TL;DR

- Media analyst Doug Shapiro offers a holistic view of the video value chain in the US suggesting that pay-TV is more resilient than prevailing perceptions suggest.

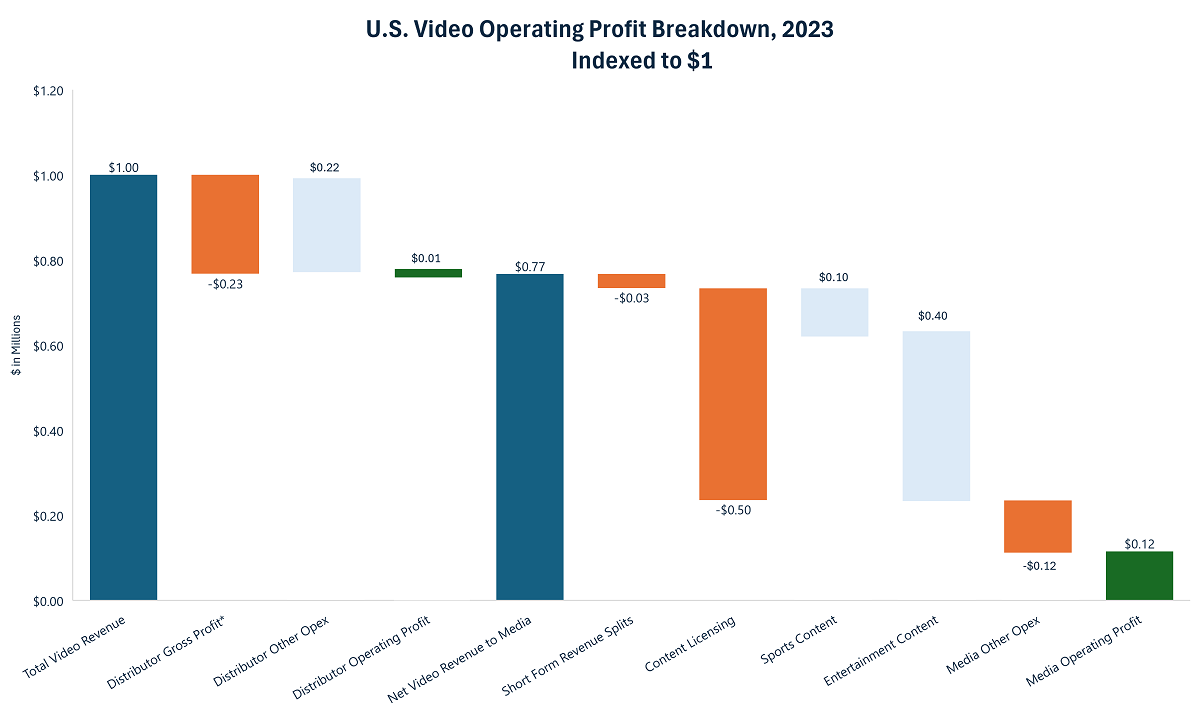

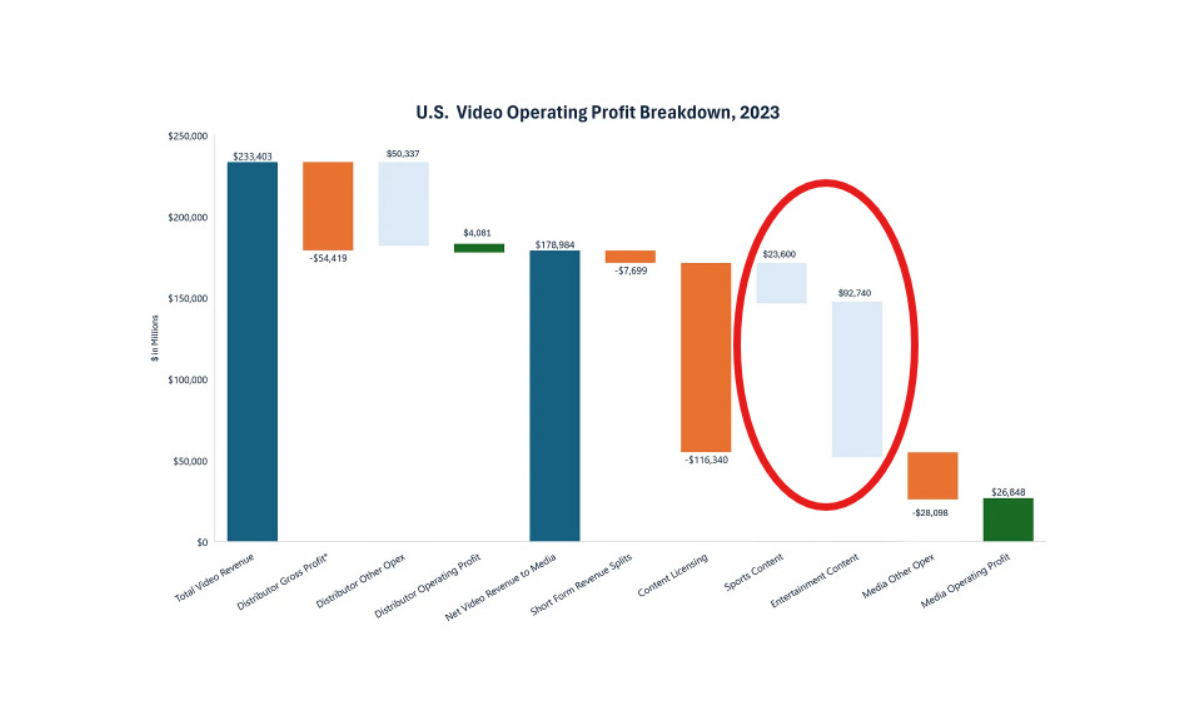

- Video distribution isn’t a great business: For every dollar of revenue, last year distributors took $0.23 off the top, but only kept $0.01 as operating profit.

- GenAI will flood the market with more entertainment content and will simultaneously push up the value of live sports.

READ MORE: Video: Follow the Money (Doug Shapiro)

The TV ecosystem has undergone a significant transition over the last decade — but perhaps not as radically as we think, according to media analyst Doug Shapiro.

“The popular narrative around the video business is that pay TV is dying, home entertainment is all but dead, box office is stagnant and streaming is growing rapidly,” Shapiro says an essay on Substack titled “Video: Follow the money.” All of that is directionally accurate, but the relative sizes of these different components is often overlooked.

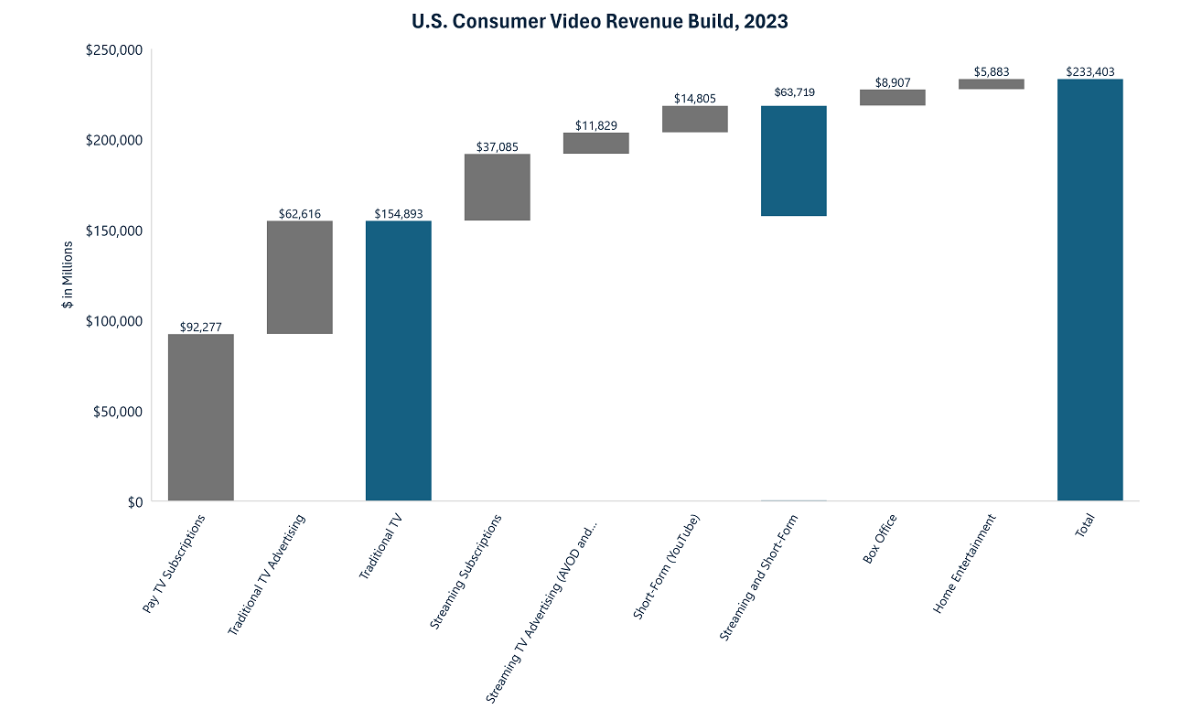

Shapiro has aggregated the numbers using data from Kagan/S&P Capital IQ, MAGNA, MoffettNathanson, OMDIA, Box Office Mojo, and DEG, along with his own estimates.

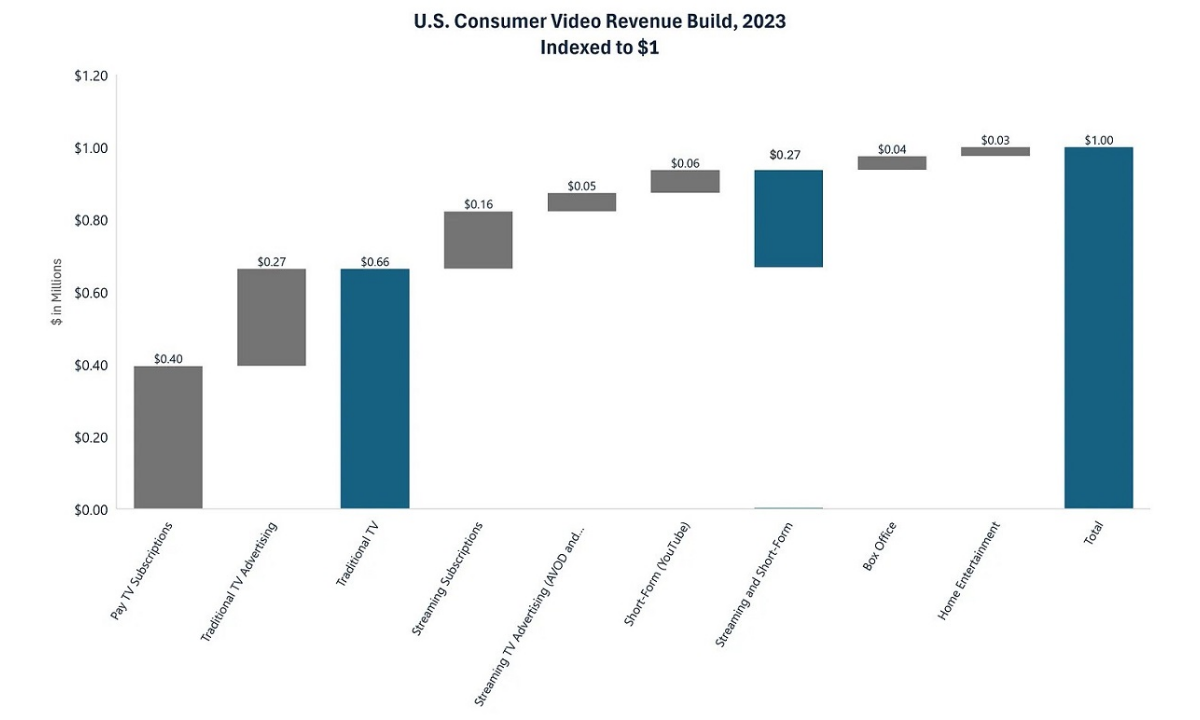

The data shows that for every dollar that consumers and advertisers spent on video in the US last year, $0.66 went to traditional TV (pay-TV and broadcast).

By comparison, all streaming (SVOD, AVOD, FAST and CTV) represented just $0.21. Box office was only $0.04 of every dollar — despite “all the press and investor focus.”

Traditional TV (pay and broadcast) is still by far the largest component of the US video market with some 70 million subscribers. They represent $0.66 for each dollar consumers and advertisers spend in the US.

Shapiro counts video revenue as both direct consumer spend from subscriptions and transactions, plus advertising. He also includes YouTube within the TV ecosystem but excludes other short-form platforms like TikTok and Reels — whose addition “wouldn’t change the story much.”

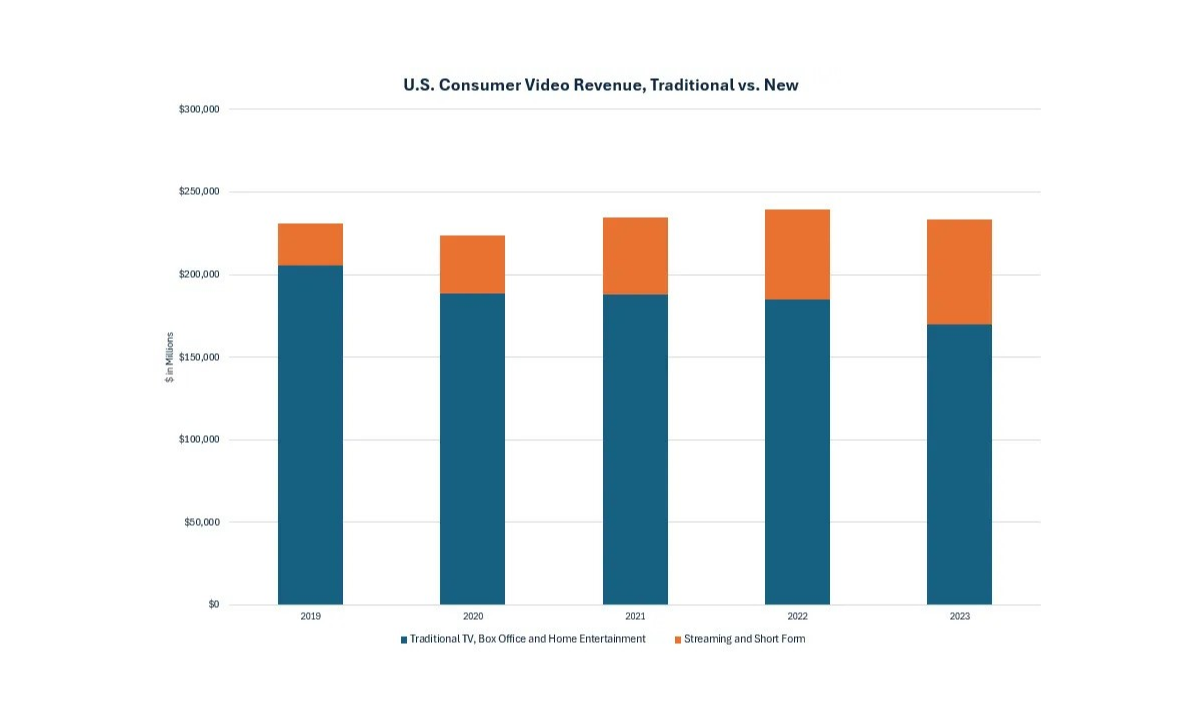

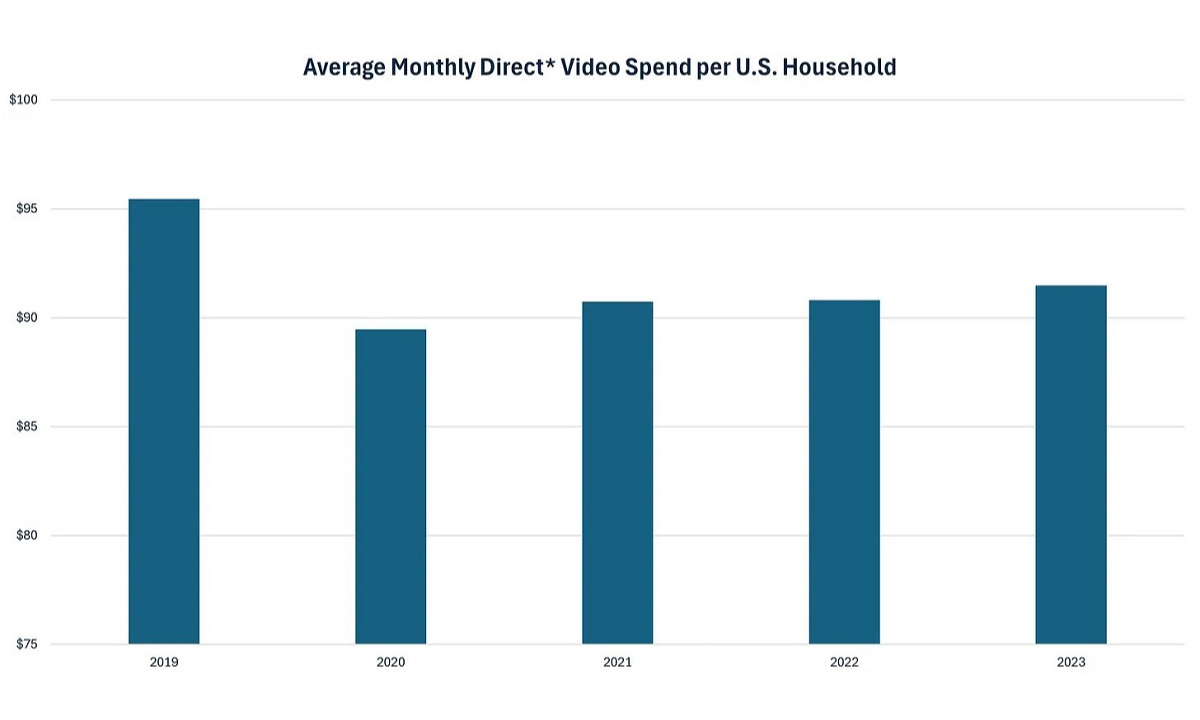

Crunching the numbers, he observes that the distribution of revenue between direct consumer spend and advertising hasn’t changed dramatically in recent years.

“I found this surprising. Keep in mind that there are a lot of moving pieces: pay TV subs revenue is falling due to cord cutting; traditional TV advertising is also falling because of rapidly declining ratings; box office has yet to re-achieve its pre-COVID high water mark (in 2019); home entertainment falls every year.”

Other factors here include streaming subscription revenue rising due to growth in subs and price increases; and streaming advertising is also growing rapidly due to increase in viewership; the growth of CTV and FAST usage and growing agency and advertiser familiarity with these channels.

“Nevertheless, the amount that both consumers and advertisers spend on video has remained remarkably stable.”

Although it might not seem so bad that consumer and advertiser video spend have been stable, Shapiro calculates that that’s occurred even as both the amount consumers have to spend (Personal Consumer Expenditures/PCE) and aggregate advertising spend have both grown (largely due to inflation).

“The result is that direct consumer spend on video as a proportion of PCE and advertiser spend on video as a proportion of total advertising spending have both declined in recent years.”

One relatively obvious observation is that distributing video is not a great business. Comcast and Charter, for instance, report video gross margins in the mid-high 30% range, but after allocating other operating expenses to video, Shapiro estimates that operating margins fall in the mid-single digits.

“It’s well understood that the big media companies spend a lot of money on content, but this analysis puts it in context,” the analyst writes. “For each dollar that comes in, half goes toward producing and licensing content — money that is spent on talent, physical production, special effects, content licensing and sports rights.”

When it comes to sports rights, Shapiro finds that budgets will increasingly move from entertainment programming to acquiring sports rights. As of last year, for every dollar of revenue, $0.77 was remitted to them by distributors and, of that, almost two-thirds went to programming — $0.40 to entertainment programming and $0.10 to sports rights (which translates to roughly $90 billion versus $24 billion).

He thinks that share will rise for a number of reasons. One is that sports programming is “dramatically outperforming entertainment in viewership.” Moreover, sports “commands a disproportionate and rising share of both advertising and affiliate fees.” In addition to which, the relative risk of producing entertainment content is rising while sports tend to be far more stable in their popularity.

There’s another reason, too, related to the role that generative AI will have in producing entertainment in a way that can’t be replicated in live sports.

“I believe that over time GenAI will blur the quality distinction between professionally-produced and independent/creator content and vastly increase the supply of entertainment content,” Shapiro says. “In an environment of abundant quality entertainment content, live events, like sports, will become relatively scarcer and therefore rise in value.”

Why subscribe to The Angle?

Exclusive Insights: Get editorial roundups of the cutting-edge content that matters most.

Behind-the-Scenes Access: Peek behind the curtain with in-depth Q&As featuring industry experts and thought leaders.

Unparalleled Access: NAB Amplify is your digital hub for technology, trends, and insights unavailable anywhere else.

Join a community of professionals who are as passionate about the future of film, television, and digital storytelling as you are. Subscribe to The Angle today!