With the significant growth ahead for streaming video applications, keeping all that content on the right screens and off the wrong ones will be a major challenge and opportunity.

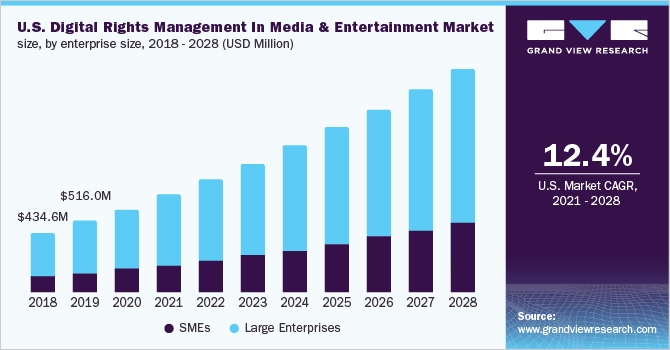

Globally, the Digital Rights Management revenue in media and entertainment will grow at a compound annual rate of 16.5% through 2028, one forecaster predicts, with annual worldwide revenues of more than $6 billion.

“Digital disruption and the increasing expanse of high bandwidth internet networks are allowing the easy distribution of media content across users,” Grand View Research says in its report. “However, this also allows for the illegal sharing of media content including audio, video, books, and applications, affecting the revenue of content publishers and distributors.”

The industry has already seen major investment during the COVID-era and its increased demand for video content. DRM for video-on-demand applications, and the soaring number of mobile video consumers worldwide, will lead the growth in the industry.

In the United States, the report pegs the annual DRM growth rate at 12.4% annually, compared to 20% in Asia Pacific. About 35% of all DRM revenue now comes from North America, where big streamers like Netflix, Amazon Prime, and Hulu are aggressively investing in DRM solutions.

With the current shift to cloud-based infrastructure to deliver on-demand content to consumers, content owners and distributors need to adopt scalable and cost-effective ways to deliver content, the report overview says. DRM solutions help deliver content where it belongs and can provide multi-tiered subscription plans as a way to increase revenue.

The report lists Google (with its Widevine technology), Microsoft, Irdeto, Apple, Vitrium, Intertrust Technologies Corp., Bitmovin, and Kugel SKI SA among today’s prominent global DRM players.

The report focuses on the United States, Canada, the United Kingdom, Germany, China, India, Japan, Mexico, and the Middle East-Africa region.

For more information, or to request a free sample copy of the customizable report, visit Grand View Research.