TL;DR

- A new report from Amazon Web Services finds video services prioritizing managing the cost of content production.

- AWS wants to expedite the move to cloud by talking up the value to the media industry of buying into SaaS tools in the cloud to scale and flex their business.

- AWS attributes the reticence toward full public cloud deployment to complexities in the current “multi-layered cloud ecosystem.”

READ MORE: Expediting Cloud Transformation in the Media Industry with Marketplaces (AWS Marketplace)

The benefits of cloud solutions are widely understood by video service executives, but Amazon Web Services says migration to public cloud isn’t happening at a fast enough rate for M&E companies to fully take advantage of them.

Naturally, AWS has a vested interest in pushing this message and says operational complexity is being exacerbated while M&E companies adopt halfway-house strategies involving on-prem, private and public cloud.

In a new study, “Expediting Cloud Transformation in the Media Industry with Marketplaces,” AWS commissioned research analysts Omdia to evaluate the potential of cloud marketplaces to expedite the cloud transformation of media operations. Omdia interviewed 66 global senior decision makers from video service providers, asking them how and why they are utilizing cloud services.

The leading external factors influencing technology strategy are topped by the lasting impact of COVID (48%), closely followed by the rise of direct-to-consumer (D2C) streaming (45%); and, related to both, the changing nature of viewer behavior and expectations (35%).

As the report points out, the pandemic hastened the use of cloud infrastructure to support business continuity by enabling remote working capabilities. It also acted as a catalyst in changing consumer behavior and facilitating the acceleration of D2C streaming as stay-at-home measures meant people sought online entertainment.

These changes to consumer behavior and entertainment needs are driving a shift in technology strategy, Omdia finds. The overall picture is one of managing the cost of content production, with a focus on technologies that aid the monetization of assets. Operations are migrating to the cloud, improving both financial and operational flexibility and giving content owners and distributors tools to pivot quickly in response to customer demand.

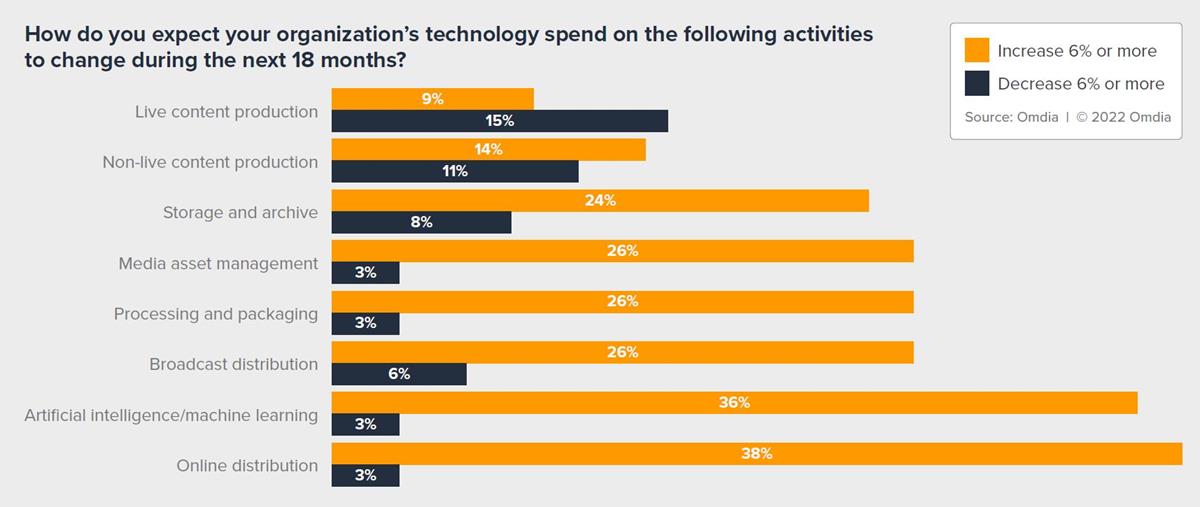

Budgets are being adjusted to promote these enabling technologies, though some functions are being prioritized over others. Online distribution and AI/ML will be key areas for technology spending, with the highest proportion of surveyed respondents stating an expectation that spending on these areas will increase 6% or more in the next 18 months. Both online distribution and AI/ML are also the perfect candidates for optimization through cloud-based technologies.

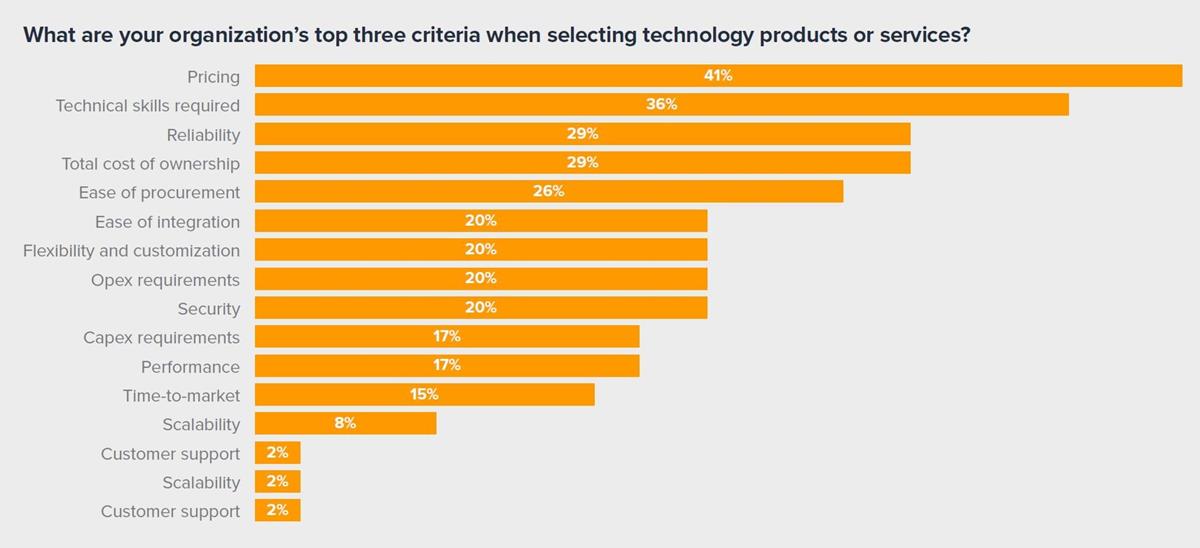

Reducing the overall spend on technology is stated as the main reason for cloud deployment by 36% of respondents. Moving away from CAPEX intensive investment is also highly rated, along with scalability.

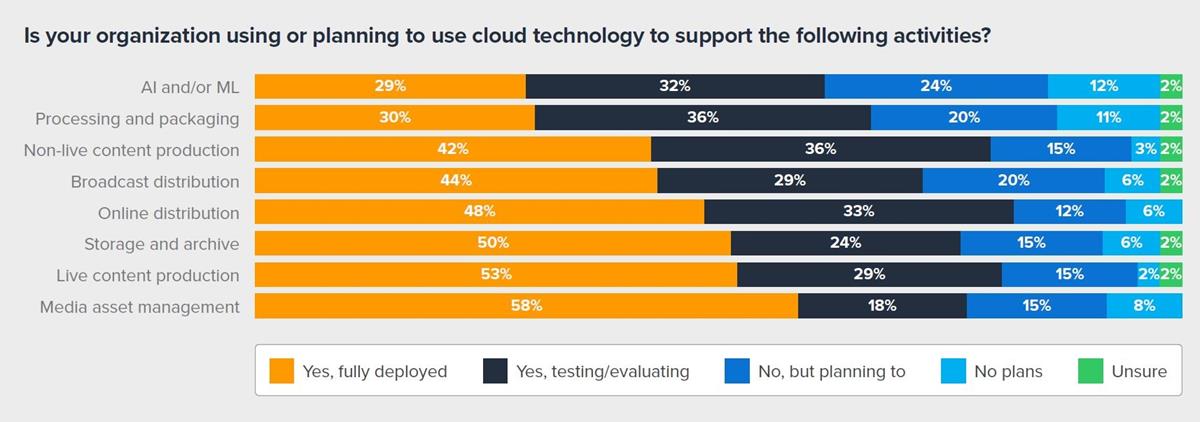

However, cloud implementation is progressing at different speeds. Processes like archiving, storage, and media asset management are much further ahead than others. These are “more naturally cloud-aligned” aspects of the media enterprise that might require significant storage and can be scaled quickly and accessed from anywhere.

AWS also says live content production is expanding into cloud as a direct result of the pandemic.

In contrast, AI/ML has the lowest level of cloud deployment due to its technical challenges. This remains “one of the most highly anticipated technologies and a key future development in terms of workflows and creating highly personalized services.”

The variation in the level of cloud deployment is matched by the mix in cloud implementation type. Rather than an outright preference for one, most content providers are utilizing a hybrid model of appliances, private cloud, and public cloud — which AWS criticizes saying it “adds operational complexity.”

These differences are at a function level too, with 56% of respondents using direct public cloud for live content production, while just 40% use it for AI/ML. Private cloud remains highly used across most media delivery functions (45-60% of respondents), while managed service providers are used by fewer than 15% of organizations across all operations.

“This complexity combined with the pace of change in the media and entertainment landscape has led to technological skills and knowledge gaps, which can be a hindrance to cloud deployment,” AWS state.

Despite the technical challenges, the benefits of using cloud to support growth are said to be extensive and well understood by users in the M&E industry.

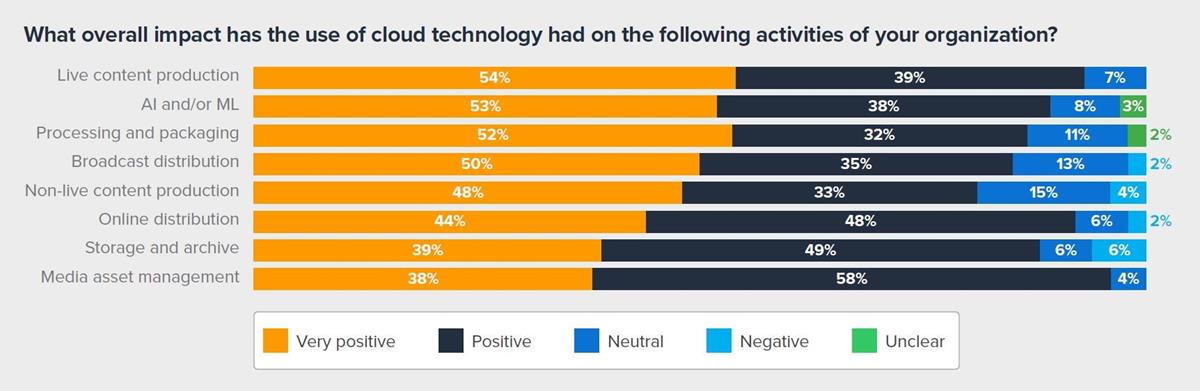

Satisfaction is high, with the vast majority of surveyed respondents — over 80% — stating the overall impact of using cloud technology was either positive or very positive.

“Therefore, the real challenge, and opportunity, for the industry is pushing more functions into the cloud, at a faster rate,” AWS comments.

Looking to the future, it seems broadcasters will continue to seek a mix of public and private cloud. AWS attributes the reticence toward full, public cloud deployment to the “multi-layered cloud ecosystem.”

There are several public cloud infrastructure providers, it explains, a multitude of complex M&E applications, and an implementation structure that can often involve working and deploying directly through a number of different technology vendors.

“This not only slows cloud implementation, but can also result in silos of data, hindering the ability to achieve a fully connected workflow — a key asset for developing monetization strategies.”

However, AWS then highlights a solution to this issue in the role of public cloud marketplaces (AWS Marketplace, Google Cloud Marketplace, Microsoft Azure Marketplace).

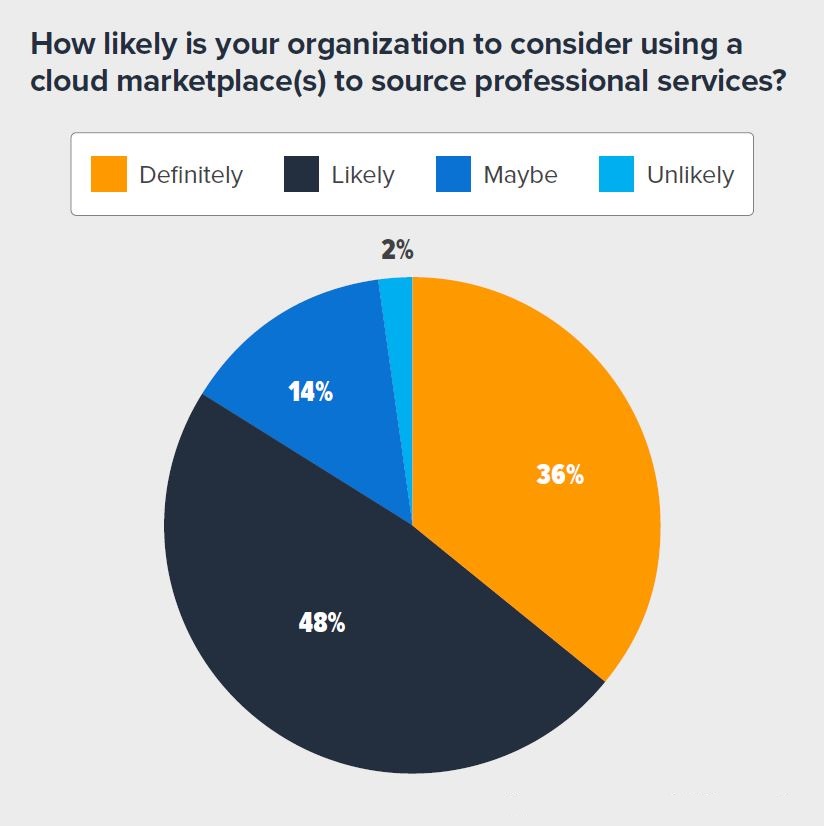

“Marketplaces are going to be a key element of future technology strategy for content providers in the media industry,” AWS contends, “though their approaches are still essentially a hybrid of available options while in this transition phase.”

Cloud marketplaces are presented as making it easier to both implement and leverage the benefits of the cloud, along with the scalable pricing structures of SaaS, Software as a Service, models.

“Media companies can license industry specific software then integrate it with other on-prem or cloud-based solutions or leverage integration services from any number of vendors. These platforms create a single source for content providers to access and test an array of advanced tools for the development of efficient processes while also supporting growth.”

AWS urges more vendors to host their software on these marketplace platforms saying that this could have “a snowball effect” resulting in a more “unified approach,” which would bring benefits to everyone.

“Using marketplaces can push forward the use of public cloud across under-penetrated and technically difficult functions. This would help to leverage the myriad of benefits that cloud can bring, but also better connect often isolated data silos, all of which can put the industry in a much stronger position going forward.”

OUR HEADS ARE IN THE CLOUD:

The cloud is foundational to the future of M&E, so it’s crucial to understand how to leverage it for all kinds of applications. Whether you’re a creative working in production or a systems engineer designing a content library, cloud solutions will change your work life. Check out these cloud-focused insights hand-picked from the NAB Amplify archives:

- Get Onto My Cloud: Why Remote Production Tools Are Used by 90% of Video Professionals

- TV Production in the Cloud: The Whys and Hows

- SaaS, IaaS, PaaS: Cloud Computing Class Is in Session

- Take a Tour of the Global Cloud Ecosystem

- Choosing Between Cloud-Native and Hybrid Storage (Spoiler: You May Not Need To)