TL;DR

- The creative process for converged TV still largely originates with high-production 30- or 60-second ad concepts, even though the output is destined for personalization and a variety of platform-specific formats.

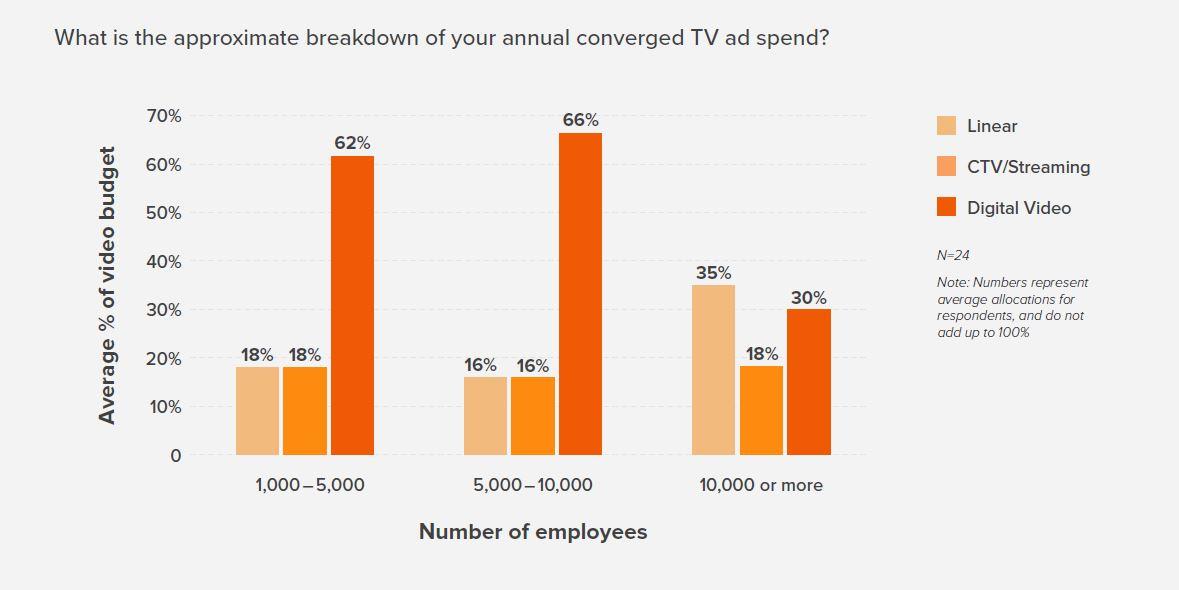

- A new report on the future of connected TV found that media plans now include at least two of the three elements of converged TV — linear, CTV/streaming, and digital video — to reach and engage with desired audiences.

- Advertisers need to think differently about how they buy, personalize, measure and optimize a much more diverse mix of video-based ads that reflects today’s viewers and their viewing habits.

READ MORE: The Future of Converged TV (Innovid)

Linear TV is converging with digital channels into converged or advanced TV at pace, but the advertising ecosystem isn’t keeping up.

Among other things, the traditionally dominant 30-60 second TV spot still takes up the most energy at creative agencies, and that may be to the detriment of the brand campaign as a whole.

Also, in a new report, “The Future of Converged TV,” published by Ascendant Network in partnership with Innovid, unified measurement is the goal, but it’s a work in progress.

The report reveals how marketing leaders have adapted advertising strategies for converged TV and how their mix has evolved across platforms.

It found that media plans now include at least two of the three elements of converged TV — linear, CTV/streaming, and digital video — to reach and engage with desired audiences.

However, linear remains an important part of the mix for advertisers seeking an efficient way to reach broad audiences.

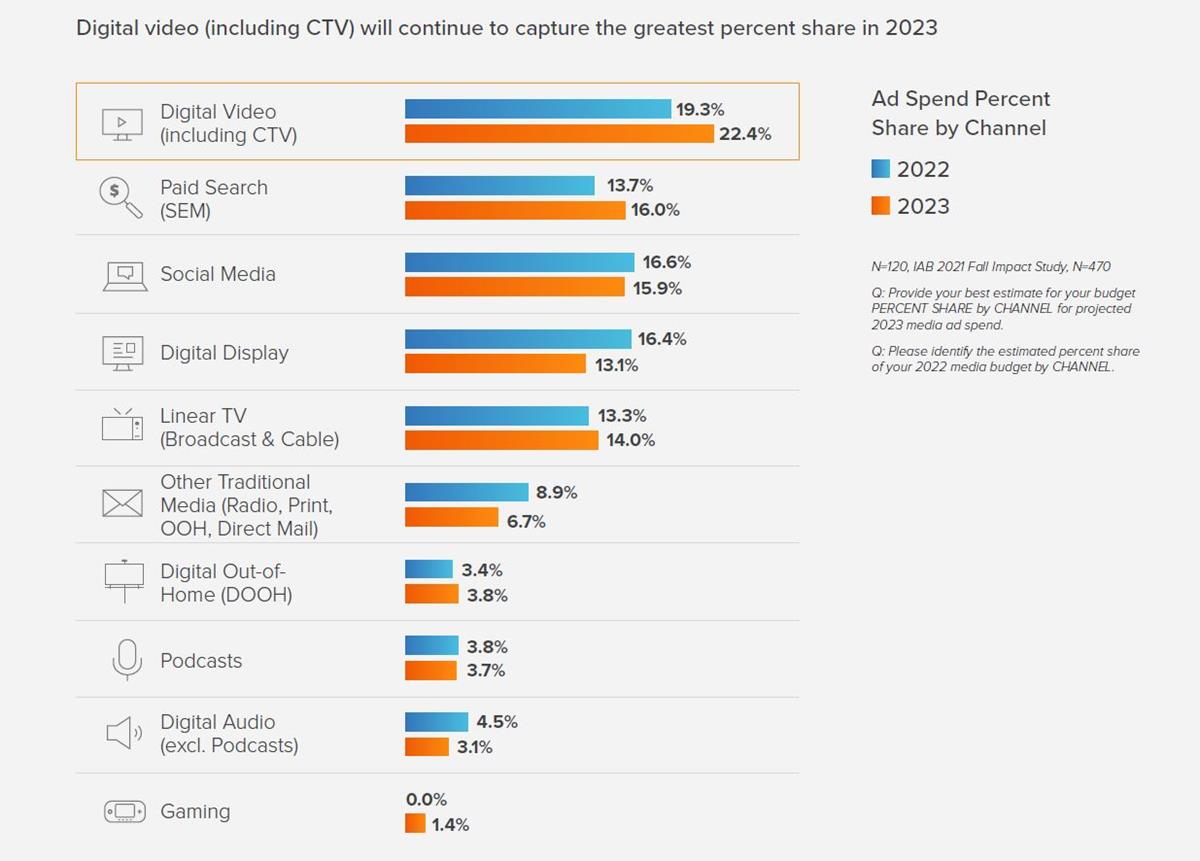

Linear TV advertising is a $66 billion business in the US and is expected to grow to 14% of total adspend in 2023. Digital video, which includes CTV/streaming in an IAB forecast, will grow to become the biggest segment of digital advertising at 22.4%, taking share of spend away from social media and traditional display.

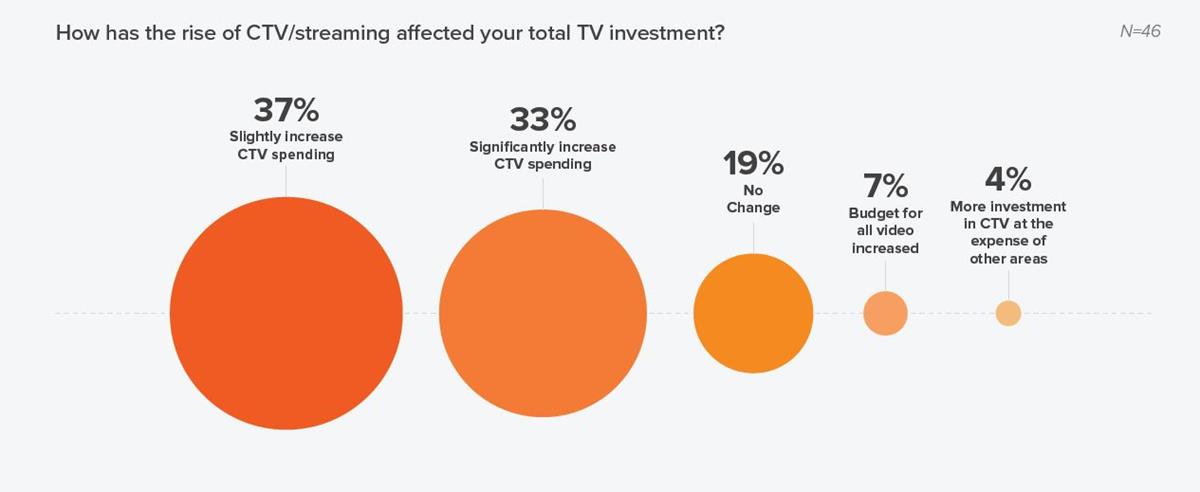

Per the report, advertisers view CTV/streaming as a complement to linear due to the unique reach it provides, opening the door to specific audiences whom they wouldn’t reach with linear TV alone.

“What YouTube and TikTok have taught marketers is that targeting works, ad content must be relevant, and effectiveness requires effort — all aspects they are bringing over to CTV/streaming.”

Perhaps because of linear TV’s continuing mass reach — but also because of inertia in the ad industry, it is implied — the TV spot retains most weight in campaigns.

As the report puts it, the creative process has long been something that starts with a “big idea.” More recently, that idea has been informed by looking beyond focus groups and competition to deep data insights about target audiences. Yet consumers increasingly insist that a single monolithic campaign does not appeal to all audiences — whether because of their personal characteristics (e.g., age, gender identity, location, education) or the channels they use.

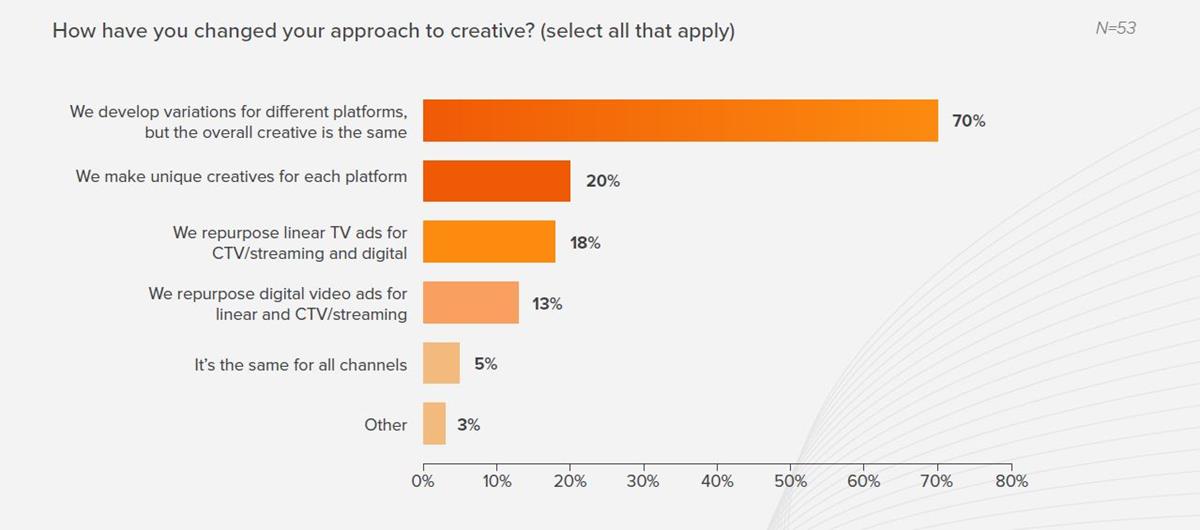

“Brands are only just now increasing their investment in personalization and interactivity for their video advertising. While more than half of those surveyed do develop channel-specific versions of the big idea, nearly 30% simply repurpose existing video ads created for linear or digital to run in other places,” the report finds.

One marketer commented in the report that, despite not having invested in linear TV in more than five years, their agency still starts by presenting a video reel of the idea. Now they have to take that idea and make sure it works on the big screen in conjunction with how it’s retooled for digital platforms.

Another admitted that even though it doesn’t do any traditional media, its internal creative teams and agencies are not very good at digital-first creatives. Most of them start with a traditional 30- or 60-second film when they are concepting.

In the highly addressable, data-driven environments that exist in digital and social advertising, the ability to customize ads to the viewer has become possible.

What started with contextual relevance has given way to personal relevance. Per the report, the need for creative to become “more personalized and relatable” — one or a few concepts modified to appeal to a specific audience or platform at scale — can be fulfilled through technologies like dynamic creative optimization (DCO) and interactive tools.

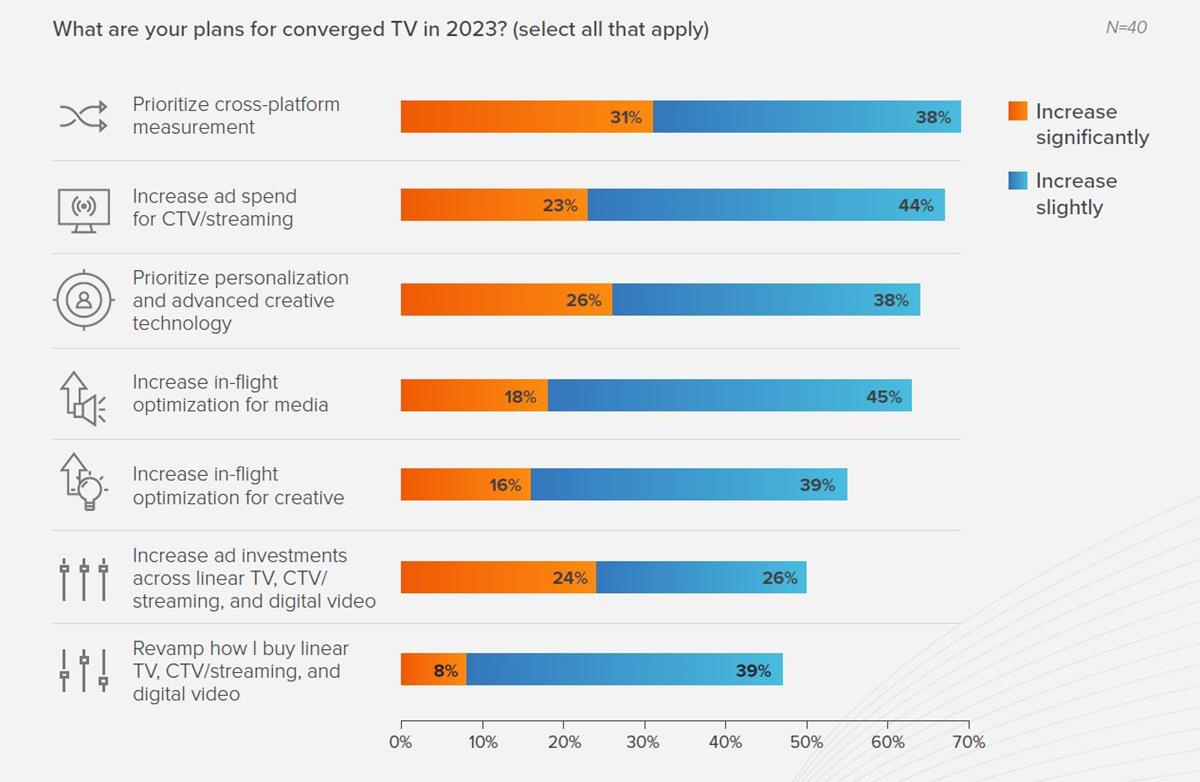

It’s a taller order due to the cost of video production and the determination of how many variations will drive a positive ROI from the effort. Encouragingly, the report found that three-quarters of respondents plan to devote more resources to new creative executions that incorporate personalization and interactivity in the coming year.

Measurement Remains a Mixed Bag

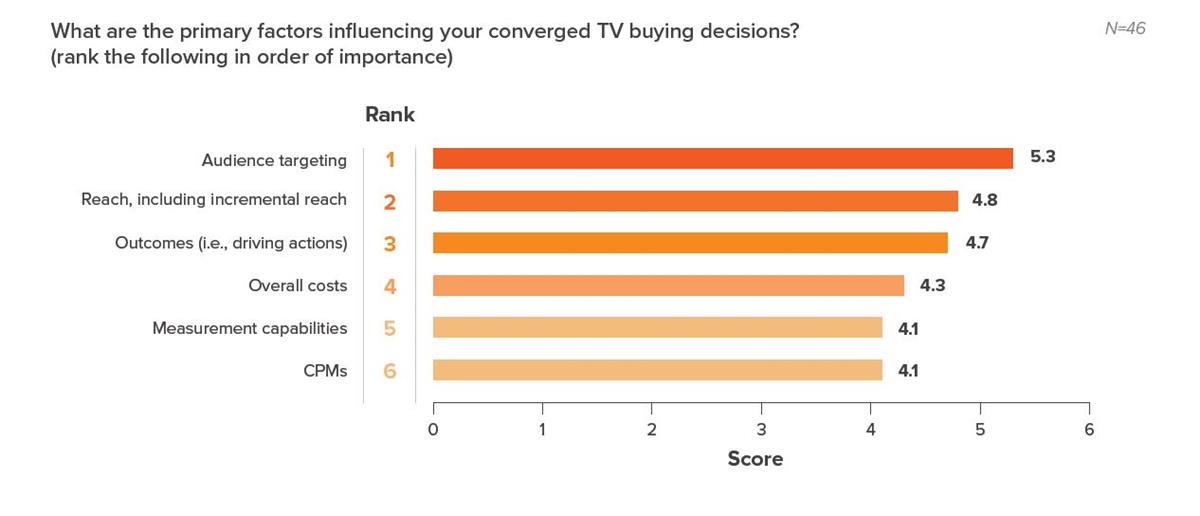

Naturally, along with the convergence of TV and video channels comes a desire to understand

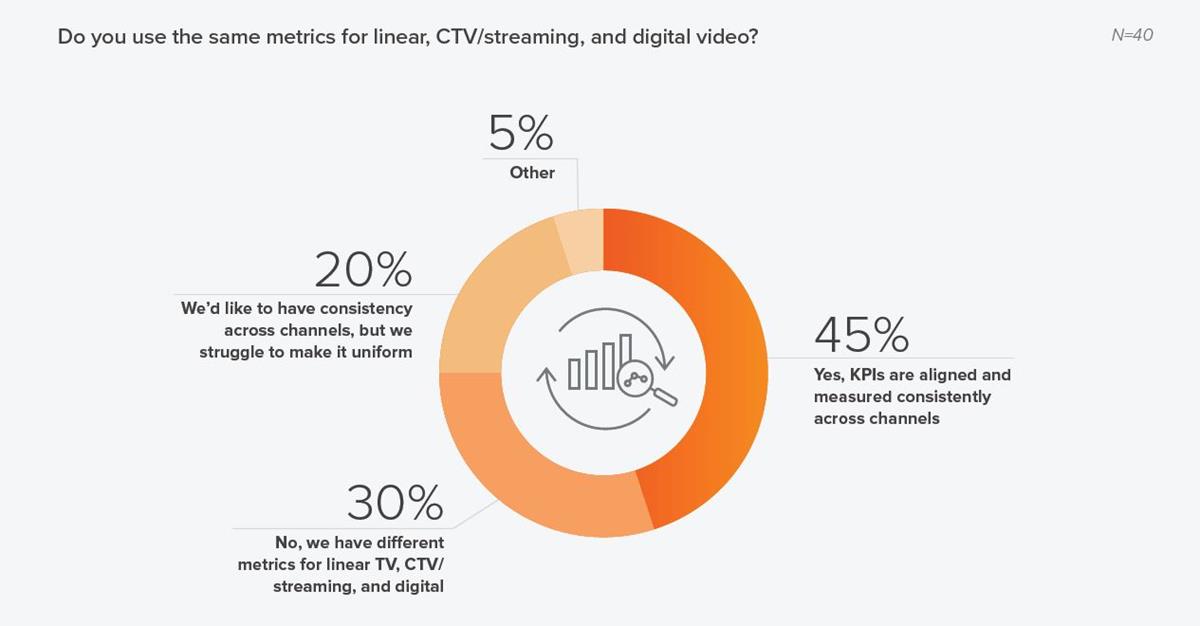

the best mix of platforms to reach target audiences and drive outcomes. But, so far, the ability to holistically value converged TV across linear, CTV/streaming, and digital for its reach, performance, and incrementality remains a challenge for many.

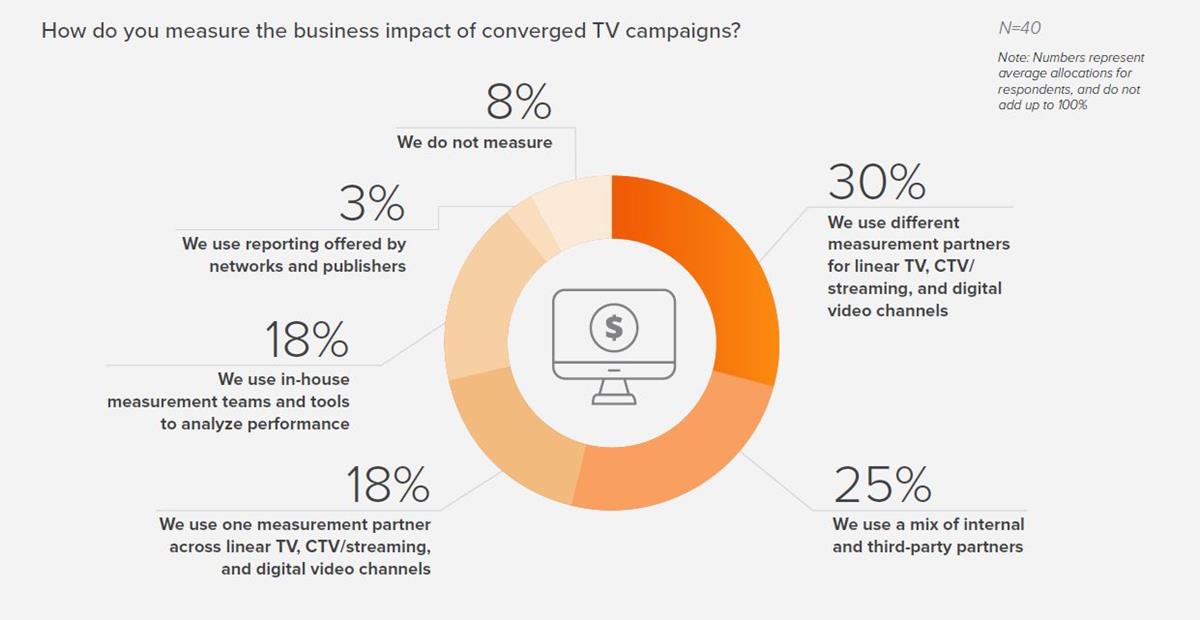

Marketers spoken to for this report still use a combination of in-house solutions, home-grown or external marketing models and third-party tools to measure the impact of campaigns.

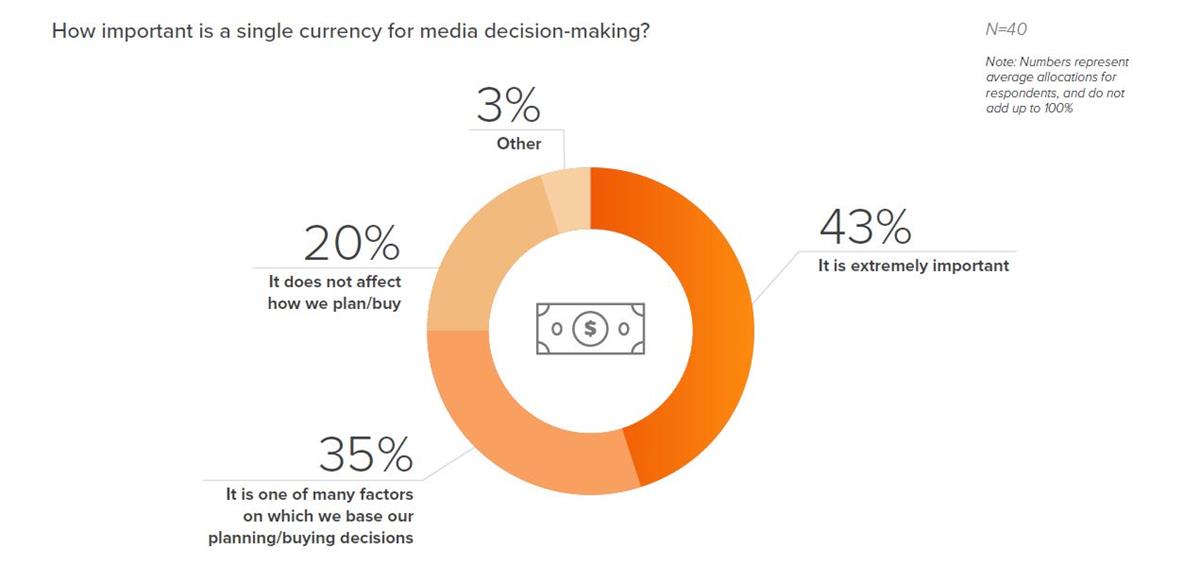

The largest share of marketers depends on native measurement for each channel (30%), while a smaller percentage use one measurement partner to assess all converged TV options (18%).

A quarter of respondents use a combination of internal and external sources to understand how their mixes are performing.