TL;DR

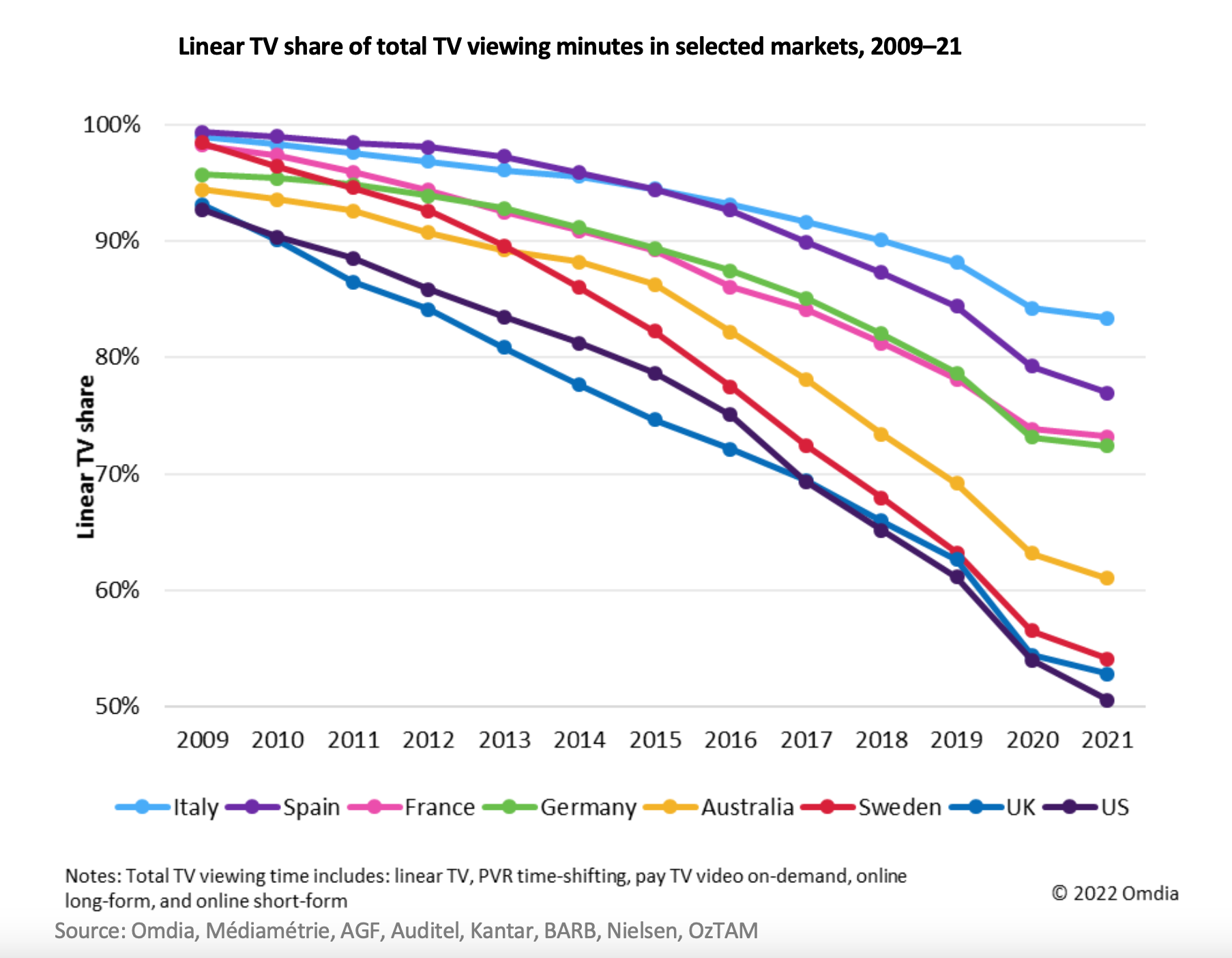

- While broadcast TV still supplies most viewing time, streaming is rapidly eating into that viewership.

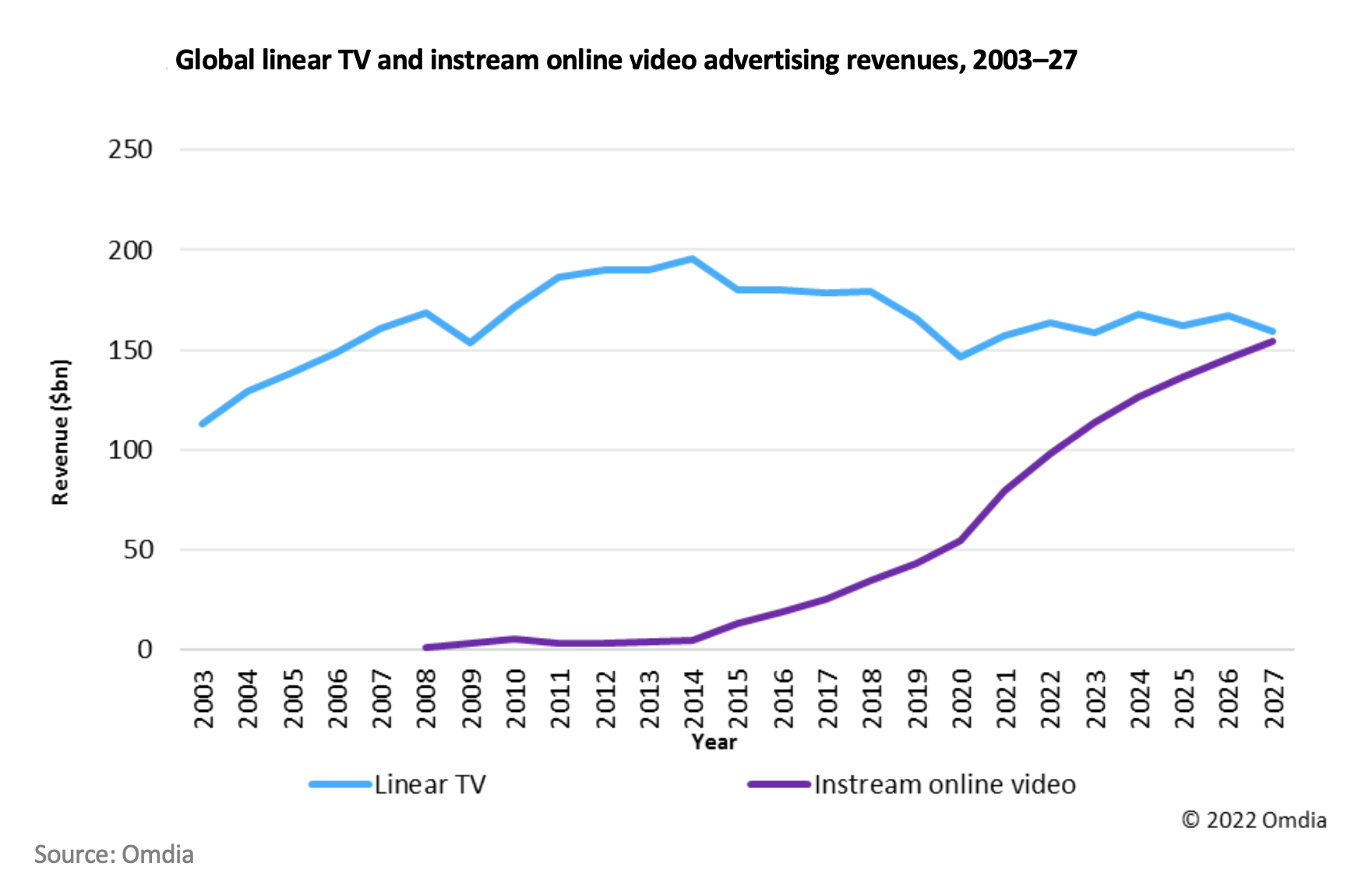

- Ad dollars are migrating toward streaming programmers, as Netflix and Disney+ roll out paid subscription tiers.

- Some broadcasters have responded to that challenge with their own streaming apps, but that may ultimately be insufficient.

As consumers adjusted to remote, internet-based work during the pandemic, many also changed their tune about the desirability of streaming services (and not just talking about the pre-2020 Big Three of Hulu, Netflix, and Amazon Prime).

Pandemic-era restrictions have been lifted, but streaming TV’s popularity hasn’t waned… actually, it is becoming the main source of TV entertainment — in paid and FAST versions — for viewers.

Until recently, OTA broadcasters have primarily jockeyed against their FAST brethren, whose content budgets more closely aligned with the more modest prime time shows cost. By virtue of their subscription cost, paid-tier streamers have traditionally been in a different lane, more equivalent to premium cable than linear TV.

However, Netflix and Disney+ have entered the ad-supported streaming game, offering their vast content libraries for a fraction of the commercial-free costs. What’s next — a Disney FAST service? The very idea is rattling some cages and prompting think pieces.

What’s Broadcast’s Future in a World With Ad-Supported Streamers?

International technology consultancy Omdia has released a short study, “It’s Time for Broadcasters to Think ‘Streaming-First,’” (free after registration) that offers some guidance, advice, food for thought on where the “TV” market is/or may be going.

Some broadcasters have responded to the streaming threat with apps for streaming their content but Omdia describes that performance as “middling.” Omdia also says that broadcasters aping the streamers’ with their own “full-fledged subscription services looks, at best, a minor revenue generator and, at worst, a costly dead-end.”

So what to do? Omdia pitches focus: “Broadcasters would be better off making their free-to-watch apps the first and best place to watch their most prized content.”

It rationalizes: “The reach of the U.S. streamers’ services will include only those willing to pay for ad-supported subscriptions — and exclude higher-value subscribers to ad-free plans that many advertisers will want to target. Fully free-to-watch services have the potential to reach a country’s entire online population.”

Some of the data presented has an apples-to-oranges feel to it; for one thing, it’s based on U.K. audiences and internet users, so factor that in.

But some human behavior is universal. American streaming content delivery powerhouses, like Netflix, Amazon and Disney+, are doing well in international markets, including the United Kingdom. And U.S.-based broadcasters aren’t the only ones looking over their shoulders at the streaming leviathans.

The Omdia study also notes the current international wave of economic unease could play a key role in decisionmaking. Many consumers aren’t old enough to remember the “inflation” years of the late 1970s–early 1980s. Advertising spending could be affected by consumer and business retrenchment. Add to that the increase in online ad spending — Omdia expects online to pass linear TV ad revenues as soon as 2028 — there are only so many ad dollars to go around to feed an increase in the number of ad-hungry mouths.

Omdia concludes: “As with all things TV, the urgency will vary by market, particularly where linear remains strong. Broadcasters that get the timing right have the chance to catch a rising tide caused by the U.S. streamers, while those that overly delay may become adrift as viewers’ and advertisers’ preferences change.”

Of course, for broadcasters it may not be an either/or dilemma. ABC is part of the Disney enterprise; CBS is a cousin to streamer Paramount; and NBC is part of, well, NBCUniversal, another streamer. Each of these broadcasting entities used to lead a corporate powerhouse, now they are each part of a multimedia content-producing hydra.

The question everyone avoids is: What will happen to the “over-the-air” broadcast portion of broadcasting. Grist for another mill.

Will OTA vs. Streaming Be the Final Face Off?

As much as streaming seems to upend the TV viewing ecosystem, it might, in the long run, be only a minor change akin to moving from black and white TV to color. Obviously, in the short term, this is critical. But how long will this model of viewers (AKA ad eyeballs) passively watching a TV/panel remain a paying business model? A growing broadband world contains the seeds to bring it all down. How will current broadcasters and advertisers react to challenges approaching?

Already difficult-to-analyze media, such as YouTube and TikTok, garner millions/billions of viewers who spend countless hours watching online video rather than traditional television. And advertisers spend millions/billions of dollars there, sometimes in lieu of OTA ad spending.

Also consider a brand-new phenomenon: Kids who have their own media device(s) and devote huge amounts of time to it, no matter where they are or what they are doing (even watching traditional TV). They are looking at the little screen — Twitter, Instagram, the ADD-feeding TikTok — and any new shiny object arriving designed to keep them married to it. That’s time away from the big (ad-revenue producing) screen. And these are the kids many advertisers are aiming to capture and have spent billions in TV ad time over the decades devoted to that goal.

They are young and are growing up in that world, increasingly away from the current broadcast/streaming TV utopia of predictable programming time and safe, somewhat reliable audience measurement. They might be an in-between generation preceding the ones that will only know computer-oriented programming coming from multiple sources, including games. The current program “formats” mean little to them and only exist as one of many options.

Experience in a 4K/8K world, possibly spiced up with interactivity, is something hard to imagine today but will be liberating and chaotic to content creators in the near-ish future.

This macrothreat might be closer than realized. Technology is changing at a faster and faster pace while “generations,” each seeking their own identities, are getting shorter and shorter. The cycles turn faster.

Industry analyst Brett Sappington, who leads the video and entertainment research practice at global insights firm Interpret, chats about the evolution of streaming and its impact on the pay-TV model on the Light Reading podcast with senior editor Jeff Baumgartner.

“Before you would ever get to a subscriber floor, I think [the pay-TV industry] fundamentally has to change… to make the economics work,” Sappington comments. “We’re really looking at a pretty significant shift in how pay-TV works in the next few years just to make the economics work out.”

Listen to the full conversation in the audio player below: