TL;DR

- After an inflated pandemic-fueled surge in streaming consumption and content production, the M&E industry has contracted — but not as far as “bloodbath” headlines would lead you to suspect.

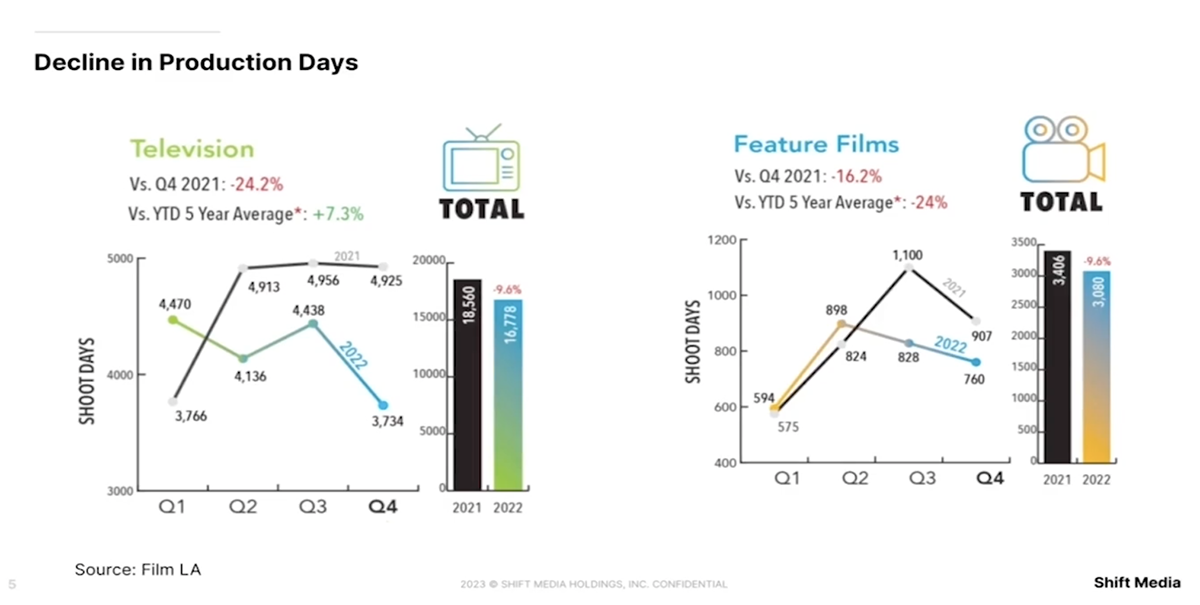

- While TV, film, commercials and video game production is down from 2021 highs, the five-year average is still up 7.3%, meaning that there’s still a lot of content being produced.

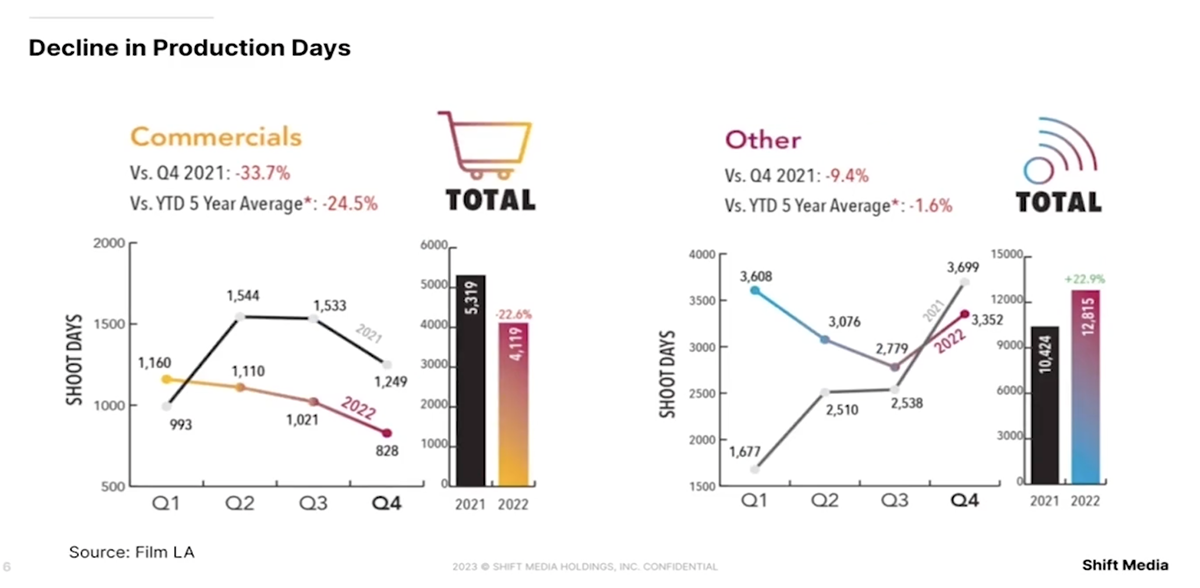

- Overall production in film, TV and commercials saw a decline of nearly a quarter in Q4 2022 compared to a year earlier, with TV seeing the biggest drop.

READ MORE: Increasing Cost Consciousness: An Industry Snapshot (MediaSilo)

WATCH THIS: Increasing Cost Consciousness: How to Maximize Efficiency While Decreasing Cost

The media and entertainment industry is being reconfigured into an economic model that more closely matches actual consumption and spend. With that in mind, the recent run of projects cancellations, staff cuts, and production spending curtailed should be seen as more temporary dip than long-term decline.

“While we don’t want to gloss over the sobering facts, it’s important to note that they’re not a death knell for the industry but rather another pressure point when considering how you’re deploying budget,” says Michael Kammes, senior director of innovation for MediaSilo.

The storage and collaborative workflow technology vendor has dissected and analyzed industry data and come up with a snapshot of spend that it says indicates increasing cost consciousness. Watch the full webinar here.

Overall production in film, TV and commercials saw a decline of nearly a quarter in Q4 2022 compared to a year earlier. TV saw the biggest drop of 24.2% year-on-year. The final quarter of 2022 saw a stark drop in production days of television to 3,733 from 4,925 in Q4 2021. Unscripted shows didn’t see the same drastic drop, but MediaSilo notes that this content is also cheaper to produce and therefore under less pressure when considering spend.

“The main takeaway is this is a regression to the mean. The back half of 2020 and all of 2021 and really the first quarter of 2022 was an anomaly and a great anomaly when it comes to the projects that we’re worked on, the money that was being spent.”

The company reports a drop of 16.2% in feature films (Q4 2021-Q4 2022), which is less of a drop, but notes that there are far fewer films than television shows produced overall. Commercial production saw the most significant drop of 33.7% in the same period.

Meanwhile the media industry saw nearly 4,000 jobs slashed in 2022.

Even the games industry is not immune to budget cuts. While downloaded and boxed PC games grew by 1.8%, the broader industry dropped 4.3% between 2021 and 2022.

“While this information does not illustrate a rosy picture, it’s important to note that 2021 was an anomaly,” says Kammes. “We see 2022 as a corrective year following the market’s two years of lockdown-fuelled growth, and while the numbers aren’t great, the projections and views in the industry are not as dire as we may think.”

The company cites recent multimillion dollar deals for content signed at Sundance by Netflix ($20 million for Fair Play) and by Apple ($25 million for Flora and Son).

“The main takeaway is that the changes we’re seeing are a regression to the mean,” says Kammes. “The industry is being reconfigured in a way that actually matches spend and consumption. But commerce is still happening, and global content expenditure is projected to increase by 2% over the next year.”