TL;DR

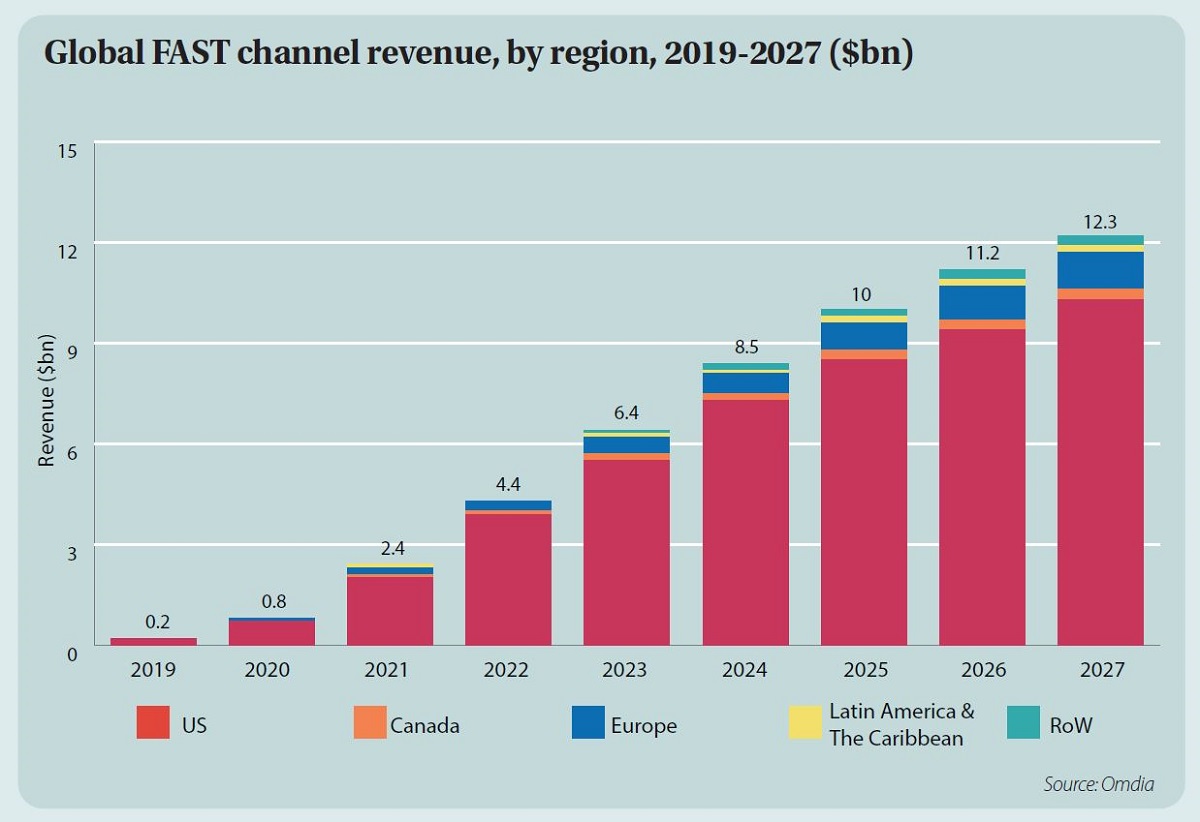

- FAST has evolved at speed in the US, proving a popular and profitable way for rights holders to incrementally increase revenue from existing library content. It is from this base that the industry is expected to develop into a $10 billion+ industry with few signs that growth will be stunted any time soon.

- For channel owners, discoverability has become the key focus and it is apparent both in the US but also in less mature markets, such as the UK. Whether in Europe or the US, cutting through on the EPG means providing a curated experience for the viewer with content that pops and demands attention.

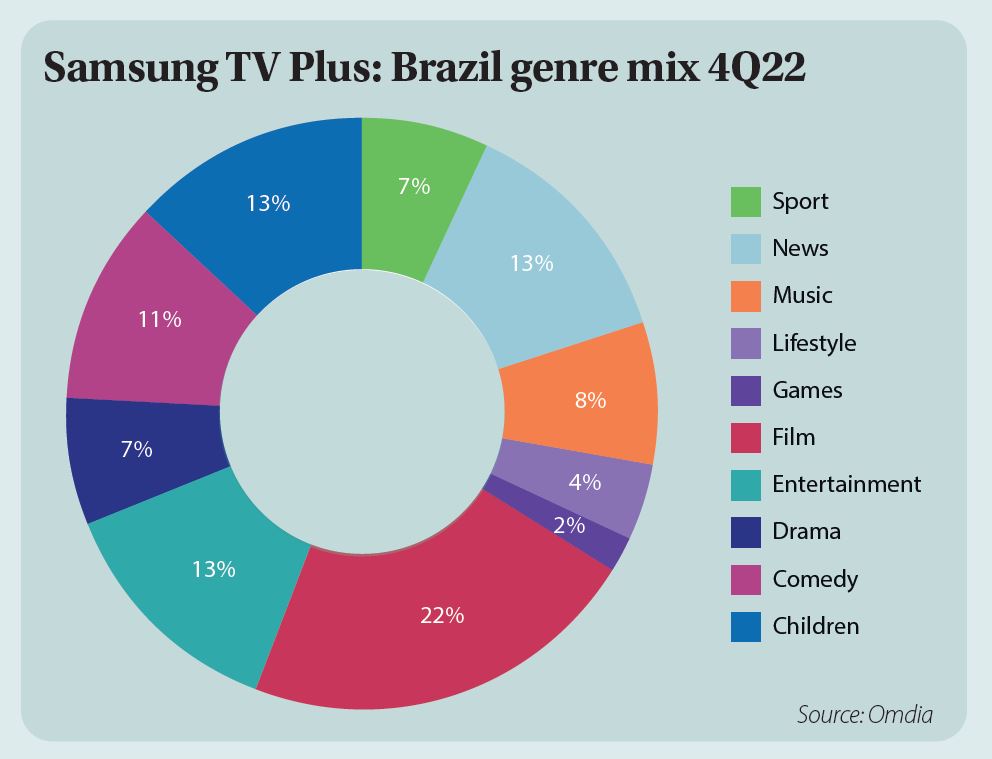

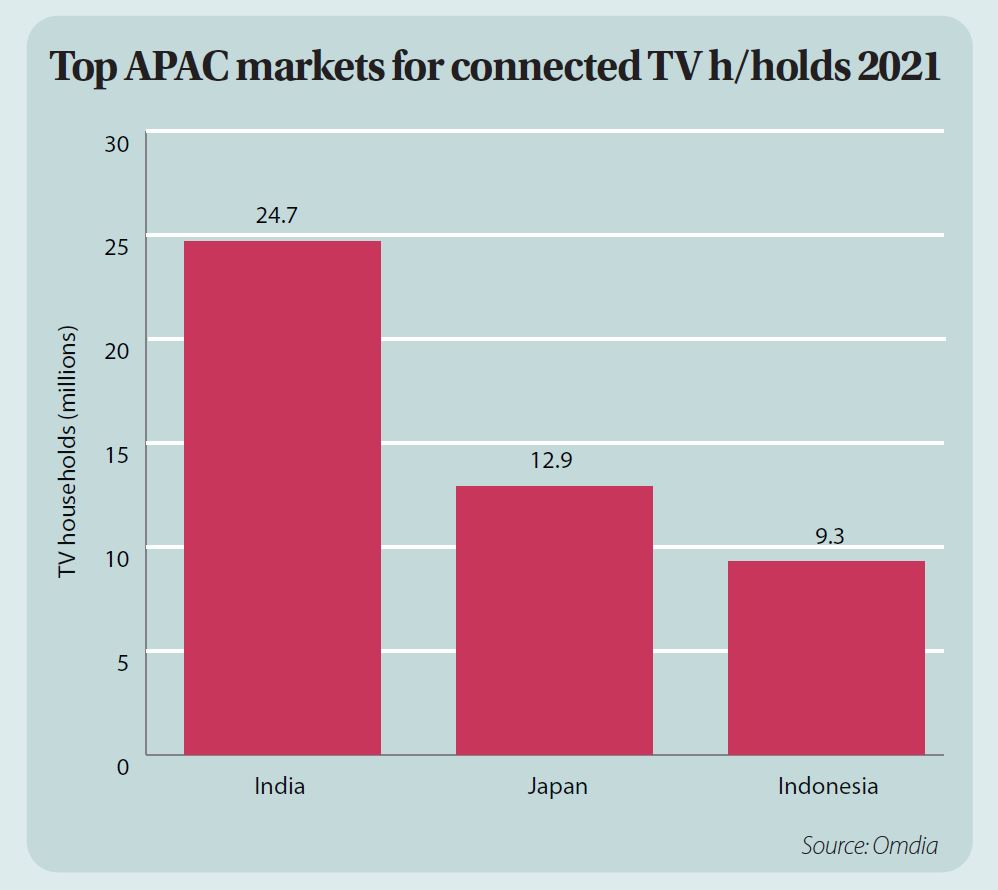

- Markets outside the US are expected to create a $2 billion revenue opportunity. Indeed, it is in countries outside of the US that growth is strongest, with FAST revenue surging by almost 50 times between 2019 and 2022.

READ MORE: Move FAST or get left behind – Sizing the free ad-supported streaming TV opportunity globally (TBI Vision)

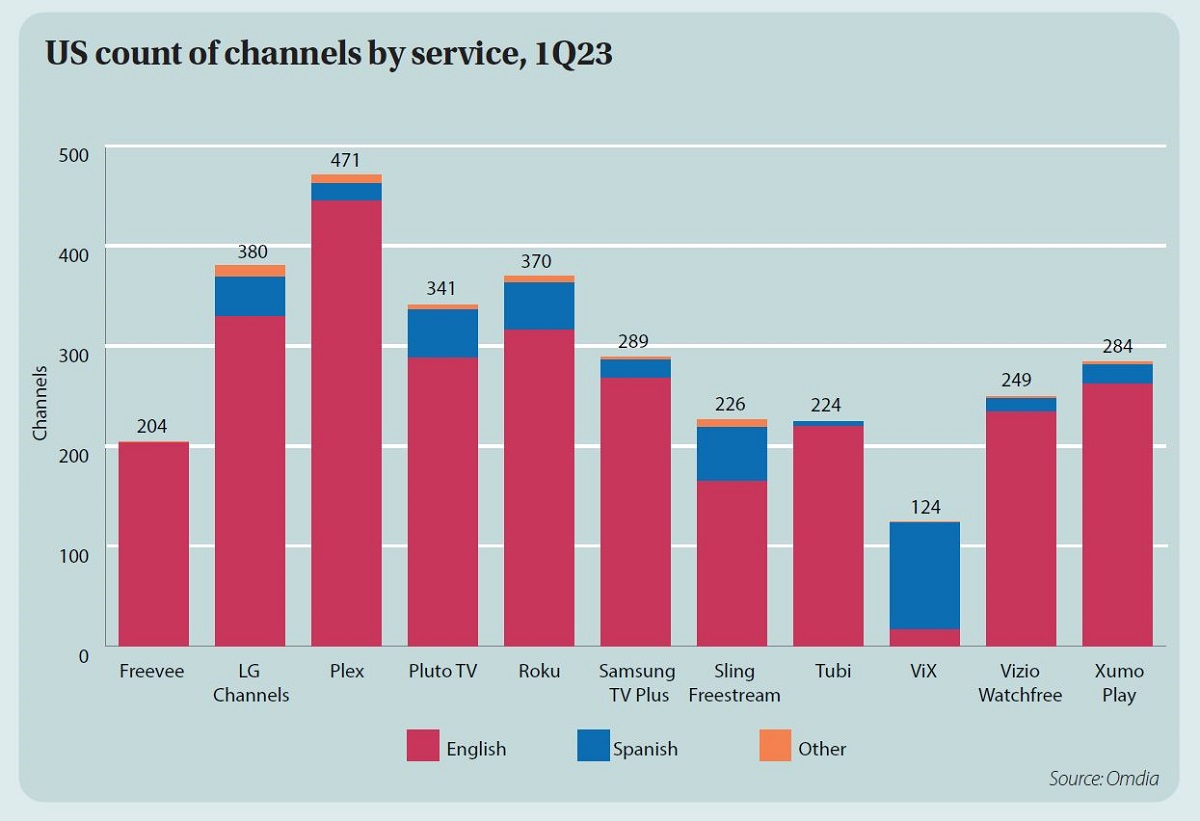

With more than 1,500 FAST channels in the rapidly maturing US market, the challenge for services providers is one of discoverability.

The US will remain dominant in absolute revenue terms, but the fastest growth will come from countries outside of the US, as FAST’s international momentum gathers pace.

These are the key findings from a new report, “Move FAST or Get Left Behind,” into the spread of the Free Ad-Supported TV ecosystem by Television Business International.

There are now an array of FAST services in the US, with the majority offering between 200 and 350 channels: LG Channels, Roku and Paramount-owned Pluto TV all hover around the top end of the spectrum, but there are also numerous niche audiences catered to via services such as current affairs-related Haystack News, The Weather Group’s Local Now, and Sinclair Broadcasting-backed STIRR.

“Clearly, with so many channels such an array of topics now available, viewers are faced with vast choice while FAST channel owners are facing considerable challenges around discoverability,” says TBI Vision editor Richard Middleton, one of the report’s authors.

“Innovation is needed for discoverability of channels and providers need to try to work together with platforms on that,” says Bea Hegedus, global head of distribution at Vice, which operates FAST channels on Tubi and Samsung TV Plus. Hegedus, quoted in the report, says that FAST channel owners “that lack clear branding will need heavy investment to find and retain an audience.”

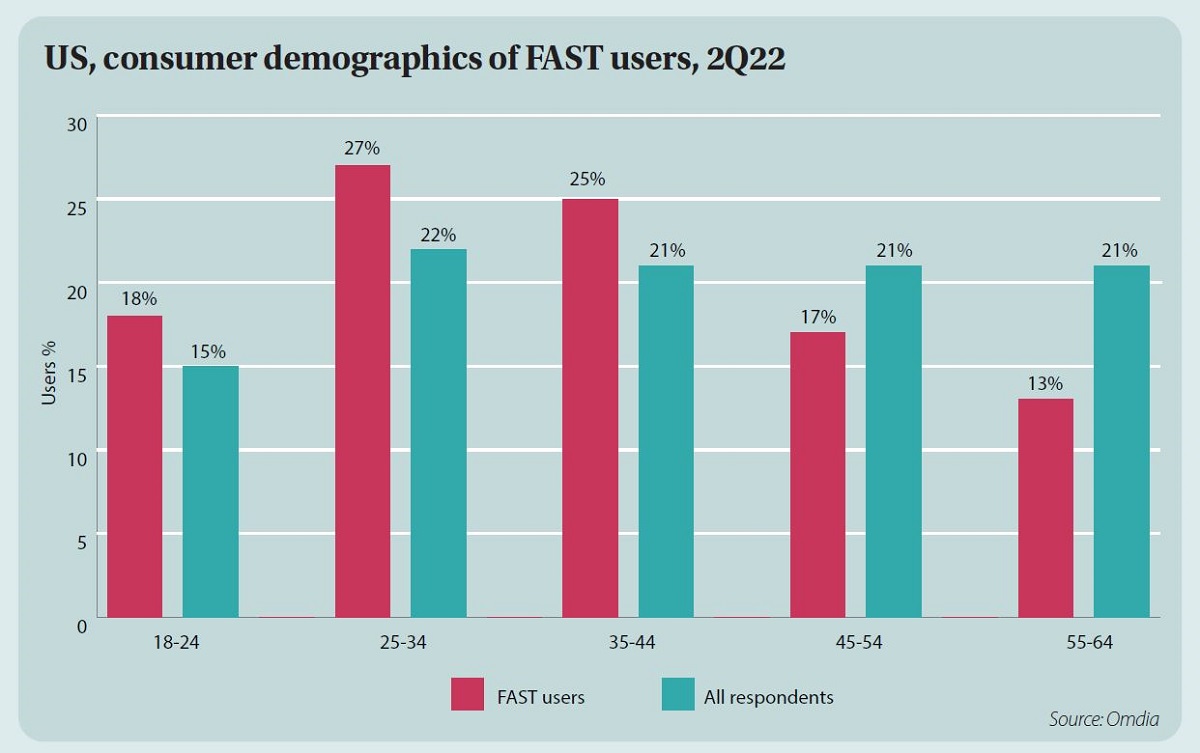

For the major players, TBI finds that the strategy of quantity is now shifting to quality. With FAST advertising revenue in the US expected to hit $7.3 billion in 2024, FAST services are looking to provide more premium fare and brand cut-through: WBD’s deal with Tubi, for example, will see the service launch 14 WB-branded FAST channels, as well as three curated FAST channels crossing reality, series and family.

“As platforms compete for viewers they will try and differentiate themselves from the competition by looking for exclusive content or an exclusive launch window for new content,” Bob McCourt, COO at Fremantle International, tells the report authors. “We are seeing this trend already, as some of the major studios are windowing more premium content into the FAST space, which is legitimizing its growing adoption as a free, cable replacement.”

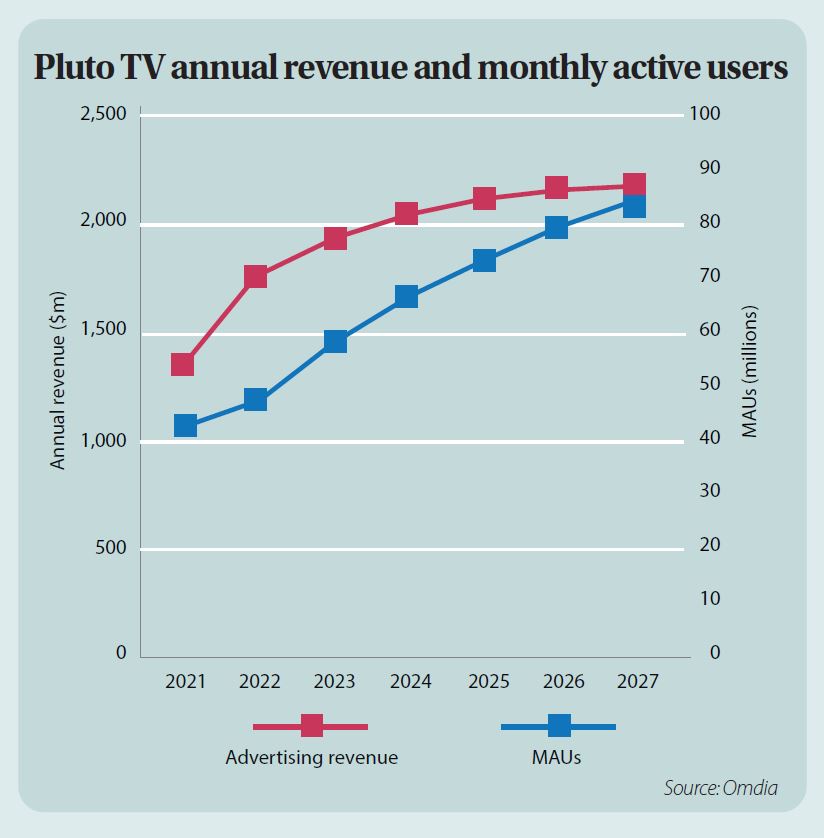

Models are also shifting, depending on the company and how it is approaching FAST. Per the report, Paramount increasingly sees Pluto TV, which it acquired in 2019 for $340 million, as a way to funnel viewers to its other streaming products, while the service itself carries numerous channels with Paramount content. However, most channels are striking multiple deals with FAST services to ensure “carriage.”

Models differ, but the US industry has tended towards an approach that sees channel owners selling a proportion of the ad inventory. Revenue share is also popular (often now around 50/50 between FAST service and the channel), while some rights holders may receive a fee for licensing a channel.

Aggregators are also buying up programming rights and curating their own channels, which are then put back into the FAST channel ecosystem, with each party receiving a fee.

McCourt adds, however, that a “critical mass” of channels is being reached. He also expects “increased allocation of advertising dollars by agencies to FAST,” and “more innovations in advertising, as platforms adopt brand integrations as well as traditional adverts.”

Shaun Keeble, VP of digital at Banijay Rights, which operates more than 20 FAST channels globally, is quoted by the report as saying the need for exclusivity of channels will heighten across all platforms.

“I expect there will be more personalization of EPG offerings and more sophisticated tailoring of content down the line, too,” he says. Keeble also believes that first and second window runs, and even original series, “will increase in number as commercial models adapt and the need for viewer retention becomes more vital than ever.”

The Rest of the World

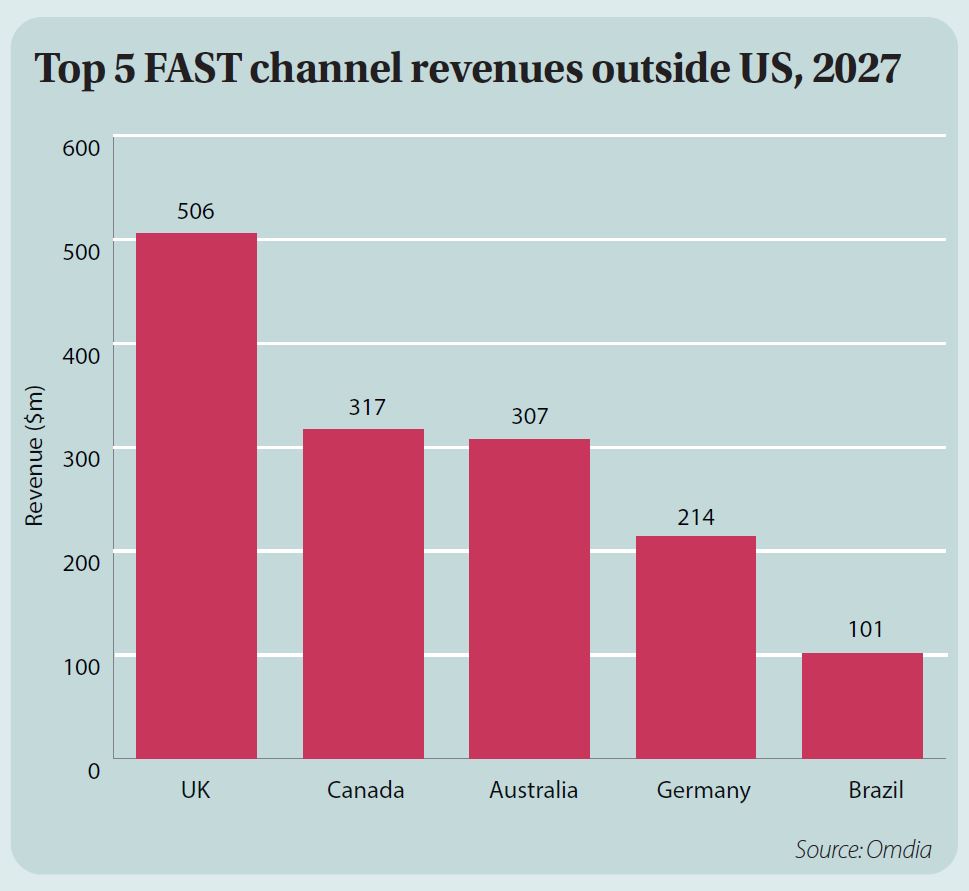

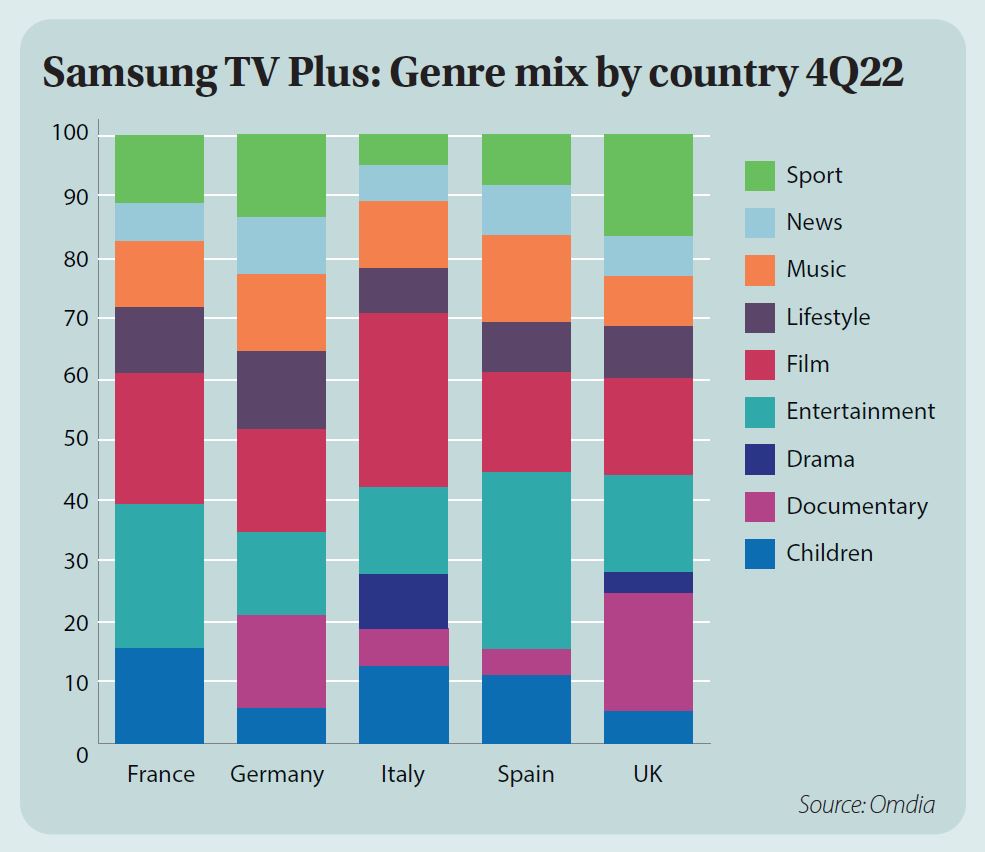

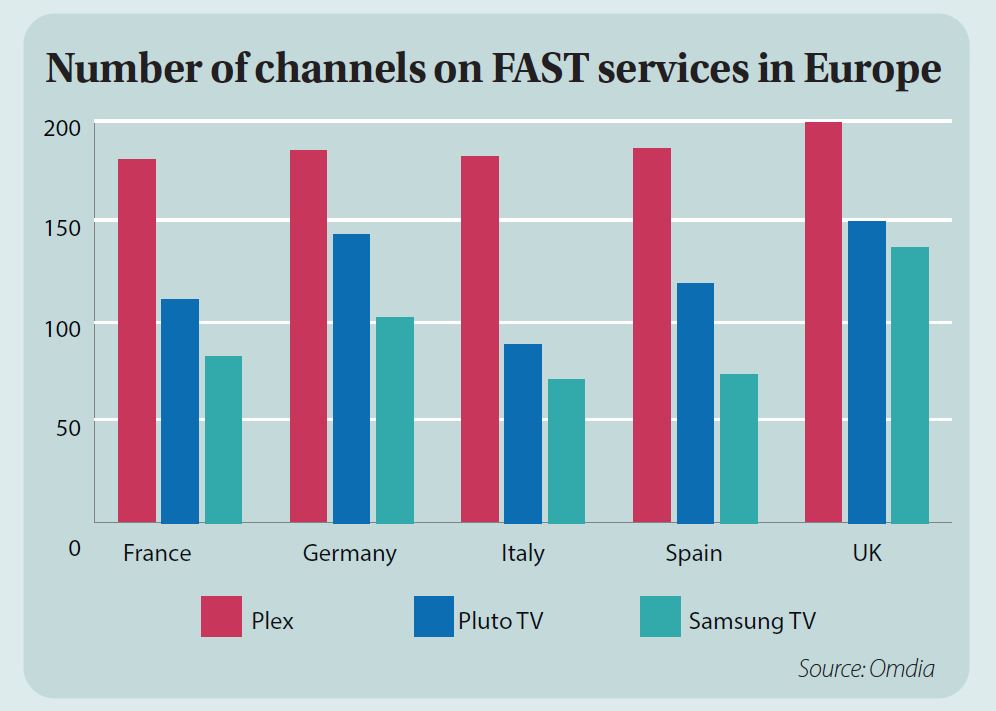

Europe has lagged behind FAST uptake but it is now growing in popularity, with advertising revenues expected to hit $500 million this year and more than twice that by 2027. There are limiting factors in some markets, such as the UK, where FTA is more common, but the opportunity to more closely target specific viewers means ad growth is widely expected.

Much of that growth will come from a select few markets, with UK revenue expected to quadruple over the next four years to hit $506 million by 2027, but Germany is also expected to provide potential, with revenues that exceed $200 million within five years.

Marion Ranchet, founder of The Local Act, tells TBI, “It’s not easy to copy and paste the US winning formula. Each region is different when it comes to CTV penetration, advertising maturity and the like, all of which are key ingredients to FAST.

“In Europe, one major difference is the fact that free as a value proposition is nothing new. We have FTA broadcasters bringing us amazing content. Therefore, the immediate appeal of FAST in the US won’t win hearts as quickly here.”

And while English-language countries have dominated the FAST landscape to date, this could change: for example, Omdia has found that Tubi is particularly popular with US Hispanic audiences largely because it carries considerable amounts of Spanish-language content.