Theatrical will bounce back and commercial TV gets a midterm boost but pay-TV continues to decline in 2022’s year of “hybrid return to normalcy,” credit ratings and market analyst S&P Global predicts in a new report, “The Big Picture: 2022 Technology, Media and Telecommunications Outlook.”

The pandemic’s aftermath looms large in 2022, altering consumer habits and charting a revised course for entertainment distributors, according to its agenda setting overview of the year ahead.

Taking these areas in turn:

Broadband Divide Closing — Slowly

It became apparent during the last couple of years just how reliant society is on connectivity for a whole range of activities from education to work — and how much of a gap there is in large swathes of the United States. S&P estimates that more than 18 million occupied US households do not subscribe to broadband as of mid-year 2021.

Strategically, bridging the digital gap is imperative to keep the US competitive in the global digital economy. With this in mind some $20.4 billion of Federal budget is being spent on deploying broadband across unserved and underserved areas in two phases over10 years.

“The demand for speed and capacity, which continuously prompts upgrades to faster, more expensive broadband tiers, will combine with the expanding subscriber pool to maintain strong revenue growth momentum,” says S&P senior research analyst Tony Lenoir.

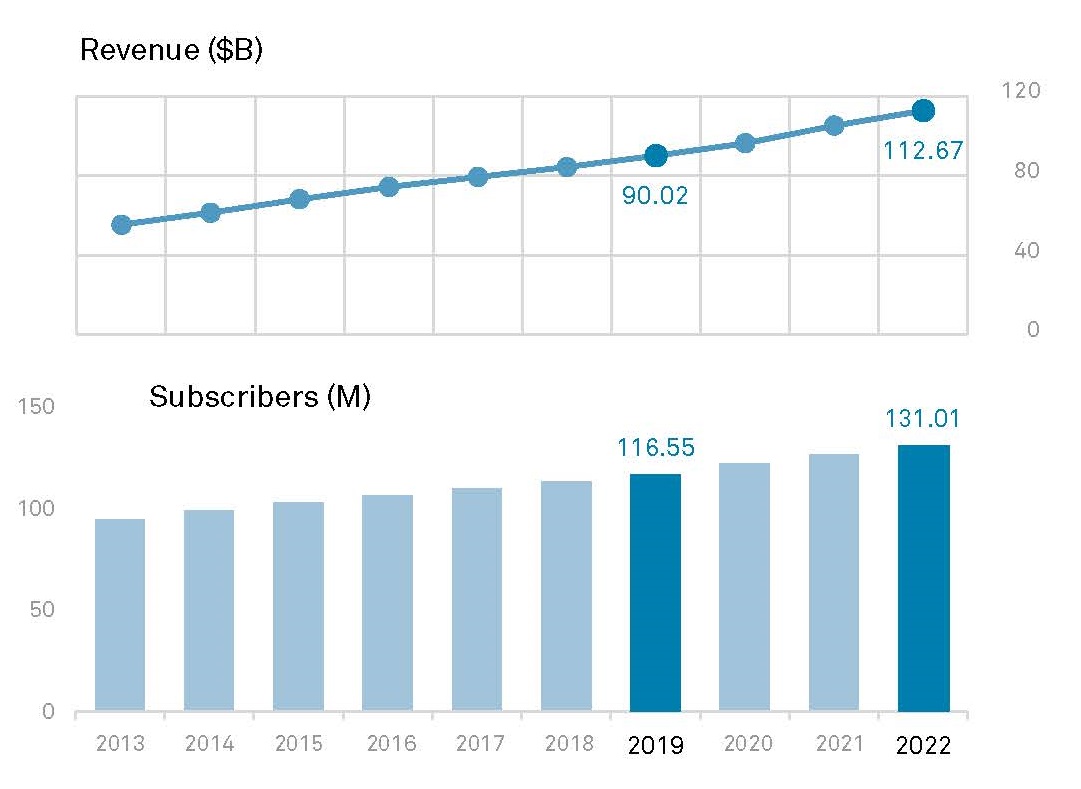

It projects $112.67 billion in US broadband revenues in 2022, up 25.2% over 2019 levels, when the idea of broadband connectivity as an economic lifeline had yet to permeate every social stratum.

Broadcasters Look To Gambling and Midterms

A deluge of ads from expanded legalized sports betting and the return of midterm political ad spending in 2022 are expected to aid US broadcasters’ rebound from the pandemic.

Based on Kagan’s projections, the US broadcast station industry is expected to reach $40.05 billion in 2022 total advertising revenue, up 13.2% from $35.39 billion in 2021, and would surpass the $39.66 billion posted pre-pandemic in 2019.

According to Justin Nielson, Senior Research Analyst, “Core ad categories have mostly recovered from the COVID-19-induced advertising pullback of 2020, and broadcasters are feeling optimistic in the back half of 2021 with an expanded schedule of NFL games and new scripted content.”

Despite the sharp decline in broadcast network ratings, TV station ratings were boosted by local news viewership during the pandemic in 2020 and should remain stable even after a slight dip in the first half of 2021.

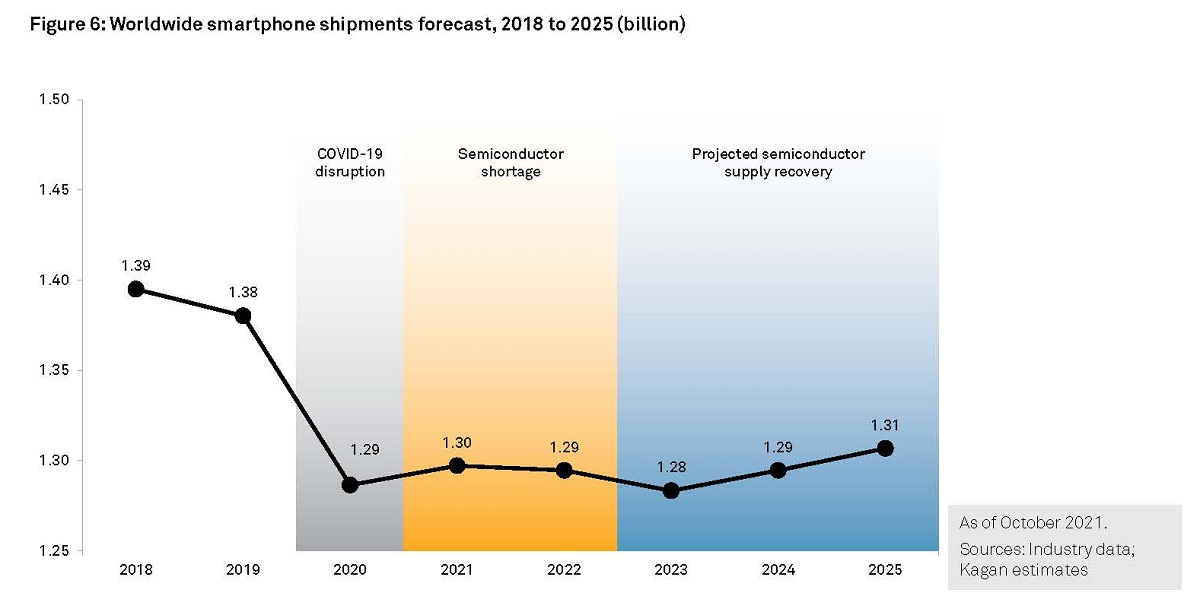

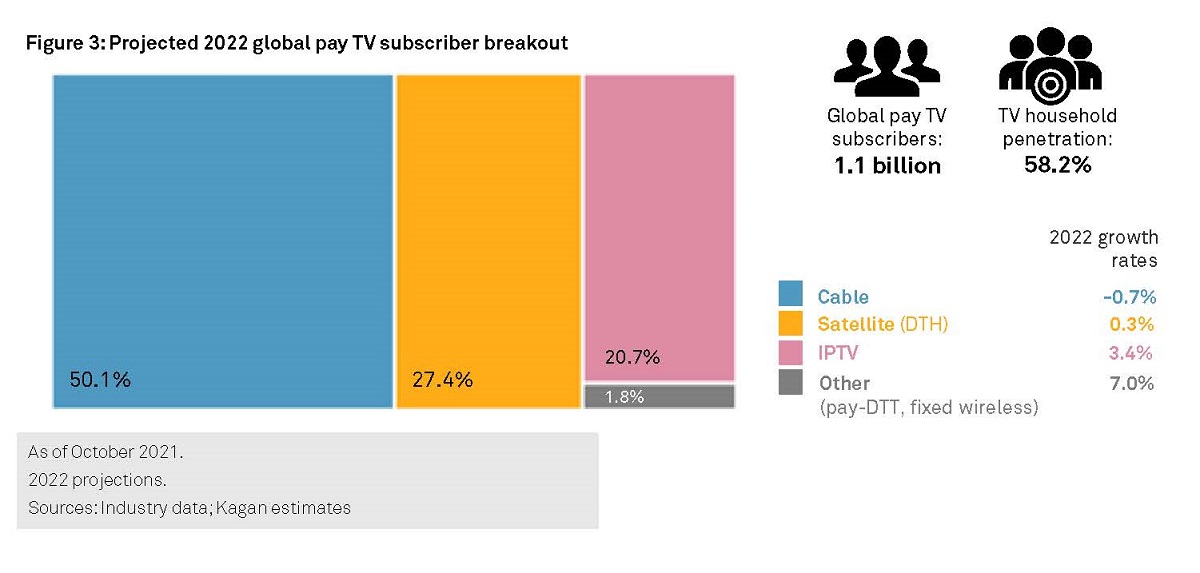

Telcos Bank on 5G

As fiber adoption accelerates globally and consumers increasingly turn to alternative forms of entertainment online, multichannel operators, particularly telcos, are beginning to reconsider their video strategies. Multichannel households are expected to continue growing globally in 2022, up 0.7% to reach a total of 1.11 billion, as subscriber gains in emerging markets make up for accelerated cord cutting in North America, Western Europe and advanced Asian markets. However, a growing number of operators are choosing to shut down traditional services and migrate customers to own- or third-party virtual multichannel or other streaming services.

The global multichannel economy is forecast to generate $370 billion in video service revenues in 2022, equating to a 3.1% year-over-year decline, largely due to rapid subscriber losses in North America.

“This is part of a larger trend by telcos to reduce costs and focus exclusively on connectivity and fixed-mobile convergence, particularly high revenue fiber and 5G services, and launching or partnering with OTT services to bundle with their broadband and mobile offers,” says S&P principal analyst Mohammed Hamza.

SVOD Steady But Slower

Marked by rapid growth during the last decade and major streamer launches in the preceding couple of years, the US SVOD market is expected to hold some of its pandemic progression, but subscriber expansion could slow in 2022.

Although no major SVOD launches are expected from the domestic market in 2022, S&P expects the SVOD pie to rise 12.5% to $33.9 billion through the year.

“Pandemic behavior appeared to mostly stick, while the launch of other streamers like Discovery+, Peacock and a rebranded Paramount+ helped increase both subscription online video homes and services per home,” suggests S&P research director Deana Myers.

One big question for 2022 is what will happen to HBO Max and Discovery+ once Warner Media and Discovery Inc. merge into a single company.

“Combining the services may be awkward and possibly alienate either audience as the two have little overlap in terms of interest,” Myers says. “Another option would be to offer them as a bundle with reduced pricing, similar to the path that both Walt Disney and ViacomCBS have taken for their SVOD services.”

High demand for exclusive and original programming has pumped up costs to a level that means most streaming services will not be profitable for several years. Even Disney+ is not expecting to be profitable until fiscal year 2024, says S&P.

To that end, expect to see more SVODs rolling out ad-supported tiers, as HBO Max did last June.

Return To the Big Screen

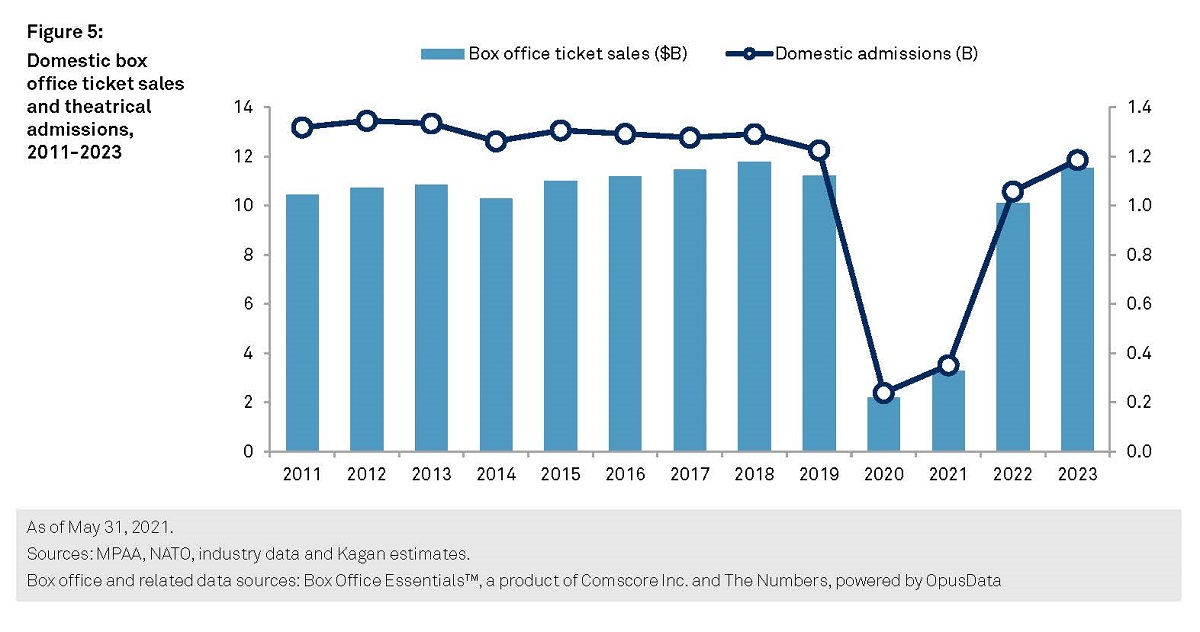

After a challenging 2020 and 2021, S&P expects recovery to ramp up in 2022 as markets will be fully opened and studios are intending to release films that had been delayed as well as new films shot in 2020 and 2021.

That major studios are committing to an exclusive theatrical window, albeit a shorter one, should also help in boosting 2022 box office. Walt Disney has moved away from a day-and-date release on Disney+ at a premium price and opted for a 45-day theatrical window. The 206.2 million in domestic box office gross through October of Shang-Chi and the Legend of the Ten Rings at the seems to support this move.

All in, S&P estimates $10.1 billion in 2022 box office revenue with 1.06 billion admissions. A full box office recovery is expected by 2023 with an estimated $11.52 billion and 1.19 billion admissions. That’s in contrast to just $2.18 billion of domestic box office in 2020, and an estimated total of $3.29 billion in 2021.

READ MORE: The Big Picture: 2022 Technology, Media and Telecommunications Outlook (S&P Global)

Let’s Not Forget the Cats of Telecom, Media and Technology