READ MORE: Digital media trends — Navigating the future of media and entertainment (Deloitte)

Subscriber churn is systemic and won’t be beaten by tinkering at the edges of streamer business models.

That’s the stark warning to Apple TV+, Peacock, Britbox, Netflix, Hulu, HBO+ and others, according to Deloitte’s 2022 Digital Media Trends survey.

“Media and entertainment executives — and especially those in SVOD — should be thinking hard about how people socialize around entertainment and how entertainment itself is becoming more personalized, interactive, and immersive,” the report states. “The business models that have brought them this far, and even the technologies they have relied on, may not carry them through the next wave of change.”

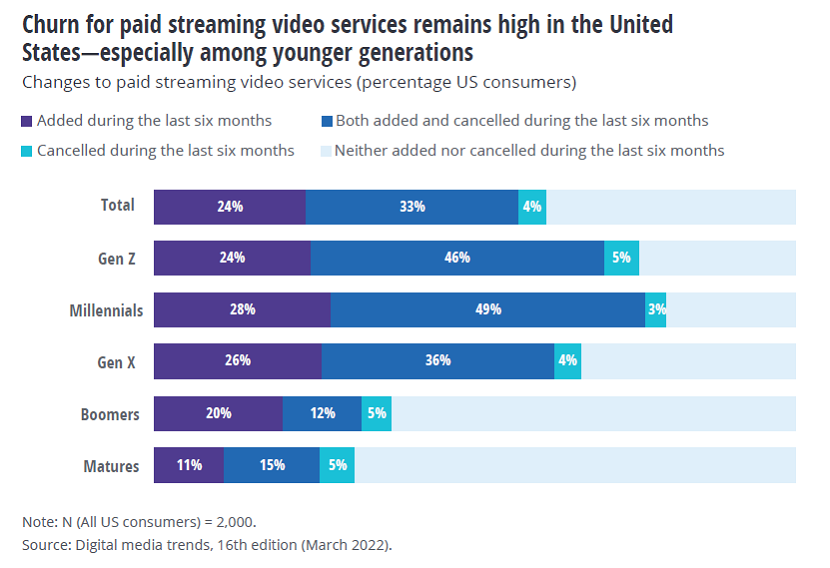

Deloitte’s report found the churn rate for streaming services in the US is at 37%, with countries like the UK, Germany and Japan seeing about a 30% churn rate.

Perhaps more worrying for streamers is that there is a clear delineation by age, with more than half of millennial and Gen Z respondents saying they added, cancelled, or added and cancelled a streaming service in the past six months.

Around a quarter of people across the countries surveyed admit they routinely cancel and resubscribe to manage costs. In every country surveyed, consumers — particularly Gen Zs and Millennials — are getting savvier about determining how much money they will spend on what content.

“I think there are two driving factors behind it,” Jana Arbanas, vice chair of Deloitte LLP and US telecom, media and entertainment sector leader, told The Hollywood Reporter. “First, they are comfortable with it, they are digital natives. Signing up for and accessing something and then cancelling and reupping it is not daunting to them in the way that it is to some generations that are not digitally native. The second part of that is cost, they are more cost-conscious in that generation.”

READ MORE: Streaming Subscriber Churn “Is Here to Stay,” Deloitte Survey Forecasts (The Hollywood Reporter)

So-called “churn and return” is not a new phenomenon, with consumers increasingly getting comfortable (“savvy”) with subscribing to a service for a particular show, knowing that they can easily cancel and return in a few months when something else they want to watch becomes available.

Streamers can counter that with a few initiatives. Content is the main one, but that is highly expensive if the aim is to retain subscribers with regular — almost weekly — drops of originals.

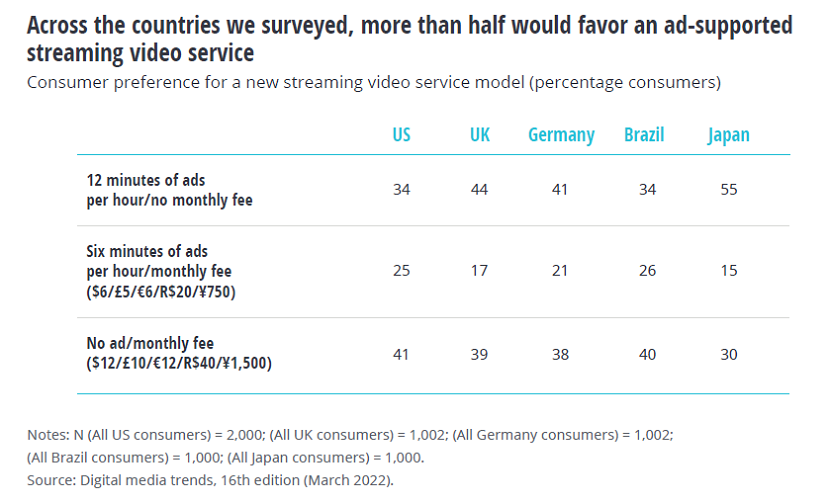

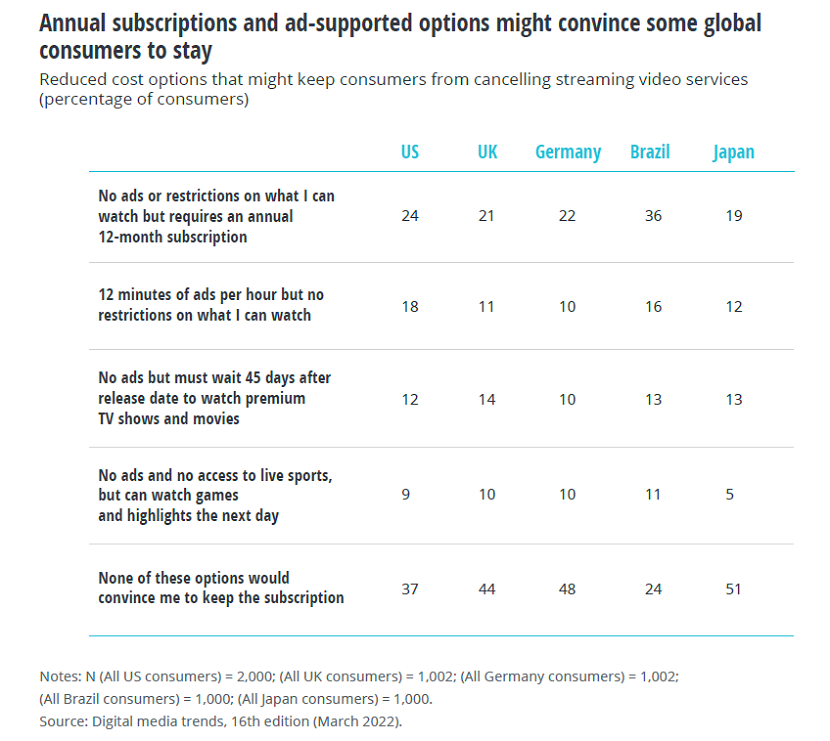

Offering flexible pricing options could be the most direct path, appealing to the cost-conscious audience. Deloitte’s survey found that more than half of consumers would like an ad-supported offering, 34% of respondents preferred a free ad-supported service and many respondents thinking of cancelling a paid SVOD would likely keep their subscriptions if they could get a discount.

“Even when there are lulls in engaging content, subscribers may not cancel their subscription if the cost is low enough.”

Worth noting also that a solid 41% of those in US say they’d actually be happy to pay more to view a service without ads.

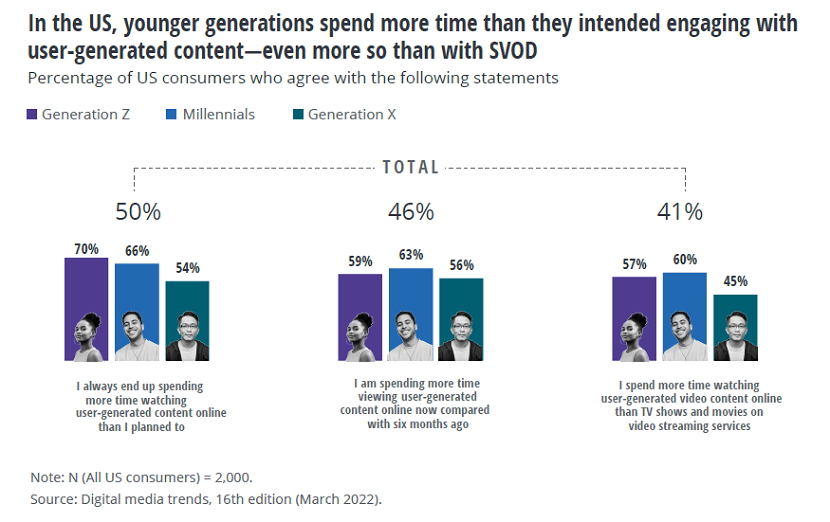

But the problem is greater than any tweaks of the business model can remedy. SVOD itself may be facing an existential crisis in the evolving preferences of younger generations who have grown up with social and interactive media.

Deloitte even has cause to question the very essence of the content streamers provide.

“Like TV and movies before them, SVODs have relied on the innate emotional and intellectual value of their stories to engage audiences and monetize their attention. But will people always value this kind of passive, lean-back-and-watch experience?”

Back to the stats: Watching TV and movies at home is the favorite activity of older generations. Across all five countries surveyed, Gen Z respondents cited playing video games as their favorite entertainment activity.

Social media and gaming further challenge retention for SVOD services.

“Every time a streaming show ends, a recommendation fails to engage, when subscription costs mount, or even when attention strays — these are moments when people may turn to social media and gaming.”

The Impact of Social Media

As Deloitte points out, social media provides both passive and active experiences and offer up “near-infinite streams of personalized content — all lit with swarming behaviors around trending content. And it’s all free and available anywhere, anytime.”

In contrast to SVOD services, social media is full of content that is bite-sized, snackable, and highly personalized. In the US, 80% of social media users say they use social media services daily and 59% use these services several times a day. Across all countries, Gen Z, Millennial, and Gen X consumers are consistently more likely to use these services.

Another differentiator from SVOD: social media is largely free. And the library of content is massive and seemingly never-ending. Users are listening to music, reading and watching news, watching TV shows and movies, and playing games, all in one place. Their newsfeeds are personalized by algorithms that serve up exactly what they want. No chasing content, and no subscription needed.

“With hundreds of millions — even billions — of users, social media services and the brands they support can capitalize on fast-moving trends. So, while the audience for SVOD is larger than ever, experiences that are social, interactive, and shoppable are competing for more of our time, attention, and money.”

The Impact of Gaming

It is the social nature of games which are considered to be most appealing to younger generations and something that SVODs needs to replicate, somehow.

Deloitte advises streaming video providers to note that about half of all gamers regardless of country say that playing video games has taken time away from other entertainment activities; these percentages increase for younger gamers.

“People play with friends, against strangers, and in front of audiences on social streaming services, reinforcing engagement,” the consultancy stresses. “Gaming allows people to become part of the story, gives them autonomy and a chance to win, enables them to share rich experiences, and it can support their emotional needs.”

About half of US gamer respondents say that playing video games helps them stay connected to other people, and a similar share say making connections is important to them while gaming — sentiments that emerge at a higher level for men.

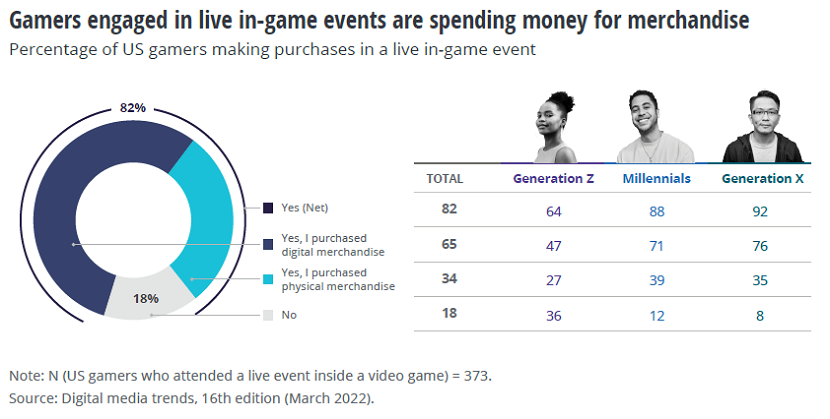

Game companies are capitalizing on this with freemium mobile games and gaming subscriptions, in-game purchases of new content, and an economy of virtual goods that has drawn in more brands and franchises. It is entry-level metaverse, and that spells even more trouble for SVODs that can’t respond.

“A major shift is underway, one that could radically recompose internets and economies,” Deloitte underscores. “In the integrated marketplace of the future, streamers, social media, and gaming companies could see their business models further disrupted — not just by younger generations, but also by the emerging infrastructure of Web 3.0.

“For now, streaming video, social media, and gaming are all very successful without full immersion, tokenized economies, and universal interoperability. But the twin engines of capital and human behavior may be moving irrevocably toward that kind of unlimited reality.

“M&E may need to collaborate more to create a future where they remain at the center.”