In the last year, Meta, Amazon, Alphabet and Microsoft have each grown by more than half-a-trillion dollars in terms of market capitalization and they’ve done so by shedding jobs and supercharging efficiency with AI, according to investment bankers Luma Partners.

In a new report, Luma also says Big Tech is poised to remove live sports from linear TV’s grasp and with it hasten linear’s decline.

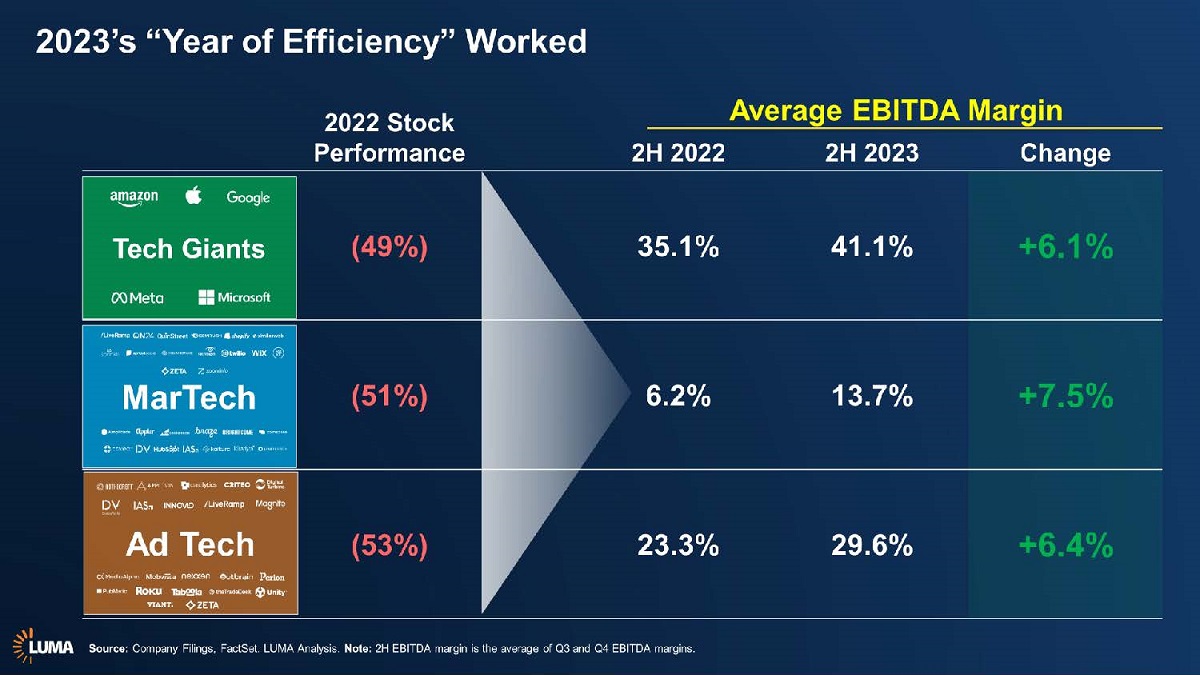

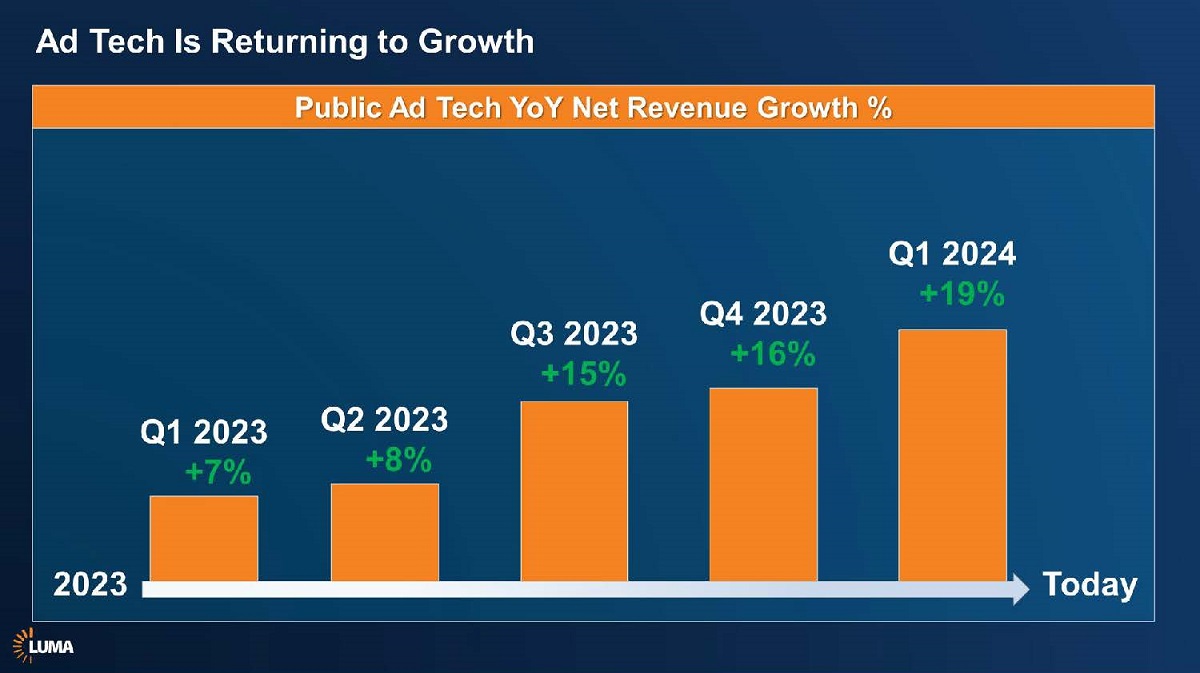

“Stock prices getting cut in half in 2022 was a wake-up call for companies to focus internally,” Luma Partners CEO Terence Kawaja said in a presentation of the company’s “State of Digital” report. “Whether big tech or independent Ad Tech and MarTech companies, everyone improved significantly across the board in the back half of 2023 versus the back half of 2022.”

Click here for a larger version of this graphic.

And they did it better than traditional media companies.

Big Tech and Ad Tech companies have righted their own ships by ruthlessly cutting jobs (Amazon slashed 16,000; Microsoft 15,000, Google 10,000 and Meta 20,000 jobs between January 2022 and March 2024), eliminating non-core programs, and most significantly rolling out AI products.

“In fact, when everyone else was talking about AI, Big Tech was going to market with AI products and achieving massive results with them.”

The deeper pockets of Big Tech are necessary in order to maintain an edge with AI, says Luma.

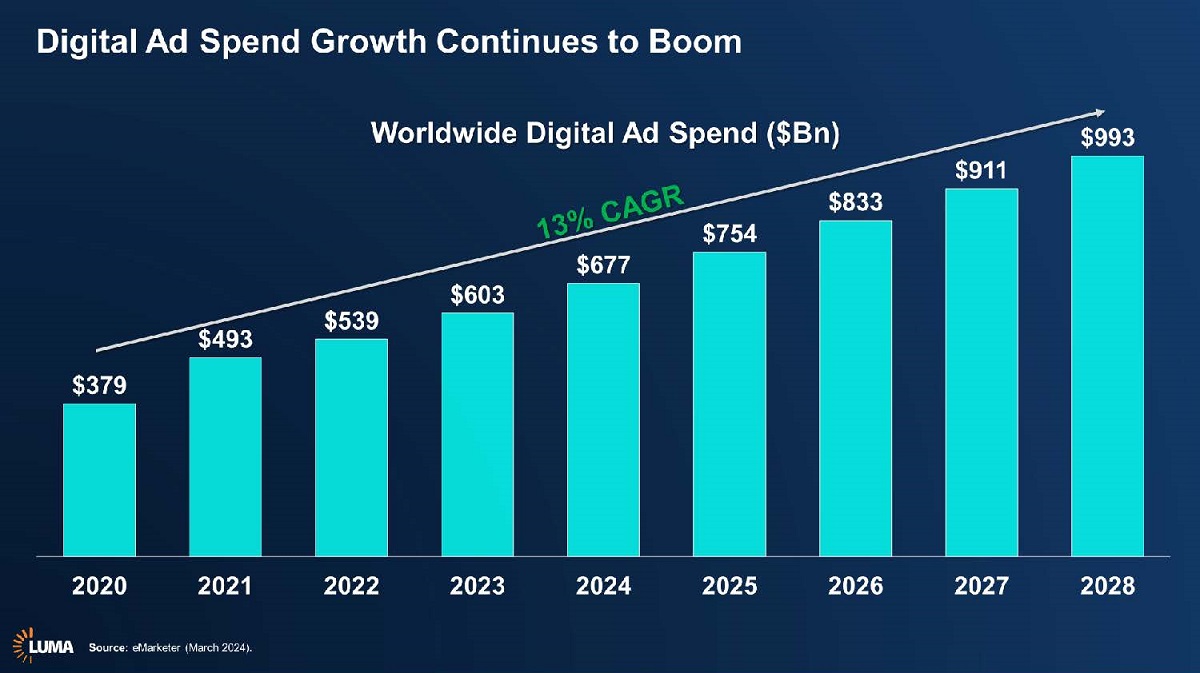

Google, Microsoft and Meta alone are expected to spend close to $400 billion on capital expenditures between 2023-2025. The majority of this is expected to be for infrastructure and development for AI initiatives.

Luma describes AI as “like a utility” and a “game for very, very large players,” advising that rival companies in media, for example, can’t cut their way to growth and sustained innovation.

“While the big tech players are using their balance sheets to fund AI developments, we believe M&A is going to be necessary component of strategy for others to reinvigorate growth going forward.”

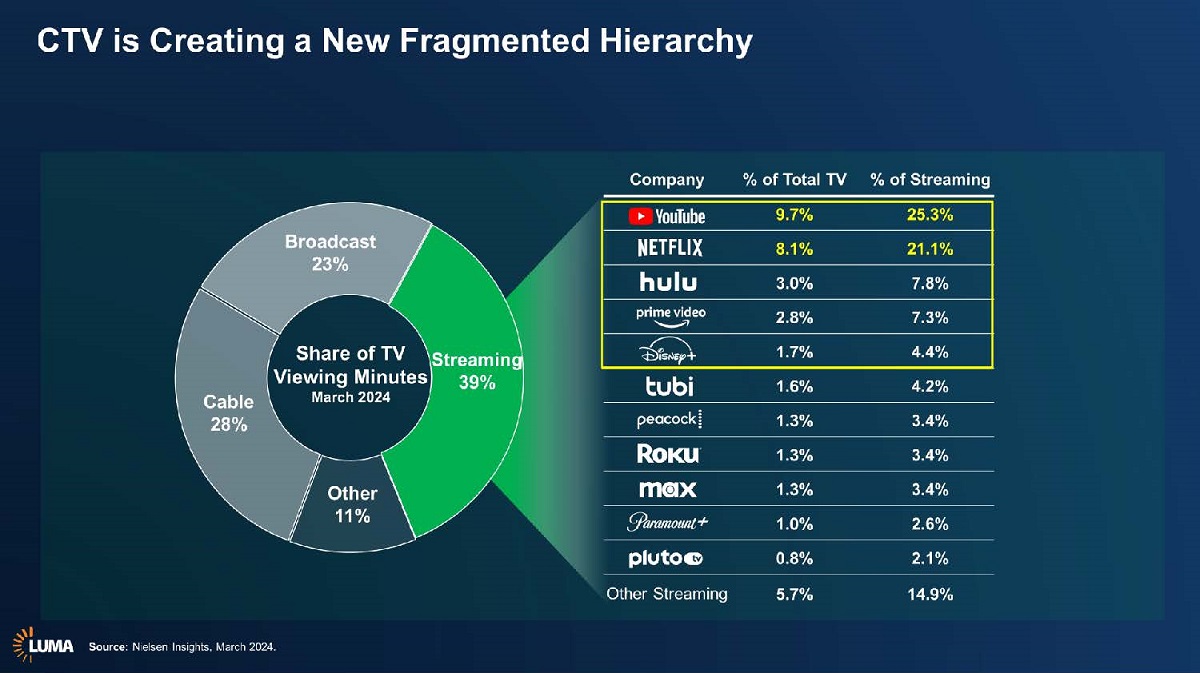

The banker also has its eye on Connected TV, noting that tech giants are all investing heavily in live sports — which it calls “the Achilles heel of linear TV.”

Big Tech will make its larger wallets evident in the bid to win live sports rights.

“It’s increasingly becoming a mismatched fight between tech and media companies. It’s inevitable that when these [sports] contracts get renewed, they’re going to go to big tech. That will be the instigator towards an inflected decline of linear.”

Ultimately, media companies need to successfully transition to streaming and Luma doesn’t think much of their efforts so far.

“Media companies were in the B2B business, and they are now forced through streaming to get into the direct-to-consumer business,” said Conor McKenna, Senior MD at the company. “They don’t really understand that business, and you can see it from the churn.”

Companies like Comcast, Warner Bros. Discovery and Disney “are having to reacquire their customers two, three, sometimes five times per year,” says McKenna. “There are lower ad loads and the loss of affiliate fees. How have they responded? By re-bundling, wholesaling and consolidation.”

CTV though carries an opportunity to reverse those fortunes. CTV, McKenna notes, brings digital attributes to the big screen “so that we can have all the kinds of capabilities around targeting, precision, and performance that we do in digital, applied to TV.”

Click here for a larger version of this graphic.

The other opportunity is to democratize TV spend. The cost of advertising on broadcast TV has historically excluded all but the largest brands.

“The real opportunity here is to go to the long tail of smaller and more performant advertisers,” he says.

“That will build a substantially better business model with more operating leverage just as tech companies have done with millions of small advertisers, and that we believe will bring a lot of health and vigor to CTV.”

This will come with new ad formats beyond the standard 15 and 30-second spots. Innovation around interactive, shoppable, pause screens, and even product placement with AI “is going to bring new blood to the CTV ecosystem.”

Luma points to the role that AI will have in ad-tech and advertising on CTV in particular, suggesting it will have a positive impact on creative ad forms.

“We believe we’re at an inflection point with AI that will see more focus on creative,” said Kawaja.

“Software that assists with data, workflow, and media optimizes for efficiency whereas for creative and content, it’s software that optimizes for effectiveness,” — and that will drive better outcomes.

Luma also believes that AI has the potential to reinvent search and even websites.

“Who needs to put data on a website that consumers never navigate to if large language models will find and provide the answer?”

READ MORE: State of Digital 2024 (Luma Partners)

Why subscribe to The Angle?

Exclusive Insights: Get editorial roundups of the cutting-edge content that matters most.

Behind-the-Scenes Access: Peek behind the curtain with in-depth Q&As featuring industry experts and thought leaders.

Unparalleled Access: NAB Amplify is your digital hub for technology, trends, and insights unavailable anywhere else.

Join a community of professionals who are as passionate about the future of film, television, and digital storytelling as you are. Subscribe to The Angle today!