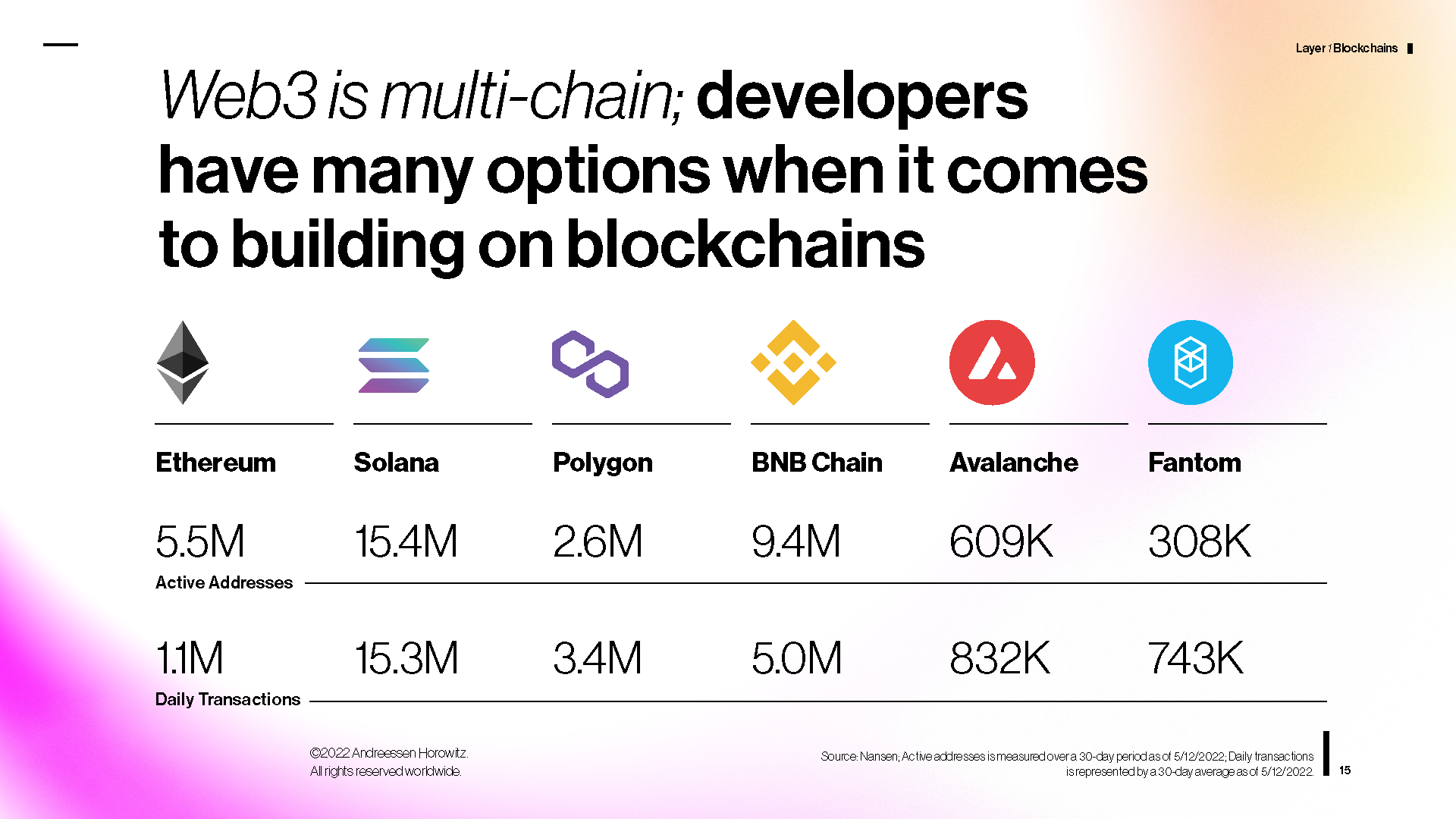

Ethereum has far and away the most builders, it states, with nearly 4,000 monthly active developers. Following that is Solana (with nearly 1,000) and Bitcoin (about 500). Developers of blockchains like Polygon, BNB Chain, Avalanche, and Fantom would appear to have an upward growth trajectory.

“Blockchains are the hit product of a new computing wave, just as PCs and broadband were in the ‘90s and 2000s, and as mobile phones were in the last decade,” says the VC. “There’s a lot of room for innovation, and we believe there will be multiple winners.” And losers…

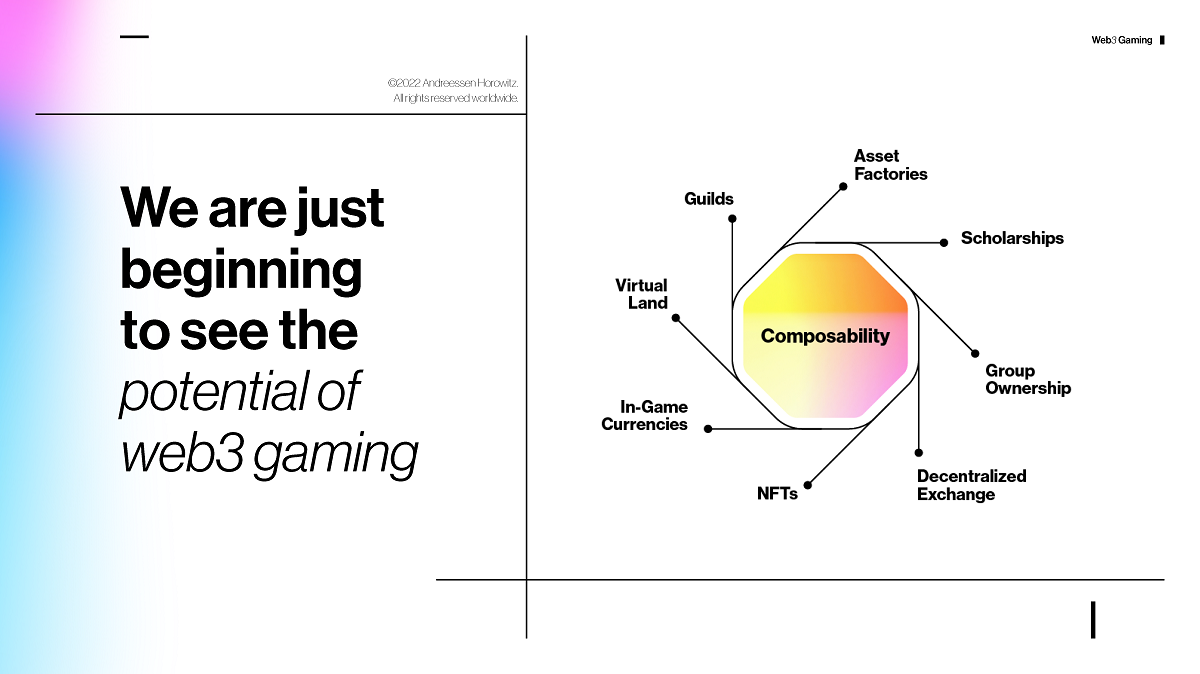

5. It’s Still Early Days

a16z takes pains to point out that Web3 is so new it is bound to have growing pains. The company predicts, though, that Web3 will remain on track for rampant adoption. It estimates there are somewhere between seven million and 50 million active Ethereum users today, and suggests that this compares to the early days of the internet, which reached 1 billion users by 2005 (from 1995).

“Though it’s very hard to estimate, if the trendlines continue as depicted, Web3 could reach 1 billion users by 2031. In other words, you’re still early. Much remains to be done. Let’s keep building.”