TL;DR

- The creator economy isn’t dying — it’s just going through a cycle of consolidation.

- The coming year will be challenging for creators with brands cutting back on spending under more austere and uncertain conditions affecting founders across sectors.

- With the emergence of generative AI, creators can now truly be global with the use of technologies that can turn content into any language using the creator’s original voice.

LEARN MORE ABOUT THE CREATIVE ECONOMY: Creator Squared Sessions at NAB Show

READ MORE: The 2023 Creator Economy — a new direction (Antler)

Creators were widely touted as being best able to bear the brunt of economic downturn but they may have to take a longer-term view of their prospects, according to VC firm Antler.

Its latest annual report into the nascent creator economy finds the future uncertain, as platforms struggle to secure large investments and many of the long-tail creators fail to earn significant incomes. Despite these challenges, many people are still optimistic about becoming creators in the future. But Antler believes the industry is moving toward consolidation rather than rapid growth — for now.

“For the first time since its inception, the creator economy is facing a difficult phase,” says Antler’s Ollie Forsyth in a preface to the report. “Brands are reducing their marketing budgets, creator platforms are making a number of layoffs and shutting down, venture capital is becoming more cautious about investing in this area, and the number of platforms achieving unicorn status has plateaued.”

He adds, “Despite the headwinds, the number of people becoming creators is increasing — motivated by their quest for independence, flexibility, creative freedom, and uncapped earning potential.

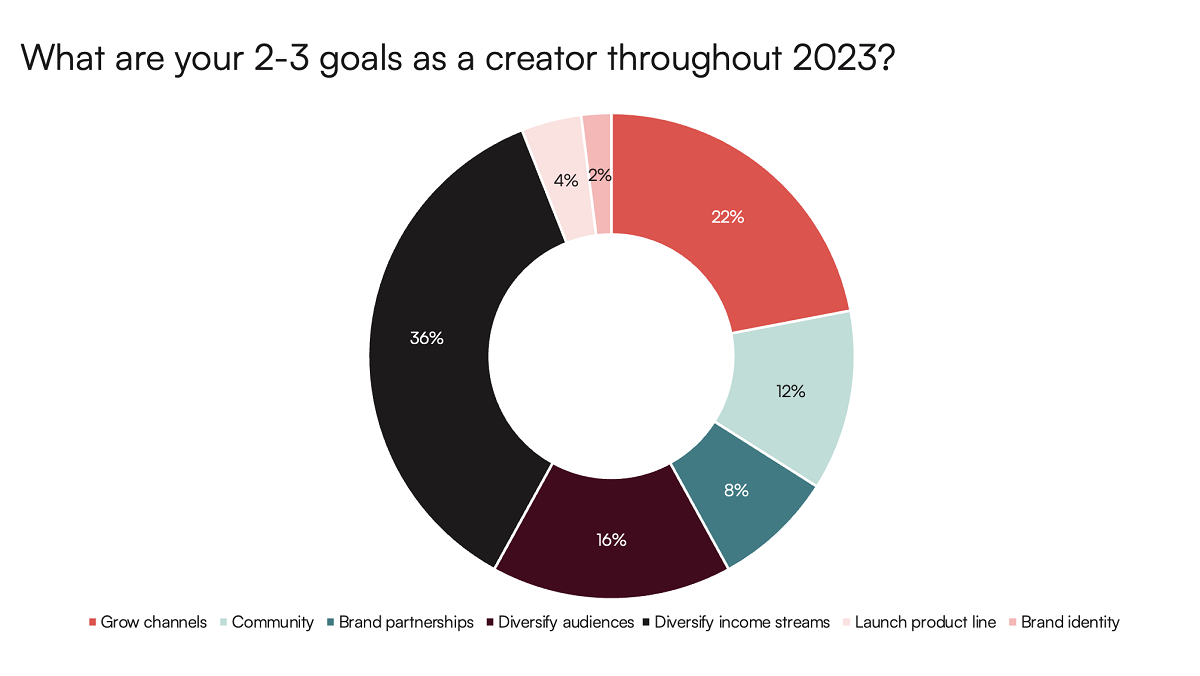

“We believe the new creator economy will weather this storm in the coming year through two priorities: community building enabling creators to build closer relationships with their fans and creators diversifying their income streams.”

After ramping upwards at a rate during the COVID-19 pandemic, the creator economy has stuttered this past year.

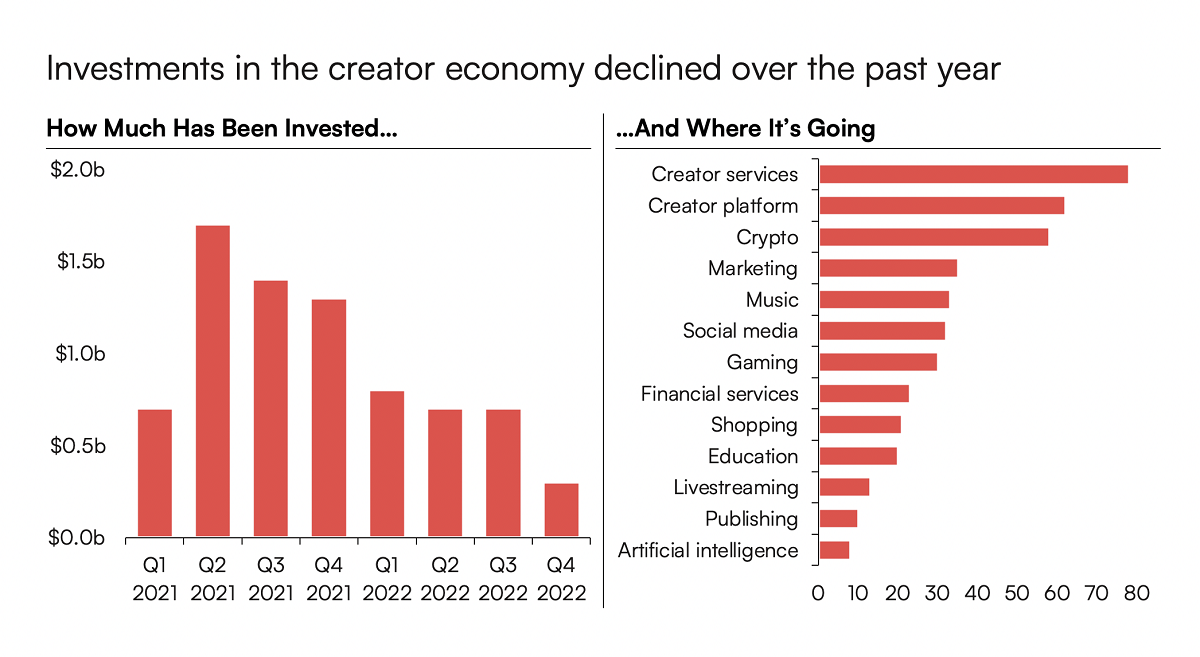

Per the report, investment in creator economy startups has dropped significantly, with only $180 million invested in Q4 2022 in the US, compared to the $500 million invested in the space in each quarter since Q1 2021.

Antler attributes the decline to factors including the threat of a recession, widespread layoffs, and startups raising at tempered valuations.

Platforms have also seen a substantial decrease in funding in Q4 2022, according to The Information’s Creator Economy Database.

The creator economy is not failing, Antler insists. “It is evolving and changing direction.

Indeed, creator economy market size remains undiminished at $100 billion, the VC firm calculates.

“Creators are still likely to play a significant role in shaping future economies and may even go on to create successful and well-known brands. It is possible that some creators will become unicorn founders — it’s just a matter of time.”

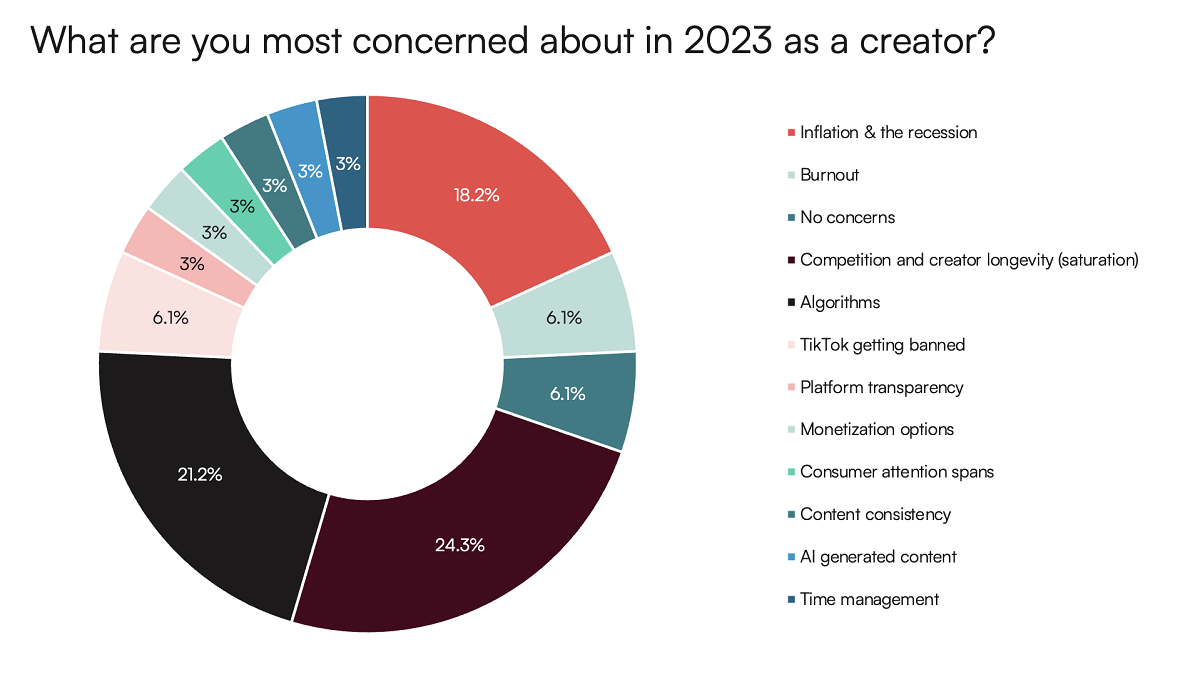

For that to happen it prepares creators to expect a reduction in income, “particularly those who depend on brand partnerships.”

Forsyth warns, “Burnout is a persistent problem for many creators, but many are becoming more aware of the economic conditions and are working to diversify their income sources and audience base.”

As a result, it expects to see platforms make more transparent and binding commitments to creators.

“This year we must see a rise in funding for platforms, which will be tough given the current fundraising environment; [we must see] platforms being more flexible on how they cater to creator needs such as upfront payments; more transparency around how platforms charge creators; and [we must see] the option for creators to own and have direct access to their fans.”

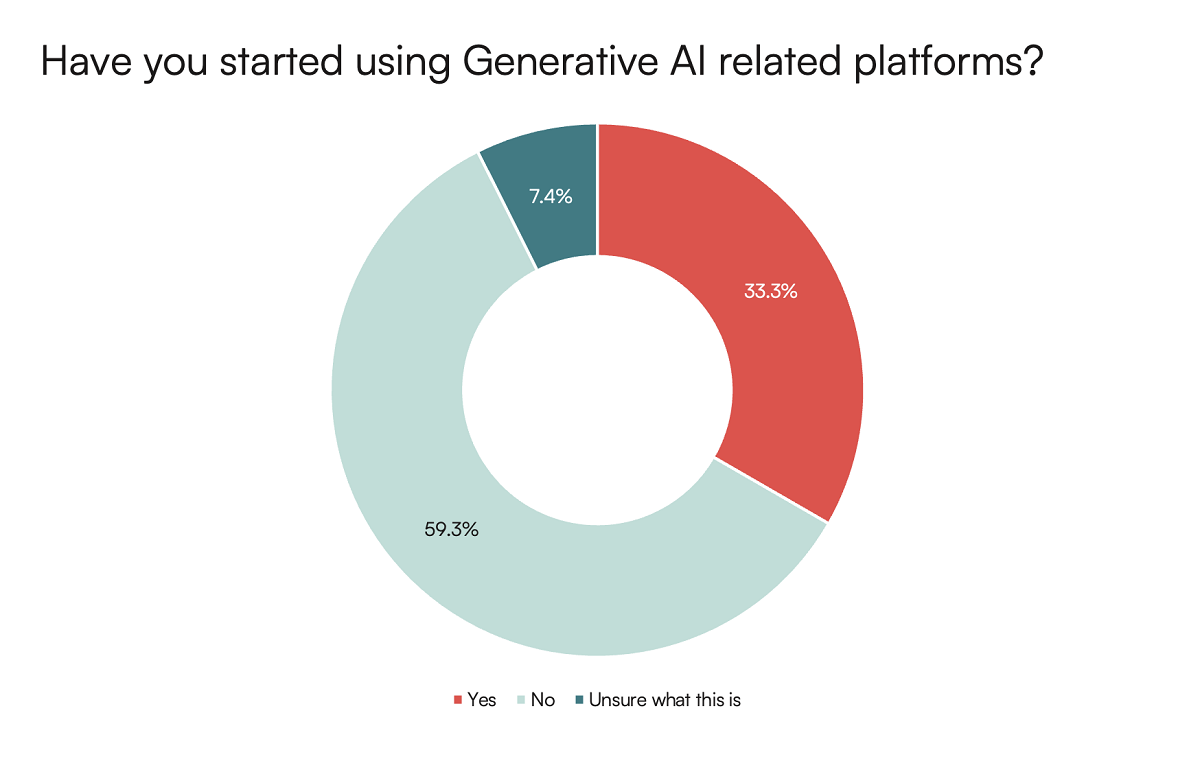

It also anticipates creators will take advantage of generative AI, for example to turn their content (text, video, or voice) into any language “while still being in the creator’s voice.”

While only 33% of the 30+ creators Antler surveyed for this report confirmed they have started using a generative AI product — and some said they were still unsure what it is — they expect its use to skyrocket this year.

“I think many of the creator platforms launched in the past few years with sky-high valuations may come to learn that the addressable market is much smaller than they originally believed,” Megan Lightcap, an investor at Slow Ventures, says in the report. “There are only so many full-time ‘professional’ creators who drive meaningful economic value for these platforms.”

“There is still very little transparency — creators don’t know how much they could be making, what platforms they should be using, how they should be defining their brand,” states Faraz Fatemi, investor at Lightspeed Ventures. “In addition, brand budgets have pulled back across the board, lowering the viability of a key creator monetization lever.”

Short-form video content platforms will most likely add e-commerce and shopping opportunities as an avenue for creators to earn additional incomes.

For example, YouTube Shorts now has 1.5 billion monthly active users contributing to 30 billion daily views.

“The opportunity is huge,” says Forsythe. “How these platforms monetize outside of advertising and e-commerce is yet to be seen; however, those are two huge revenue opportunities for platforms to be paying attention to.”

At the same time, creator Sandy Lin warns of the downsides of short-form content that creators need to be mindful of: “Today creators are realizing TikTok and short-form content is not the best way to create an engaging community, monetization isn’t consistent, and constantly creating short-form content is leading to more creator burnout than ever. Creators are reverting back to YouTube to create more engaging audiences. We are heading toward TikTok generation creators treating YouTube as their main platform.”