TL;DR

- Deloitte’s latest Digital Media Trends survey says “subscription fatigue” among consumers is getting worse, making it even more challenging for SVOD streamers to retain customers.

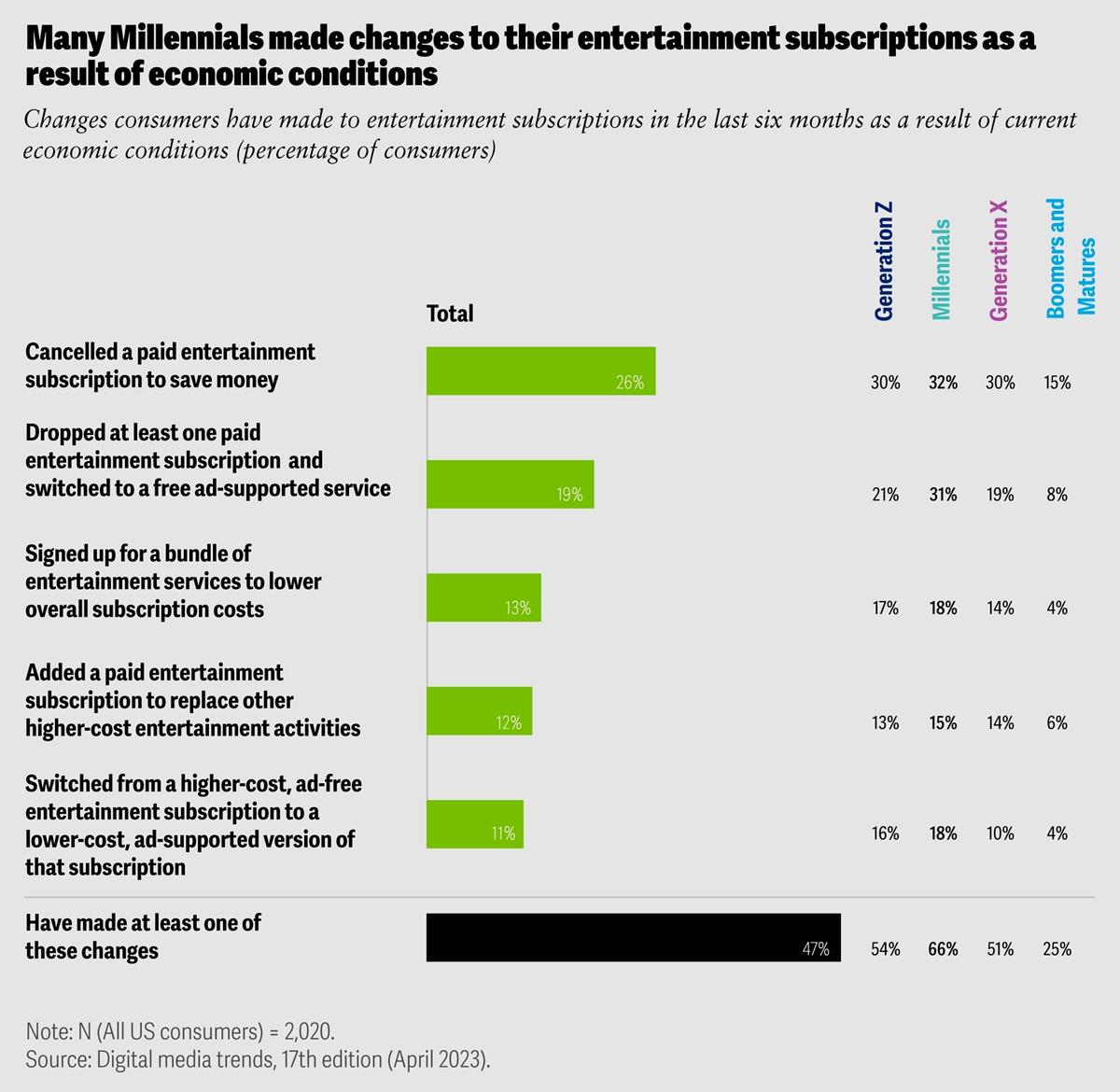

- Millennials are the most likely to have made changes to digital media subscriptions due to economic pressures.

- Americans spend $48 per month on video streaming services — and half of those surveyed say that’s too much.

READ MORE: 2023 Digital Media Trends (Deloitte)

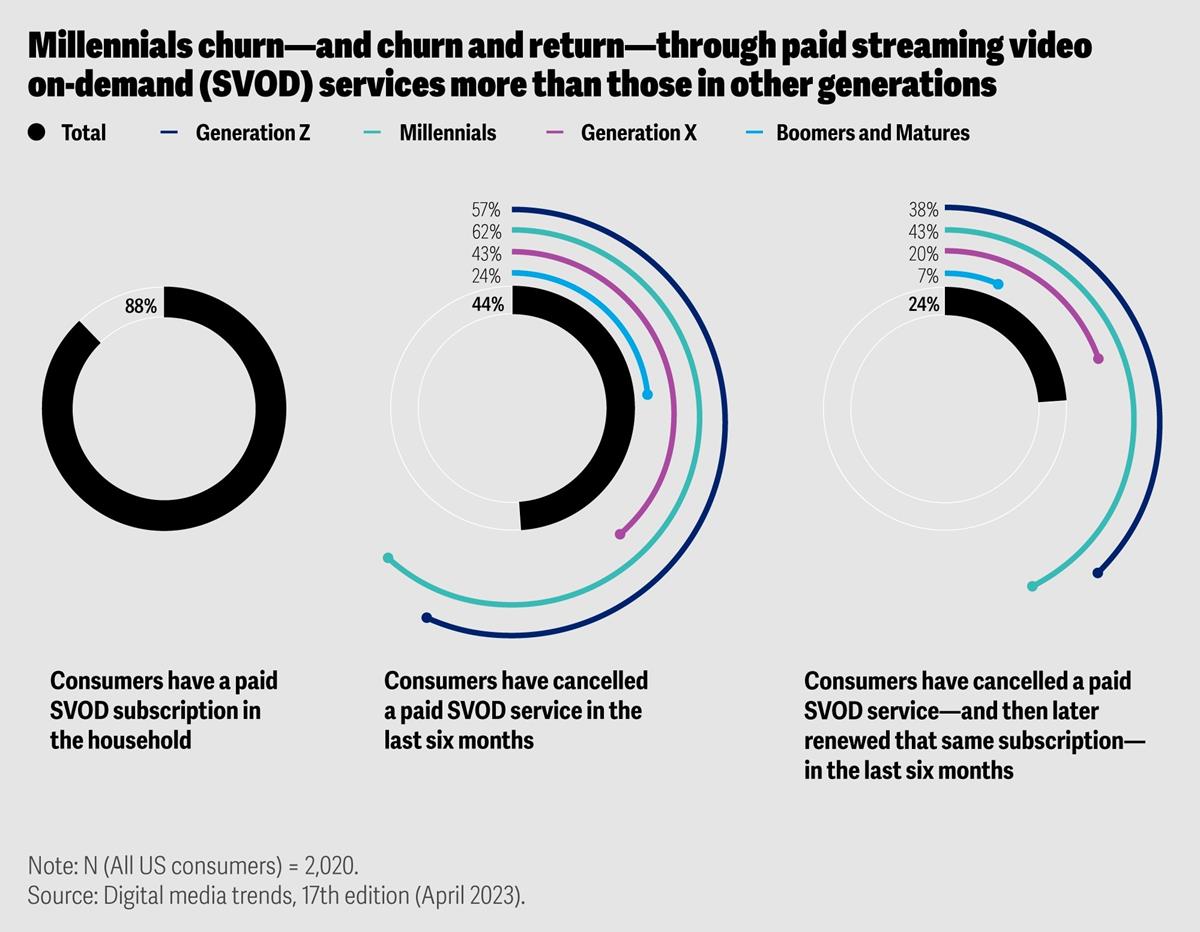

As streaming video competition continues to intensify, subscription growth rates across the industry have slowed — and churn rates have increased, according to Deloitte’s 17th annual Digital Media Trends report.

On average, US consumers pay $48 per month for SVODs, Deloitte’s survey found. About half of those surveyed agreed that they “pay too much” for SVOD services, while about one-third said they intend to reduce their number of entertainment subscriptions.

Around half of consumers (47%) surveyed said they have made at least one change to their entertainment subscriptions because of their current financial situation, such as canceling a paid service to save money, switching to a free ad-supported version of a service or bundling services together.

Millennials are the most likely to have made changes to digital media subscriptions due to economic pressures. Indeed, millennials spend more than any other generation on paid streaming video services — an average of $54 per month. Nearly 45% of millennials have “churned and returned” with a paid SVOD service, cancelling a paid subscription only to renew that same subscription within six months, according to Deloitte’s study.

READ MORE: Americans Spend $48 per Month on Video Streaming Services — and Half of Those Surveyed Say That’s Too Much (Variety)

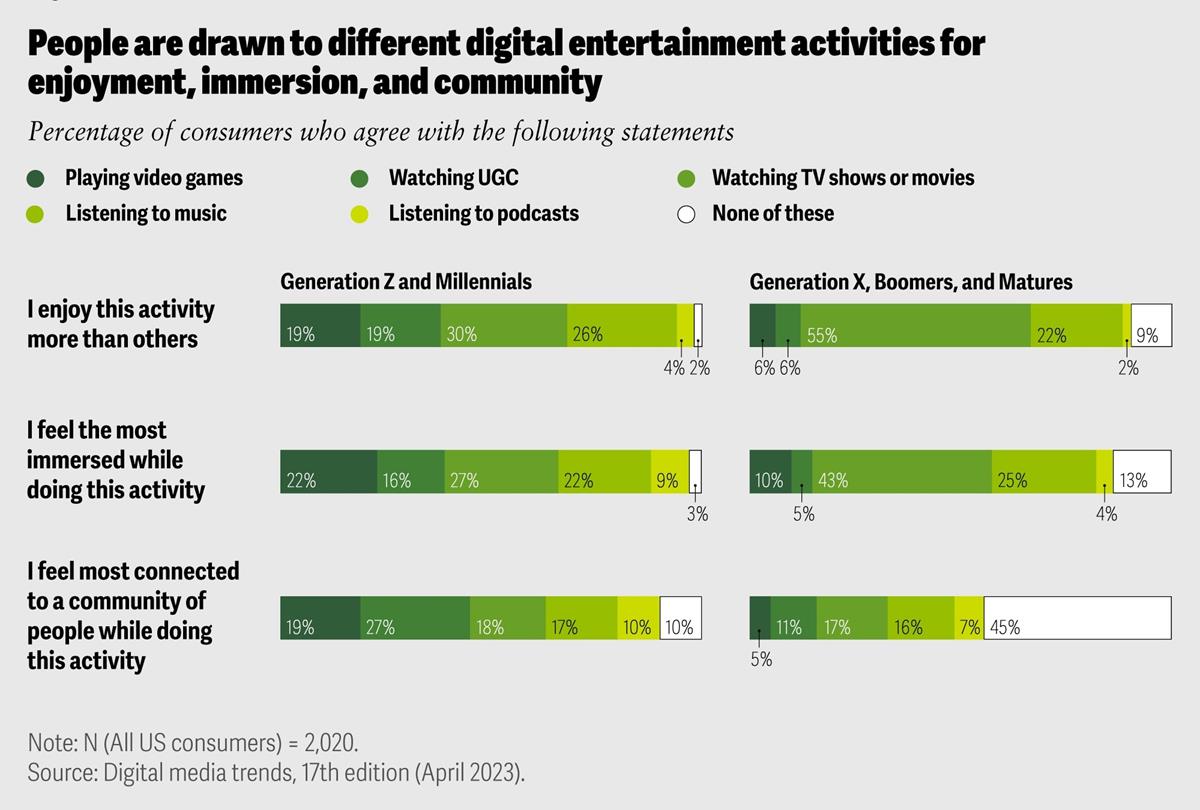

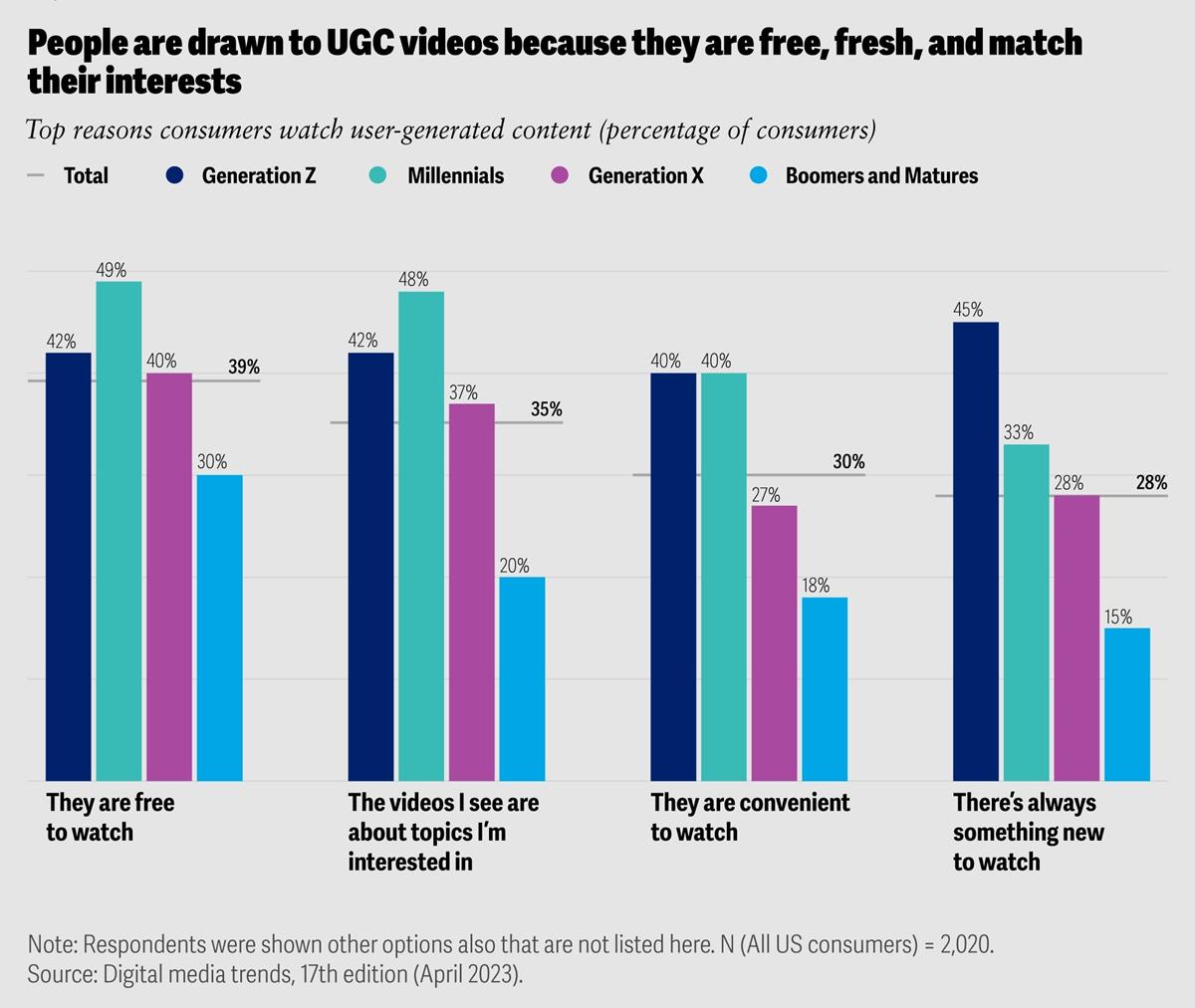

The report said that watching TV shows and movies at home is no longer the dominant, “go-to” activity it once was — especially with younger generations that are more evenly dividing their entertainment time across TV shows and movies, user-generated content (UGC) on social media services, and video games. They seek entertainment, connection, immersion and utility.

Deloitte describes millennials using media via a personalized tapestry of immersive, social and vibrant experiences. SVODs, therefore, need to adopt and accelerate new strategies to reduce churn that accounts for this change in consumer behavior.

Kevin Westcott, a vice chair who leads the US Technology, Media & Telecommunications practice at Deloitte, said, “The race to continue to add customers by commissioning and acquiring really high-cost content will not succeed on its own.”

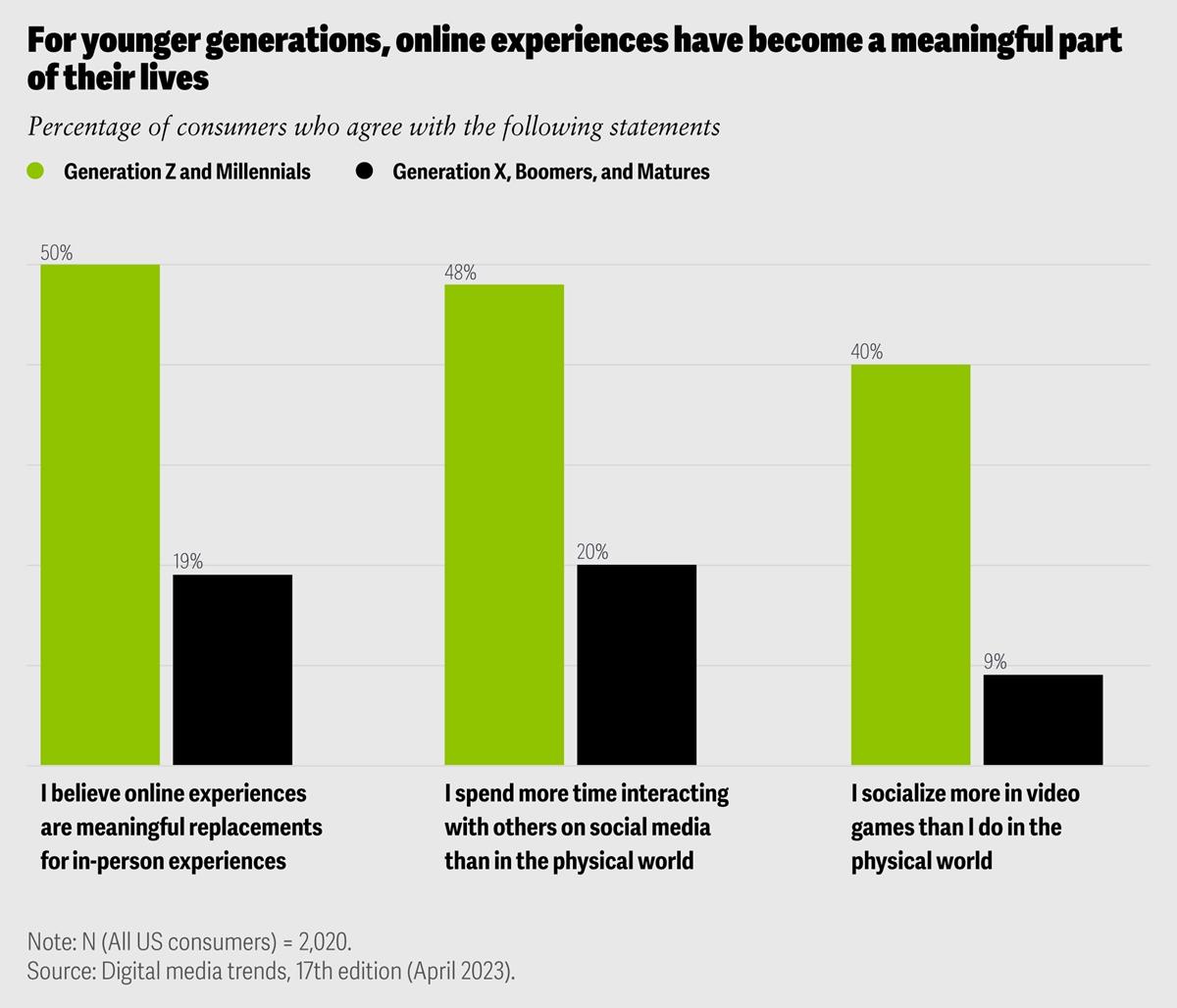

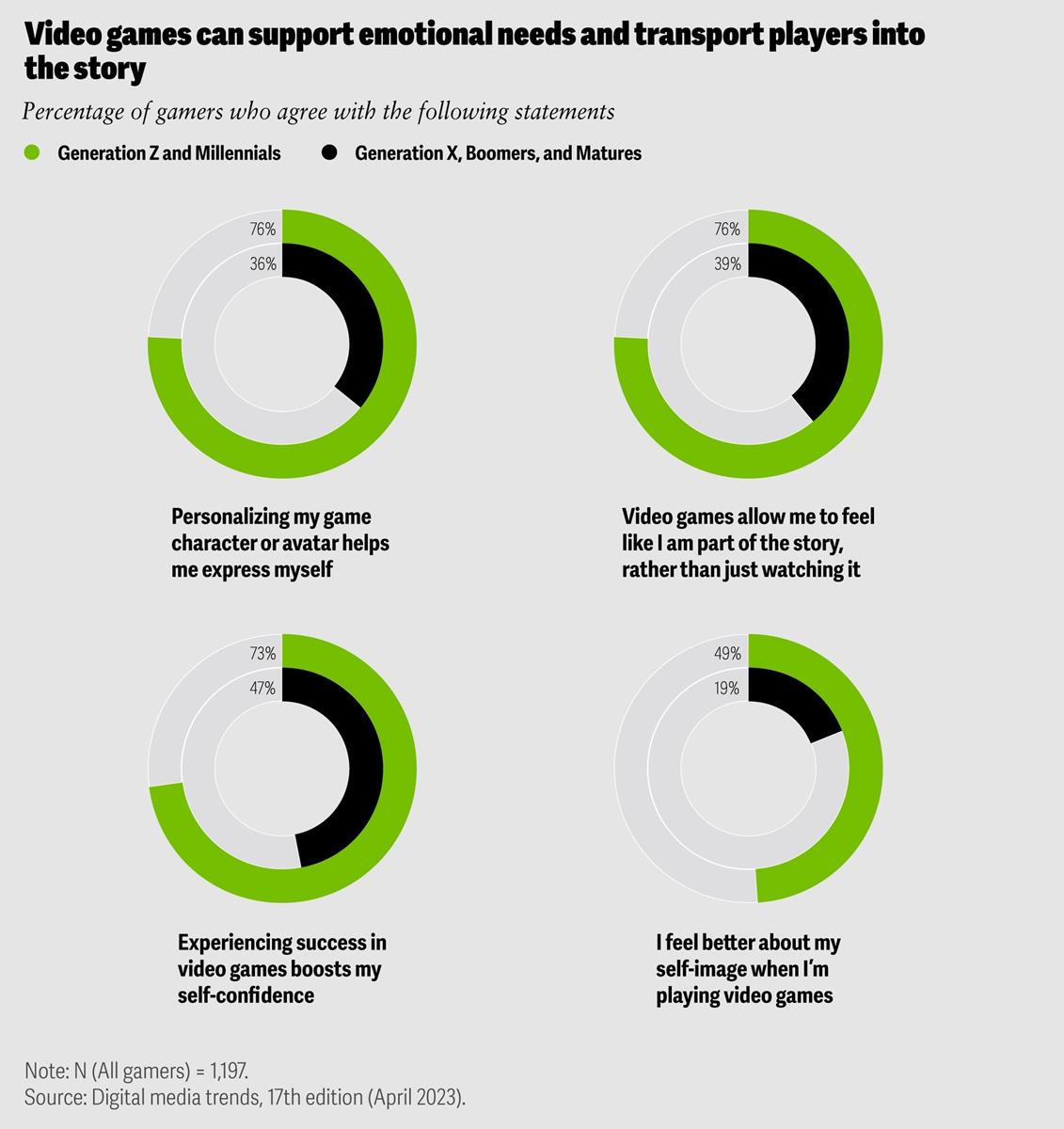

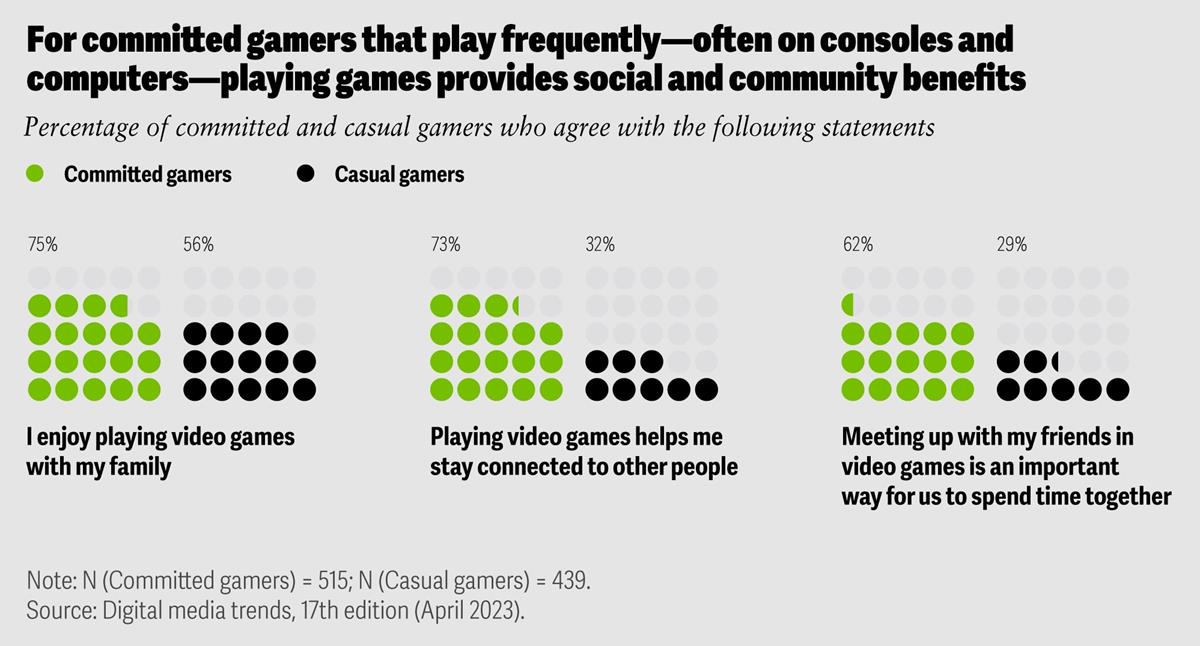

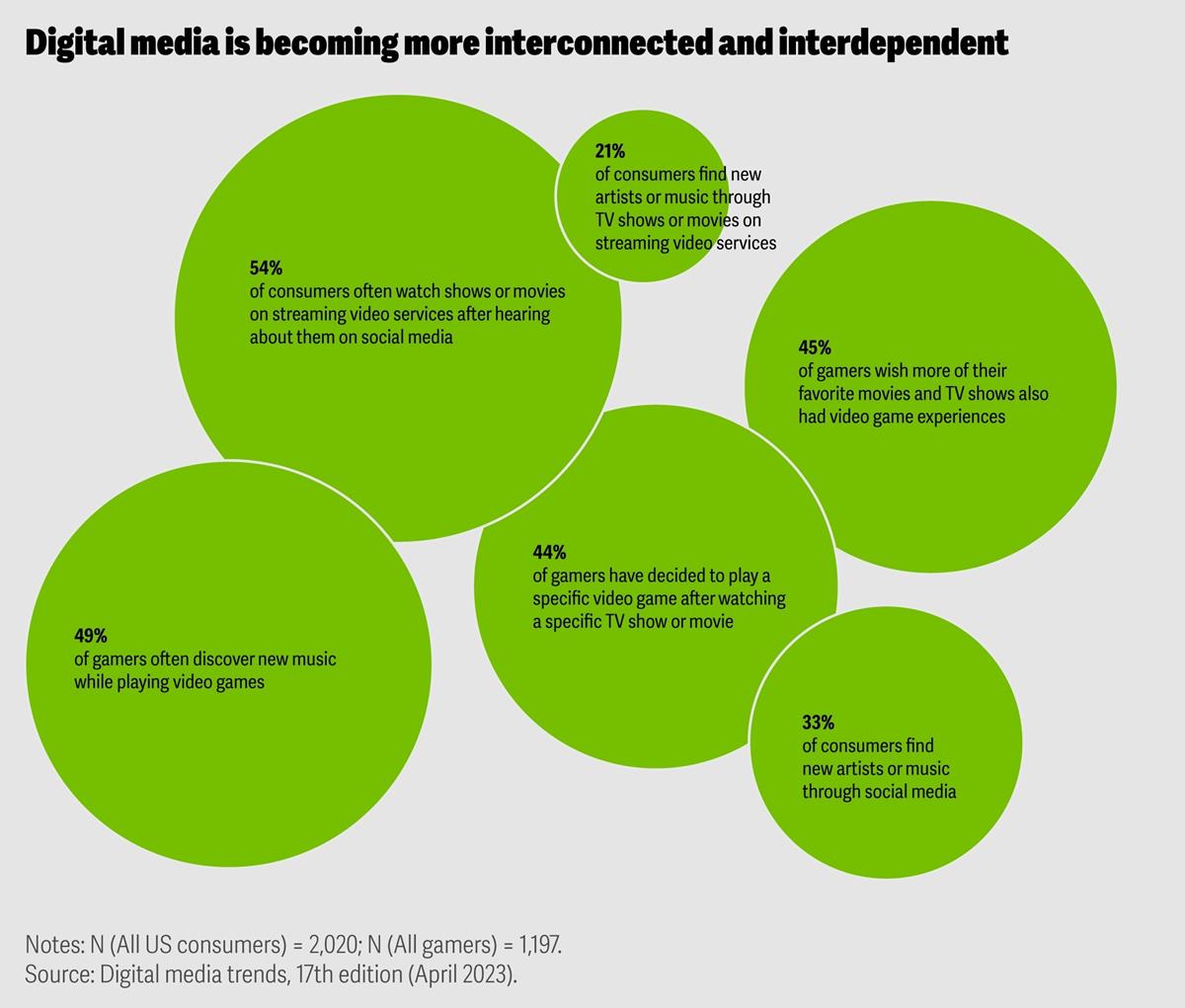

The influence of video games is illuminating. More than half of younger gamers decide to play a specific video game after watching a certain TV show or movie. About 45% of gamers said they want to play games based on their favorite movies and TV shows. More than a third of gamers say they feel better about their self-image when they’re playing video games. In addition, Deloitte said, almost half of Gen Z and millennial gamers say they socialize more in video games than in the physical world. A majority of Gen Z and millennial gamers wish more of their favorite movies and TV shows also had video game experiences.

The report said 32% of people surveyed in the US consider online experiences to be meaningful replacements for in-person experiences. For Gen Zs and Millennials, it’s 50%.

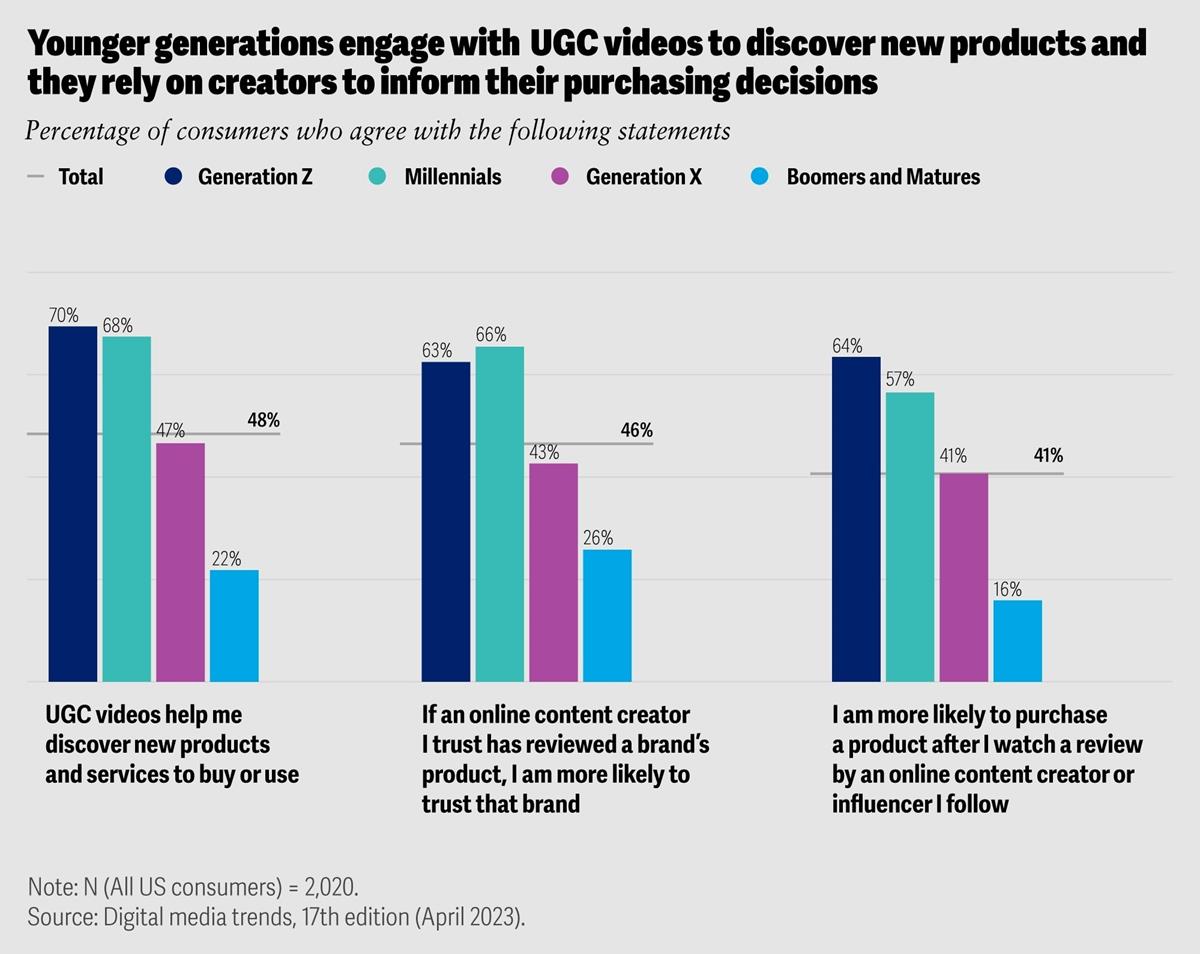

Half of consumers say UGC videos help them to discover new products or services to buy, and around 40% of consumers say they are more likely to purchase a product after they watch a creator they follow review it.

Westcott said SVOD services should invest in diversifying the content on their platforms, including considering incorporating user-generated short-form video, music and games.

“Streamers are under pressure to reinforce their core offerings, but they should also be leveraging gaming and social media, especially considering the behaviors we are seeing in younger generations. To stay competitive, SVOD providers should seriously consider how to engage broader audiences, play across diverse media properties that add value, and advance their ad platforms to better support advertisers.”

Next, Watch This

Watch the NAB Show session, “Immersive Storytelling: Expanding Audiences with XR in Games, Education, and Location-Based Entertainment” that examines the growing convergence between traditional entertainment and advanced technology and what’s next on the horizon for virtual reality (VR), augmented reality (AR) and extended reality (XR).